Table Of Contents

What Is Average Collection Period?

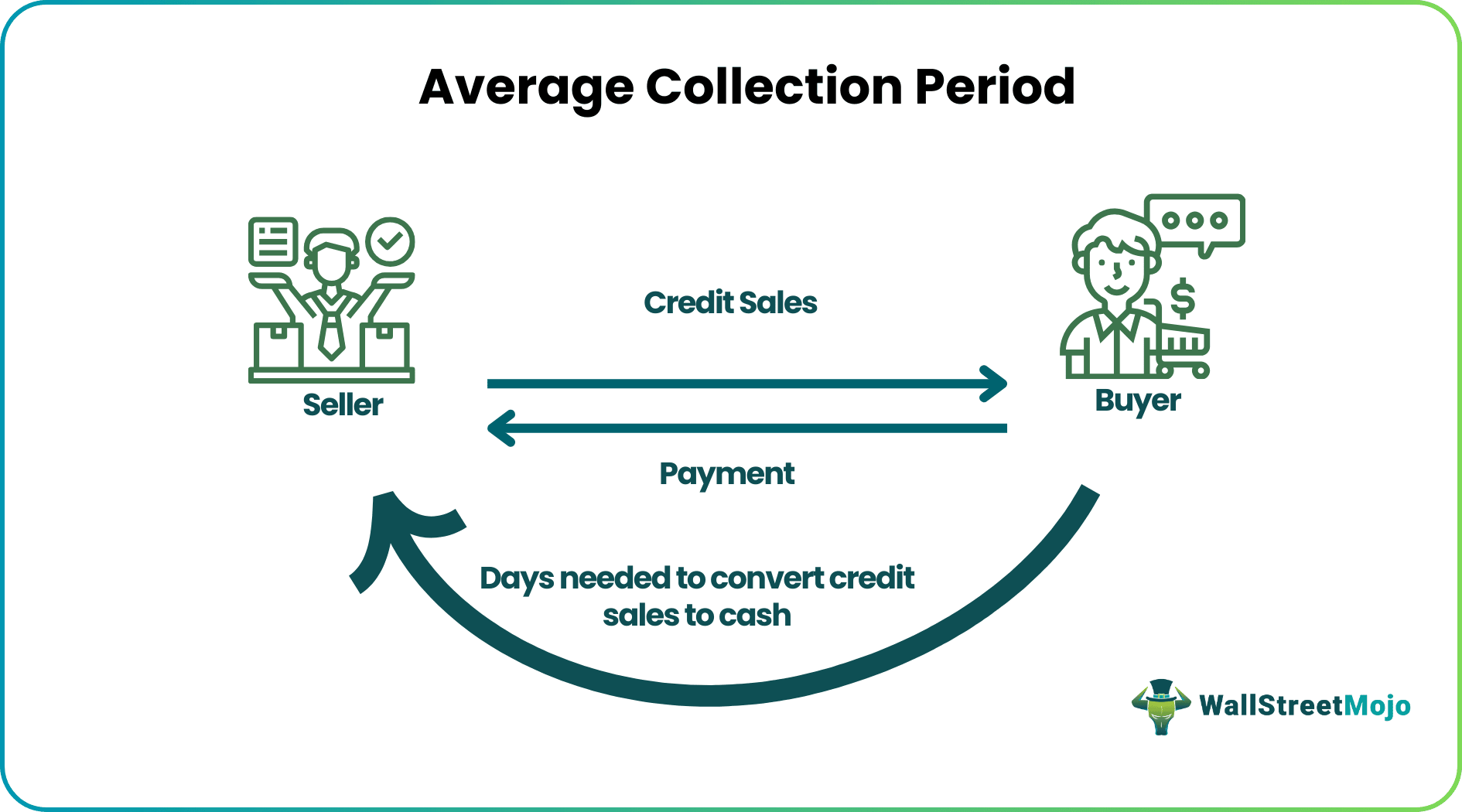

The average collection period is the time a company takes to convert its credit sales (accounts receivables) into cash. It provides liquidity to the company to meet its short-term needs or current expenses as and when they become due.

