Table Of Contents

Formula to Calculate Bond Equivalent Yield (BEY)

The formula is used to calculate the bond equivalent yield by ascertaining the difference between the bond nominal or face value and its purchase price; these results must be divided by its price, and these results must be further multiplied by 365 and then divided by the remaining days left until the maturity date.

An investor needs to know the bond equivalent yield formula. It allows the investor to calculate the annual yield of a bond sold at a discount.

Bond Equivalent Yield Formula = (Face value – Purchase Price) / Purchase Price * 365/d

Here, d = days to maturity

Example

Mr. Yamsi is confused about two bonds he is considering for investments. One bond offers $100 per bond as a purchase price, and another offers $90 per bond. Both fixed-income securities would offer $110 per bond after six months (for the first) and 12 months (for the second). Which one should Mr. Yamsi invest in?

This is a classic case of being confused between two fixed-income securities.

However, we can easily find the BEY to see which investment is more fruitful for Mr. Yamsi.

For the first bond, here’s the calculation –

Bond Equivalent Yield = (Face Value – Purchase Price) / Purchase Price * 365 / d

- Or, BEY = ($110 - $100) / $100 * 365 / 180

- Or, BEY = $10 / $100 * 2.03

- Or, BEY = 0.10 * 2.03 = 20.3%.

Now, let’s calculate the BEY for the second bond.

BEY = (Face Value – Purchase Price) / Purchase Price * 365 / d

- Or, BEY = ($110 - $90) / $90 * 365 / 365

- Or, BEY = $20 / $90 * 1 = 22.22%.

By calculating the BEY for both of these bonds, we can easily say that Mr. Yamsi should invest in the second bond.

However, if time becomes a factor, Mr. Yamsi may choose the first bond because it is six months. It is offering a staggering 20.3% return.

Interpretation

If you look closely, you will see two parts of this formula for bond equivalent yield.

- The first part talks about the face value and the purchase price. In short, the first part depicts the return on investment for the investor. For example, if an investor pays $90 as a purchase price for the bond. And at maturity within 12 months, he would receive $100; the return on investments would be = ($100 - $90) / $90 = $10 / $90 = 11.11%.

- The second part is all about the time horizon. If the maturity for the bond is six months from now, then d would be 180 days. And the second part would result in – 365 / 180 = 2.03.

Use and Relevance

As an investor, you have many options. When you have so many options, you would only choose the option which will provide you with the most return.

That’s why you need to use the bond equivalent yield formula to determine whether a particular investment is better or worse than the other investments.

However, to calculate the bond equivalent yield, you must remember that these investments don’t offer annual payments. And you can use this formula for fixed income securities. For example, if you find out about a bond offering a discount on the purchase price, first be sure to find the bond equivalent yield and then go ahead (if you want to).

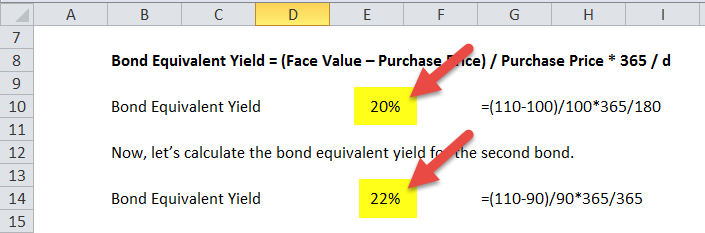

Bond Equivalent Yield in Excel (with excel template)

Let us now do the same example above in Excel. This is very simple. You need to calculate BEY for both of these bonds.

You can easily calculate the BEY in the template provided.