Table Of Contents

What Is Yield To Maturity?

Yield to Maturity refers to the expected returns an investor anticipates after keeping the bond intact till the maturity date. Unlike the current yield, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of its bond term. In other words, a bond's expected returns after making all the payments on time throughout the life of a bond.

Thus, it is a concept that evaluates the expected return. the calculates the potential gain or loss at the maturity. Though it is a complex process, it is useful for both the business as well as investors who can judge whether the investment is profitable and a better option as compared to another form of investment.

Key Takeaways

- The yield to maturity refers to the anticipated return of a bond at the time of its maturity rather than its present yield.

- To find a bond's actual yield to maturity, trial and error are needed to calculate different rates until the current value matches the market price. Effective yield through compounding is vital to consider.

- Yield to maturity (YTM) helps investors compare bond investments to other market options by factoring in the time value of money (TVM), providing a more accurate performance assessment.

Yield to Maturity Explained

Yield to maturity is a financial concept that helps to evaluate the return or yield that the investor or bondholder can expect to get at the maturity of the bond. It is necessary to hold the bond till maturity date. In the calculation, the concept takes into account the current price, the face value, the interest rate of the coupon payment and the time left till maturity. It calculates the possible loss or capital gain in the investment.

The yield to maturity of a bond is a complex process involving calculation using formula. The process may also require some financial software or Excel tools and calculators to get accurate results which are crucial for financial decisions.

The process helps bondholders compare the potential returns of various bonds and make informed business decisions. Even though there are many challenges in the process, investors should be aware about the market conditions and bond features so as to handle problems and make financial decisions with maximum return.

