Table Of Contents

What is the Efficiency Ratio?

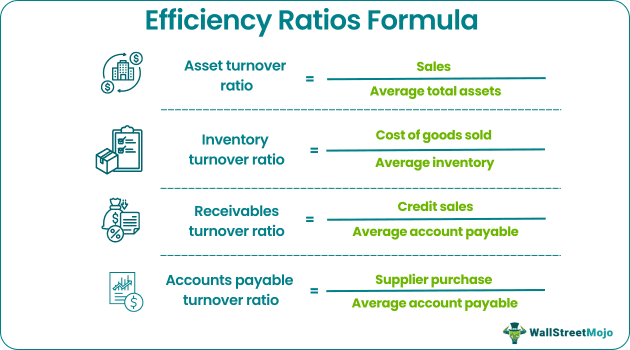

Efficiency ratios measure how effectively a company manages its assets and liabilities and include formulas like asset turnover, inventory turnover, receivables turnover, and accounts payable turnover.

The Asset turnover ratio measures an organization’s ability to utilize its assets for generating revenues effectively.

Asset Turnover Ratio = Sales / Average Total Assets.

The Inventory turnover ratio indicates the number of times the total inventory has been sold.

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory.

Receivables turnover ratio or debtors turnover ratio refers to the number of times in a period an organization collects its accounts receivable.

Receivables Turnover Ratio = Credit Sales / Average Accounts Receivable

The speed at which a company pays its suppliers is measured by the accounts payable turnover ratio.

Accounts Payable Turnover Ratio = Supplier Purchase / Average Account Payable

Explanation of Efficiency Ratios Formula

#1 - Asset Turnover Ratio

To calculate the asset turnover ratio, the following steps should be undertaken:

Step 1: Calculate the sales.

Step 2: Calculate average total assets using the formula.

Step 3: Calculate the asset turnover ratio using the formula.

#2 - Inventory Turnover Ratio

To calculate the inventory turnover ratio, the following steps should be undertaken:

Step 1: Calculate the cost of goods sold.

Step 2: Calculate the average inventory using the formula.

Step 3: Calculate the inventory turnover ratio using the formula.

#3 - Receivables Turnover Ratio

To calculate the receivables turnover ratio, the following steps should be undertaken:

Step 1: Calculate the total credit sales.

Step 2: Calculate the average accounts receivable using the formula.

Step 3: Calculate the receivables turnover ratio using the formula.

#4 - Accounts Payable Turnover Ratio

To calculate the accounts payable turnover ratio, the following steps should be undertaken:

Step 1: Calculate the Supplier Purchases.

Step 2: Calculate the average accounts payable using the formula.

Step 3: Calculate the accounts payable turnover ratio using the formula.

Examples of Efficiency Ratios Formula (with Excel Template)

Below are the examples for the calculation of efficiency ratios formula.

Example #1

Rudolf Inc. gives you the following information about the company:

- Sales: $50,000

- Average Total Assets: $10,000

- Cost of Goods Sold: $30,000

- Average Inventory: $6,000

Calculate the Asset Turnover Ratio and Inventory Turnover Ratio from the above data.

Solution:

Calculation of Asset Turnover Ratio will be -

Asset Turnover Ratio = 50000/10000

Asset Turnover Ratio = 5

Calculation of Inventory Turnover Ratio will be -

Inventory Turnover Ratio = 30000/6000

Inventory Turnover Ratio = 5

The Asset Turnover Ratio is 5, and the Inventory Turnover Ratio is 5.

Example #2

The Chief Accountant of Alister Inc. gives some information about the business for the year 2018:

- Credit Sales: $60,000

- Accounts Receivable (1.1.2018): $8,000

- Closing Accounts Receivable (31.12.2018): $12,000

- Supplier Purchase: $30,000

- Accounts Payable (1.1.2018): $6,000

- Accounts Payable (31.12.2018): $10,000

Calculate the following assuming there are 360 days in a year:

- Receivables turnover ratio and the debtor days.

- Accounts Payable Turnover Ratio.

Solution:

Calculation of Average Accounts Receivable will be -

Average Accounts Receivable = (8000 + 12000)/2

Average Accounts Receivable = $10,000

Calculation of Receivables Turnover Ratio will be -

Receivables Turnover Ratio = 60000 / 10000

Receivables Turnover Ratio = 6

Debtor Days = 360/6 = 60 days

Receivables Turnover Ratio is 6, and debtor days is 60.

Calculation of Average Accounts Payable will be -

Average Accounts Payable = (6000 + 10000)/2

Average Accounts Payable = $8,000

Calculation of Accounts Payable Turnover Ratio will be -

Accounts Payable Turnover Ratio = 30000/8000

Accounts Payable Turnover Ratio = 3.75

Accounts Payable Turnover Ratio is 3.75.

Example #3

Baseline Inc. gives you the following financial information for 2018:

- Credit Sale (all sales are on credit): $6,000

- Average Accounts Receivables: $2,000

- Average Total Assets: $10,000

- Cost of Goods Sold: $5,000

- Average Inventory: $1,000

- Supplier Purchase: $3,000

- Average Accounts Payable: $600

Calculate the following efficiency ratios:

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Receivables Turnover ratio

- Accounts Payable Turnover Ratio

Solution:

Calculation of Asset Turnover Ratio will be -

Asset Turnover Ratio = 6000 / 10000

Asset Turnover Ratio = 0.6

Calculation of Inventory Turnover Ratio will be -

Inventory Turnover Ratio = 5000/1000

Inventory Turnover Ratio = 5

Calculation of Receivables Turnover Ratio will be -

Receivables Turnover Ratio = 6000/2000

Receivables Turnover Ratio = 3

Calculation of Accounts Payable Turnover Ratio will be -

Accounts Payable Turnover Ratio = 3000/600

Accounts Payable Turnover Ratio = 5

Example #4

George Inc. had the following financial information in 2017:

- Credit Sale: $20,000

- Average Accounts Receivables: $2,000

- Average Total Assets: $10,000

- Cost of Goods Sold: $15,000

- Average Inventory: $3,000

All the sales are on credit. Find out the following ratios:

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Receivables Turnover Ratio

Solution:

Step 1: In order to calculate the asset turnover ratio, use the above formula.

Asset Turnover Ratio = 20000/10000

Asset Turnover Ratio will be -

Asset Turnover Ratio = 2

Step 2: To calculate the inventory turnover ratio, use the above formula.

Inventory Turnover Ratio = 15000/3000

Inventory Turnover Ratio will be -

Inventory Turnover Ratio = 5

Step 3: To calculate the receivables turnover ratio, use the above formula.

Receivables Turnover Ratio = 20000/2000

Receivables Turnover Ratio will be -

Receivables Turnover Ratio = 10

Thus, Asset Turnover Ratio is 2. The Inventory Turnover Ratio is 5. The receivables Turnover Ratio is 10.

Relevance and Uses

Efficiency ratios are industry-specific. It implies that certain industries have higher ratios due to the nature of the industry.

The higher the asset turnover ratio, the better it is for a company, indicating that it is efficient in generating its revenues. The debtors turnover ratio indicates the efficiency with which a company turns its receivables into cash. With the help of the debtors turnover ratio, debtor days can be calculated. Debtor days give the average number of days a business takes to collect its debts. The high number of debtor days indicates that the debt collection system of the company is poor.

The inventory turnover ratio indicates how fast a company is able to move its stocks. The accounts payable turnover ratio indicates how many times a company pays off its suppliers in a particular period.