Table Of Contents

What Is Loss Ratio?

The loss ratio depicts the insurance company’s percentage loss on claim settlement compared to the premium received during a particular period. A higher ratio is a matter of concern for the insurer. The companies use it as an indicator of its financial condition.

Thus, the metric is used to measure the amount of the insurance claim that the company pays out as a percentage of the premium that is collected. It depends on the risk factors, type of claims, and the rules and practices followed by the insurance company. A higher loss ratio should be tackled on time to prevent the company from facing fund crunch.

Key Takeaways

- The loss ratio is a metric used in the insurance industry to measure the percentage of losses incurred by an insurance company on claim settlement relative to the premium earned during a specific period.

- It is calculated as the total losses paid out in claims, plus adjustment expenses, divided by the premiums earned in the same period.

- The loss ratio helps to estimate an insurance company's profitability and sustainability.

- Additionally, loss ratios play a crucial role in determining future policy premiums, as insurance companies use this information to adjust pricing and remain competitive while maintaining profitability.

Loss Ratio Explained

The loss ratio method accurately estimates the insurance company's profitability from its core business. It is like calculating gross margins (the difference between revenue and direct costs like raw materials and fuel) for other businesses. The gross margin tells you what a manufacturing or service business makes from its core business without factoring in the different operating and administrative overheads.

Insurance companies make money and stay solvent when they pay out (claims) lesser than what they collect (premiums) in a particular period. When an insurance company regularly pays out a higher proportion of premiums in losses, it can run into financial trouble, lose its capital, and default on future claims. Therefore, it is always advisable for insurance companies to maintain adequate loss ratios.

The claims loss ratio differs across insurance sectors, and some sectors may have a higher ratio than the other sectors. For example, property and casualty insurance tend to have a lower loss ratio than health insurance.

Features

Let us look at the various features of this claims loss ratio in detail.

- Different insurance companies will have different loss ratios depending on their cover losses.

- This ratio may fluctuate from period to period due to reasons under or beyond the insurer's control.

- The insurance companies pay the loss adjustment expenses to ensure they do not pay for fraudulent claims even though it eats into their profits.

- Fraudulent claims sometimes show a high loss ratio for insurance companies, even though they use various checks to dishonor fraudulent claims rightly.

- The insurance companies can also reimburse loss adjustment expenses in case of some commercial liability policies.

- Loss ratios are always used in conjunction with combined ratios to measure the overall outflow relative to the inflow.

