Table Of Contents

What Is The Sustainable Growth Rate Formula?

A sustainable growth rate (SGR) signifies how much the company can grow sustainably in the future without relying on external capital infusion in the form of debt or equity and is calculated using the return on equity (which is the rate of return on the book value of equity) and multiplying it by the business retention rate (which the proportion of earnings kept back in the business as retained earnings).

- Return on equity is the percentage of earnings for a company period for the equity invested in the company. Return on equity is arrived at by dividing earnings from equity.

- The Retention ratio is the percentage of earnings that the company retains for its use and future growth. The retention amount is the residual amount after the amount paid from earnings as a dividend.

Sustainable growth rate Formula = RR * ROE

Where

- RR= Retention ratio

- ROE= Return on Equity

Explanation

It is the operational growth rate achieved without considering the borrowed funds in the form of debt by the company. That's why this ratio is considered to be sustainable as this much the company will be able to grow even without taking any outside debt investments.

It is the growth achieved by a company with the help of the earnings it decides to retain after distributing the amount of money to the shareholders in the form of a dividend. Therefore, an analyst looking at a sustainable growth rate ratio will look for a higher ratio as it signifies a better prospect for the company.

Video Explanation of Sustainable Growth Rate

Examples of Sustainable Growth Rate Formula (with Excel Template)

Let's see some simple to advanced examples to understand it better.

Example #1

Let's assume some numbers in the table below to calculate the sustainable growth of the two companies. Calculate the sustainable growth rate for these two arbitrary companies.

| Company | A | B |

|---|---|---|

| Earning Per Share | $4 | $5 |

| Dividends Per Share | 1.5 | 2 |

| Return on Equity | 14% | 10% |

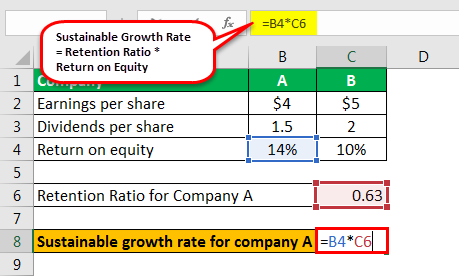

To calculate a sustainable growth rate, we need the return on equity of a company and retention ratio, which is calculated by deducting the dividend amount payable from the company's earnings and dividing that numerator by net income available to the shareholders.

Retention ratio for Company A

RR= 1- (dividends paid/earnings)

- Retention ratio for Company A= 1- (1.5/4)= 0.63

Retention Ratio for Company B

- Retention ratio for Company B= 1- (2/5) = 0.60

Therefore the calculation of the Sustainable Growth Rate equation for company A is as follows,

- Sustainable growth for company A = 14%*.63

Sustainable Growth Rate for company A

- Sustainable growth for company A= 8.8%

Therefore the calculation of Sustainable growth rate for company B is as follows,

- Sustainable growth for company B = 10%*0.60

Sustainable Growth Rate for Company B

- Sustainable growth for company B= 6.0%

Example #2

Calculate the Sustainable growth rate for Reliance Industries. The table below depicts the dividend, earnings per share, and the return on equity for reliance industries.

| Headings | Ratios |

|---|---|

| Earnings Per Share | Rs 56 |

| Dividends Per Share | 6 |

| Return on Equity | 12% |

Retention Ratio for Reliance Industries

- Retention ratio for Reliance Industries = 1- (6/56) =0.89

Therefore the calculation of the SGR formula is as follows,

- Sustainable growth for Reliance Industries = 12%*.89

The sustainable growth rate for Reliance Industries

- Sustainable growth for Reliance Industries = 11%

The higher the rate of Sustainable growth the better it is for the company; the ratio signifies how much the company can do in the normal course of business. For example, the ratio for reliance industries signifies that reliangrow sustainably in the future with the number of earnings it generates with the help of industries can grow by 11% on a sustainable basis.

Example #3

The table below depicts the dividend, earnings per share, and the return on equity for Tata Steel.

| Headings | Ratios |

|---|---|

| Earnings Per Share | Rs 75 |

| Dividends Per Share | 9.4 |

| Return on Equity | 23% |

Retention ratio for Tata Steel

- Retention ratio for Tata Steel = 1- (9.4/75) =.87

Therefore the calculation of the SGR formula is as follow,

- The sustainable growth for Tata Steel = 23%*0.87

The SGR for Tata Steel

- The sustainable growth for Tata Steel = 20%

The higher the rate of SGR the better it is for the company; the ratio signifies how much the company can grow sustainably in the future with the number of earnings it generates with the help of the normal course of business. For example, the ratio for Tata Steel signifies that Tata Steel can grow by 20% on a sustainable basis in the future.

Relevance and Uses

Sustainable growth is a critical ratio to finding out the prospect of a company. Therefore, analysts who analyze the company keep a very close look at the ratio. The ratio is arrived at by using two vital parameters: the return for the company's equity shareholders. And the second variable used for calculating the SGR Formula is the retention ratio.

It is desirable to have a higher ratio for return on equity as that signifies higher earnings on the same level of equity investments and a higher retention ratio. Suppose a company is maintaining a higher level of retention ratio. In that case, it signifies that the company has future growth prospects and is confident of generating a higher return with the money it is willing to retain. The reason for which return on equity is used as a variable for the ratio is that it directs towards the operational growth of the company, which is attained without the use of financial leverage.