Table Of Contents

Excise Tax Definition

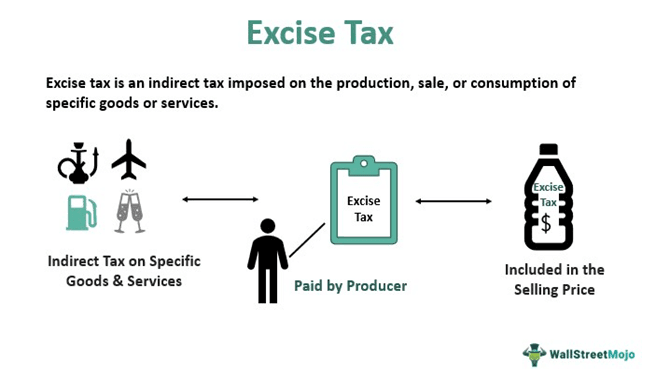

Excise Tax or Duty is a type of indirect tax mandatorily levied by the federal government on producing or selling specific goods and services. It helps decrease the utilization of harmful commodities or direct the accumulated profit toward fighting against the adverse effects of the related item or utility.

The manufacturer or retailer pays the federal excise tax (online or offline) and then ingrains it in the selling price rendered by the customer. It comprises taxes on tobacco, alcohol, soda, insurance premiums, fuel, etc. Furthermore, the Internal Revenue Service (IRS) form 720 is obtainable for voluntary electronic Quarterly Federal Excise Duty Return filing.

Key Takeaways

- Excise tax is an indirect tax imposed on the manufacturing, selling, or license of particular products and services. This includes tobacco, alcohol, highways, fuel, etc.

- The seller or producer pays excise duty that is later embedded in the market price paid by the consumer.

- It can be filed both online and offline. However, paying excise tax online is better due to less processing time and errors.

- It is paid quarterly throughout the calendar year via the Internal Revenue Service (IRS) Form 720.

Excise Tax Explained

Excise tax is charged on manufacturing, selling, or utilizing products or services. Sellers submit the excise tax payment to dealers and add up the paid amount in product costing, therefore surging the final market price. Moreover, it may be enforced while importing, selling by the maker or distributor, or using producer or end-user.

The goods and services liable to federal excise tax payment include (but are not limited to),

- Highways

- Aviation

- Tobacco

- Alcohol

- Health insurance providers

- Indoor tanning

- Coal

- Sports wagering

- Gasoline

- Diesel

The excise tax payment earnings are allocated for trust (60%) or general funds (40%) associated with the taxed item or utility. This helps prevent dangerous actions or combat adverse outcomes of the related product, like reducing industrialization. Moreover, it is imposed on nationally manufactured products, thus differs from customs tax applied on internationally produced items.

It is often termed a regressive tax due to its uniformity. Moreover, excise duty payment is independent of income tax. Also, a 3rd party accrues a few excise taxes for submission to the IRS and filing Form 720. For instance, the airline usually collects the tax on a ticket paid by the buyer.

When To File?

Companies must file IRS Form 720 every quarter throughout the fiscal year. The due date is shifted to the next business day, if it occurred on a Saturday, Sunday, or legal holiday.

| Quarters | Months | Deadline |

| Quarter 1 | January, February, and March | 30 April |

| Quarter 2 | April, May, and June | 31 July |

| Quarter 3 | July, August, and September | 31 October |

| Quarter 4 | October, November, and December | 31 January |

Where To File?

The IRS accepts both paper and electronic excise duty filing. However, paying excise tax online is advisable because of decreased errors and processing time. Business taxpayers must pay out the provider’s fee for online form submission. They can contact any authorized e-file transmitters on IRS.gov and submit the online form 24x7.

Types Of Excise Tax

There are 2 crucial types of excise tax:

#1 - Ad Valorem Tax

It is imposed as a percentage of the retail price or other defined value of products or commodities provided by a firm. In short, Ad valorem tax denotes the per dollar applied to the item’s value. For example, the tax is applicable on indoor tanning or sports wagering.

#2 - Specific Tax

The specific tax depends on the actual measuring unit like density, amount, or size. It is signified as Litre, Kg, Gallon, or Ton. For instance, the tax raised on alcohol or tobacco comes under this category.