Formula

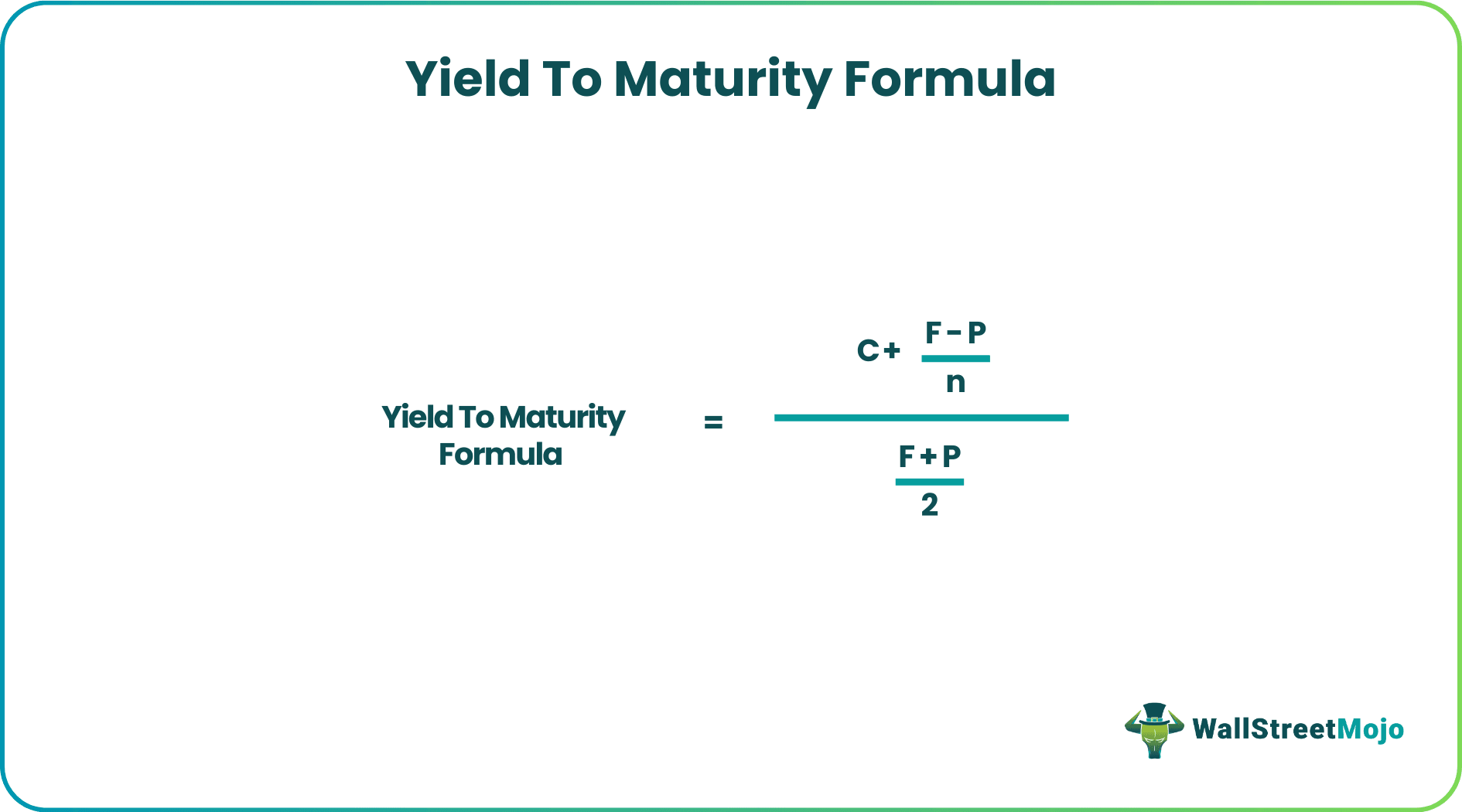

YTM considers the effective yield of the bond, which is based on compounding. The below formula focuses on calculating the approximate yield to maturity, whereas calculating the actual YTM will require trial and error by considering different rates in the current value of the bond until the price matches the actual market price of the bond. Nowadays, computer applications facilitate the easy calculation of yield to maturity of a bond.

Yield to Maturity Formula = /

Where,

- C is the Coupon.

- F is the Face Value of the bond.

- P is the current market price.

- n will be the years to maturity.

The formula or the yield to maturity equation below calculates the bond’s present value. If you have the bond’s present value, you can calculate the yield to maturity (r) in reverse using iterations.

Present Value of Bond = + . . . . . . +

How To Calculate?

The steps to calculate yield to maturity are as follows.

Gather information on the bond-like its face value, months remaining to mature, the bond's current market price, and the bond's coupon rate.

Now calculate the annual income available on the bond, which is mostly the coupon, and it could be paid annually, semi-annually, quarterly, monthly, etc. Accordingly, the calculation should be made.

Also, one needs to amortize the discount or premium, which is a difference between the face value of the bond and the current market price over the bond's life.

The numerator of the YTM formula will be the sum of the amount calculated in steps two and step 3.

The denominator of the YTM formula will be the average price and face value.

When one divides step 4 by step 5 value, it shall be the approximate yield on maturity.

Examples

Let us try to understand the concept to calculate yield to maturity with the help of some suitable examples.

Example #1

Assume that the bond's price is $940, with the face value of the bond at $1000. The annual coupon rate is 8%, with a maturity of 12 years. Based on this information, you must calculate the approximate yield to maturity.

Solution:

Use the below-given data for the calculation of YTM.

We can use the above formula to calculate approximate yield to maturity.

Coupons on the bond will be $1,000 * 8%, which is $80.

Yield to Maturity (Approx) = (80 + (1000 – 94) / 12 ) / ((1000 + 940) / 2)

YTM will be -

Example #2

FANNIE MAE is one of the famous brands trading in the US market. The government of the US now wants to issue a 20 year fixed semi-annually paying bond for their project. The price of the bond is $1,101.79, and the face value of the bond is $1,000. The coupon rate is 7.5% on the bond. Based on this information, you are required to to calculate yield to maturity on the bond.

Solution:

Use the below-given data for the calculation of yield to maturity.

Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually.

Yield to Maturity (Approx) = ( 37.50 + (1000 - 1101.79) / (20 * 2) )/ ((1000 + 1101.79) / 2)

YTM will be -

This is an approximate yield on maturity, which shall be 3.33%, which is semiannual.

