Table Of Contents

Key Takeaways

- Credit risks are the chances that a lender will suffer a loss on a loan when the borrower defaults on making principal and interest payments on time.

- Rating agencies can't always forecast outcomes accurately, so the investor must confirm the credit risks of the businesses they intend to invest in.

- The company's financial statements are available for review by investors. The company's credit rating will be lower if operating cash flows are higher.

Top 3 Credit Risks Examples

Each example of the Credit Risk states the topic, the relevant reasons, and additional comments as needed.

Example #1

Assume Tony wants his savings in bank fixed deposits to get invested in some corporate bonds as it can provide higher returns. However, he is aware that bonds include counterparty default risks or credit risks, i.e., the bond issuer will default, and Tony will not receive any of the promised cash flows.

So Tony decides to price these risks to get reimbursed for the extra risk he is going to be exposed to. He finds the two basic measures of credit risks are:-

- Credit Risk Scores - Every institution and individual uses qualitative and quantitative factors to measure such risk of borrowers. Lenders use credit risk scores to allow or reject the loan application. A credit score is expressed in a numerical format that ranges between 300 and 850, where 850 is the highest credit score possible.

- Bond Credit Ratings - Publicly traded companies that issue bonds have been rated by rating agencies like Moody’s, Standard and Poor (S&P), Fitch, etc. The rating is a grade in an alphabetical format that gets assigned to a bond. E.g., the ratings by S&P may vary from AAA (safest company) to D (a company in default).

The advantage of investing in a rated company is that the investor has a sense of what the rating agencies think about the company's credit risk. Also, rating helps the investor to charge an appropriate spread for taking the extra risk called default spread.

E.g., let’s say Tony purchased a 10-year bond with a 'BBB' rating. The default spread for a similar bond is 1.84%, and the risk-free rate for a 10-year bond is 1.5%. So the interest rate demanded by Tony must be (1.84 + 1.5) 3.34%.

However, rating agencies cannot always make accurate predictions, and it becomes the responsibility of the investor to double-check the credit risks of the companies they want to invest in. The following are some basic factors to help investors measure the risk of the company:-

- An investor can look at the financial statements of the company. If the company generates larger cash flows from operations, then it has a lower credit rating.

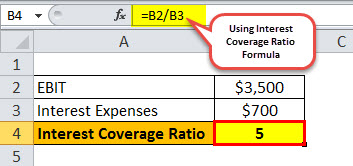

- Perform a ratio analysis formula, e.g., an important ratio is the interest coverage ratio, which measures a company’s ability to repay its debt payments.

Let’s say Tony investigates a company with earnings before interest and taxes (EBIT) of 3500 million and interest expenses of $700 million.

Thus Interest coverage ratio = 3500/700 = 5

According to various agencies' data, the companies with an interest coverage ratio between 4.5% to 6% have a rating of 'A-,' and their relative default risk is 2.5%. I.e., Tony should charge a 2.5% higher interest rate than the risk-free rates.

Example #2

Let’s say Mr. Tony and a businessman run a clothing wholesale business limited to the New York City of America. To expand the business, he started providing large credits to its customers without any definite credit policy and credibility checks.

Tony neglects to consider the inflated credit risks. At year-end, he finds some of his customers are not paying their invoices on due dates. Upon investigating the background of his clients, he finds that a few have very low credibility.

With low client credibility, the credit risks to Tony inflates heavily, and there might arise a possibility that he might not get reimbursed for the goods he supplied to its clients.

None/ low payments of regular invoices negatively affect the cash flows of Tony's firm and cause losses to the entity, generally referred to as bad debts.

To avoid such risks, Tony should structure an effective credit policy and properly check the credibility of its customers before offering any credit or loan.

Example #3

Assume Mr. Tony wants to purchase a car worth $120,000. He paid an amount of $20,000 as a down payment and decided to take a bank loan for the remaining amount of $100,000 at the rate of 20% per annum to be paid in 1 year.

This means the bank needs to receive $120,000 back in one year from Tony. The bank's risk management checked Tony's credit risks before issuing the loan, i.e., the possibility that he might not be able to repay the loan or installments on the due date.

With higher credit risks, Tony’s loan application may get rejected by the bank, or the bank will allocate a lower sum of money that suits his credibility (ability to repay the loan) criteria. Tony, with a low credit risk count, gets the approval for loan allotment.

Tony successfully paid a couple of installments of $10,000 each. But during the year, Tony made some big losses in his business due to offering goods on credit to customers with low credibility and applying liberal credit policies.

The bank thinks Tony might not be able to make any further payments against the loan. The current situation creates huge risks to the bank against a loan provided to Tony.