Table Of Contents

Indirect Tax Meaning

An indirect tax can be transferred to another entity; it is imposed on the manufacturer, who then passes it on to the customers. The tax amount is added to the product’s selling price in the form of Excise duty, Service tax, VAT, etc.

It is also known as consumption tax; consumers pay for the taxes indirectly—by paying more for the product. It is not obvious to most customers. The US charges Indirect taxes at a subnational level. The states also impose certain taxes. In addition, local jurisdictions have the authority to impose a sales tax.

Key Takeaways

- An indirect tax is a form of imposition by the local, state, or central government. The charges are imposed on one entity, but its financial liability falls on another.

- These charges are imposed on goods and services manufactured or sold by businesses.

- Indirect taxes are further classified into excise duty, customs duty, sales tax, service tax, entertainment tax, stamp duty, securities transaction tax, goods, and service tax, and value-added tax.

Indirect Tax Explained

An indirect tax is imposed by the government on organizations that can recover the amount from customers. It is a tax that is charged on manufacturers—who pass it on to customers. Hence, the consumers are the final Taxpayers.

The US charges indirect taxes at a subnational level. State and local jurisdictions also have the authority to impose indirect charges.

The following features distinguish indirect tax from direct taxes:

- An indirect tax is levied by the local, state, or central government. It is charged on the goods and services sold by manufacturers, sellers, service providers, and other firms.

- The manufacturer, wholesaler, or retailer is responsible for submitting the tax amount to the government.

- It involves a shift of tax liability—businesses shift the burden onto the customers.

- They are considered regressive taxes. There are some exceptions, though; GST, for example, is a progressive tax.

- Indirectly, these charges influence customers to spend less and save more.

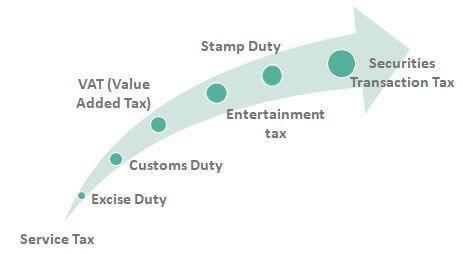

Types of Indirect Taxes

Indirect taxes are classified into the following types:

- VAT (Value Added Tax): The government charges VAT on goods that improve across the supply chain. The charges are imposed on price appreciation at every stage of the supply chain. Ultimately, it is the customer who bears the burden at the final consumption stage.

- Service Tax: It is levied on individuals or businesses that render services—consultancy, legal, hospitality, etc.

- Excise Duty: Excise duty is levied on manufacturing goods; the manufacturer collects the amount from the customer. It is also called an excise tax.

- Customs Duty: The government charges a percentage on the import and export of goods.

- Securities Transaction Tax (STT): It is levied on stock exchange transactions—the purchase and sale of securities. The term securities refer to stocks, bonds, mutual funds, etc.

- Stamp Duty: It is imposed on the purchase and sale of immovable properties or assets. It is collected by the particular state government—depending on where the respective property is physically located. It is even imposed on legal documents, agreements, and registries.

- Entertainment Tax: This type of tax is imposed on every transaction, product, or service involving any sort of entertainment—movies, sports, stage shows, and exhibitions.

- Goods and Service Tax (GST): The GST is one tax that includes and replaces multiple indirect taxes such as VAT, excise duty, service tax, etc.

Examples

Let us look at some examples to understand the practical application.

Example #1

XYZ Ltd. sells toilet fittings in Washington. Keeping with the state laws, a 9.22% sales taxes is charged on the sale of this product. If the base price per tap is $6.25, determine the marginal selling price (inclusive of sales tax).

Solution:

Marginal Sales Price = Base Price +

Marginal Sales Price = $6.25 + = $6.83

Therefore, the customer will pay $6.83 for buying a tap (inclusive of sales tax).

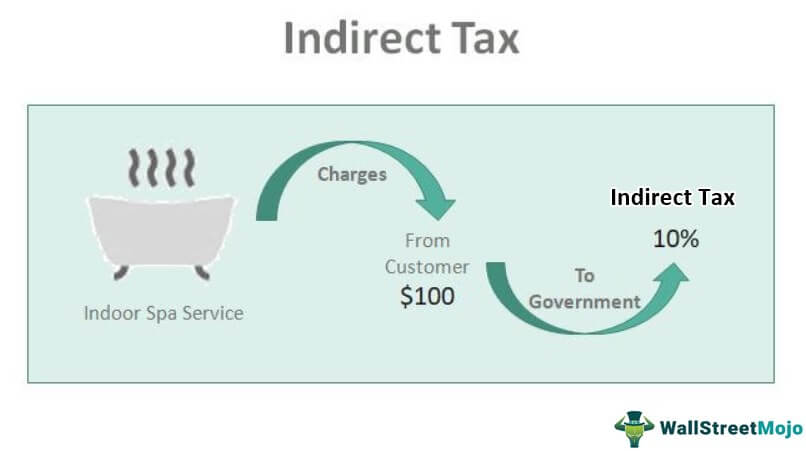

Example #2

Let us assume that the US government charges a 10% service tax on spa services. If the base price of the service is $100, what will be the billing amount?

Solution:

Total Bill = Base Price + Service Tax

Total Bill = = $100 + = $110

Thus, the client will pay $110 for the spa (including service tax).

Advantages and Disadvantages

Indirect charges benefit businesses as it is not charged from their pockets. Let us discuss other benefits:

- Based on Purchasing Power: Indirect taxes are only imposed on those who consume a certain product. In a way, the poorer sections of society are exempt from these taxes. Customers can limit consumption to escape such tax liabilities.

- Convenient Collection: These taxes are directly collected from the manufacturers or retailers—convenient for the government.

- Tax Evasion can be Avoided: The amount is collected by one party and paid by another. As a result, tax evasions are minimal.

- Not Noticeable: The government is able to raise funds without attracting attention. The charges remain inconspicuous, among manufacturing, transport, and other costs.

- Discourages Harmful Products: On addictive or harmful goods like tobacco and cigarettes, the government imposes heavy taxes. These measures can indirectly reduce the consumption of harmful goods.

The demerits are as follows:

- Increases Commodity Prices: These charges are imposed on every stage of the supply chain, from raw material purchases to retailing the finished goods. By the time a customer purchases the finished product, the seemingly small charges add up.

- Regressive: These taxes are also imposed on the essential goods or services—salt, sugar, etc. Often the charges are considered an unnecessary burden on the poor.

- Unsteady Source of Revenue: The government’s revenue from these taxes is highly dependent on demand-supply, which keeps on fluctuating.

- No Civic Consciousness: Many a time, the consumers are unaware of such taxes since it is included in the product’s price.

- Not Feasible for Industries: When charges are imposed on raw materials, manufacturers cannot always afford the total cost—they end up purchasing smaller quantities. Therefore, indirect charges negatively impact manufacturers’ cash flow.