Excise Tax Calculations

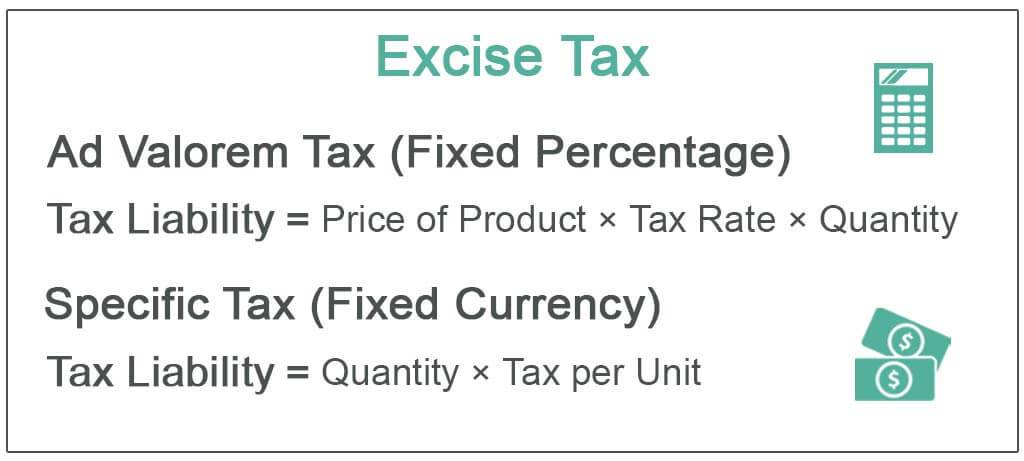

Here lies the formula for both types of excise tax calculations:

Ad Valorem Tax (Fixed Percentage)

Tax Liability = Price of Product × Tax Rate × quantity

Specific Tax (Fixed Currency)

Tax Liability = Quantity × Tax per Unit

Examples

The following are excise tax payment examples.

You can download this Excise Tax Excel Template here – Excise Tax Excel Template

Example #1 (Ad Valorem Tax)

Gina wants to sell her house on a 6% property tax rate. Furthermore, the market value of her home is worth $500,000. Here Here is how to calculate the Ad Valorem tax,

Tax Liability = Price of Product × Tax Rate × quantity

= $500,000 x 6% x 1

= $500,000 x 0.06 = $30,000

Therefore, Gina must pay the property tax of $30,000.

Example #2 (Specific Tax)

A beer company named Hunt Inc. produces nearly 1,500 liters of beer daily. The U.S. federal tax department charges the firm an excise duty worth $3 per liter. Since it is a specific excise tax, the applicable formula is,

Tax Liability = Quantity × Tax per Unit

Tax Liability = 1,500 × $3

= $4,500

Thus, Hunt Inc. must pay $4,500 to sell 1,500 liters of beer per day.

Example #3

New Zealand has witnessed a significant reduction in fuel excise duty owing to increased petrol rates. As a result, the central government has declared the fuel excise duty decrement and partial reduction of public transport costs for three months. Moreover, this decision has been taken in light of the ongoing war in Ukraine.

Economists had predicted an increment in the country’s inflation rate of over 7%. Due to this, the government will diminish fuel usage prices by 25 New Zealand cents. The alterations will decrease the cost to fill up a 40-liter petrol tank by over NZ$11 and a 60-liter tank by NZ$17.

Advantages and Disadvantages

Levying excise duty on products and services has two sides, and it can be beneficial or detrimental in specific ways:

Advantages

- It has major revenue-generating capabilities for the government.

- When the price of goods and services rises, so do tax revenues, which the government can use to fund schemes for social and national welfare.

- It is easy to administer as it requires only estimating the number of goods and services transacted.

- Unlike the specific tax rate system, the Ad Valorem tax compensates for the frequent price increase and does not require rate indexing.

- The system promotes socio-environmental changes, leading to a healthy lifestyle.

- In comparison to other taxes, it is easier to collect and measure.

- Higher taxes levied on products can cause health damage resulting in less consumption of such products.

Disadvantages

- It increases the price of goods, which burdens the recipient of commodities and reduces demand for the same, thus hampering industrialization.

- The cost of a project, machinery, and technology rises due to the excise duty.

- It makes people and businesses engage in unlawful activities such as smuggling to avoid loss of profits.

- The tax revenue remains constant during inflation.

- The rising cost of basic necessities has put them out of reach of the average person.

- It is regressive as the price of a product remains the same, regardless of whether a rich person or a poor individual buys it.

- The amount of money raised by such a tax is difficult to estimate.

- If it is not paid on time, the tax agency may impose a significant financial penalty.