Annual YTM will be -

Example #3

Mr. Rollins has received the lump sum amount from the lottery. He is a risk-averse person and believes in low risk and high return. He approaches a financial advisor, and the advisor tells him he is the wrong myth of low risk and high returns. Then Mr. Rollins accepts that he doesn’t like risk, and a low-risk investment with a low return will do. The advisor gives him two investment options, and the details of them are below:

Solution:

Option 1

Coupon on the bond will be $1,000 * 9% / 2 which is $45, since this pays semi-annually.

Yield to Maturity (Approx) = (45 + (1000 - 1010) / (10 * 2)) / (( 1000 +1010 )/2)

YTM will be -

This is an approximate yield on maturity, which shall be 4.43%, which is semiannual.

Annual YTM will be -

Therefore, the annual Yield on maturity shall be 4.43% * 2, which shall be 8.86%.

Option 2

Coupon on the bond will be $1,000 * 8.50% / 2 which is $42.5, since this pays semi-annually.

Yield to Maturity (Approx) = (42.50 + (1000 - 988) /(10 * 2))/ (( 1000 +988 )/2)

This is an approximate yield to maturity curve, which shall be 4.34%, which is semiannual.

Annual Yield to Maturity will be -

Therefore, the annual Yield on maturity shall be 4.34% * 2, which shall be 8.67%.

Since the YTM is higher in option 2; hence the advisor is correct in recommending investing in option 2 for Mr. Rollins.

Relevance And Uses

- Yield to maturity equation allows an investor to compare the bond's present value with other investment options in the market.

- TVM (Time value of money) is taken into consideration while calculating YTM, which helps in better analysis of the investment about a future return.

- It promotes making credible decisions as to whether investing in the bond will fetch good returns compared to the value of the investment at the current state.

Problems And Solutions

The calculation of this financial concept is complex and challenging. So, along with the formula, various software and excel tools are used to make it simple. However, let us look at the problems and solutions involved in the process.

Problems:

- It has to be done using complex calculation and formula, as already highlighted above.

- The bond prices in the financial market keep changing due to constant fluctuation in credit rating of the issuer, variation in market conditions and interest rates. This creates a variation in the yield.

- Certain bonds have features of call and put. They allow the issuer or the bondholder to redeem the bond before the date of maturity. Dealing with such bonds are difficult.

- There are some bonds that are also called amortized or sinking fund bonds in which a part of the principle is paid off before the maturity. This complicates the YTM calculation.

- There is the problem of default in which the issuer may not be able to fulfill the payment obligation due to fall in credit worthiness.

- Bonds are sensitive to interest rates. The yield keeps changing according to rise or fall in interest rates.

Solutions:

- Various software and calculators are available to make the calculation easier, quicker, and more accurate.

- It is necessary for investors to regularly evaluate, monitor and track the bond prices so that they can take informed investment decisions.

- Investors should be careful while dealing with the call and put features of bonds and may need to calculate the yield to cll and put instead of maturity, depending on the type of bond.

- Investors need to make adjustment in the cash flows of amortised bonds and recalculate the YTM.

- It is necessary to evaluate the credit rating of the issuer before investment, so that the risk of default may be reduced to the minimum.

- The investors should consider the potential interest changes and their impact on the return of the bond.

Yield To Maturity Vs Current Yield

Both the above are important concepts that measure the returns on bond investing. However, there are some differences between them as follows:

- The former is a comprehensive measure of total returns which the investor should expect till maturity. But the latter is a simple measure of the interest income relative to the current market price of the bond.

- The yield to maturity curve takes into account the capital gains along with the interest payment due to bond price fluctuation in the secondary market. But the latter takes into account only the interest payment that is fixed.

- The former assumes that all the coupons will be reinvested in the market at the same rate of interest till maturity, which is not always applicable, whereas the latter does not have any such assumptions.

- The former involves the calculation of the present value of the future cash flows and discount them back to the present but the latter concentrates on the current bond prie in the market.

- The current yield focuses on the income the bond generates periodically but the YTM focuses on annualized return till maturity.