Table of Contents

What Is Transactional Data?

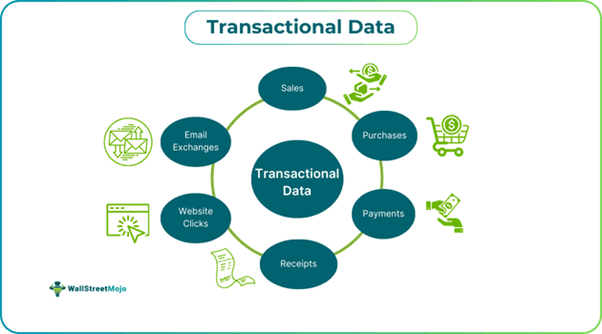

Transactional data is information a business can capture when a customer or client purchases its service or product. These data sets include information about invoices, orders, payments, and even logistical data such as storage and delivery records. The organization's think tank uses this information to understand customer preferences, organizational shortcomings, and future plans.

An efficient transactional data model combined with behavioral data can provide organizations with a much-needed perspective of their customer base and market in general. As a result, businesses can determine KPIs and ultimately increase their revenue and profits. However, it is also critical to ensure the quality and quantity of data to ensure that the information captured remains clean and conducive for analysis.

Key Takeaways

- Transactional data refers to information a business captures from its interactions with key stakeholders, such as customers, suppliers, and employees.

- It is used to analyze the business's financial and operational aspects.

- Each set of data must be analyzed as soon as the business can. Otherwise, there is a considerable risk of the data being deemed outdated and cannot be relevant.

- Invoices, sales, payments, and receipts are typical examples of transactional data. These data points often signify a company's financial standpoint.

- Analyzing these pieces of information helps businesses improve their financial performance, marketing campaigns, and customer satisfaction.

Transactional Data Explained

Transactional data refers to information captured during business affairs, such as sales, payments, purchases, and other operational activities. These detailed data points capture a wide array of information and are highly valuable for business functions such as Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP).

Transactional data systems are non-negotiable to ensure that the operational aspects of the business run smoothly. They also make analyzing performances and processes easier. As a result, the company's think tank can analyze inventory management procedures, forecast demand, and optimize its supply chain.

The market operates based on trends more often than not. In fact, in the internet era, a trend replaces another rather quickly. Therefore, analyzing customer purchase patterns or price fluctuations can give businesses a fair idea of changing trends well before they peak. Hence, they can make the most of them and maximize their profits.

These pieces of information allow organizations to track sales of different regions or channels, improve customer sales, optimize processes, discover new opportunities, and track financial performances closely.

However, these analytical tools are not free of challenges. The sheer volume of data that a business might produce on a daily basis can take time to maintain. Even if they find a way to capture the data, filtering it according to its relevance and integration might be a challenge.

Therefore, businesses must take adequate steps to ensure their transactional data systems are foolproof and secure and eliminate unclean or irrelevant data. If a business manages to do so, it is highly likely to increase its performance and, ultimately, profits.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Who Can Use?

Multiple parties within an organization conduct transactional data analysis for the betterment of their overall performance. A few of the most common ones are:

- Sales Managers: Understanding customer behavior, identifying growth opportunities, and tracking sales figures are everyday responsibilities for sales managers. Information derived from these verticals can give the team a clear idea of the customer service and sales strategies that might work based on numbers.

- Operations Managers: It is commonly believed that processes define an organization’s success. Therefore, operations managers can gain valuable insights into the organization's internal processes. They can find inefficiencies and incorporate developmental changes to reduce costs and streamline processes.

- Marketing Managers: Marketing campaigns combine customer segmentation with understanding consumer behavior. In these cases, transactional data provides crystal-clear data on customer purchasing patterns, trend identification, and overall market sentiments.

Examples

Now that the transactional data model's theoretical aspects are well-established, the examples below will shed light on its practical aspects.

Example #1

XYZ Enterprises has been experiencing a downward trend in sales numbers for the last two quarters. They decided to find the root cause and address it immediately. As soon as their purchase reports come in, they find that their new vendor has been supplying goods at a rate 5% higher than the market rate. After adding its profit margin, ABC sold it at 12% above the market price.

