Table Of Contents

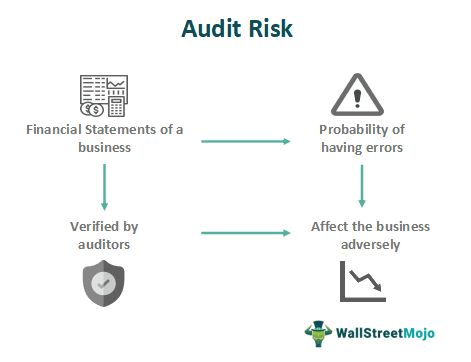

What Is Audit Risk?

Audit risk is the probability that the company's financial statements contain an error that is material to the company even though the same has been verified and audited by the company's auditor without any qualification concerning it.

In simple terms, Audit risk is defined as the risk of financial statements not being truly representative of an actual financial position of the organization or a deliberate attempt to conceal the facts even though audit opinion confirms that statements are free from any material misstatement. This risk can have a bearing on shareholders, creditors, and prospective investors.

Key Takeaways

- Audit risk arises from the possibility of material misstatements in financial statements due to inherent risks associated with the nature of

- Control risk relates to the risk of misstatements not being prevented, detected, or corrected by the entity's internal controls. It considers the effectiveness of internal controls in mitigating the inherent risks.

- Detection risk refers to the risk that auditors fail to detect material misstatements in financial statements during the audit process. The nature, timing, and extent of audit procedures performed influence it.

Audit Risk Explained

The audit risk model refers to a type of risk in the business in which the auditors may not issue a correct opinion about the true financial condition of the business. In this type of risk, the auditor may be unable to point out any misstatement in the financial statement. or unable to identify an important error or fraud. This will lead to inappropriate audit opinions about the financial statement.

This risk may arise due to any one or both of the two – Clients or Auditors. This risk may be due to two reasons – mistakes/errors or a deliberate misstatement.

However, it is necessary to understand that various factors like complex transactions, type of industry, rules and bylaws of the company and transparency of the management.

Sometimes even the internal risk control processes fail to identify the frauds. Audit risk assessment shows that internal control systems are not efficient enough to reflect misstatements. But the auditors may fail to detect frauds due to nature of the transaction or limited timing of te audit procedure.

It is important to understand that the auditors may try to minimize and control the risk, but it is impossible to eliminate it from the system totally. The organization should aim for proper and maximum management of such a risk so that the financial statements have reasonable accuracy and reliability.

Types

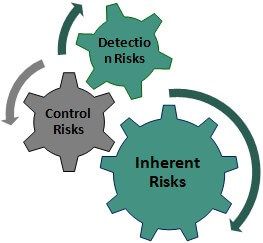

Following are the Top 3 Types:

#1 - Inherent Risks

The inherent risk could not be prevented due to uncontrollable factors, and it is also not found in the Audit.

Example: transactions involving high-value cash amount carry more inherent risk than transaction involving high-value cheques.

Sources of Inherent Risk:

- Complex business transactions involving derivative instruments;

- Transactions requiring a high level of judgment may lead to the risk of not being identified;

- Industry having frequent technological developments may expose the firms to technology obsolescence risk.

- A company that has already misreported certain figures in the past may be more likely to misreport it again.

#2 - Control Risks

Control Risk is the risk of error or misstatement in financial statements due to the failure of internal controls.

Example: Failure on the part of management to control and prevent transaction carried out by staff who is not authorized to carry out those transactions in the first place.

Sources of Control Risk:

- Failure of management to instill proper and effective internal control for financial reporting.

- Failure to ensure proper segregation of duties among people responsible for financial reporting;

- The non-existence of the culture of proper documentation and filing;

#3 - Detection Risks

Detection risk is the risk of failure on the auditor's part to detect any errors or misstatements in financial statements, thereby giving an incorrect opinion about the firm's financial statements.

Example: Failure by Auditors to identify the company's continuous misreporting of financial statements.

Sources of Detection Risk:

- Poor audit planning, selection of wrong audit procedures on the part of the auditor;

- Poor interaction and engagement with audit management by Auditor;

- Poor understanding of the client’s business and complexity of financial statements;

- Wrong selection of sample size.

If you want to learn more about Auditing, you may consider taking courses offered by Coursera -

Examples

Let us look at some examples to understand the concept of audit risk model.

Example #1

Example: transactions involving high-value cash amount carry more inherent risk than transaction involving high-value cheques fall under the inherent risk category.

Example #2

Failure on the part of management to control and prevent transaction carried out by staff who is not authorized to carry out those transactions in the first place fall under the category of control risk.

Example #3

Failure by Auditors to identify the company’s continuous misreporting of financial statements fall under the detection category.

Formula

Overall the risk is calculated by combining all the above three types of audit risk assessment. The formula is as follows:

Audit Risk = Inherent Risk * Control Risk * Detection Risk

Based on the above risk factors, Auditors can arrive at the level of risk and decide on the strategy to deal with it.

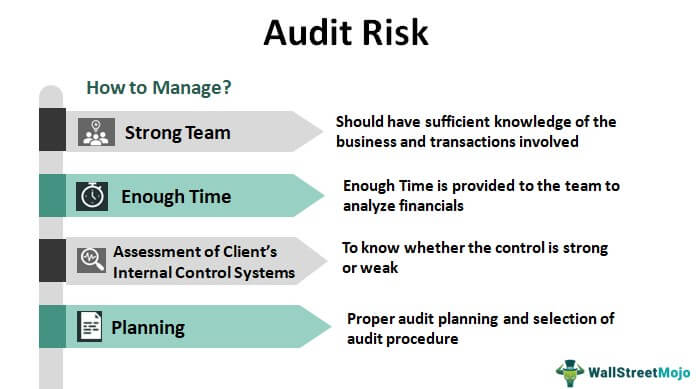

How To Reduce?

Let us understand the various ways and means to minimise and control this type of risk in business.

- Having a strong Audit team that has sufficient knowledge of the business and transactions involved. is very essential; This helps in identifying the areas where risk may exist.

- The business has to ensure that sufficient time is provided to the team to analyze financials. This will help the auditors perform thorough testing of transactions, account balance and disclosures. This will identify misstatement and lead to audit risk assessment.

- Ensuring strong engagement with the management of the client firm to understand business philosophy and practices;

- Ensuring proper and adequate sampling techniques is required.

- Accurate assessment of the client's internal control systems to know whether the control is strong or weak. is very important. Proper quality control ensures that the audit is conducted in a professional manner. The process involves challenging and questioning assumptions and evidences.

- Proper audit planning and selection of Audit procedure;

Audit Risk Vs Business Risk

The above two concepts of risk are very common in the business context. Let us understand the differences between them.

- The audit risk assessment refers to the risk that the auditors may give an incorrect opinion about the financial statements whereas the latter refers to the risk the business while trying to achieve its objective.

- The former risk involves failure to identify misstatements, errors, frauds, etc and the latter risk involves low profitability, losing market position, operational inefficiency, etc.

- The former is influenced by inherent risk, control and detection risk, whereas the latter is influenced by competition, changes in economic and political condition, regulation changes, operational inefficiency and improper management decision.

- The former is limited to the audit process but the latter is beyond audit and extends to business operations and industry.