Table of Contents

Key Takeaways

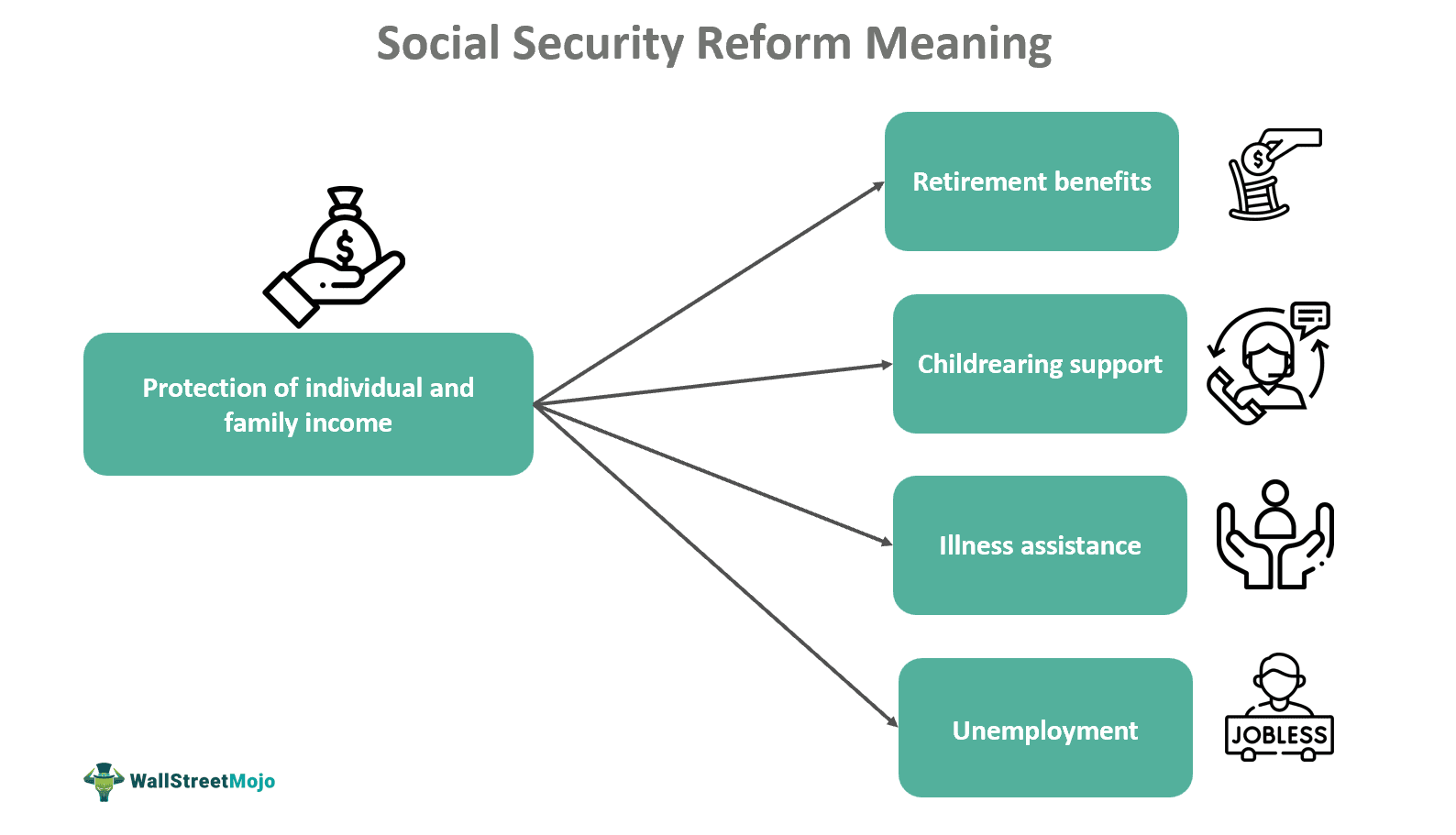

- Social Security reform means modifying the present system to solve concerns such as funding gaps, benefit adjustments, and program sustainability in order to ensure long-term financial stability and sufficiency.

- To address budget gaps and maintain the program's long-term stability, proposals for Social Security reform include raising the payroll tax cap, lowering benefits for higher earnings, and investigating alternate funding systems.

- The reform aims to solve financial issues and maintain program sustainability by implementing modifications to the retirement age, benefit structures, and funding sources.

- These changes affect economic variables, retirement planning, and the general financial stability of the Social Security system.

Proposals

The social security reform proposals are as follows-

#1 - Increasing the age of retirement

- The Congress-established schedule in 1983 progressively raised the age at which an individual could receive full Social Security retirement payments. For people born in 1960 and later, it has reached 66 and will eventually grow to 67. One way to close the financial deficit for Social Security is to raise the full retirement age. A plan to raise it to 68 is put up, with a two-month increase per year until 2028. This is meant to close an 18% funding shortfall. An additional plan seeks to boost it to 70 and calls for a similar gradual increase until 2040, which should close 44% of the financial deficit.

- Critics of raising the full benefits age contend that the change is justified since people are living longer. They argue that in the absence of these changes, pensioners would have to face financial difficulties since they would be living in retirement for a large percentage of their life. Notably, fewer people lived to retirement age, and life expectancy was lower in 1935, the year Social Security was established. Supporters contend that these changes are required to ensure the Social Security system's sustainability and to conform to rising life expectancies.

- Up to $110,100 in annual income is subject to Social Security payroll tax; income over this amount is not subject to Social Security payroll tax. Currently, this cap, which rises yearly in line with the average national pay, accounts for around 84% of all national wages. There is a proposal to raise the threshold to cover 90% of all wages, which is anticipated to fill 36% of the financial gap for Social Security.

