Table Of Contents

What Is Equity Research?

Equity Research refers to the process of analyzing a company’s market position to assess the investment opportunities available there and help investors get a clear picture of the business and organization before they finally invest in it. It primarily involves analyzing the company’s financials, performing ratio analysis, forecasting, and exploring scenarios to help make a BUY/SELL stock investment recommendation.

After the analysis and research is thoroughly conducted, equity research analysts put forth their observations in the form of equity research reports. Once investors consider a company to invest in, the equity research people look into the economic aspects like GDP, growth rates, the market size of the industry and the competition aspects, etc. to assess how worthy they are for an investment.

Equity Research Explained

Equity Research involves preparing an estimate of the company's fair valuation to recommend the buy-side clients. The equity research job rewards analysts with relatively higher compensation, but it also provides excellent exit opportunities. Though, as a research analyst, one may spend 12-16 hours a day at the office; however, this is a dream job for many who love finance and financial analysis.

Equity research is the division of investment banking firms. This section of the firm, as the name suggests, take care of the updates on the firms their clients desire to invest in. The analysts here follow a series of steps to analyze the businesses in the most efficient way to ensure the information forwarded to the investors are accurate and reliable.

The research division explores every aspect of a business and study the companies’ financial track records. From historical patterns to current involvements, the professional take into consideration everything to make sure they do not mislead clients in any manner. From the GDP to the market size to the regular cash flows, etc., the professional observes everything possible.

Equity research is all about finding the valuation of a listed company (Listed companies trade on a stock exchange like NYSE or NASDAQ etc. Once the professionals understand the economics behind the business, they perform the financial statement analysis of the historical balance sheet, cash flows, and income statement to form an opinion on how the company did in the past.

Once they accomplish their part of research, they mention all their observations in an equity research report.

Equity Research plays a critical role in filling the information gap between the buyers and sellers of shares. All levels (individual or institutional) may not have the resources or capabilities to analyze every stock. Additionally, full information is not provided by the management, due to which further in-efficiencies are created and stocks trade below or above the fair value.

Equity Research analyst spends a lot of time, energy, and expertise analyzing stocks, following the news, talking to the management, and estimating stock valuations. Also, equity research tries to identify the value stocks out of the massive ocean of stocks and help the buyers to generate profits.

An independent equity research firms do not have a trading and sales division. They perform financial analysis with the idea of charging fees on a per report basis. On the contrary, for major equity research firms, fee income is earned by brokerage trades (Soft Dollars).

Types Of Equity Research

Let us look at the different kinds of equity research.

- Buy-Side Research: Mutual funds, hedge funds, and asset management firms perform buy-side research to make informed internal decisions related to investments.

- Independent Research: This type of research is carried out by organizations that have no affiliation with any trading institution. The aim of these firms is to remain unbiased.

- Sell-Side Research: Investment banks and brokerages carry out this type of research. They share reports with their clients to influence trading behavior and boost trading volume.

Equity Research - Explained in Video

Roles

Equity research jobs come in various forms. To understand the responsibilities that one gets exposed to when they join this division of investment banks, it is important to study the roles offered in the field. Let us have a quick look at them below:

#1 - Head of Research

The Head of Research acts as a key member to manage the Equity research analyst team, providing the team with leadership, coaching, and guidance to ensure that the brokerage goals and objectives are met. They perform the following functions:

- They oversee research reports, publications; it's editing and monitoring the process of analysis and brokerage recommendations.

- They ensure that adequate support is provided to sales and trading teams.

- The heads contribute to equities by providing expert-level inputs for overall strategy, goals, initiatives, and budgets.

- They are responsible for Analyst hiring, compensation, development, and performance management.

- They act as a link between fund managers and the research teams.

#2 - Senior Analyst

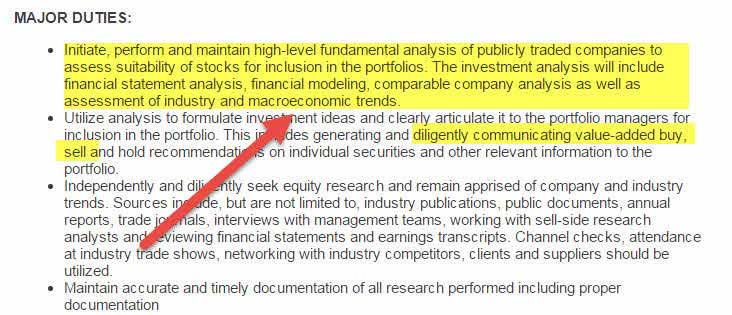

Below is an excerpt from a job requirement for a Senior analyst -

source - FederatedInvestor

- Typically an equity research senior analyst would cover a sector with not more than 8-15 stocks. Coverage implies tracking these stocks actively. Senior Analyst tries to bring maximum companies under coverage in the sector they track (initiating the coverage)

- Many senior equity analysts cover companies that investors may want to invest in. These companies are like the high market capitalization companies or those with higher trading volume. There could also be cases where investors want to invest in small-cap or mid-cap stock companies with fewer analysts' coverage.

