Table Of Contents

Income Tax Payable Definition

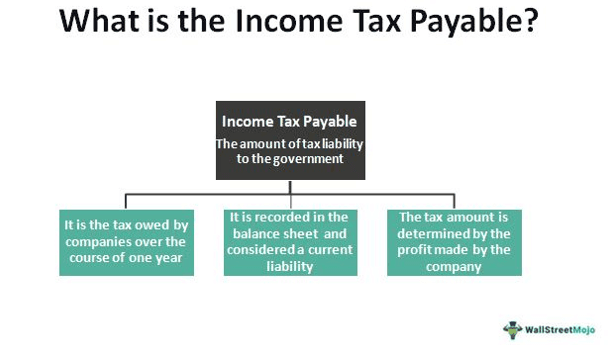

Income tax payable is typically the tax incurred and due within a year. It is the amount firms have to pay to the government as part of their earnings. Income tax payable on a company's balance sheet falls under the current liabilities portion of the balance sheet.

Since businesses operate using the facilities provided by the government, their profits are a way of giving back to it. Hence, the taxes are determined by the business's profitability during a particular period. Since it is accrued in a year, it is considered a current liability rather than a long-term one.

Key Takeaways

- Income tax payable is the amount that is due to be paid by businesses to the government within one year.

- The amount levied as tax is usually calculated on gross income. They are subjected to various deductions as per the laws.

- Income tax payable on the balance sheet is considered a current liability and not long-term liability as it is due to be paid within a year.

- Paying income tax has several advantages, including avoiding penalties, safeguarding credit scores, making it easier to apply for financial help, increasing social security payments, etc.

Income Tax Payable Explained

Income tax payable is calculated according to the different tax laws of the country the business or organization belongs. Different countries have varying levels and criteria based on which they tax businesses. The rate of taxation is determined by the prevailing corporate tax of a place. Therefore, it is not a long-term liability since it must be settled within a year.

Gross income in totality includes gains. Losses are ignored and reported on Form 8949 or Schedule D. Gross income from a business is usually the amount considered per line 7 of Schedule C; or line 9 of Schedule F. Moreover, the tax credit received by companies reduces the tax liability. It is because the business credit for the year consists of the credits carried forward from previous years and the current year's credits. This is subtracted from the tax to be paid.

Formula

The amount of money an organization owes the government on its taxable income is the income tax payable. This amount is not reported on the income statement; instead, it is present on the balance sheet. Based on depreciation, deductible expenses, and other specific accounting factors, there is often a difference between income tax expense and income tax payable. Figuring out taxable income is difficult, especially for businesses. There is no definite formula for calculating that, but meeting accounting standards is essential.

Income tax expense, an amount levied by the government on individuals and businesses alike, accounts for taxes related to income and not on assets or property.

The formula for calculating tax expenses is:

Taxable income x tax rate = income tax expense.

For example, if the business had a total taxable income of $100,000 and the tax rate is 10%, the estimated income tax payable will be $10000.

Revenue vs Income Explained in Video

Calculation Example

Here is an example to demonstrate the calculation of income tax:

The rent of a place is $6,000 per month, and the tax rate prevailing in the area is 35%. Therefore, in the income statement for 2022, the owner includes the following details: The revenue for the year will be $72000; the expenses will be $21,000; the pre-tax income will be $51000 (72000–21000); the tax rate will be 35%, and the income tax expense will be $17850 (51000*35/100). We are now about to do the taxable income calculation.

If there is an additional month of rent revenue in 2023, it will be included as it is. Therefore, the sum of 72000 and 6000 will be 78000. The expense remains at 21,000. Therefore, the taxable income becomes more than 57,000 (51,000+6000), calculated with the same tax rate of 35%.

The tax payable will be thus $19,950.

Income Tax Payable for an individual

Income tax payable by an individual is different from that of a business. Personal income tax payable by individuals differs according to their income category.

For example, the estimated tax to be paid in the U.S for individuals is as follows:

If the individual is unmarried under 65, they have to pay a tax of (as of 2021) $12,550. For those who are 64 and older and unmarried, their personal income tax payable is $14250. There are also separate categories for married people filing jointly, married people filing separately, and widowed people. All these standards are calculated on gross income. Gross income includes all non-exempt income, such as money, products, property, and services. Additionally, it has income from sources outside the United States or from the sale of the individual's primary residence (even if they exclude part or all of it). These include exemptions too.

If an individual is self-employed and runs a service-based business (where products aren't a factor), the gross revenues represent their gross income. If self-employed people work in manufacturing, merchandising, or mining businesses, their gross income is calculated by subtracting the total sales minus the cost of items sold. Either scenario will include investment income and money from incidental or outside operations or sources.

Individuals and businesses can hire professionals to calculate the income tax and help with their timely payments. Paying income tax is beneficial in many ways, such as avoiding penalties, protecting credit scores, ease of application for financial aid, building social security benefits, etc.