Table Of Contents

Key Takeaways

- The bond yield formula serves as a tool to assess the potential profits derived from investing in a specific bond.

- The formula entails dividing the bond's market price by the annual coupon payment or dividing the bond's face value by the coupon rate to derive the yearly payment amount.

- Bond yield and price have an inverse relationship. Yields fall as prices rise and vice versa. The formula disregards payment frequency, maturity amount, and time value of money.

What is a Bond Yield?

The bond yield formula evaluates the returns from investment in a given bond. It is calculated as the percentage of the annual coupon payment to the bond price. The annual coupon payment is calculated by multiplying the bond's face value with the coupon rate. It is important to understand that price and yield are inversely related.

The current bond yield formula is a critical indicator in finance. It reveals the return an investor can expect from a bond investment. A higher yield typically means more income for the investor but may indicate higher risk. Conversely, lower yields suggest lower risk but lower potential returns. Bond yield helps investors make informed decisions, balancing risk and reward when considering fixed-income investments.

key Takeaways

Bond Yield Explained

Bond yield, a critical metric in the world of finance, refers to the return an investor can expect to receive from a bond investment. It is typically expressed as a percentage and represents the annual income generated by a bond relative to its current market price.

To calculate bond yield, one commonly considers two primary components: the bond's coupon rate and its current market price. The coupon rate is the fixed interest rate that the bond issuer promises to pay to the bondholder, usually on an annual basis. This rate is typically set when the bond is issued and remains constant throughout its life.

The yield, however, fluctuates based on changes in the bond's market price. If a bond's market price rises above its face value, the yield will be lower than the coupon rate. Conversely, if the market price falls below the face value, the yield will be higher than the coupon rate.

Investors use bond yield as a crucial tool to assess the attractiveness of a bond investment. A higher yield may indicate greater potential returns, but it can also signify higher risk. Conversely, a lower yield may imply a more secure investment, but with lower income potential.

Therefore, understanding government or corporate bond yield is essential for investors to make informed decisions in the complex world of fixed-income securities. Bond yield plays a pivotal role in shaping investment strategies and asset allocation within portfolios, making it a fundamental concept in the realm of finance.

Formula

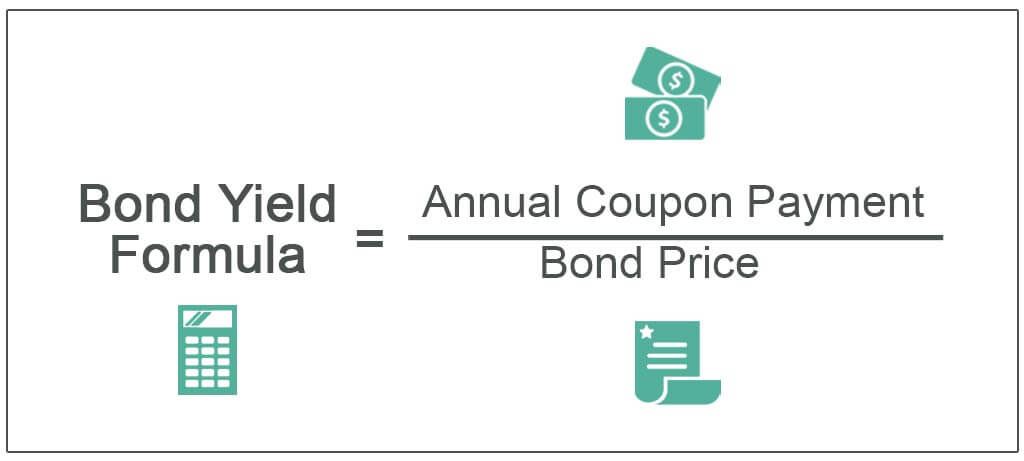

Let us understand the current bond yield formula under the yield in detail.

Bond Yield Formula = Annual Coupon Payment / Bond Price

- Bond Prices and Bond Yield have an inverse relationship

- When bond price increases, bond yield decreases.

- When bond price decreases, bond yield increases.

How To Calculate?

To calculate a government or corporate bond yield formula the following steps can be used.

- First, we would have to determine the bond's annual interest payment, known as the coupon payment, which is typically expressed as a fixed percentage of the bond's face value. Then we multiply this coupon rate by the face value of the bond.

- Next, ascertain the current market price of the bond. This price can fluctuate based on market conditions and investor demand.

- Now, divide the annual coupon payment by the current market price of the bond. Finally, multiply the result by 100 to express the bond yield as a percentage.

Examples

Let us understand the practical applications and intricacies of the current bond yield formula through the examples below.

Example #1

Suppose a bond has a face value of $1300. The interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600.

- Face Value = $1300

- Coupon Rate = 6%

- Bond Price = $1600

Solution:

Here we must understand that this calculation completely depends on the annual coupon and bond price. It completely ignores the time value of money, frequency of payment, and amount value at maturity.

Step 1: Calculation of the coupon payment annual payment

Annual Coupon Payment = Face Value * Coupon Rate

- =$1300*6%

- Annual Coupon Payment =$78

Step 2: Calculation of bond yield

Bond Yield = Annual Coupon Payment/Bond Price

- =$78/$1600

Bond Yield will be -

- =0.04875 we have considered in percentages by multiplying with 100’s

- =0.048*100

- Bond Yield =4.875%

Here we have to say that increased bond prices result in decreased bond yield.

Example #2

If a bond has a face value of $1000 and its prices $970 now and the coupon rate is 5%, find the bond yield.

- Face Value =$1000

- Coupon Rate=5%

- Bond Price = $970

Solution:

Here we must understand that this calculation completely depends on the annual coupon and bond price. It completely ignores the time value of money, frequency of payment, and amount value at the time of maturity.

Step 1: Calculation of the coupon payment Annual Payment

- =$1000*5%

- Annual Payment =$50

Step 2: Calculation of bond yield

- =$50/$970

Bond Yield will be -

- =0.052*100

- Bond Yield =5.2%

Hence, it is clear that if the bond price decreases, the bond yield increases.

Bond Yield Vs Bond Price

We have understood the inverse relationship between the current bond yield formula and price. Let us now discuss the differences between them through the comparison below.

Bond Yield

- Represents the return on investment generated by a bond.

- Expressed as a percentage, indicating the annual income relative to the bond's current market price.

- Helps investors gauge the income potential and risk associated with a bond.

- Calculated using the formula: Yield (%) = (Annual Coupon Payment / Current Market Price) x 100.

- Yields can be fixed (for fixed-rate bonds) or variable (for floating-rate bonds).

- Provides insight into the profitability of holding a bond until maturity.

Bond Price

- Refers to the current market value or purchase price of a bond.

- Fluctuates based on supply and demand in the bond market.

- Inversely related to bond yield: as bond prices rise, yields fall, and vice versa.

- Influenced by factors such as interest rates, economic conditions, and issuer creditworthiness.

- High demand for a bond can drive up its price, causing its yield to decrease.

- Conversely, low demand can lead to lower bond prices, resulting in higher yields.

- Bond prices are crucial for investors looking to buy or sell bonds in the secondary market.