Formula

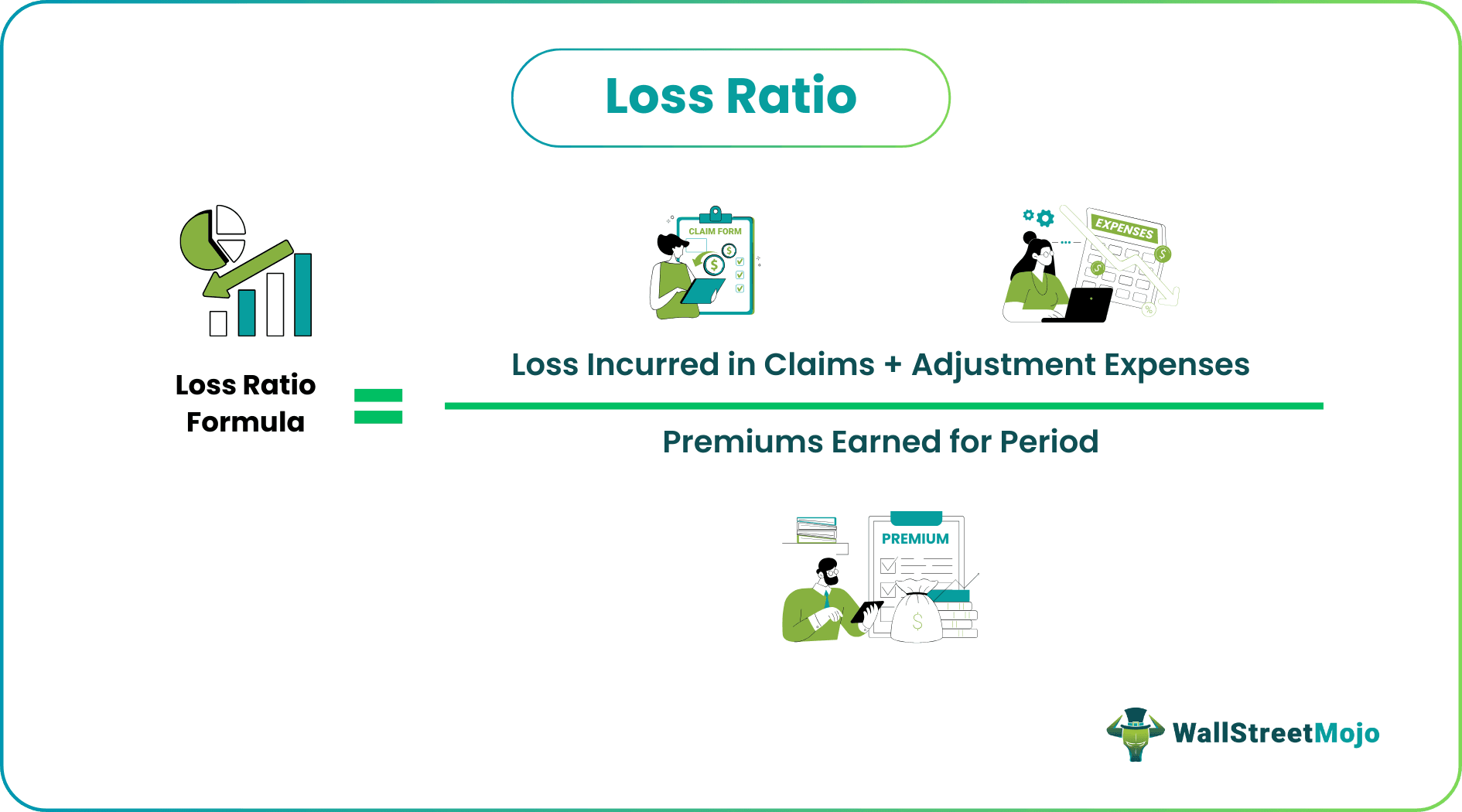

The loss ratio is calculated as losses incurred in claims (paid to the insured for damages when the risk event happens) plus adjustment expenses (incurred by the insurance company for investigating and settling an insurance claim) divided by the premiums earned during the period.

Loss Ratio Formula = Losses Incurred in Claims + Adjustment Expenses / Premiums Earned for Period.

For example, if an insurer collects $120,000 in premiums and pays $60,000 in claims and adjustment expenses. The loss ratio for the insurer will be calculated as $60,000/$120,000 = 50%

Types

The following are two types under the loss ratio method–

#1 - Medical Loss Ratio

It is generally used in health insurance and is the ratio of healthcare claims paid to premiums received. Health insurers in the United States are mandated to spend 80% of the premiums received towards claims and activities that improve the quality of care. Failing the condition, the insurers have to give the excess funds back to the consumers.

#2 - Commercial Insurance Loss Ratio

It is meant for the insured, wherein the insured must maintain an adequate loss ratio, failing which the business risks non-renewal of insurance or increased premium for the cover. For example, a furniture store pays $3,000 in premium to ensure the inventory, and a hailstorm causes $4000 damage. The ratio for one year becomes $4000/$3000 or 133%. In this case, the insurer will look at the long-term claim history of the insured and take a call on increasing the premium or not renewing the policy.

Example

Farmers insurance posted a loss ratio of 155%, while Allstate corp posted a ratio of 257%.

Advantages

Below are some of the reasons why loss ratio analysis are useful in the insurance industry –

- It helps to determine the profitability of the insurance company.

- Comparison of loss ratios amongst different insurance companies can give us useful insights into the businesses and differences in business models of these companies.

- Loss ratio analysis helps determine future policies' premiums as the companies take regular feedback for issued policies and tweak pricing to stay competitive and profitable.

Disadvantages

There are some disadvantages of the ratio as well that should be analysed as given below.

- This ratio is volatile and can fluctuate with the changes in amount and frequency of claims due to change in rules of the industry or any natural disaster, etc, that are unforeseen contingencies.

- This ratio only considers the claim outflow. It does not take into account any kind of other expenses that the insurance company has incur related to administrative and marketing expense. Such expense also affects the company’s income negatively.

- Such ratio can be misused by the underwriters of the company to follow strict rules regarding policy acceptance or during claim payout. They may deny insurance to clients who might have the possibility of facing higher risk

- The insurance companies always invest the funds that they collect from the policyholders in different profitable investment avenues. This income affects or increases the profitability of the companies. However, the loss ratio does not take into account this income, which results in presenting an incorrect picture of the firm’s profitability.

Loss Ratio Vs Combined Ratio

Both are important measures of profitability in the insurance industry and is frequently used to assess the company’s profitability in terms of underwriting. However, the major points of differences between them are as follows.

- The former is a percentage of the premium that is going out as claims but the latter is a combination of the expense ratio and the loss ratio.

- The former compares the claim made in comparison to the premium earned whereas the latter compares the cost of underwriting with the premium earned.

- A high loss ratio indicates a negative situation for the company where the claims going out is more than the premium that is is able to collect form the policyholders. But a higher combined ratio above 100% indicates that the insurance company is making a profit in underwriting and a loss means the ratio is below 100%.