Table Of Contents

What Is Cash Conversion Cycle?

A cash conversion cycle (CCC) refers to the time taken to convert the amount invested in inventory into the cash received after the sales. It is represented as the number of days the cycle takes to complete. It becomes an important metric for users who get an opportunity to estimate everything from receiving the outstanding dues to paying their bills.

Also known as the net operating cycle or cash cycle, this working capital unit might not be an effective calculation for every organization as not all of them deal with physical inventory. However, the lower the CCC, the lesser the time taken to convert an investment into returns.

Table of contents

- The cash conversion cycle (CCC), also known as the net operating cycle, is the time businesses take to convert their inventory into sales-generating cash.

- It is one of the best ways to check the company's sales efficiency. It helps the firm know how quickly it can buy, sell, and receive cash.

- Days Inventory Outstanding, Days Sales Outstanding, and Days Payables Outstanding are the three elements of the Cash Conversion Cycle.

- As the calculation depends on various factors, the values of each variable must be derived carefully.

Cash Conversion Cycle Explained

A cash conversion cycle lets businesses calculate the time taken to sell their inventory, convert their investments into earnings, and pay their outstanding dues using the cash received. Though the result obtained depicts the time taken to convert investments into earnings, it speaks about the efficiency of the business. If the time taken is less, it would mean that the company converts its inventory investment into earnings quickly, which signifies how efficiently it works.

When businesses purchase inventory, the cash is not immediately paid. That means the purchase is made on credit, giving the firm the time to market the inventory to the customers. During this time, the firm makes sales but doesn’t receive cash. This non-receipt of the payment from customers makes the businesses late in paying for the inventory they bought.

As the entire process, from buying inventory to having receivables to making payments, is interconnected, it forms a cycle, which indicates how quickly the investments turn into cash through sales,

Suppose that the due date for payment for a purchase is 1st April, and the date of receiving the cash from customers is on 15th April. The cash cycle here would be the difference between the date of payment and the day of receiving cash, which in this case is 14 days.

If CCC is shorter, it’s good for a firm as it allows it to quickly buy, sell, and receive cash from customers. On the other hand, if the process takes too long and the business has to pump in more money to keep the process intact, it is often referred to as negative cash conversion cycle.

Explanation of the Cash Conversion Cycle in Video

Components

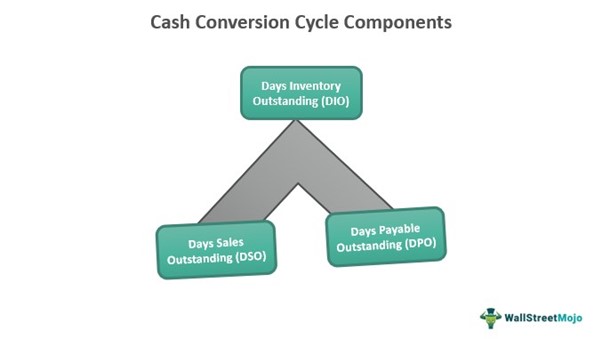

While calculating the time taken to convert the investments into cash, there are three major components that one must know of - Days Inventory Outstanding(DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO). Knowing these elements helps us understand the cash conversion cycle meaning better.

While DIO is the time taken to sell the inventory, DSO is the time taken to collect cash on sales. Similarly, DPO is the time taken by businesses to pay their bills and clear their accounts payables. Cash conversion cycle interpretation gives a detail overview of all the components and the overall time taken to procure, sell, collect payments, and settle dues.

Formula

The cash conversion cycle formula is derived using the three components. It is expressed as:

CCC = Days Inventory Outstanding + Days Sales Outstanding - Days Payables Outstanding

Calculator

cash conversion cycle interpretation can be understood fully through understanding the numbers around it. Let us take an example and compare the CCC of two companies to find out whose cycle is better and which is more efficient in its functioning.

| In US $ | Company A | Company B |

| Inventory | 2000 | 4000 |

| Net Credit Sales | 30,000 | 40,000 |

| Accounts Receivable | 6,000 | 7,000 |

| Accounts Payables | 2,000 | 2,000 |

| Cost of Sales | 50,000 | 30,000 |

First, let’s find out the Days Inventory Outstanding (DIO) for both companies.

| In US $ | Company A | Company B |

| Inventory | 2000 | 4000 |

| Cost of Sales | 50,000 | 30,000 |

| DIO (Break-up) | 2,000/50,000*365 | 4,000/30,000*365 |

| DIO | 15 days (approx.) | 49 days (approx.) |

Next, let us calculate Days Sales Outstanding (DSO).

| In US $ | Company A | Company B |

| Accounts Receivables | 6,000 | 7,000 |

| Net Credit Sales | 30,000 | 40,000 |

| DSO (Break-up) | 6,000/30,000*365 | 7,000/40,000*365 |

| DSO | 73 days (approx.) | 64 days (approx.) |

Thirdly, let us calculate the final portion before calculating the Cash Cycle, which is Days Payables Outstanding (DPO).

| In US $ | Company A | Company B |

| Accounts Payables | 2,000 | 2,000 |

| Cost of Sales | 50,000 | 30,000 |

| DPO (Break-up) | 2,000/50,000*365 | 2,000/30,000*365 |

| DPO | 15 days (approx.) | 24 days (approx.) |

Finally, let us derive the Cash Cycle for both companies.

| In US $ | Company A | Company B |

| DIO | 15 days | 49 days |

| DSO | 73 days | 64 days |

| DPO | 15 days | 24 days |

| CCC (Break-up) | 15+73-15 | 49+64-24 |

| CCC | 73 days | 89 days |

Both these companies are from the same industry, and if other things remain constant, Company A still has a better hold on its CCC than Company B.

Importance

CCC holds huge significance in terms of working capital requirements. It lets companies calculate the cash that remains tied up in working capital with no cash received in exchange immediately. In such negative cash conversion cycle scenarios, businesses conduct Ratio Analysis and make investments before it makes sales.

Through CCC, businesses calculate how long it takes to get back their cash tied up in their working capital in the form of accounts receivable.

Problems & Solutions

Though cash conversion cycle interpretation is very useful in finding out how fast or slow a firm can convert inventory into cash, a few limitations must be focused on.

- The calculation depends on multiple variables. If one variable is calculated wrong, it would affect the overall calculation and may affect the decisions of the firm.

- Therefore, the calculation of DIO, DSO, and DPO should be done carefully to avoid any kind of mistake in the final calculation.

Frequently Asked Questions (FAQs)

As known, CCC calculates the days taken to convert the businesses' investments into cash. The shorter this period is, the better the business's position. In short, if the value is lower, it signifies that the business is more efficient.

A negative CCC depicts the quickest conversion of investment to cash. This means that the inventory investment is converted to cash even before a business has to pay for the inventory. In short, sometimes vendors finance a company's business operations.

There are several ways in which the CCC can be reduced. Some of them include the following:

• Facilitating early payments

• Delivering products in less time

• Introducing different modes of payment

• Simplifying invoices

• Investing in real-time analytics for proper tracking

Recommended Articles

This has been a guide to what is a Cash Conversion Cycle (CCC). We explain its components, formula, example, associated problems & solutions, and importance. You can learn more about financing from the following articles –