Table Of Contents

What is Call Price?

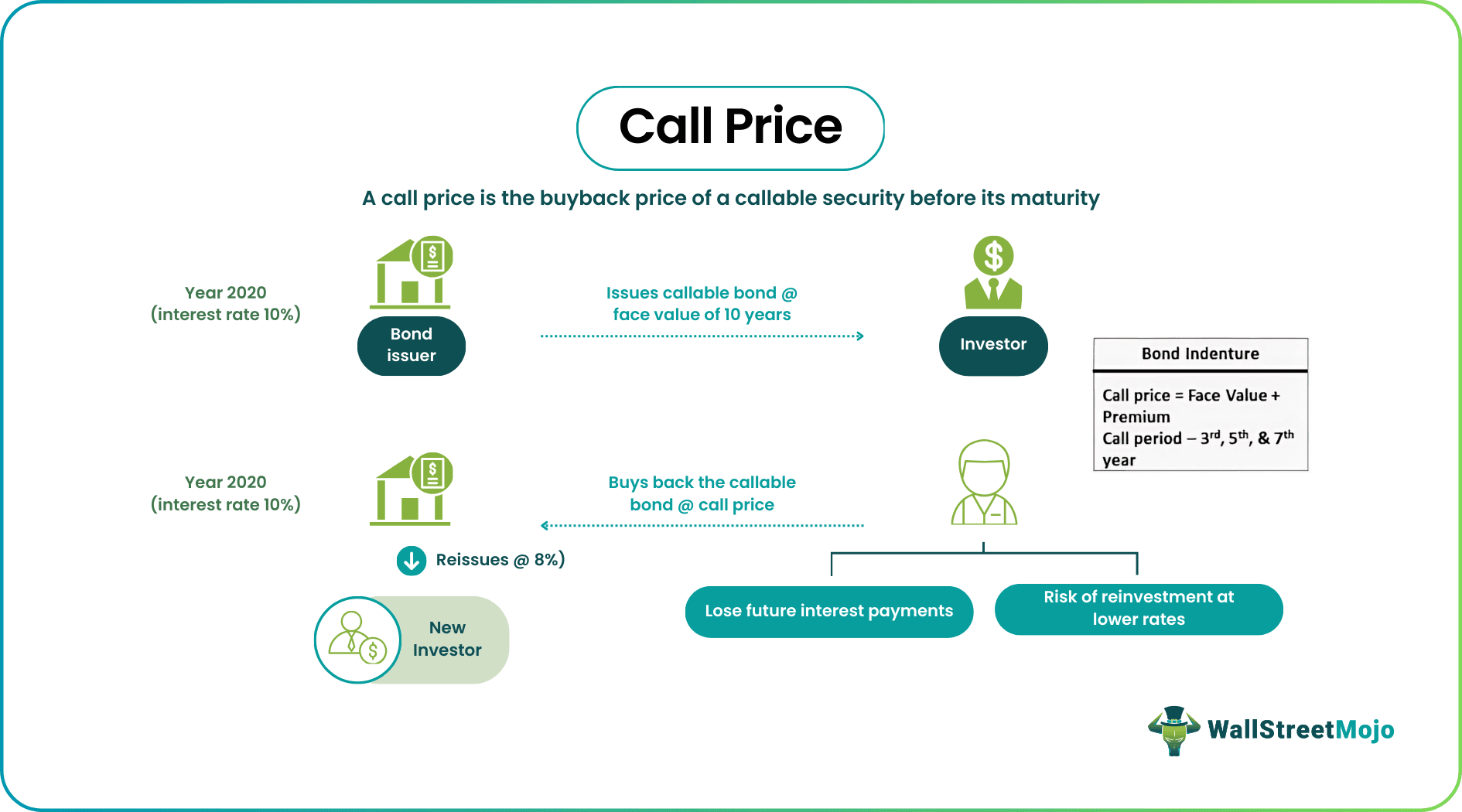

A call price (CP) is the amount an issuer pays the buyer to buyback, call, or redeem a callable security before it matures. Callable securities include fixed-income instruments like bonds and preferred stocks. Redeeming securities at call price allows the issuer to refinance its debt obligations and restructure its capital.

The call price of a security is set by the issuer at the time of its issue. It is duly records it in the prospectus or bond indenture. The price ensures better prospects for the issuer but is risky to the investor. As a result, securities with call prices trade at higher prices.

Key Takeaways

- A call price is the price of callable security that the issuer pays to the investor on redemption before maturity.

