Market Cap vs Enterprise Value | Same or Different?

Table Of Contents

Market Cap vs Enterprise Value

Probing the value of a company plays a critical role in any finance industry sector. A key reason is that it helps the investors make better investment decisions and provides them with a comprehensive view for acquisition assessments and budgeting purposes. Also, it enables investors and analysts to forecast and predict the future earnings of a company.

Thus, it becomes even more important to use the right metrics to measure the value of a company, given the widespread financial metrics. However, the most frequently used parameters are Market Cap and Enterprise Value.

Let us have a look.

What is Market Cap?

Also known as market cap is the market value of a company's stock. This financial metric assesses the value of a business based solely on the stock. Therefore, to find the market cap of a company, one can multiply the number of shares outstanding by the stock's current share price.

The market capitalization formula is as follows;

Market capitalization = shares outstanding x price per share

Where:

- Share outstanding = the total number of common stocks issued by a company excluding the preferred shares.

- Price per share = the stock's current price in the individual listed market such as NSE, BSE, NYSE, NASDAQ, etc.

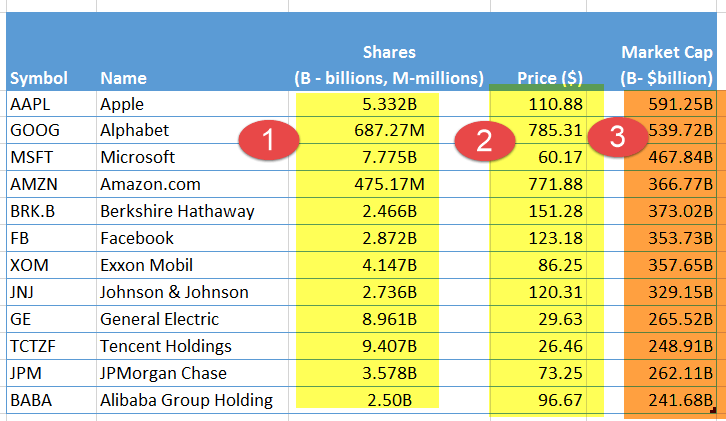

Market Cap Calculation

Please have a look at the below table for Market Capitalization calculations.

source: ycharts

Market Capitalization is Shares Outstanding (1) x Price (2) = Market Cap (3)

Apple has a total of 5.332 billion shares outstanding, with each share trading at the current market price of $110.88 (Nov 9th closing). Consequently, its market capitalization is worth $591.25 billion (5.332*$110.88), based on the information given above.

The important thing to note here is that a company's market capitalization keeps changing with the fluctuation in the share price. It means that the company's market cap increases and decreases with the rise and fall of the stock price.

Where to find Market Cap information?

Determining the value of a company, the students or entry investors can find detailed information regarding the current share price of a company, shares outstanding, enterprise value, etc., on various websites such as Yahoo! Finance, Google Finance, Bloomberg, and many other websites. One can search the company by filling in the company's name or ticker in the search engine to get the information.

You can also consider making access to Ycharts for the same.

Video Explanation Of Market Cap vs Enterprise Value

Price vs. Market Capitalization

Investors should not be carried away with the price per share because it is one of the common misconceptions regarding a good indicator of the size of a company.

For instance, if a company, ABC, has 7.78 billion shares outstanding and the current market price of its stock is $80 per share, it will have a market capitalization of $622.4 billion. That is to say, the market cap of company ABC is higher by $29.7 billion compared to Apple's market cap of $592.7 billion.

Moreover, this larger market cap for ABC was despite its current share price being lower than that of Apple, as stated above. Thus, a company with a higher share price does not necessarily mean that the company is worth more than the company with a lower stock price.