- One of the most important responsibilities of a Senior Analyst is to develop a Quarterly Results Update – results from summary, expectation, and performance against those expectations, updating forecasts, etc.

- They talked to the clients (buy side) and showcased their calls on the stocks. They have to communicate buy-sell recommendations of stocks diligently. Additionally, they have to articulate clearly why a certain stock should be included in their portfolio.

- Write important industry event updates like conferences or management meeting updates.

- To update the Sales team, deal with the trading team about the latest news in the sector and the company, and keep them updated with the brokerage's view.

- Attending conference calls for important company updates, results, etc

- Attend trade shows, meet company management, suppliers meetings, etc.

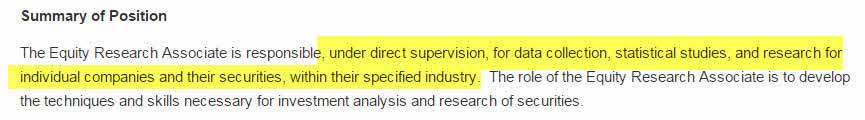

#3 - Associate

Below is the summary of the Associate job description from efinancialcareers

- The primary job is to support the Senior Analyst in the best way possible.

- An associate has prior experience of around three years or so in a similar industry.

- Updating the financial model, verifying the data, and preparing the valuation models.

- Working on various client requests like a request for data, industry analysis, etc.

- Prepare draft Equity Research Reports (update of results, events, etc.)

- Work on client requests

- Participate in meetings and calls with clients on the stock under coverage.

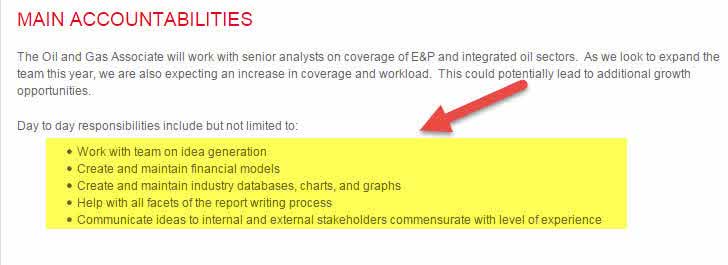

#4 - Junior Analyst

Here is a snapshot of the Junior Equity Analyst's responsibilities.

source - careers.societegenerale.com

- The main responsibilities of a Junior Analyst are to support the Associate in every format.

- The majority of the work done by Junior Analysts is related to data excel etc.

- Also, Junior Analysts may be involved in doing primary research, industry research, coordinating with clients, etc.

- We maintain the industry database, charts, graphs, financial models, etc.

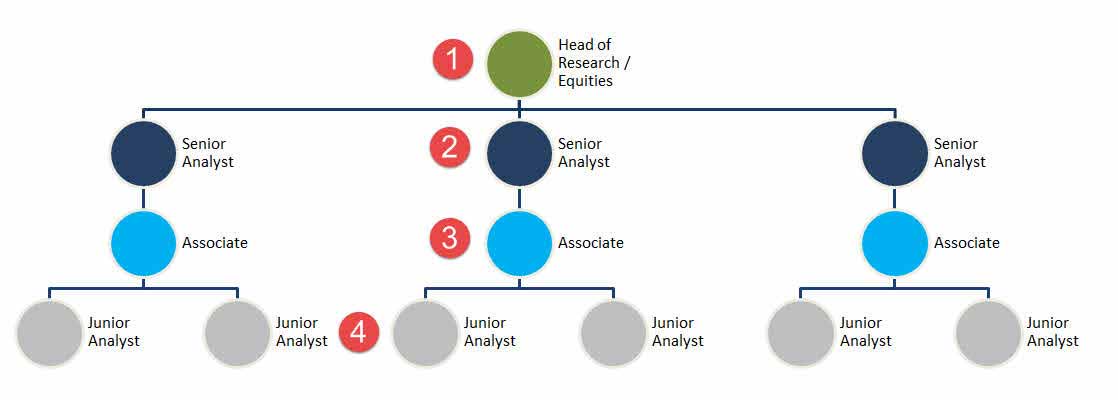

Hierarchy

Now when the roles and responsibilities of each of the professional employed in the equity research division of the investment banking firm is known, it is important to note the hierarchy. This helps understand who is monitored by whom and how it all works step by step:

- A typical hierarchy at an Equity Research firm starts with the Head of Equities/Head of Equities at the top.

