Table Of Contents

What is Free Float Market Capitalization?

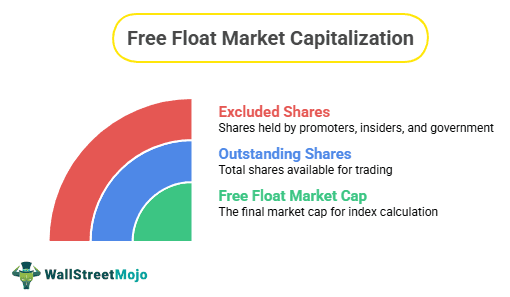

Free float market capitalization is a method by which the market cap of the underlying index is calculated by multiplying the price with the number of outstanding shares, excluding shares held by promoters, insiders, and the government.

Key Takeaways

- In the free float technique, shares held by promoters, insiders, and the government are not included in the calculation of the market capitalization of the underlying index. Instead, the price is multiplied by the number of outstanding shares.

- The free-float market capitalization has several advantages. Companies with huge market capitalizations or low free-floating shares can now be considered in the index's composition, and the index's scope under free float expands significantly.

- Since only the company's free-floating capital is considered, it is conceivable to include these kinds of businesses in the index under the free-float market capitalization to broaden the playing field.

- The full-market capitalization technique contrasts with the free-float methodology in that it calculates market capitalization using active and dormant shares.

Brief Explanation

Free float market capitalization calculates the company’s market capitalization after considering only those shares of a company that are actively traded in the open market and are not held by the promoters or locked-in shares. Free shares that the company issues are readily available and are actively exchanged in the market.

These shares exclude the following shareholders but are not limited to: –

- Shareholding by promoters/founders/partners/directors

- Controlling interest

- Shares held by private equity funds/hedge funds or any other fund

- Locked-In shares pledged to debt borrowers

- Equity held by cross-holdings

- Equity held by various trusts which are not actively traded

- Any additional locked-in shares which are not actively traded in the securities market.

The method is also known as float-adjusted capitalization. Under this method, the resulting market capitalization will always be lesser than the full capitalization method. The world’s major indexes have widely adopted the free-float methodology. The famous indexes which currently use the free-float method are S&P, FTSE, and MCI index.

Video Explanation of Market Capitalization

Formula to Calculate Free Float Market Capitalization

Calculation

Let us assume that there is an XYZ company with the following details –

- Outstanding Shares = 20,000 shares

- Promoter Holding = 5,000 shares

- Locked Shares with Shareholders = 2,000 shares

- Strategic holding = 1,000 shares

The current market price is $50 per share. But, first, let us determine the market capitalization and free-float market capitalization.

Market capitalization = total number of shares x current market price = $50 x 20,000 = $1000,000 = $1 million

For calculating the free-float market capitalization, follow these steps: -

- Number of shares unavailable for trading = Promoter Holding + Locked shares with Shareholders + Strategic Holding

= 5,000 + 2,000 + 1,000 = 8,000 shares

- Free Float Market Capitalization = $50 x (20,000 – 8,000)

- Free Float Market Capitalization = $50 x $12,000

- Free Float Market Capitalization = $600,000

Advantages

- The free float index represents the market sentiments more rationally and accurately. This is because it considers only actively traded shares in the market, and no promoter or shareholder holding a major percentage - can easily influence the market.

- The method makes the index’s base broader as it reduces the concentration of the top companies in the index.

- The scope of the index under free float becomes much wider as companies with large market capitalization or low-free floating shares can now be considered in the composition of the index. Under the free-float market capitalization, since only the company’s free-floating capital is considered, it is possible to include these types of companies in the index to increase the ground play.

- Large free-floating shares have less volatility in their claims as more shares are actively traded in the market, and fewer people have the power to increase or decrease the share price significantly. On the other hand, claims with less free-float are likely to see more price volatility as it takes fewer trades to move the share price.

- It is considered the best method and is the industry’s best practice. Almost all major indices of the world, like the FTSE, S&P STOXX, etc., are weighted under this method. In addition, the NASDAQ-100’s Exchange Traded Fund QQQ is also weighted free-floating. In India, both the NSE and BSE use the free-float method to calculate their benchmark indices – Nifty and Sensex – and assign weight to stocks in the index.

How should investors use Free Float information?

A risk-averse investor generally looks to invest in the shares with a large free-floating of claims, resulting in less share price volatility. In addition, the percentage is actively traded, increasing the volume of shares, giving the investor an easy exit in case of a loss. The shareholding of the promoter party is also less, giving the retail investor more voting rights and power to actively participate in the company’s initiatives and express their opinion and solutions to the board.

Development of Free-Float Factor in BSE Sensex (India)

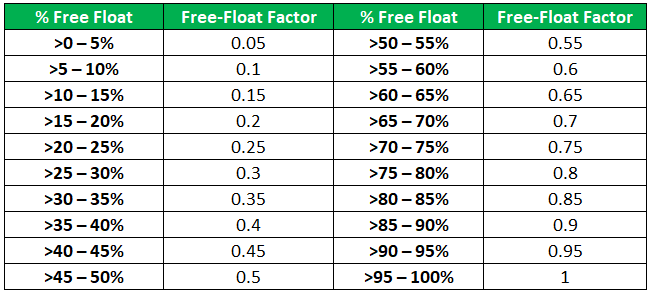

In India, the Bombay Stock Exchange has developed a platform whereby each listed company must submit its shareholding patterns quarterly. It determines the free-float factor, which the exchange adjusts to the full market capitalization method. It is rounded off to the higher multiple of 5, and each company is categorized into one of the 20 bands mentioned below. A free-float factor, e.g., 0.55, means that only 55% of the company’s market capitalization will be considered for index calculations.

Free-Float Bands

Source:- Bse Website

These factors are multiplied as per the information provided by the company to calculate the free-float market capitalization of any company in the exchange.