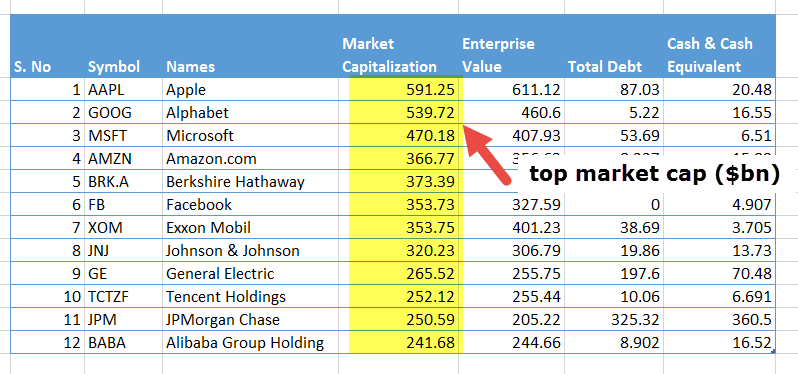

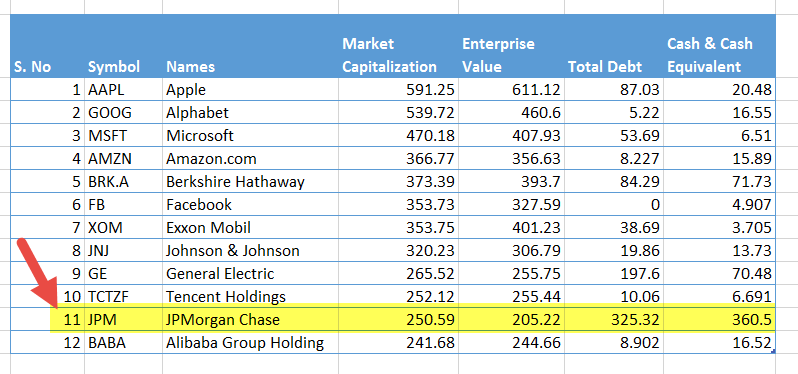

Top 12 companies by Market Cap

Below is the list of the top 12 companies by Market Capitalization. We note that Apple is on top with a market capitalization of close to $590billion, whereas Google is second with a market cap of $539.7 billion.

source: ycharts

Market Capitalization and Investment rationale

A company with a lower market cap provides investors with greater growth opportunities in the future. In comparison, the company with a higher market cap is entitled to carry less risk regarding price volatility, and a sustainable growth rate with a good return on investment. The chart below shows the market cap for the largest companies in the world.

Why is Market Cap important?

- It helps investors and analysts to examine the cost of buying the entire shares of a company in the case of a merger or acquisition.

- This financial metric lends a hand in determining factors in stock valuation.

- It represents the market view of a company’s stock value.

- Market cap enables investors to make a potential investment in a company based on the market cap size, such as large-cap, medium-cap, and small-cap.

- It facilitates investors in identifying peers within the same sector or industry. Also, read comparable comps.

Thus, it is evident from the above information and examples that market capitalization is the function of both the price per share and the shares outstanding. However, it completely ignores the debt portion of a company that plays an equally important role in the company's overall valuation on the purchase by the new owners. As such, the latter part of this article will briefly highlight the Enterprise Value that provides a clear picture of the real value of a company. Let us have a look.

What is Enterprise Value?

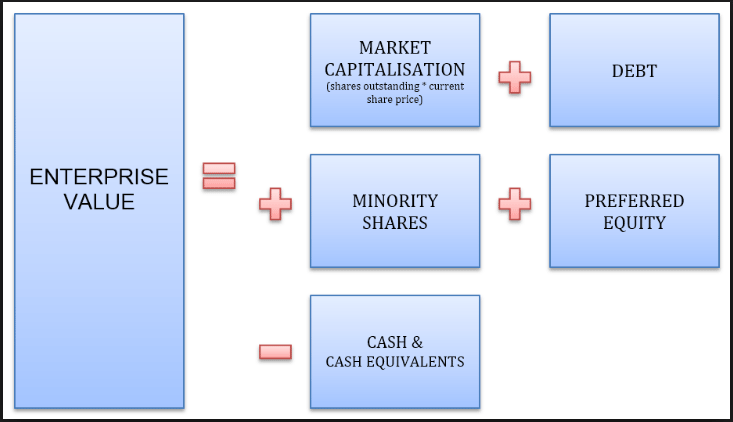

On the other side, Enterprise Value is a more comprehensive and alternative approach to measuring a company's total value. It considers various financial metrics such as market capitalization, debt, minority interest, preferred shares, and total cash and cash equivalents to arrive at the company's total value. Although the minority interest and preferred shares are usually kept at zero effectively, this may not be the case for some companies.

In simple words, enterprise value is the total price of buying a company as it calculates the accurate value of a company.

The formula to calculate EV would be;

Enterprise Value = market value of the common stock or market cap + market value of preferred shares + total debt (including long and short-term debt) + minority interest – total cash and cash equivalents.

Or

Enterprise Value = Market Capitalization + Debt + Minority Shares + Preferred Stock – Total Cash and Cash Equivalents

source: ycharts

However, it is considered that a company with more cash and less total debt on its balance sheet will carry an enterprise value less than its market capitalization. In contrast, a company with small cash and more debt on the balance sheet will have an enterprise value higher than its market capitalization.

