Table Of Contents

What is Minority Interest?

Minority Interest is the holding of a stake by the investors, which is less than 50% of the existing shares or the voting rights in the company. Therefore, they do not have control over the company through their voting rights, having a little role in making its decisions.

In simple words, Minority interest is the value of a share or the interest attributable to the shareholders holding less than 50% of the total number of shares. Shareholders holding less than 50% of the total outstanding shares are known as minority shareholders. It is also known as Non-controlling interest.

In the accounting world, it means ownership in a subsidiary company not owned by a holding company, which is also known as Parent Company. For a Company to be a holding company, it must always hold more than 50% of the shares in its subsidiary company.

For example, A & B are the two shareholders of Company Pine-Apple Inc., holding 80% and 20%, respectively. In the Balance-sheet of Pine–Apple Inc., Shareholder B will be considered a minority shareholder since it owns less than 50% of total shares, and its net worth as on date has to be shown under the separate head as a minority interest. Whereas, shareholder A is the majority shareholder of Pine-Apple Inc.

Table of contents

Financial Reporting of Minority Interest

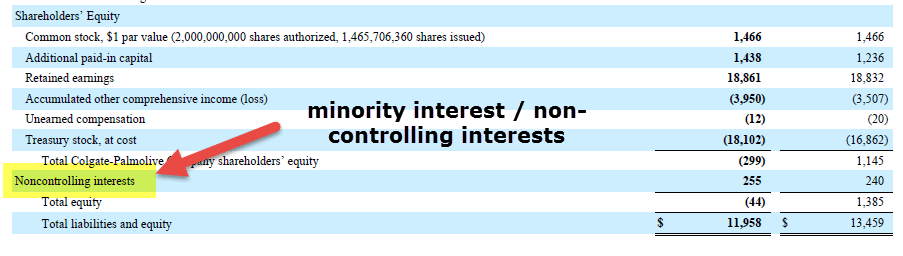

This concept arises only when the company prepares two sets of financial statements Viz. A separate set of financial statements and Consolidated Financial Statements. It is reported separately only in the consolidated financial statement. Minority interest adjustments occur when the parent does not own 100% of the subsidiary.

In the consolidated profit and loss, account minority interest is the proportion of the results for the year that relate to the minority holdings. It is disclosed on the face of the consolidated profit and loss account under "Profit on ordinary activities after taxation."

As per IFRS, Minority Interest is shown under the Equity section of the consolidated balance sheet, whereas US GAAP offers much flexibility for reporting. For example, under US GAAP, it can be reported under the liabilities or equity section.

Checkout the difference between IFRS vs. US GAAP

The reason for separate line items with respect to such interest is to give a clear picture to the users of financial statements about the various controlling interests in the company. It helps them in making informed economic decisions and also helps them in making comparisons on the shareholding patterns of different companies. In addition, it plays a huge role in analyzing various investment opportunities and calls for its consideration while computing various ratios and analyzing financial statements.

One other reason for separate disclosure is to provide certain protection to minority shareholders as they are in a position of disadvantage. Since they are hardly involved in the decision-making process, there is a need to protect them from oppression and mismanagement of conduct of the company’s affairs by management.

Minority Interest Explained in Video

Minority Interest Example - Consolidation Calculation

As mentioned earlier, it arises whenever a holding company owns a controlling interest (Less than 100 percent) in a subsidiary company. The claim of shareholders on a company's net assets is known as a minority interest. These minority shareholders, like any other shareholders, have an equal but proportionate claim on the earnings and assets of the subsidiary.

The consolidated balance sheet comprises all of a subsidiary's assets and liabilities. Similarly, the consolidated income statement includes all of the revenues and expenses of a subsidiary. The controlling interest of the parent company gives it enough rights to manage all of the net assets of a subsidiary, which justifies the inclusion of 100 percent of the subsidiary’s assets, liabilities, revenues, and expenses in the consolidated financial statements. It is important to note that the parent company includes 100 percent of the subsidiary’s assets, liabilities, revenues, and expenses in its consolidated financial statements. However, it does not have a claim on 100 percent of the net assets or earnings. The consolidated financial statement, therefore, recognizes the claim of the minority shareholders. Let's understand the above facts with the help of illustrations.

Let's assume that H Inc. acquired 80% of equity shares in S Inc. for $ 650,000 in January 2015. On the date of acquisition, the book value of equity was also $ 650,000 (Comprising of equity shares $500,000 and retained earnings $150,000).

Exhibit 1

| Total | Company H (80 %) | Minority Shareholders (20%) | |

|---|---|---|---|

| Equity shares | 500,000 | $ 400,000 | $ 100,000 |

| Retained earnings | $ 150,000 | $ 120.000 | $ 30,000 |

| Total Equity | $ 650,000 | $ 520,000 | $ 130,000 |

Let's see how goodwill will be calculated and shown in the consolidated balance sheet of H Inc.

Calculation of Minority Interest

20% of 650,000 = $ 130,000

Calculation of Goodwill

Amount paid for 80% equity in S Inc. $ 650,000

Books value of 80% equity $ 520,000

(650,000 x 80%)

Excess amount paid or Goodwill $ 130,000

Consolidated Balance sheet of H Inc. as of January 2015.

| Shareholder Equity | |

| Minority Interest | 130,000 |

| Assets | |

| Intangible assets | |

| Goodwill | 130,000 |

This $ 130,000 will not appear in the separate financial statement of either H or S Inc. Rather, it will appear in the consolidated financial statement of H Inc.

