Table Of Contents

Surtax Meaning

Surtax is an extra amount of tax that is charged upon the already existing income tax to fund a specific program of the government, and this can be a percentage of a certain amount or a flat dollar rate that individuals are bound to pay. The surtax rate is generally higher for HNIs (high-net-worth individuals).

Taxpayers need to be aware of the circumstances that might attract surtax. Typically, high-income individuals or businesses with substantial profits find themselves navigating the nuances of this additional financial obligation. Governments may also implement surtax to address specific social or economic objectives, such as wealth redistribution or funding critical public services.

Surtax Explained

Surtax is an additional tax imposed on top of the regular income tax. It's akin to an extra layer of financial responsibility that individuals or corporations may encounter based on specific circumstances.

Picture this: you've diligently calculated your income tax, ticking all the boxes and crossing the T's. Now, you have to account for an additional expense - a surtax. The purpose of the surtax calculator varies, but it commonly serves as a means for governments to generate additional revenue, especially in times of economic uncertainty or when specific financial thresholds are breached.

One might wonder, "How does a surtax differ from regular income tax?" The distinction lies in its application. While income tax is a standard levy on one's earnings, surtax comes into play when specific criteria are met. These criteria could range from surpassing a predetermined income threshold to engaging in specific financial activities that trigger this supplementary taxation.

Navigating through the documentation and implementation of surtax requires a keen understanding of the applicable laws and regulations. Taxpayers are advised to stay informed about potential triggers for surtax, as well as any changes in the tax code that may impact their financial responsibilities. In the world of finance, awareness is not just power; it's also the key to effectively managing and planning for the ever-evolving landscape of taxation.

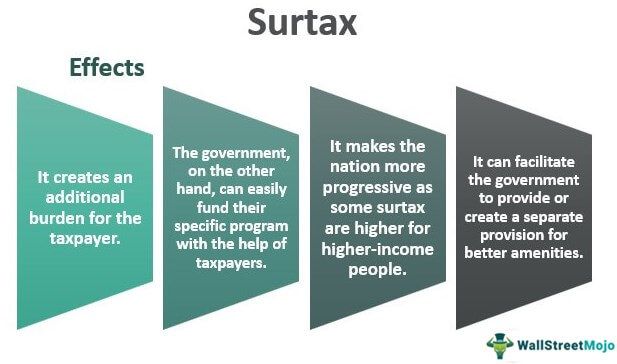

Effects

Let us understand the different effects the levying of surtax rate has on taxpayers and the economy as a whole through the discussion below.

- It creates an additional burden for the taxpayer who, along with payment of regular tax, has to pay an extra tax too mandatorily.

- The government, on the other hand, can easily fund its specific program with the help of taxpayers, who will have better transparency about where this part of the money is being utilized.

- It makes the nation more progressive as some surtaxs are higher for higher-income people, so depending on the income, the nation collects this additional fund for its welfare and development.

- It can facilitate the government to provide or create a separate provision for better amenities for its citizens.

Example

- Obama is launching additional medicare tax in the US above the already existing medicare tax, where an additional 0.9% was being charged above the already existing 1.45% medicare tax for individuals earning above $200,000 and a couple earning above $250,000.

- In 1968, the then President of the United States implemented a 10% surtax for taxpayers well above their regular tax rate to support the funding activity for the Vietnam War.

- Germany introduced a solidarity tax with a flat tax rate of 7.5% after East and West Germany were merged, and later, in 1998, the Surtax was reduced from 7.5% to 5.5%.

Surtax Rate

In the US, Surtax was originally introduced at a 10% rate for all taxpayers above their regular tax rate by the President in 1968 to support the Vietnam War. At present, it is more progressive considering the US is a developed nation where the Surtax is charged based on income, which means a higher income individual will end up paying more tax than a lower bracket individual. A person who falls under the 20% bracket of income tax is being charged 10% over it, which takes the effective tax rate to 22% overall, and a 50% bracket individual has to shell out again an overall effective tax of 55%.

The US has also introduced a sales surtax rate, which varies from state to state and is generally between 0.5% to 1.5%. These rates are generally charged to small counties on and above the general tax rate.

Advantages

Let us understand the different advantages if using the surtax calculator through the points below.

- It can help government fund specific programs aimed at the betterment of society as a whole.

- At times of war, it can provide additional funds that can help safeguard the nation.

- The rate charges here have better transparency as the taxpayer is aware of the program and where the money is being utilized.

- It’s a kind of more progressive tax system since it is charged differently for taxpayers with different levels of income.

- It can help the government provide better schemes related to health or any aspect to its citizens with the help of raising additional funds in the form of this tax.

- It doesn’t hurt the pocket a lot since the considered amount required by the government is split into all the taxpayers based on their income level.

Disadvantages

Despite the various advantages, there are a few factors of the implementation of a surtax rate that prove to be a disadvantage. Let us understand them through the explanation below.

- It unnecessarily creates an additional burden for the taxpayers who have to pay extra tax apart from their regular income tax.

- At times funds may be raised to safeguard the nation from war or prepare for a war, which is not a great option as war only brings about destruction.

- Since it is a mandatory aspect of government, every taxpayer is bound to shell the amount even if he/she is not benefited by it or the scheme for which it has been raised.

- It minimizes the savings level among the citizens since the amount they shell under the Surtax could have been invested in some other avenues generating better returns.

Surtax Vs Sales Tax

Let us understand the differences between surtax and sales tax through the comparison below. This shall help us understand the intricacies of the concept.

Surtax

- An additional tax is imposed on top of the regular income tax.

- Triggered by specific circumstances such as surpassing income thresholds or engaging in particular financial activities.

- Often serves as a revenue-generating mechanism for governments, especially during economic uncertainty.

- Primarily impacts high-income individuals or profitable businesses.

- May be implemented to achieve specific social or economic goals, such as wealth redistribution or funding public services.

- Requires a comprehensive understanding of applicable laws and regulations to manage and plan for financial responsibilities effectively.

Sales Tax

- A consumption tax imposed on the sale of goods and services.

- Applied at the point of sale, usually as a percentage of the purchase price.

- Generates revenue for the government based on consumer spending.

- Consumers bear the immediate financial impact, but businesses are responsible for collection and remittance.

- Often used to fund state and local government activities.

- Businesses must understand and comply with varying sales tax rates and regulations across different jurisdictions.