Table Of Contents

Credit Period Definition

Credit Period refers to the duration of time given by the seller to the customer to pay off the amount of the product that the customer has purchased from the seller.

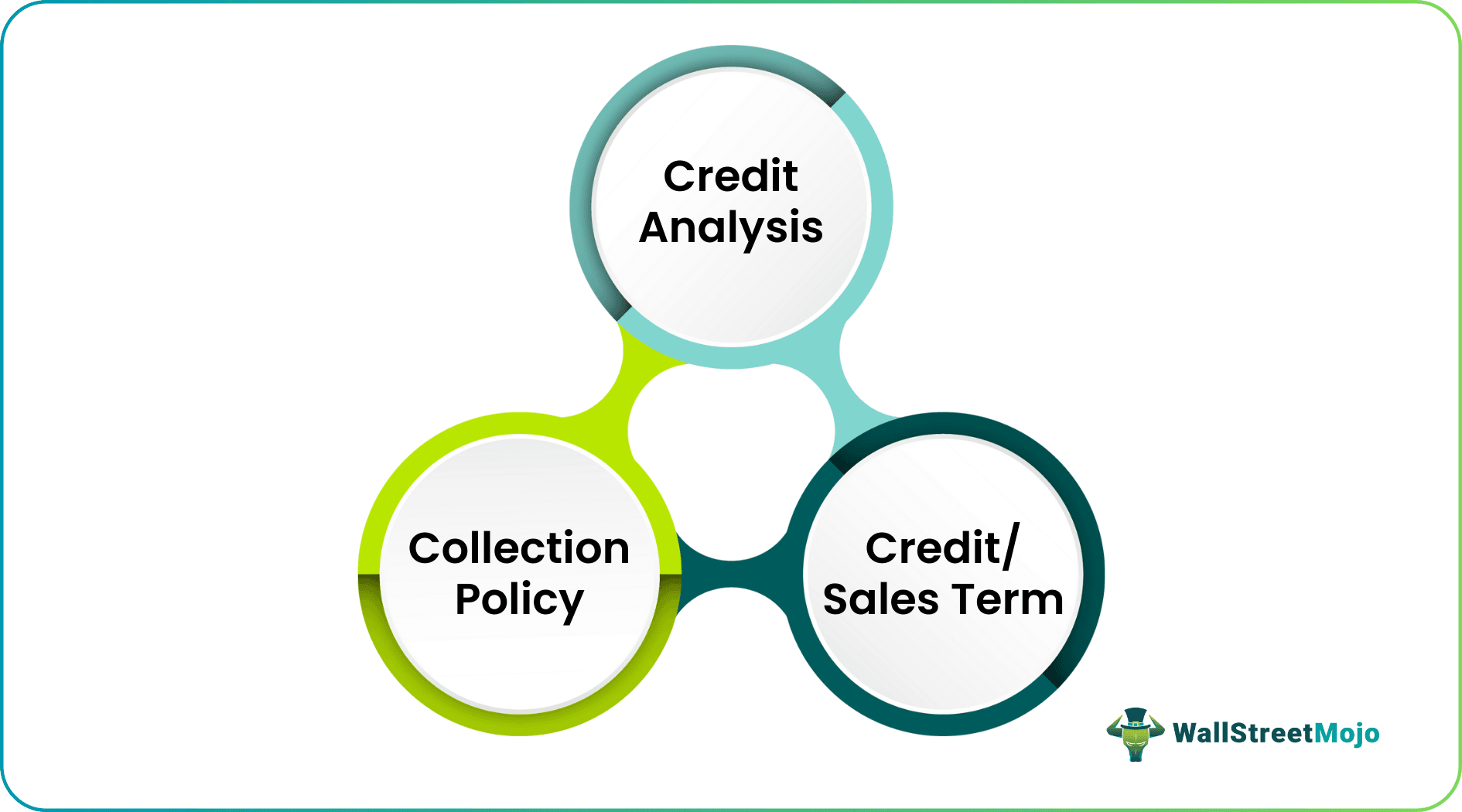

There are three essential components of the credit period are as follows:

- Credit Analysis: Credit analysis is done to know the customer's creditworthiness. Credit analysis can be done using various financial analysis strategies; trend analysis to check the customer's repaying worthiness.