- After that, there are Analysts (seniors) covering different sectors. Each analyst mostly covers around 10-15 companies in a specific sector.

- Each Senior analyst may be supported by an Associate, who a couple of Junior Analysts may support.

How To Do?

Equity Research analysts follow stocks and recommend whether to buy, sell, or hold those securities using fundamental analysis. Equity Research is a very challenging job, where an analyst may be required to spend more than 12-14 hours a day.

For creating a professional Equity Research Financial model, an expert analyst's recommended approach must follow the below-mentioned steps:

#1 - Industry Analysis

The first thing to take care of while doing a professional analysis is learning about the economic parameters affecting the industry. These may include factors, like the industry dynamics, competitors, etc. From how a firm deals with its competitors and strategize policies to improve and be the first choice of end users to how it adapts to the latest trends and advancements, everything falls under this step of equity research.

#2 - Fundamental Analysis

Fundamental analysis includes studying the role of management in the form as well as studying the financial statements of the business. The equity firm professionals have the liberty to ask questions from the management directly, which the investors cannot. Hence, having a dedicated equity research team is highly recommended to individual and institutional investors.

When it comes to studying the financial statement, be it a balance sheet or cash flow statement, the analysts try to have a separate sheet to reflect the performance as depicted by those statements. The most important steps here is to perform a ratio analysis of the company under consideration. Let us check the following example depicting how ratio analysis was carried out for Colgate’s historical years:

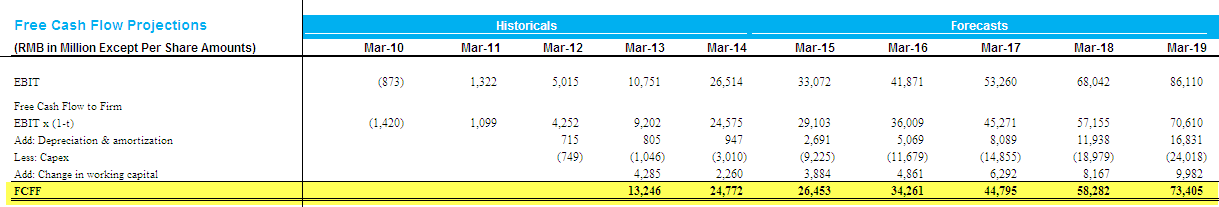

#3 - Forecasting

In the report, the analysts also provide a forecast, thereby guiding investors of the pros and cons of investing in the company they have been considering for so long. This conclusion is derived on the basis of how they decipher the information gathered. The professionals consider the industry size and growth, market share of the company and its revenue generated to derive their conclusions.

- Company management does not provide the future financial projections of the company. Therefore, a research analyst needs to project this data. Forecasting the financials of the company is known as Financial Modeling. I earlier wrote a 6000-word step-by-step tutorial on Financial Modeling. If you want to master Financial Modeling, you can refer to this Financial Modeling Tutorial.

#4 - Valuations

Valuation is the next step in the process. In the process, the analysts evaluate the company’s net worth. This is done in two ways – by considering the Discounted Cash Flow (DCF) or by figuring out the relative valuations. Once the financial model is ready, analysts calculate DCF, which is the valuation method determining the value of the investment that one is supposed to make with respect to the future cash flows as expected.

Relative valuation, on the other hand, is based on comparing the company’s valuation under consideration with the valuation of other firms.

The common approach the analysts follow to figure out the relative valuations is given below.

- The professionals identify the comparable based on the business, market capitalization, and other filters.

- They, then identify a suitable trading valuation multiple to be used for this business.

- The analysts use the average valuation multiple to find the valuation of the company.

- In the last step, they suggest Undervalued or Over-valued.

#5 - Research Report

Once you have prepared the financial modeling and found the fair valuation of the company, the analysts communicate this to clients through the research reports. This research report is very professional and is prepared with a lot of caution. Plus, it contains recommendations, guiding investors or clients of what return they could expect the investment to generate in a specific time period.

