Table Of Contents

What Is An Equity Research Analyst?

An equity Research Analyst refers to the person who analyzes financial information along with the different trends of the different organizations or the different industries and then gives an opinion in his equity research report based on analysis conduct, thereby helping the clients make the goods investment decisions.

They are financial experts who are experienced and skilled with knowledge enough to understand various trends and scenarios that show the current financial condition of companies are their future potential. They make projections and analyses that help stakeholders and management take important investment-related decisions. They are adept at interpreting financial data and giving opinions on them.

Equity Research Analyst Explained

The equity research analysts are professionals in the field of finance who are experts in handling and interpreting financial data from financial statements, annual reports, publications, etc. They analyse past trends, current conditions and make future projection regarding investments in stocks or equity of businesses.

The primary role of an Equity research analyst is to recommend buying, selling, or holding any financial securities. They prepare a report based on the financial statement of a company. They analyze costing, revenue, risk in the company. An analyst also keeps track of various activities in a company like an industrial seminar, investor day event, investor meeting.

They gather all information and analysis to build a financial model. These models are used to find the value of a company and analyze its financial position; it is based on some assumptions. It helps to predict the future financial performance of the country. An output of the model has the recommendation to buy, sell, or hold with a potential return from the current price. Assumptions made differ from analyst to analyst, and every analyst has a different specification.

Thus, equity research analyst positions is very crucial in driving the market or the economy towards long term investments and also mobilising funds in the right direction. However, it is necessary that they act in the best interest of their clients so that the best results can be achieved by harnessing the knowledge and expertise of these professionals.

Classification

Equity research analysts can be classified as follow:-

#1 - Buy Side

In buy-side companies have research analysts to help them with investment purposes. They monitor the securities daily and access the impact of macroeconomic news on the long-term performance of the stocks. Additionally, they are in touch with the sell-side research analyst for stock advice and updates.

#2 - Sell-Side

The analysis is done to advise the client on the current investment opportunities on the sell-side. They analyze equities to recommend buying or selling particular financial security. These tips are provided to the agent or relationship manager of a brokerage firm and bank in the form of reports prepared by the research analyst.

Video Explanation Of Equity Research

Career

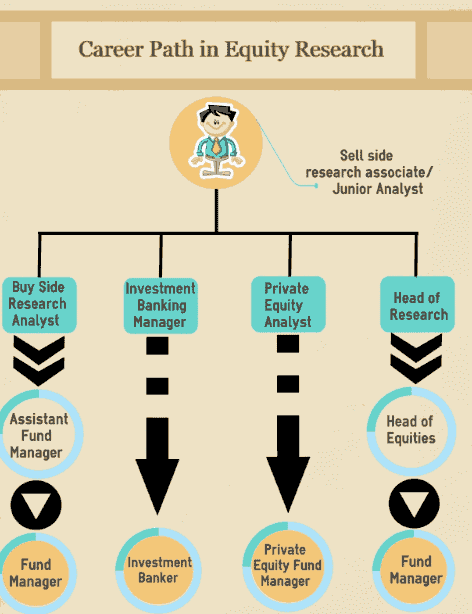

The below mentioned chart will give a snapshot of the career path for these equity research analyst positions. However, let us also lean the details as given below.

Equity Research career starts as a junior analyst and then moves to the Equity Associates roles.

- As a junior analyst, you are responsible for almost everything, including data entry jobs and preparing the companies' financial model. Your main role is to support the Associate in his daily tasks.

- The associate manages either one or maybe two to three junior analysts and ensures the timely completion of the results updates, financial models, equity research reports for the senior analyst.

- The Senior Analyst role is mostly client-facing, wherein they are expected to call and meet the fund managers and regularly communicate about their investment thesis and its rationale.

