Table Of Contents

What is the Invested Capital Formula?

The invested capital formula refers to the mathematical expression that allows businesses to calculate the total cash invested in it over its life, which becomes the source of its operating profits. The figure obtained becomes the metric for firms to assess how fruitful the investments are.

Invested capital is the total money by issuing debt to bondholders and securities to equity shareholders. It would sum the capital lease obligations and total debt to the amount of equity allocated to the investors.

Key Takeaways

- Invested capital means the total money through issuing debt to bondholders and securities to equity shareholders.

- It will sum the capital lease obligations and total debt to the equity given to the investors.

- A company may select the funding source instead of borrowing a loan from financial institutions.

- One can also use this to estimate ROIC, i.e., Return on Invested Capital. Again, if the ratio increases, it describes the firm as a value creator.

Invested Capital Explained

Invested capital is the capital or amount of money that firms raise to run, grow, and expand their businesses. The return that an entity receives in exchange for the monetary resources it gathers and uses, helps it assess how fruitful the latter has been.

Companies must generate more and more earnings than costs incurred to ensure that the invested capital is being utilized properly and is being fruitful for the business. In case, the scenario is the opposite, it indicates that the invested capital are not properly utilized. The formula for Invested Capital (IC) is as follows: –

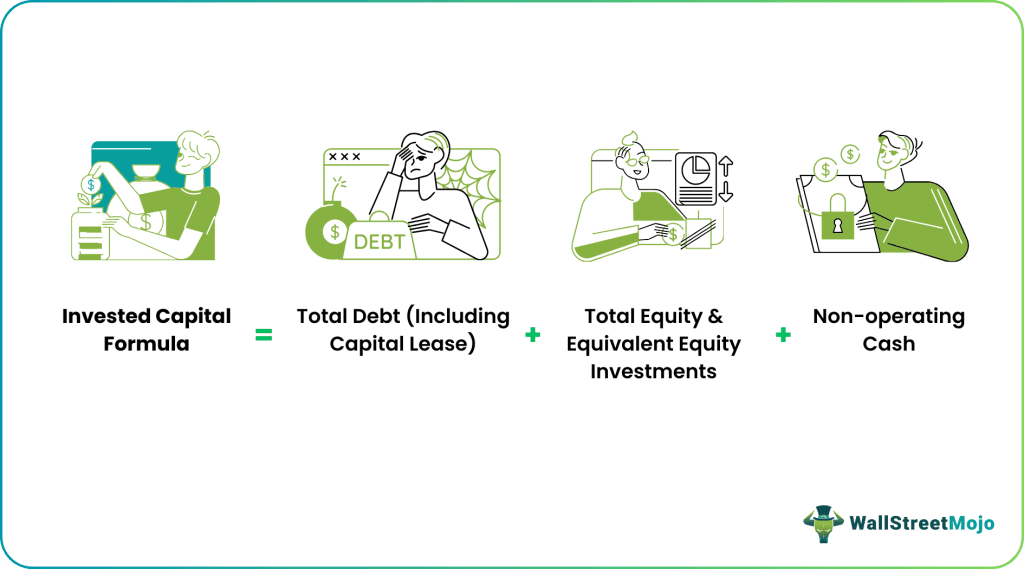

Invested Capital Formula = Total Debt (Including Capital Lease) + Total Equity & Equivalent Equity Investments + Non-Operating Cash

When the businesses record significant earnings, they offer a good rate of returns to the stakeholders. Return on investment capital (ROIC) is the metric that helps assess how efficiently a company allocates its capital to generate maximum profits out of it. Likewise, the investors get an opportunity to check how well a company utilizes its capital investments. If the investors find the figures convincing, they definitely consider investing or continue with their investments in the firm., given its growth and ability to leverage.

How To Calculate?

There is a series of steps to follow to calculate invested capital using the formula. Let us have a quick look at them:

- Calculate the total debt, including all interest-bearing debt, whether long term debt or short term debt.

- Calculate the total equity and equity equivalent issued to equity shareholders, including reserves.

- Then, calculate non-operating cash and investment.