Therefore, there had been a dip since customers had the option of buying the same product at a significantly lower price. ABC’s sales team also checked the sales data to cross-check and confirm if the change in supplier was the reason. The sales data corroborated the theory, immediate changes were made, and a new supplier onboarding process was initiated.

Example #2

In May 2024, multiple executives of banks across Asia met virtually to attend and address the Fintech Fireside Asia Webinar. They discussed how banks can use the thousands, if not millions, of transactional data impressions they gather every day.

They discussed how these data points can be used to improve customer engagement and lifetime value and boost business impact. Moreover, they also discussed in length the security of the data and steps to avoid breaches that can lead to significant legal and financial liability for these banks.

Benefits

An exemplary transactional data system can bring multiple benefits to a business. A few of the most prominent ones are:

- A business's success lies in its ability to improve its processes constantly. Having sufficient data to approach improvement from a cause-and-effect perspective is a significant advantage. As a result, businesses can analyze the efficiency of their operational aspects.

- By analyzing these data sets, they can find areas where customers are finding it easy or challenging during the shopping experience. With this data, they can work towards improving customer experience. Thereby, customer loyalty catapults, and complaint rates plummet.

- A business might have various channels and regions to which it caters. Hence, tracking each of these verticals might be difficult, given their vastness and the volume of data. Transactional data ensures that the data across different regions is captured well and shows data that can help improve sales and customer satisfaction for different regions.

- Meeting market trends and capitalizing on them are most often the difference between a good and great business. Analyzing these data points can provide invaluable insights that can help understand consumer and overall market sentiment.

- Every business, regardless of size, likes to track its financial performance. The numbers that matter the most and indicate a company's financial health include revenue, profits, and expenses. This data can answer the question of what drives these numbers up or down.

Challenges

While the advantages of conducting transactional data analysis are aplenty, there are a few factors that pose a few challenges. It is essential to keep them in mind to ensure that the business is always on an upward trajectory. A few of the most common challenges are:

- The sheer volume of data is a challenge that each organization solves in its unique way. For example, an organization might have to onboard additional employees to process this information regularly.

- Ensuring the security of captured data, especially financial data, is a massive challenge for companies. Given the rising number of online frauds and scams, safeguarding customer data is a significant challenge.

- Another critical function that poses a challenge for businesses is data privacy. They must be careful not to share personal or identifiable information with third parties without the consent of the customer. Data phishing is a rising threat that must be avoided at all costs.

- Captured data must be analyzed before too much of it accumulates. Moreover, data has a period of relevance, after which it becomes outdated. Therefore, businesses must ensure that all the data is captured, analyzed, and updated.

Transactional Data Vs Master Data Vs operational data (in points or as a table)

Distinguishing between transactional data systems, master data, and operational data is an integral part of understanding the different aspects of information collected by businesses. Below are a few of the most significant distinctions.

| Basis | Transactional Data | Master Data | Operational Data |

|---|---|---|---|

| Definition | It refers to the information generated through business transactions such as payments, purchases, and sales. | It is the core data of business entities such as suppliers, customers, and products. | Operational data is the information generated through daily business processes and operations. |

| Purpose | They capture details of particular interactions or events. | It provides a singular point of reference information across an enterprise. | These pieces of information help with finding the real-time operational performance of a company. |

| Usability | Financial reporting, transaction history analysis, and customer insights can be enhanced through these data sets. | It is often a reliable reference point for other forms of data, such as operational and transactional data. | Operational information helps with monitoring processes, daily operations, and resource allocation. |

| Time Frame | Typically, short-term. It is updated after every transaction. | Long-term. It is rarely updated other than to account for any changes to changes in key entities. | It is dynamic. They keep changing based on the real-time operations of an organization. |

| Examples | Invoice, receipts, payments, and sales orders. | Product details, employee profiles, and customer information. | Delivery status, inventory levels, and production schedules. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.