Salary

The equity research analyst compensation in this kind of job profile will depend on the location, qualification, and experience, the type of company where they are employed etc. However, an approximate breakdown of the salary levels are as follows:

Professionals joining an entry level job can expect a salary of $60000 to $100000, on an annual basis. The professionals who are already at mid-level may expect from $80000 to $150000, yearly. The senior level employees working at reputed financial institutions and also having a good track record may expect $150000 to $300000 annually, excluding bonus. The bonus can be based on performances of individuals, or on the basis of commission, profit share or any other benefits. The more profits the employers earn due to their recommendation, the higher will be the amount of bonus. However, equity research analyst compensation is usually less than the investment bankers since the latter has higher and complex responsibility levels.

How To Become?

The key here in equity research analyst vacancy is to be able to work well under pressure. You should be good at research and analytical stuff. For a Junior equity research analyst, a bachelor’s degree in accounting may be sufficient. However, you should be able to demonstrate your passion for finance. Taking CFA exams is one plus.

Skills

The equity analysts are experienced professionals in the field of finance. Their expertise has a varied range. Let us study each of them in details, as given below.

#1 - Awesome in Financial analysis

In an equity research analyst vacancy, you are expected to be excellent in financial ratio analysis. You should be able to fully understand and analyze the SEC filings and present those in excel.

#2 - Excellent Communication Skills

It is important to have great communication and writing skills. Equity Analysts are expected to publish their investment reports at frequent intervals, and they should be able to communicate well with their clients.

# 3 - Awesome in Financial Modeling

Financial modeling involves forecasting the company's financials and estimating the fair value using DCF Valuation, trading multiple valuations and other valuation tools. As an Equity analyst, be prepared to be awesome in financial modeling.

#4 - You should be Great at Excel

Mostly, you will work under intense pressure with deadlines, especially during earning seasons (quarterly and annual result announcements. Clients expect you to come up with the analysis quickly and accurately. Therefore, you must take every measure to save time. Equity Analysts are experts at excel, and they can pull reports and prepare financial models and charts in no time.

Who Provides Equity Research Analyst Jobs?

These analysts are hired in the following sectors -

- Stock Brokerage

- Mutual Funds

- Wealth Management Firms

- Banks

- KPO's

- Credit Rating Firms

- Media Companies

- DataBase Firms

Exit Opportunities

As discussed earlier, you may work as a sell-side equity research analyst for a couple of years, get promoted as an associate, and move up the chain. However, if you have decided to quit equity research, the following options may be open for you –

# 1 - Get into Buy-Side Roles

Here you would be basically working for the hedge fund managers or the portfolio managers. The skillset for both is similar as you analyze investments and make recommendations. The buy-side offers an even better lifestyle and investing.

#2 - Get into Investment Banking

Many research analysts move into Investment Banking roles like IPO, M&A, etc. Most of the skills required for Investment Banking are the same as that of equity research and offer a lucrative career due to its dynamic nature.

#3 - Get into Private Equity

Getting into private equity could be another exit option. However, this can get tough as you are not working on transactions at equity research jobs and hence the profile differs a bit. That does not mean it is impossible to get into PE. As a research analyst, you would be well versed with investment research only that this will be respect to private companies and not public.

Equity Research Analyst Vs Investment Banker

Both the above roles are in the field of finance and involve a lot of responsibility and experience. They are key players in the financial market who have the ability to provide a lot of insight in the investment scenario. Let us study the differences of both in details.

- The main focus of the equity research analyst roles is the analysis and recommendation of stocks and shares of companies, while the latter mainly concentrates on advisory services in the field of investments, merger, acquisition, capital requirements and raising of capital from investors, portfolio diversification and return levels, etc.

- The equity research analyst roles involves more of interaction with fund managers, investors and other stakeholders of the business. But the latter has to interact and coordinate more with institutional investors, large financial entities and other corporate clients.

- The former’s main aim is to do analysis and forecasting, which helps in predicting the future trends and potential for business growth and its possible opportunities. The latter however helps in structuring and negotiation of financial deals and closing them in a profitable manner in the best interests of all parties.

Thus, we see that both play a very crucial role and have a lot of responsibility in the financial sector. Their skills, experience and interest in the job can make a lot of difference in the market regarding growing and channelizing of valuable resources as and when needed.