- Now, take a total of step1, step2, and step3, which shall be invested capital.

Examples

Let us consider the following examples to understand the concept better and also check the calculation part in detail:

Example #1

M Co. has given the following details. So, you are required to calculate the invested capital of the firm.

Use the below data given for the calculation of economic profit.

- Long-term debt: 235000.00

- Short-term debt: 156700.00

- Equity issued: 100900.00

- Capital leases: 47899.00

Solution:

Calculation of invested capital done using the below formula: –

Invested Capital = Total Debt + Total Equity & Equivalent Equity Investments + Non-operating Cash

=(Long-term debt + short-term debt + capital lease) + Equity

- =( 235,000 + 156,700 + 47,899) + 100,900

Invested Capital will be: -

- Invested Capital= 540,499

Hence, the invested capital of the firm is 540,499.

Example #2

Barclays & Barclays, a profit-making and cash-generating firm, has published its annual report. Below is the summary of its financial position at the end of the financial year.

Apart from the above, the company has also reported capital leases commitment off-balance sheet, and the present value of the same is $35,589,970.

The management is looking to raise the return on capital ratio by repaying the debt, which shall boost the morale of its shareholders. Therefore, the company's CFO has asked its junior to submit the number of funds the firm invests in an Excel file.

You are required to calculate the invested capital of the firm.

Solution

The CFO of the firm wants to calculate the invested capital.

First, we need to calculate the total debt and total equity.

Total Debt Calculation

=337500000+495000000+123750000

Total Debt =956250000

Total Equity Calculation

=450000000+65000000+58500000

Total Equity =573500000

Calculation of invested capital done as follows: –

= 95,62,50,000 + 57,35,00,000 + 3,55,89,970

Total Invested Capital will be: -

- Invested Capital = 1,56,53,39,970

Therefore, the invested capital will be 95,62,50,000 + 57,35,00,000 + 3,55,89,970 which shall equal to 1,56,53,39,970

Note:

We have also included capital lease commitment as part of invested capital.

Example #3

Wyatt Inc. has given you the following details about its investment by raising equity and debt. The firm had not provided the equity and debt mix, but it has provided an application. Based on the information below, you must calculate the total invested capital made by Wyatt Inc.

- Current assets: 33890193.00

- Current liabilities: 32534585.28

- Intangibles: 169450965.00

- Plant and machinery: 211813706.25

- Buildings: 232995076.88

- Cash from non-operating assets: 78371071.31

Solution:

We will use the operating formula for calculating invested capital to solve this example.

Below are the steps to calculate invested capital using the operating approach: -

- Compute the net working capital and the difference of current assets, and deduct non-interest-bearing current liabilities.

- The second would be to take tangible assets – plant, equipment, and machinery.

- Last would be to take intangible assets, including patent and goodwill.

- The final step would be Steps 1, Step 2, and Step 3.

We do not directly have the classification of equity and debt, but we can state that the firm has invested those funds. Hence, we shall use the total of those applications as the total invested capital.

Calculation of Working Capital

=33890193.00-32534585.28

Calculation of Tangible & Intangibles

=169450965.00+211813706.25+232995076.88

Total Tangible & Intangibles = 614259748.13

Calculation of invested capital can be done as follows:-

=78371071.31+614259748.13+1355607.72

Total Invested Capital will be: -

- Total Invested Capital = 693986427.16

One can notice that the firm has invested heavily in fixed assets and the rest in working capital. The remaining is from non-operating assets.

Therefore, the total invested capital is 69,39,86,427.16.

Relevance and Uses

For a firm, invested capital becomes a source of funds that allow them to capitalize on new opportunities like taking over another firm or expanding the existing ones. Listed below are its uses.

Let us have a look:

1. To purchase tangible assets like buildings, land, or equipment.

2. To cover its routine daily operating expenses like paying for employee salary or inventory.

3. A company can choose this funding source instead of borrowing a loan from financial institutions for its needs.

4. Further, one can also use this to calculate ROIC, which is Return on Invested Capital, and when this ratio increases, it depicts that the firm is a value creator.