Subsequent recognition from the date of acquisition

Let's assume in the above example,

Company S Inc. generated retained earnings of $ 7,000 in three years (January 2015 to January 2018). After the date of acquisition, S Inc registered a net profit of $ 48,000 in year 4.

Now let’s see how this impacts the calculation of minority interest.

Exhibit 2

| Total | Company H | Minority Interest | |

|---|---|---|---|

| Equity shares | $ 500,000 | $ 400,000 | $100,000 |

| Retained earnings: | |||

| Year 1 | $ 150,000 | $ 120,000 | $ 30,000 |

| Increase in earnings over three years | $ 7,000 | $ 5,600 | $ 1,400 |

| Net profit for year 4 | $ 48,000 | $ 38,400 | $ 9,600 |

| Total Shareholders’ equity | $ 705,000 | $ 564,000 | $ 141,000 |

In exhibit 1 above, H Inc.’s investment in subsidiary company S was valued at $ 520,000 in year 1, subsequently increasing by $7,000 between year one and year 3 for its 80% share of Company's earnings. Company S earned $48,000 during year 4.

Similarly, minority interest in company S increased from $130,000 on January 1, 2015, to $ 141,000 in January 2019.

Minority Interest Valuation

Any valuation of a company requires forecasting financial statements for the future based on certain assumptions and parameters. While most of the financial figures directly relate to revenue and net profit, forecasting the minority interest based on the revenue and net profit figures will lead to ambiguous data. Hence, to address the above issue, analysts have drawn out four common methods or approaches for correct computation.

- Constant growth - Analysts rarely use this approach as it assumes there is no growth/decline in the performance of the subsidiary.

- Statistical growth – In this approach, analysis is done on past figures to establish a certain trend. This model suggests that the subsidiary will grow at a stable rate based on past trends. It is known as statistical growth as it uses various forecasting tools like moving average, time series, regression analysis and etc. It is not used for companies engaged in dynamic growth industries like FMCG and etc. but are used for companies engaged in industries like utilities that experience constant growth.

- Modeling each subsidiary separately – This involves forecasting each subsidiary individually, followed by adding up the individual interest of subsidiary companies arrive at one consolidated figure. This approach offers flexibility to analysts and results in the most accurate computation. But this cannot be adopted in all circumstances as it leads to time and cost constraints, and also, this concept is not feasible in cases where there are several subsidiaries.

The most important thing to remember in the valuation of minority interest is that its valuation is affected by internal and external factors applicable to the company and the industry in which it operates. These require careful consideration as their impact will differ for different companies. Also, one has to consider the applicable laws, bye-laws, and regulatory regulations.

FAQ's

Since the balance sheet is prepared on the historical cost basis or the book value basis, itu00a0should also be valued on a book value basis. However, the debate is raging on the pros and cons of this approach.

Yes, absolutely, it is important in Ratio Analysis. Any ratio that takes into account capital structure has to take into account the implication of such interest.u00a0 To name a few important ratios: Debt equity ratio, Return on equity, Capital gearing ratio, and return on capital employed are impacted.

Interpret ROE u2013 The numerator should be profit after minority interest while the denominator includes u0022shareholder's equity excluding minority interest.u0022 The above formula will calculate the return generated by the parent shareholders.

Net Margin ratio u2013 Revenue in the denominator and numerator should be taken as profit before minority interest/sales.

Liability can be defined as an obligation on the company arising out of past events that will result in an outflow of resources. E.g., the provision on unpaid bills, employee dues, creditors balances all these denote and will entail the outflow of resources (i.e., cash or its equivalents) in the future. Since no cash has to be paid to outsiders on account of such interest hence, it cannot be treated as a liability.

On the other hand, assets mean something of value to an enterprise on which it has control and will result in receipt of cash or its equivalents in the future. Though such interest has value, the company has no control over it. It represents the non-controlling interest of shareholders. Hence, It is neither an asset nor a liability.

It is certainly not debt as there is no obligation on the company to repay it. There are no mandatory payments, fixed life, etc. Since minority interest is not payable, it cannot be termed as debt. Whereas, it does satisfy some preconditions to be construed as equity. Assets of the consolidated balance sheet have some contribution coming from minority interest. As per the generally accepted accounting principles, it is presented as part of shareholders' equity in the consolidated balance sheet. And even it is included with shareholder's equity in all relevant ratios.

Enterprise value is the company's total value. Enterprise value is always greater than market capitalization since it also includes the debt. But one pertinent question which lingers on is whether it should be included for computation of enterprise value. Since enterprise value represents the total capitalization of a company, hence it is always a part of enterprise value.

Conclusion

Minority interest provides the user of financial statements with useful insights, which helps them analyze and make informed decisions.

- Appointment of directors on the board of directors of the company and fix their compensation.

- Making changes in the articles of association and other important applicable regulatory provisions.

- Registration of the company's shares for initial public offering

- Making changes in the capital structure of the company

This concept has evolved. In the past, it has not received much attention in the accounting literature. It was referred to as a liability, equity, or neither. Even today, there is little guidance on treating and presenting minority interests. And there is no consensus on any position.