Examples

Let us consider the following examples to understand the equity research definition and how does it work:

Example #1

Suppose Jenny asks John to invest in her company X, which has been operating in the market for over 10 years. Though it has not been a dominant market player, the growth or performance of the company has been consistent. For the sake of friendship, John could agree to make the investment, but he decides to assess the maximum risk associated with the deal.

For risk assessment, he contacts an investment banking firm to conduct thorough research and let him know the possibilities. The firm assigns the task to a dedicated equity research team, which ensures John of the same consistent growth, indicating investment in X would not be too risky as the company has been showing a positive growth throughout its journey.

Hence, John agrees to invest in Jenny’s company.

Example #2

On November 07, 2023, Marathon Capital LLC announced establishing its equity research division with an aim to study and observe the constantly transitioning global energy for establishing a clean economy, which it has always wanted to set up. The team has selected members for the venture, who are expected to leverage this product. This team would utilize its prior skill along with their experience in the clean energy sector to conduct research and make the firm, one of the most dominant players in the finance industry.

How To Get Into Equity Research?

When it comes to entering the field of equity research, there are few criteria that an individual must fulfill. Whether one is willing to join this division of investment banking firms as an analyst or as an associate, there are requirements to meet.

For holding a position in the equity research field, one must possess the following skill sets qualifications:

Key highlights to note from this excerpt is -

- MBA is a plus (not a necessity). If you are an MBA, you have certain advantages, but if you are a graduate, you should not get disheartened. You have a chance if you prove your interest in finance. Please look at Can an engineer get into an Investment Bank?

- Financial discipline is not essential, but you must have a strong interest in the financial markets with excellent quantitative and analytical skills.

- You should be fluent in English and have excellent verbal and written communication skills.

- You possess intellectual curiosity, focus, and creativity and have a keen research instinct with creative problem-solving abilities.

- Strong proficiency in Microsoft Excel and Powerpoint

- CFA designation - This is one important designation that the finance industry respects. Try to ensure that you take the CFA examination and pass at least a couple of levels.

Other top skill sets required to enter the Equity Research Industry are –

- Excel Skills

- Financial Modeling

- Valuations

- Accounting

- Report Writing

If you wish to acquire most of the skills that are required to build an illustrious career in equity research, you may consider choosing the Investment Banking Mastery Program (IBMP). The program has been created to provide practical knowledge of key topics like financial modeling, accounting, and Excel through real-world examples and case studies. Moreover, it comes with a certificate that can help boost career development.

Compensation

One of the major concerns of individuals willing to join this field is the salary figure they are offered. Here are designation-wise estimates of compensation one is supposed to receive:

- Junior Analyst/Assistants have a base comp of $45,000 - $50,000 per year (average)

- Associates have a base salary of $65,000 - $90,000 per year (average) depending on the experience. Additionally, they get a bonus of 50-100% of the base salary (in an average to good year)

- Senior Analysts generally have a base compensation of $125,000 - $250,000. Their bonus may range from 2-5 times the base compensation.

Exit Opportunities

The opportunities are huge for sell-side research analysts. Career opportunities that individuals are exposed to once they confirm meeting the eligibility criteria have been explained in detail below:

Within Equity Research Firm

- If you join as an associate, you can move up the ladder to become a Senior analyst assuming full responsibility for the sector coverage.

- Later you can move further up to become Head of Research and Head of Equities.

Private Equity Analyst

- Sell side analysts also move to the Private Equity domain working as Private Equity Analyst.

- Instead of analyzing public companies, they analyze private companies from the point of view of investments.

- They can move up the hierarchy to become a Private Equity Fund manager. Check out the list of Top Private Equity Firms.

Investment Banking Analysts

- The movement of sell-side analysts to Investment banking is slightly tough but not impossible.

- Sell side analysts are fully aware of financial research and modeling-related work.

- They haven't worked on transaction-related work like IPO filing documents, Pitch book, registration work, etc. If you are confused between Investment Banking and Equity Research, read this article - Investment Banking vs. Equity Research.

Buy Side Firms

- Sell side analysts sometimes are also absorbed as buy side analysts (working for Mutual funds, etc.).

- The buy side analysts assume the responsibility of fund managers over some time.

Corporate Finance

- Sell-side analysts work a lot on financial analysis, analyzing company projects and their effect on the overall company's financials. Hence, they get into typical Corporate finance roles of large corporations (take care of financial analysis, planning Projects, etc.)

- Another unique role they get into is Investor relations. As sell-side analysts, they get equipped with the FAQs and how to deal with critical information and its sharing, etc. Due to this, they also become eligible for Investor Relations jobs.

