Table Of Contents

What is Effective Duration?

Effective Duration measures the duration of security with options embedded and helps in the evaluation of price sensitivity of hybrid security (bond and an option) to a change in the benchmark yield curve.

Effective duration approximates modified duration. But there is a difference in the denominator for calculation of both. The modified duration can be called a yield duration, while effective duration is a curve duration. This is so because the former is calculated using its own YTM, and the latter takes the market curve as a basis for calculation.

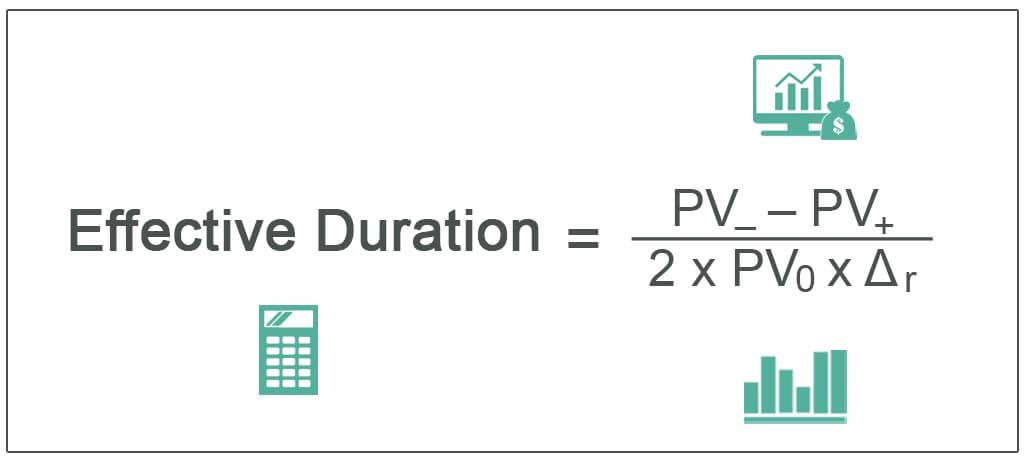

Effective Duration Formula

The formula is given below:

Where,

- PV- = Present value of expected cash flows if the yield falls by r basis points.

- PV+ = Present value of expected cash flows if the yield increases by r basis points.

- PV0 = Present value of expected cash flows when no change in yield.

- Δr = Change in yield.

Examples of Effective Duration

Example #1

A US-based pension scheme under the Defined Benefit Obligation (DBO) structure has liabilities to the tune of USD 50 million. The benchmark yield is standing at 1%. if the benchmark yield changes by 5 bps, then the liability amount changes from 48 million to 51 million USD. Calculate the effective duration of pension liabilities.

Solution:

Given,

- PV- = USD 51 million

- PV+ = USD 48 million

- PV0 = USD 50 million

- Δr = 5 bps = 0.0005

Calculation of Effective Duration will be -

Effective Duration Formula = (51 - 48) / (2 * 50 * 0.0005) = 60 Years

Example #2

Suppose a bond, which is valued at $100 now, will be priced at 102 when the index curve is lowered by 50 bps and at 97 when the index curve goes up by 50 bps. The current measure of the index curve is 5%. Calculate the effective duration of the bond.

Solution:

Given,

- PV- = $102

- PV+ = $97

- PV0 = $100

- Δr = 50 bps = 0.005

Calculation of Effective Duration will be -

Effective Duration formula = (102 - 97) / (2 * 100 * 0.005) = 5 Years

Advantages

- Calculate accurate duration for asset-liability management.

- Works for hybrid securities.

- Based upon market yield instead of its own YTM.

- Helps in the calculation of the duration of complex items such as mortgage-backed securities.

Disadvantages

- Complex calculation.

- Difficult to measure the variables in a practical scenario.

- An approximate measure of duration.

Limitations

The biggest limitation of effective duration measure is its approximation.

Take an example of an option embedded bond. The pricing of the bond must be impacted by a number of factors:

- The period of availability of the call option.

- The call dates.

- The call price.

- Future interest rate direction and measure.

- Change in credit spread.

- The rate of the proxy instrument(s) for e.g., the index curve.

But while calculating duration, only a change in the last factor that is the increase or decrease in benchmark rate is considered. All other factors are assumed to be constant for the sake of calculation.

Further, the increase or decrease in rate is assumed to be constant in both the directions and a price is determined, whereas the change in interest rate might be varying and would impact the price differently.

Furthermore, if the interest rates are constant and the credit rating of the issuer gets upgraded, then the issuer would be able to get credit at a cheaper rate, and it would trigger a call execution and redemption. But such things are not taken into consideration at the time of calculation.

Conclusion

Effective Duration is helpful in analyzing the sensitivity of hybrid instruments to the interest rate. Though the measure is an approximation, it is a widely used model for option embedded asset-liability management.