- Callable securities include fixed income instruments like bonds and preferred stocks that can be called back before the end of their life.

- Call price enables the issuer to refinance its debt at lower interest rates. It benefits issuers more than investors.

- Issuers offer a call premium to attract investors and compensate them for the higher risk.

- A call premium is the difference between the call price and the par value of the security.

Call Price Explained

The call price is usually associated with callable securities like bonds and preferred shares. This is because they have an in-built call option that permits the issuer to repurchase them before maturity. Their redemption is at a pre-established price and time, which is disclosed at the time of issue of such securities. This pre-set price is referred to as the call price.

The details related to the issue of callable securities to the investors are enclosed in an indenture (for bonds) and prospectus (for preferred stock). An indenture specifies the call provision, which is the clause for early redemption. It contains the terms and conditions of redemption and multiple dates for a call back of security throughout its lifetime.

The Call Provision sets the price that the issuing company will pay to the investors on the redemption of the securities. The company normally fixes the CP at a higher value than the actual face value of the callable security. However, as the callable securities near their maturity date, their price reduces.

The difference between the actual value and the call price is called call premium. The issuing company offers a call premium to the investors to compensate them for the risk arising out of early redemption. They also offer higher interest rates on callable bonds and more dividends on callable preferred stocks to make them attractive to investors.

Benefits and Risks of Call Provision

An issuer calls a bond before maturity to reduce its cost of borrowing. It will do so when interest rates are falling. In such a scenario, it may call back the bonds at a CP and reissue them at a lower rate as it will reduce its funding cost. Similarly, a company may also buyback its preferred stock to avoid paying dividends and modify its capital structure.

Investors usually invest in callable bonds to enjoy a higher interest rate than non-callable securities. Though they receive a call premium in case of a buyback, they have greater exposure to risk. They have to bear the loss of future interest income and the risk of reinvestment at lower interest rates.

Examples

Let us understand the concept of the CP better using the examples given below.

Example #1

Let us consider a multinational firm XYZ Inc. issuing callable bonds to investors with a maturity period of 10 years at a 10% rate of interest. The face value of a bond is $200. The bond indenture details the call provision, including call prices, call dates, and the terms and conditions of the redemption.

As per the terms contained in the indenture, the firm XYZ can call or redeem its preferred stocks or bonds in the third, sixth, and ninth years respectively. Since XYZ issued the bonds in 2012, it could buy them back in 2015, 2018, and 2021.

The CP of the bond for these years is $250 (2015), $230 (2018), and $220 (2021). Therefore, if XYZ exercises its right to repurchase its shares in the year 2018, then it must buyback the shares at the CP of $230.

In this case, XYZ has to offer $30 as a call premium.

Call Premium = Call Price – Face value of the Bond

= $230 – $200 = $30

The bondholders receive $30 as a call premium but have to forgo their future interest income and find a comparable investment offering similar interest. On the other hand, the bond issuer can refinance its debt at lower rates.

Example #2

In this example, let's focus on the financial gains of the bond issuer. Suppose a firm, A2Z Inc., offers a callable bond for ten years at a 10% interest rate in 2022. The face value of the bond is $100. As per the bond indenture, callable intervals are in the fifth (2027) and the seventh (2029) year. The CP is $120 for 2027 and $110 for 2029.

Suppose the interest rate remains 10% in 2027. In this case, A2Z will not benefit from exercising the call provision. So, it will refrain from buying back the bonds.

However, if the interest rate for the bond decreases to 8% in 2029, then A2Z can utilize the CP to buyback the bonds from the investor at $110. Rather than paying the bondholder at 10% till maturity, A2Z may reissue new bonds at 8% and redeem the callable bonds at a call premium of $10. Thus, it will be able to refinance its debt at 8%, saving 2% in interest payments.

Importance of Call Price

CP is quite important to both the investor as well as the issuer. First of all, the callable nature of the securities puts the return on maturity at a question mark for the investor. Secondly, the investor has to weigh the benefit of a high call price against the risk of losing interest/dividend income in the future.

Also, the investor has to put up with the risk of reinvesting at lower interest rates in case of callbacks. Lastly, the investor has no control over the ownership of the security as the firm can recall it at callable intervals.

For the issuer, the call price is a tool to gain investors' confidence and achieve funding for the business without any risk. When interest rates are falling, the bond issuer may redeem the bonds at call price and reissue them at lower rates, thereby minimizing its debt cost.