Once a credit sale happens, the customers get a specific time limit to make the payment. Every company monitors this period and tries to keep it as short as possible so that the receivables do not remain blocked for a long time. This fund helps the company plan its future expenses and provides liquidity.

Key Takeaways

- The average collection period is the time a business takes to convert its trade receivables (debtors) to cash.

- The formula for calculating the average collection period is 365 (days) divided by the accounts receivable turnover ratio or average accounts receivable per day divided by average credit sales per day.

- The accounts receivable turnover ratio formula is net credit sales divided by average accounts receivable.

- A company must ascertain the credit period since most cash flow depends on this and helps formulate a credit policy.

Average Collection Period Explained

The average collection period is the timea company’s receivables can be converted to cash. It refers to how quickly the customers who bought goods on credit can pay back the supplier. The earlier the supplier gets the funds, the better it is for business because this fund is a huge source of liquidity. In addition, it can be readily used to make short-term payments or obligations. Therefore the average collection period analysis is critical.

It increases the cash inflow and proves the efficiency of company management in managing its clients. An organization that can collect payments faster or on time has strong collection practices and also has loyal customers. However, it also means that they follow a very strict collection procedure which may also drive away customers because they prefer suppliers who have more flexible credit terms.

Average Collection Period Video

Example

We will take a practical example to illustrate the average collection period for receivables.

BIG Company decides to increase its credit term. The company's top management requests the accountant to find out the company's collection period in the current scenario.

Here is the information available to the accountant –

- Net Credit Sales for the year - $150,000

- Accounts Receivables at the beginning of the year - $20,000

- Accounts Receivables at the end of the year - $30,000

- As an accountant, find out the collection period of BIG Company.

In this example, first, we need to calculate the average accounts receivable.

- The beginning and ending accounts receivables are $20,000 and $30,000, respectively.

- The average accounts receivables for the year would be = ($20,000 + $30,000) / 2 = $50,000 / 2 = $25,000.

Now, we will find out the accounts receivables turnover ratio.

- Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

- Or, Accounts Receivable Turnover Ratio = $150,000 / $25,000 = 6.0x

Now, we can calculate average collection period.

- Collection Period = 365 / Accounts Receivable Turnover Ratio

- Or, Collection Period= 365 / 6 = 61 days (approx.)

BIG Company can now change its credit term depending on its collection period.

Formula

Investors widely use the first formula. However, the second formula is used when one doesn't want to use the first formula.

In the first formula, we first need to determine the accounts receivable turnover ratio.

The formula for accounts receivable turnover ratio is –

Once we know the accounts receivable turnover ratio, we can do the average collection period ratio. All we need to do is to divide 365 by the accounts receivable turnover ratio.

In the second formula, we need to find out the average accounts receivable per day (meaning average accounts receivable divided by 365) and the average credit sales per day (meaning average credit sales divided by 365). This helps to calculate average collection period.

Thus, the above above formula shows the average collection period ratio.

Interpretation

Since the company needs to decide how much credit term it should provide, it needs to know its collection period.

For example, if a company has a collection period of 40 days, it should provide 30-35 days.

Knowing the average collection period for receivables is very useful for any company.

There are two reasons for this –

- First, a considerable percentage of the company's cash flow depends on the collection period.

- Second, doing the average collection period analysis helps a company decide the means to collect the money due to the market.

The collection period may differ from company to company. For example, a company may sell seasonally. In that case, the formula for the average collection period should be adjusted as needed.

If the company decides to do the Collection period calculation for the whole year for seasonal revenue, it wouldn't be just.

Calculator

You can use the following Calculator

Calculation in Excel (with excel Template)

Let us now do the average collection period analysis calculation example above in Excel.

This is very simple. You need to calculate the average accounts receivable and find out the accounts receivables turnover ratio. And then find the collection period.

First, we need to calculate the average accounts receivable.

Now, we will find out the accounts receivables turnover ratio.

Now, we can calculate the collection period.

You can download this Excel template here – Average Collection Period Excel Template.