Top Equity Research Firms

Institutional Investors ranking suggests that in 2014, the best research firm was Merril Lynch Bank of America, second place was taken by JPMorgan, and Morgan Stanley came third.

Apart from the top 3 above, there are other notable equity research firms (listed below)

| Deutsche Bank | Standard Chartered Bank |

|---|---|

| Credit Suisse | Cornerstone Macro |

| UBS | Wolfe Research |

| Barclays | BNP Paribas Securities |

| Citi | CIMB Securities |

| Nomura | Cowen and Co. |

| Goldman, Sachs & Co. | Berenberg Bank |

| CLSA Asia-Pacific Markets | Citic Securities |

| Wells Fargo Securities | CRT Capital Group |

| VTB Capital | Empirical Research Partners |

| Sberbank CIB | J. Safra Corretora |

| Santander | Keefe, Bruyette & Woods |

| ISI Group | Kempen & Co. |

| Daiwa Capital Markets | Otkritie Capital |

| Jefferies & Co. | Raymond James & Associates |

| Mizuho Securities Group | Renaissance Macro Research |

| SMBC Nikko Securities | SEB Enskilda |

| Macquarie Securities | ABG Sundal Collier |

| HSBC | Amherst Securities Group |

| Banco Português de Investimento | Antique Stock Broking |

| Batlivala & Karani Securities India | Autonomous Research |

| BBVA | Helvea |

| BGC Partners | Ichiyoshi Research Institute |

| BMO Capital Markets Corp. | ICICI Securities |

| BOCI Research | ING Financial Markets |

| Brasil Plural | Intermonte |

| Commerzbank Corporates & Markets | JB Capital Markets |

| Davy | Kepler Capital Markets |

| EFG-Hermes | LarrainVial Corredora de Bolsa |

| Equita S.I.M. | Lazard Capital Markets |

| Fidentiis Equities | MainFirst Bank |

| Gazprombank | N+1 Equities |

| Goodbody Stockbrokers | Oddo Securities |

| Guggenheim Securities | Okasan Securities Co. |

| Handelsbanken Capital Markets | Oppenheimer & Co. |

| Samsung Securities | Petercam |

| Stifel | Rabobank |

| Strategas Research Partners | Redburn Partners |

| UniCredit | Washington Analysis |

| Vontobel | Zelman & Associates |

Importance

Let us understand the importance of equity research by going through the following points:

- It makes investors aware of potential risks associated with stocks.

- Equity research promotes market efficiency as it helps prices reflect the available information.

- It supports portfolio-related decisions for institutions as well as individuals.

- This process enhances transparency as companies are subject to scrutiny on a regular basis.

- Limitations

- Some of the key disadvantages of this process are as follows:

- Conflicts of interest or analyst bias can impact objectivity.

- Smaller companies may get little to no coverage.

- It is possible that forecasts turn out to be inaccurate owing to different unpredictable market factors.

Equity Research vs Investment Banking

Equity research, being a part of investment banking firms, are supposed to have similar functions as investment banking division of the firms. However, the two terms differ widely, thereby making it important for individuals and entities to be aware of them. Listed below are the differences between the two to have a quick look at if one is willing to take assistance or start a career in the fields:

- While investment banking has a series of positions in line for individuals to join, get promoted, and grow professionally, equity research offers only two but yet important designations to show their performance – one if of an associate and the other is of an analyst.

- The hierarchy to be followed for investment banking is huge and rigid. This means, to get to the next position, one must learn and fulfill the expectations at the current position/designation.

- When the hierarchical structure is organized and there is something to learn at every stage, performance betters and there are chances of having excellent professionals to carry out respective tasks. This is what the field of investment banking ensures. On the other hand, the equity research field has limited opportunities and hence individuals try to grab as much knowledge as possible in the positions they work in. Plus, they are expected to be and they are excellently skilled.

Equity Research vs. Asset Management

People often find the concepts of asset management and equity research confusing. To eliminate all the doubts related to their meaning, purpose, and other aspects, they can look at the following differences:

| Equity Research | Asset Management |

|---|---|

| The main objective of carrying out equity research is to assess companies’ equity and provide buy, sell, and hold recommendations to investors. | Asset management predominantly involves managing an investment portfolio comprising different financial instruments, like mutual funds, real estate, stocks, bonds, etc. |

| Popular equity research roles or designations include senior analyst, head of research, junior analyst, and associate. | In the case of asset management, some popular roles include trader, portfolio manager, and research analyst. |