Table Of Contents

What Is Medicare Tax?

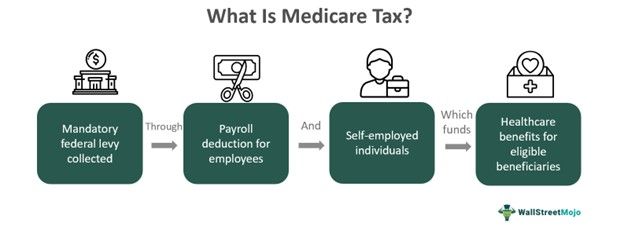

Medicare Tax is a federal payroll deducted from US employees' paychecks. The funds support medicare, which covers individuals aged 65 and older, as well as certain younger people with disabilities. This tax is typically paid by most employees, employers, and self-employed individuals in the US, regardless of citizenship status.

The Medicare tax was introduced in 1966 to help fund the Medicare program. While it aims to ensure proper healthcare support for seniors and disabled individuals, its primary goal is to finance the Medicare program rather than directly making insurance policies more affordable.

Key Takeaways

- Medicare tax is a federal payroll tax in the U.S. that funds insurance policies and medical healthcare for senior citizens, retired individuals, and persons with disabilities.

- It was introduced in 1966 and is imposed on most individuals, companies, and entities operating in the U.S.

- In 2024, the current Medicare tax rate is 1.45% for both employees and employers, totaling 2.9%. Self-employed individuals pay the complete 2.9%.

- While tax rates may change in the future, tax remains an integral part of the United States healthcare financing system, alongside programs like FICA and Social Security.

Medicare Tax Explained

Medicare tax is a contribution made to raise funds that are directed toward funding the Medicare program, including Medicare Part A, which offers hospital insurance primarily for seniors and disabled individuals. The tax is deducted from an employee's paycheck to support these healthcare services.

The tax withheld is on all US-based workers and is grouped under the Federal Insurance Contributions Act (FICA). The current tax rate is 1.45% for 2024, but this may vary over time. The tax is categorized into two parts: the employee pays an automatic deduction, and the other is taken care of by the employer. The tax is based on medical taxable wages, a calculation that applies the total pay and deducts the pre-tax healthcare deductions.

To be specific, Medicare Part A provides health insurance for people aged 65 and above, persons with disabilities, and specific medical issues. It is also known as hospital insurance. Generally, it covers the costs of skilled nursing, hospice, overnight hospital stays, and home health services. The tax is charged from an employee's taxable income, which technically includes tips, bonuses, salary, and overtime.

Form 1095-B is a separate document used to verify health insurance coverage for individuals who have coverage through a private insurance provider or specific government programs. It is not directly related to Medicare but may be applicable to individuals who have both Medicare and other health coverage. Regarding finances, the $353 billion collected annually in Medicare taxes isn't solely from payroll taxes but includes premiums and other revenues. These funds support healthcare for seniors, but beneficiary numbers may fluctuate.

Rates And Limits

The rates and limits under Medicare tax are as follows -

- For 2024, the employee Medicare tax percentage is 1.45%. This is matched by another 1.45%, which is the employer tax rate. So, the total tax rate percentage is 2.9%.

- For an employee, only their portion of the Medicare tax amount is withheld from their paycheck.

- As for the limit, there is no wage-based limit for tax, and all covered wages are subject to a Medicare tax.

- If an employee's annual wage exceeds $200,000, their employer will withhold an additional Medicare tax.

- For married employees, there might be insufficient taxes withheld. If the married couple is filing jointly and their combined earned income surpasses $250,000, they will incur an additional tax.

- If the couple opts to file separate tax returns, the additional tax applies if their incomes exceed $125,000. In this scenario, adjusting the employee's withholding and making estimated payments is necessary to cover the additional tax liability.

- For self-employed individuals, they are liable to pay a total of 2.9% of tax.

- There are no special rules for US citizens, nonresident aliens, and resident aliens living abroad. The medicare wages earned by such individuals will also be subject to additional tax.

- Employers are not required to pay the additional tax. They have the responsibility to withhold it.

Examples

Let us understand the concept with the help of some hypothetical and real-world examples.

Example #1

Suppose Tulip has just started her new job as an architect in New York. She earns $45,000 annually. For example, she should keep all other taxes and deductions constant if she only pays taxes. Tulip will make an annual contribution of 1.45% from her income, which will be matched by another 1.45% from her employer, making a total of 2.9% annual contribution.

Therefore, 1.45% of $45,000 from Tulip's side is $652.5, and again, the exact amount will be contributed by her company, making a total tax payment of $1305. In real-world taxation, there are several other factors considered, such as if the individual is filing single or jointly. The wage base, the income threshold, the other added tax slabs, and layers of the IRS.

Example #2

In March 2023, US President Joe Biden unveiled a proposal to bolster medicare's financial stability by increasing the tax on high-income individuals. This initiative, part of his budget proposal, aims to extend the solvency of Medicare's Hospital Insurance Trust Fund. President Biden advocates raising the tax rate from 3.8% to 5% on earned and unearned income exceeding $400,000, characterizing the adjustment as modest.

Additionally, the proposal includes provisions to negotiate drug prices, seeking to save costs and ensure the program's viability. President Biden emphasizes the need for wealthier individuals to contribute more to medicare, positioning the tax increase as a crucial step towards securing the program's future amidst demographic and financial challenges.

Benefits

The benefits of medicare tax are -

- It funds the US healthcare system, particularly for older people, senior citizens, retired individuals, hospital insurance, and people with disabilities.

- It ensures affordable insurance policies and helps mitigate medical expenses for senior citizens.

- Prior to the implementation of the tax program, insurance companies frequently terminated policies as individuals aged.

- From a government's perspective, it is a reasonable way to help senior citizens and structure the entire healthcare system.

- It is a revenue generation model for a good cause and support.

Medicare Tax vs FICA Tax

Understanding the distinctions between Medicare and FICA tax is essential for navigating the intricacies of federal payroll deductions-

- Medicare tax is a federal payroll tax specifically designated to fund the Medicare program, which provides health insurance primarily for senior citizens and individuals with disabilities. On the other hand, the FICA tax encompasses both Social Security and Medicare taxes, funding various social security and medical programs.

- Medicare tax was indeed introduced in 1966, whereas the FICA tax has a more extended history, dating back to its creation in 1935 to fund Social Security and expanded to include medicare in 1965.

- The Medicare tax rate for 2024 is 2.9%, with both employees and employers contributing an equal split. In contrast, the FICA tax rate is 15.3%, comprising 12.4% for Social Security (up to a certain income threshold) and 2.9% for medicare, with each component equally split between employees and employers.