Table Of Contents

What Are Payroll Taxes?

A payroll tax is imposed on employers by the federal or state government. Employers pay the tax on behalf of their employees. Eventually, employers collect the amount by deducting a percentage from employee salaries, wages, or commissions.

In the US, The Federal Insurance Contribution Act (FICA) uses the collected amount to fund retirement benefits, disability, old-age survivors, nursing home services, hospice care, hospital expenses, healthcare costs, and other citizen benefits. Payroll taxes are classified into three types—Social Security, Medicare, and Federal Unemployment taxes.

Key Takeaways

- A payroll tax is a percentage imposition on the employee’s salary, wages, and commissions—collected by the state or federal government.

- The employer is responsible for submitting this tax, which is later deducted from the employee compensation.

- The contribution collected under the Federal Unemployment Tax Act (FUTA) funds workers’ unemployment compensations.

- These charges are often considered regressive—both rich and poor are equally burdened. It is imposed at a fixed rate up to a certain income cap.

Payroll Tax Explained

Payroll tax is a liability imposed by the Federal or State Government on employers. It is a percentage of wage expense spent on employees (who are on the firm’s Payroll). An amount is deducted from wage before disbursing.

It is a handsome source of revenue for the federal government. After all, the primary objective behind any tax is to eliminate fiscal deficits. Thus, it is a regressive form of taxation (in most countries).

The Federal Insurance Contribution Act (FICA) collects 15.3% of employee compensation. Of this 15.3%, 12.4% goes to The Social Security Program (6.2% paid by employer and employee each). The remaining 2.9%, however, goes to the Medicare Program (in which the employer and employee have an equal liability of 1.45% each). Also, the Federal Unemployment Tax Act (FUTA) imposes a 6% payroll charge—employer remits only 0.6%—5.4%, is received through credit.

Similarly, self-employed individuals also pay payroll charges to the government. For taxation purposes, 'self-employed' includes small business owners, lawyers, doctors, contractors, freelancers, etc. However, they have to bear both the employer’s share and the employee’s share of tax liability single-handedly.

Payroll Tax Types

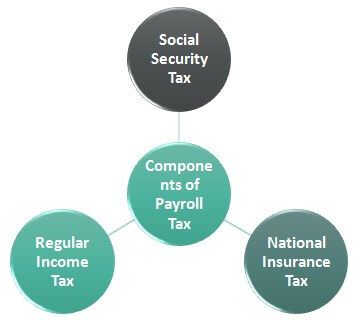

There are following four types of payroll charges imposed by the state or federal government:

#1 - Social Security Tax

The government charges a percentage of Social Security tax on the employer. The employee and the employer both contribute towards it. It is imposed at a fixed rate up to a certain income cap. In 2022, if income surpasses the Social Security wage base of $147,000, the amount above the income cap is not taxed.

The government uses collected taxes towards retirement benefits, disability, old-age survivors, and other citizen benefits. For example, in the US, FICA imposes a 12.4% payroll charge in 2022—the employer and the employee pay 6.2% each.

#2 - Medicare

The hospital insurance tax is a contribution made by the employer and the employee towards the medical insurance program. It is used for nursing home services, hospice care, hospital expenses, and other healthcare costs.

The government collects 2.9% of employee wages—the employer pays 1.45%, and the employee pays 1.45%. For self-employed individuals, 92.35% of earnings are subject to 2.9% Medicare charges. Unlike firms, self-employed individuals are not taxed on 100% of their earnings. FICA deducts 7.65% as an expense (wage tax expense on each dollar).

#3 - Federal Unemployment Tax

The Federal Unemployment Tax Act (FUTA) imposes a 6% payroll tax, and out of this, 0.6% is remitted by the employer for every $7000 spent on employee compensation. At the same time, the state collects the remaining 5.4% as credit.

The funds are used for unemployment compensation. The state unemployment tax agencies are responsible for collecting federal unemployment tax.

Payroll Tax Calculation Example

Let us look at some examples to understand the practical application of taxation.

Let us assume that Gemma works for Black PLC. As of March 31, 2022, her annual salary is $60,000. Now, calculate the payroll tax contribution deducted from Gemma’s salary (in accordance with FICA rates).

Solution:

Employee’s Contribution:

Towards Social Security: 6.2% of $60,000 = $3,720

Towards Medicare: 1.45% of $60,000 = $870

Total Employee Contribution = $3,720 + $870 = $4,590

Employer’s Contribution:

Towards Social Security: 6.2% of $60,000 = $3,720

Towards Medicare: 1.45% of $60,000 = $870

Total Employer Contribution = $3,720 + $870 = $4,590

Total Contribution to FICA = $4,590 + $4,590 = $9,180

On behalf of the employer and Gemma, a total payroll tax of $9,180 is paid to the government.

Employers can use the Payroll Tax Calculators to determine the exact amount.

Problems and Solutions

These charges referred to as a regressive tax —both rich and poor are equally burdened. But, there are alternatives that can reduce the burden on economically disadvantaged sections of society.

For instance, removing the entire income capping would lead to a massive increase in additional government revenue. This way tax burden on individuals will increase according to their net worth. Such a policy, if implemented, would lower marginal income tax rates on corporate and personal income.

There is a need for simplified payroll charge forms and rules—so that entities can file taxes quickly.