Table Of Contents

DV01 Meaning

DV01 or Dollar Value of 1 basis point, measures the interest rate risk of bond or portfolio of bonds by estimating the price change in dollar terms in response to change in yield by a single basis point (One percent comprising 100 basis points). However, the DV01 valuation is an approximation.

DV01 is also known as the Dollar Duration of a Bond and is the foundation of all Fixed Income instruments risk analysis and is used in abundance by Risk Managers and Bond Dealers. However, a major limitation is that it assumes that bonds have fixed rates and pay interest at regular intervals.

Key Takeaways

- DV01, also known as the dollar duration, measures a bond's price change for a one-unit change in yield. It quantifies the bond's interest rate risk by estimating the dollar value gained or lost for a slight change in yield.

- The DV01 formula calculates the change in price by multiplying the bond's modified duration by the bond's price and the yield change in decimal form.

- While DV01 and duration both measure a bond's price sensitivity to changes in yield, they differ in terms of the units used.

- DV01 measures the change in price in dollar terms for a one-unit change in yield, while duration measures the percentage change in price for a one-basis-point change in yield.

DV01 Explained

In other words, where Duration is basically the ratio of the percentage change in the price of a security to a change in yield in percent, DV01 helps to interpret the same in Dollar terms, thereby enabling relevant stakeholders to understand the price impact of change in yields.

For instance, suppose a Bond has a Modified Duration of 5 and the Market Value of the Bond as of date is $1.0 million, the DV01 is calculated as Modified Duration multiplied by Market Value of the Bond multiplied by 0.0001 i.e., 5 * $1 million* 0.0001= $500. Thus the bond will change by $500 for a one-point change in basis point in yield.

Dollar Duration or DV01 can also be calculated if one is aware of the Bonds Duration, current yield, and change in yield.

Formula

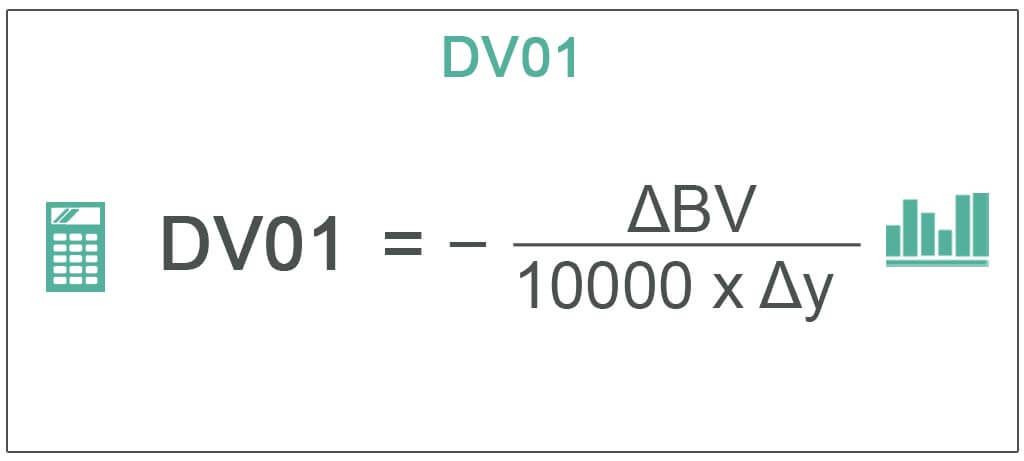

The calculation of the Dollar Value of one basis point, aka DV01 calculation is very simple, and there are multiple ways to calculate it. One of the most common formulas used to calculate DV01 is as follows:

DV01 Formula = - (ΔBV/10000 * Δy)

Where,

- ΔBV = change in Bond value

- Δy = change in yield

Hereby Bond Value means the Market Value of the Bond, and Yield means Yield to Maturity.

It is important to note here that we are dividing by 10000 because DV01 is based on linear approximation but is one basis point, which is 0.01%. Therefore, by dividing it by 10000, we are rescaling from 100% to 0.01%, which is equivalent to one basis point.

How To Calculate?

Let us understand how to calculate and derive the DV01 valuation through the step-by-step-guide provided below.

- Determine the current price of the bond (market price).

- Decide on the basis point change in yield. Typically, it's 1 basis point (0.01% or 0.0001).

- Convert the change in yield to a decimal (0.0001 for 1 basis point).

- Apply the formula.

- The result will give you the dollar change in the bond's price for a 1 basis point change in yield.

It is vital to note that DV01 is an approximation, and its accuracy might vary depending on factors like bond characteristics, convexity, and market conditions. Additionally, DV01 is not standardized and can differ across different bonds or bond markets.

It's crucial to understand the limitations and assumptions when using DV01 for risk assessment or pricing decisions.

Examples

Now that we know the basics, formula, and DV01 calculation, let us apply that knowledge into practical application through the examples below.