For example, have a look at JPMorgan Chase. It is cash, and the cash equivalent is very high. It results in its enterprise value is less than the market capitalization.

source: ycharts

Top 12 Enterprise Value Companies

Why Enterprise Value is Important?

- A company with less or no debt remains an attractive buy option for investors due to the lower risk.

- A company with high debt and less cash carries a higher risk because the debt raises the costs, and therefore it remains less attractive to investors.

For example, two companies with the same market capitalization can fundamentally provide different enterprise values due to a high level of debt and low cash balances for one and low debt and high cash for the other. It is given in the table below.

| Description | Market Capitalization | Debt | Cash | Enterprise Value |

|---|---|---|---|---|

| Company A | $10 billion | $5.0 Billion | $1.0 billion | $14.0 billion |

| Company B | $10 billion | $2.0 billion | $3.0 Billion | $9.0 billion |

From the above example, it is clear that Company A remains riskier than Company B due to higher debt, despite their market capitalization being identical. Therefore, the buyer will likely acquire Company B with no debt.

Why Enterprise Value provides an accurate value for a company?

Digging further into enterprise value unveils that it computes the assets' value that allows the company to produce its product and service. Hence one can say that it encompasses the economic value of a firm because it considers the equity capital and debt obligation of an enterprise. A key aspect that includes the total debt and total equity is that these metrics enable the company to calculate EV ratios.

Also, look at Equity Value vs. Enterprise Value.

EV Ratios

EV ratios help investors provide key insights and comparisons between two companies with large differences in capital structure and thereby make sound investment decisions.

There are quite a number of EV ratios. They include;

- EV/EBIT (Earnings before interest and tax)

- EV/EBITDA (Earnings before interest, tax, depreciation, and amortization)

- EV/CFO (Cash from the operation)

- EV/FCF (Free Cash Flow)

- EV/Sales or Revenue

- EV/ Assets

For this discussion, we will discuss the EV/EBIT Ratio.

EV/ EBIT

EV/ EBIT ratio assists the investors in finding out the enterprise multiple that remains a critical function in the purchase decision. Usually, the lower enterprise multiple is considered a better value for a firm in comparing the two different companies held for acquisitions.

The investors can get the earnings yield upon turning the ratio around, which allows the investors to get to know the earnings yield for a company. More often than not, a higher-earning yield indicates a better value for a firm.

Let us compare two companies to better understand this ratio and its implication for the decision-making process. For instance, company ABC has an enterprise value of 5 billion, and its earnings before interest and tax are $500 million. In comparison, company XYZ has an enterprise value of $5 billion, and its earnings before interest and tax are $650 million.

Company ABC:

EV/ EBIT = $5.0 billion / $500 million = 10 multiple (5000/500)

EBIT/ EV = $500 million / $5.0 billion = 10% yield (500/5000)

Company XYZ:

EV/EBIT = $5.0 billion/ $650 million = 7.7 multiple

EBIT/EV = $650 million/ 5.0 billion = 13% yield

Investment rationale for EV/EBIT

The thumb rule says that lower enterprise multiple and higher earnings yields reflect better value for your money. Thus, in this case, the investors will be willing to put their money into the company XYZ as it has a lower enterprise multiple and higher earnings yield.

Likewise, the value investors can calculate the other ratio. The thumb rule applies to all the EV ratios despite large differences in the other financial metrics such as EBITDA, cash flow from operations, free cash flow, sales and revenue, and assets while keeping the capital structure neutral.

Thus, once the investors or value investors can find out the enterprise value, he or they can be in a better position to make their decision to go for acquisition or not. EV can be considered a critical financial metric for calculating the enterprise value.

Market Capitalization vs. Enterprise Value

| Area of Comparison | Market Capitalization | Enterprise Value |

|---|---|---|

| 1. Meaning | Refers to the market value of the shares outstanding | Refers to the costs of acquisition, including the amount payable towards debt and Equity |

| 2. Formula | Number of shares outstanding (x) the current share price | Market Cap + Debt + Minority Interest + Preferred shares - total cash & cash equivalents |

| 3. Preference | Less preferred due to its usage in theoretical calculation rather than practical to determine the value of a company. | More preferred because it takes into consideration a number of factors to calculate the true value of a company. |

Conclusion

Thus it is clear from the above examples that both the financial metrics have different approaches to identifying the market value of the given company. Market capitalization is one side that helps the investors to find information regarding the company's size, value, and growth; the enterprise value enables investors to measure the overall market value of a company on the other. However, the enterprise value is preferred more than the market capitalization metric because it accurately determines the company's value and helps the analysts forecast the company's growth in the future by using the EV ratios, as stated in this article.