- Collection Policy: Collection policy involves the methods adopted by the organizations for the recovery of accounts receivable. It also prescribes the late fees, interest, and other charges payable if the payment is delayed.

- Credit Terms or Sales Term: Credit terms should mention the credit period with some sellers prefering 30 days' credit while others may give lesser or more periods depending upon their terms of sales.

Credit Period Formula

It can be calculated with the help of the below-mentioned formula:

Credit Period Formula = Average Accounts Receivable / (Net Credit Sales / Days)

Or

Credit Period Formula = Days / Receivable Turnover Ratio

Where,

- Average Accounts Receivable = It is calculated by adding the Beginning balance of the accounts receivable in the company with its ending balance of the accounts receivable and then dividing by 2.

- Net Credit Sales = It refers to the total amount of net credit sales made by the company during consideration.

- Days = Total number of the days in a particular period like in a year total of 365 days are considered for the calculation.

- Receivable Turnover Ratio = It is calculated by dividing the net credit sales of the company by the average accounts receivable.

Example of Credit Period

Below is an example of the credit period.

During the accounting year 2018, net credit sales of the company B ltd was $1,200,000. Therefore, for the accounting year 2018, the beginning balance of the accounts receivable was $400,000, and the ending balance of the accounts receivable was $440,000. Using the information, calculate the Credit period of the company. Consider 365 days in a year for the calculation.

Solution

- Beginning balance of the accounts receivable of the company: $400,000

- Ending balance of the accounts receivable of the company: $440,000

- Net credit sales during the year: $1,200,000

- The number of days in a period: 365 days.

Now to calculate the Credit period, firstly, the Average accounts receivable will be calculated as below:

Calculation of Average Accounts Receivable

Average Accounts Receivable = (Beginning Balance of Accounts Receivable + Ending Balance of Accounts Receivable) / 2

- Average Accounts receivable = ($400,000 + $440,000) / 2

- Average Accounts receivable = $420,000

Calculation of the Credit Period

- = $420,000 / ($1,200,000/ 365)

- = 127.75 days

Thus, the company's credit period for the accounting year 2018 is 127.75 days.

Advantages

The various advantages related to the Credit period are as follows:

- Minimal Cash Outlay - It is a type of loan that doesn't have any interest. However, one must regularly make sales and clear the dues left with the suppliers. It helps earn more revenues, and the company may easily achieve its goals.

- Discount for Fast Payments - An organization must timely clear the supplier's payments to get noted in their good books and receive huge discounts.

- Enhanced Creditworthiness - An organization can enhance its creditworthiness by ensuring the suppliers' dues are settled on time.

- Uninterrupted Supply of Goods - Suppliers prioritize companies that clear their payments very much on time, and in return, they also ensure that such companies receive an uninterrupted supply of goods.

Disadvantages

The various disadvantages related to the Credit period are as follows:

- Fees and Penalties - An organization that fails to clear off the supplier's payment and that too on time or has made it a regular pattern of delaying their payments can be penalized by them. Therefore an organization must ensure that the vendors' payments are not delayed to minimize or eliminate the possibilities of being penalized.

- Loss of Credit Period Privileges - If an organization has made a pattern of delaying suppliers' payment, then it may happen that the supplier no longer trusts the organization's credibility. It may refuse to offer its credit period privileges in the future.

- Impact on Credit Rating - All vendors do not acknowledge it. Therefore, credit rating impact may happen that organizations that avail credit period for settling the supplier's dues may fall out of their good books. It might ultimately impact the organizations' credit rating.

- Difficulties in Cash Flow - With the credit period, it might also happen that the cash gets stuck, and hence, cash flow might get impacted.

Important Points

The different essential points related to the Credit period are as follows:

- It refers to the number of days in which a company customer is allowed before paying the invoice for the credit sales.

- It is calculated by dividing the number of days in a particular period by the receivable turnover ratio.

Conclusion

Credit Period refers to the average time given by the seller to its customer for making the payments against the credit sales. It is a type of loan which doesn't have any interest in it. However, an organization that fails to clear off the supplier's payment on time can be penalized. Therefore, the organization must ensure that the vendors' payments are not delayed to minimize or eliminate the possibility of being penalized.