Example #1

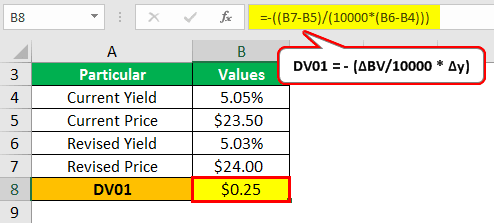

Ryan is holding a US Bond with a yield of 5.05% and is currently priced at $23.50. The yield on the Bond declines to 5.03%, and the price of the Bond increases to $24.00. Based on the information, let’s calculate DV01 using the formula stated above:

The calculation of DV01 is as follows:

- DV01 formula = - ($24.00-$23.50)/10,000 * (-0.0002)

- = $0.25

Thus the value of the Bond will change by $0.25 for every single basis point change in the yield of the Bond.

Example #2

Let’s understand the same with the help of a more complex practical example:

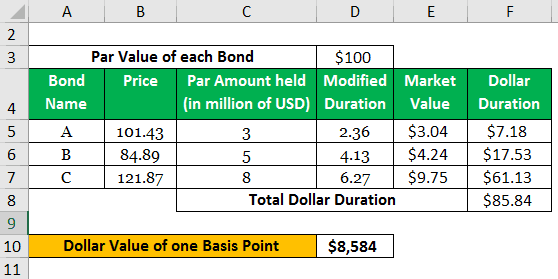

ABC Bank has the following portfolio of Bonds in its Trading Book and intends to quickly understand the impact on its Market value due to change in Interest Rates. The Par Value of each Bond is $100. Based on the details furnished below to let’s try to calculate the value of the Portfolio’s DV01 and understand the resultant impact:

| Bond Name | Price | Par Amount held (in million of USD) | Modified Duration |

|---|---|---|---|

| A | 101.43 | 3 | 2.36 |

| B | 84.89 | 5 | 4.13 |

| C | 121.87 | 8 | 6.27 |

The calculation is as follows:

- Dollar Value of One Basis Point = Dollar Duration * $1000000*0.0001

- = $85.84* $1000000*0.0001

- = $8,584

Thus it implies that for each single basis movement in yield, the portfolio will get impacted by $8584.

Advantages

Let us understand the advantages of DV01 valuation through the points below.

- DV01 enables banks and other financial institutions to quickly assess the impact of changes in yields on their portfolio in dollar terms. Thus they can be well prepared with different scenarios on the impact of yield movements on the Market Value of their Portfolio.

- It is relatively simple to calculate and easy to understand.

- DV01 is additive in nature, which means that one can calculate the same for each bond in the portfolio and aggregate them to derive the portfolio DV01.

- DV01 enables Bond Dealers and Portfolio manager to hedge their portfolio against adverse yield movements. By computing the DV01 separately for each Bond, Banks, and Financial Institutions can actually hedge their long position against a short position in a different bond with almost the same DV01.

Disadvantages

Despite the advantages mentioned in the section above, there are a few factors that prove to be a hassle. Let us understand the disadvantages of DV01 calculation through the points below.

- The biggest shortcoming of DV01 lies in its assumption of a parallel shift in the yield curve, which is more theoretical in nature than in the real world. The yield curve never shifts parallel. The impact of yield movement varies based on maturity and usually short maturity. Fixed Instruments yield change faster than long-maturity Fixed Instruments. By assuming a parallel shift, the impact suggested by DV01 on the value of Bond varies from the actual impact on the price of the Bond.

- Hedging undertaken using standard DV01-neutral hedge fails to provide a perfect hedge due to the imperfect one to one relationship caused by rising and fall of basis points across different instruments used for hedging.

- DV01 simple calculation assumes that Bonds pay fixed coupon payments at regular intervals; however, there are certain categories of Bonds such as Floating Rate Bonds, Zero Coupon Bonds, and Callable Bonds which requires the complex calculation to derive DV01.

DV01 Vs PV01

DV01 calculation and PV01 are both measures used in fixed income markets to assess the impact of a small change in yield on the price of a bond. While they serve a similar purpose, they are calculated slightly differently and are used in different contexts:

DV01

- DV01 represents the change in the dollar price of a bond for a 0.01% (1 basis point) change in yield.

- DV01 is widely used and is common in the U.S. bond market.

PV01

- PV01 also measures the change in the price of a bond for a 0.01% change in yield.

- PV01 is commonly used in the European bond market.

In summary, both DV01 and PV01 measure the impact of a small change in yield on a bond's price. The primary difference lies in the calculation and the regions where they are used. While DV01 is prevalent in the U.S., PV01 is more commonly used in Europe. Despite the regional differences, both measures serve the same fundamental purpose of quantifying interest rate risk in fixed-income investments.