#2 - Raise the Payroll Tax Ceiling

Proponents contend that increasing the ceiling to include 90% of total income is just and fair. The fact that only 6% of workers make more than the current $110,100 threshold is highlighted. Proponents stress the equity of having higher-earning people contribute more to Social Security, in line with Congress's original 1977 goal to pay 90% of earnings. When paired with other changes, this plan is thought to be a workable way to guarantee Social Security's financial stability and possibly provide cash for benefit enhancements.

#3 - Decrease Benefits for People with High Incomes

The earnings due to Social Security payroll taxes influence Social Security benefit disbursements. Higher lifetime earners are compensated more generously than their peers, although the benefits are less than their previous earnings. According to one idea, payments for higher lifetime earners might be reduced to close the financing shortfall for Social Security. This might entail changing the benefit calculation, using a sliding scale to reduce benefits more significantly for high incomes, less significantly for intermediate earners, and not at all for low workers. The highest-earning 25% of the population (estimated to contribute 7% of the funding deficit) or the highest-earning 50% (estimated to fill 31% of the funding gap) could have their benefits steadily reduced over time.

Examples

Let us look at the social security reform examples to understand the concept better-

Example #1

Urbanization and industrialization picked up speed during World War I, which led to calls for social changes such as pensions for older people and allowances for civilian widows and their families. Manitoba led the way, passing the Mothers' Pensions Act in 1916, which gave widows and deserted wives with children access to financial support. This signaled the start of provincially-wide legislation known as "public assistance," which was modeled after the English poverty law.

The federal Liberal Party made the following promises in 1919: unemployment insurance, contributory old-age pensions, and health insurance. Due to the BNA Act and commercial interests, these promises were not kept. In order to address these issues, the federal government implemented conditional grants, which enable it to work with the provinces on public assistance initiatives.

The first old-age pension program began in 1927, followed by blind pensions in 1937, both of which used rigorous means criteria, reflecting the poor-law attitudes of early social security.

In response to rising unemployment during the Great Depression, the federal government came out with relief programs, away from the 19th-century model of local help. This included giving grocery, fuel, and clothing help, as well as lodging unemployed men in military-style barracks modeled after previous poorhouse traditions. This period saw a transition in Canada's social structure as it responded to its residents' changing needs amidst difficult/unknown circumstances.

Example #2

Social Security retirement payments, which millions of Americans had been looking forward to, were about to be cut by 20% over the following ten years due to a funding shortfall. This resulted from the fact that Social Security's trust funds would run out by 2034 and that payouts would have been cut immediately. Senator Bill Cassidy and Representative John Larson had each put out separate measures for change, but delays prevented swift action.

Cassidy proposed to close 70% of the financial deficit by establishing a new fund that made stock market investments. Larson's Social Security 2100 measure, meanwhile, aimed to raise payments and help individuals escape poverty. However, there were issues with both plans and doubts about their quick implementation.

The potential ramifications for Social Security claimants further highlighted the importance of taking action. The impending benefit shortage may have had a substantial effect on people and their families who depended on Social Security for financial help if a resolution hadn't been achieved. Voters were urged to put pressure on Congress as the discussion went on to address these important concerns and guarantee Social Security's long-term security.

Impact

The impact of social security reform is listed below-

- When analyzing the effects of social security reform on saving, several theoretical differences emerge that necessitate choosing the appropriate theoretical framework and assumptions about household behavior.

- The social security system's complexity makes it difficult to understand its functioning; therefore, comprehending the current program execution is critical before analyzing the consequences of new decisions.

- Differences in saving behaviors among households highlight the need for personalized approaches in social security reforms, which indicates that alternative models may be better for different populations.

- There is widespread agreement that switching to a sustained funding system can be good as long as changes in government expenditure or taxes do not offset it. Improving the program's funding is viewed as the utmost and primary need to influence the country's savings rate.

- Saving more pushes the trade-off between current and future spending and thus raises the savings rate, which may not necessarily improve household welfare. For example, transitioning from an unfunded to a funded system might be difficult.

- Political economy variables have an important role in determining the impact of social security reform. The efficacy of reform in growing national savings may be dependent on its implementation, especially the administration of the Social Security trust fund and the constraints imposed by obtaining consent from existing employees and retirees.

Social Security Reform Explained

Social security refers to a collection of government programs meant to assist people and families financially throughout various life events that can result in income loss. These events include disability, pregnancy, illness, accidents, the loss of a breadwinner, unemployment, and retirement.

In Canada, social security is an important part of the country's social safety net, providing the cornerstone for the welfare system. As Canada's population ages, the relevance of social security programs grows, sparking continual debates and discussions about how to structure and support these initiatives to meet the changing demands of the population.

Global timeline for social security reform

Pre-1883: Origins of Social Security

Prior to 1883, social security originated as philanthropy and community-imposed taxation for people with low incomes motivated by religious ideas. In 1883, under Chancellor Otto von Bismarck, Germany pioneered social insurance, which included illness and accident coverage. Between 1900 and 1930, other countries such as Austria, Italy, Sweden, and the Netherlands also implemented social insurance. In 1908, Britain adopted non-contributory pensions, which were later expanded to include illness and unemployment payments in 1911. Family allowances were introduced in Belgium and France in the 1930s, motivated by social Christian values. The United States passed the Social Security Act in 1935 and was motivated by Britain's Beveridge Report in 1942 to establish a comprehensive social insurance system by 1948.

Post-WWII: Global Expansion and Modernization