Table Of Contents

What is Investment Research?

Investment Research means analyzing the performance of various financial instruments like stocks, mutual funds, bonds, debentures, etc., to provide an investor with a view of how the company is performing. It also helps in determining their future performance for price movements. For investors with time constraints and limited knowledge of the market hire an investment research analyst to do the research for them.

It gives investors an insight into the company's standing in the market, which helps them to decide whether investing in a particular company is viable or not. Unfortunately, investors often don't get the data on time, which traps them into buying an overvalued stock. It helps in removing the information gap and letting investors make more efficient and profitable decisions.

Table of contents

Investment Research Explained

Investment research refers to the process of an investor analyzing different factors of a particular instrument or an asset class before parking funds into them. This involves calculating the possible returns from the investment, its risk factors, and other such factors.

Global investment research helps an investor to ace out and stand long in the market. It helps an investor make an efficient and profitable decision, provided the research has been done, considering all relevant factors. It means an analyst must be a prudent, efficient person who can identify the areas of study which can affect his decision-making.

Timing is of utmost importance while doing investment research. The analyst must be able to discount all relevant factors before choosing an alternative within the investor's risk appetite. The risk and reward ratio must be balanced out completely, whether bonds, mutual funds, stocks, or any other financial instrument. It can be the best tool if used wisely by the investor.

Investment Research of any stock starts with data collection, which is then analyzed, and finally, a report is being submitted, giving the pros and cons of the data taken. Time is of the essence because any non-updated vital information can drastically impact the investor's decision. Many tools are used for such research as Stock Charts, Signals, and Screeners, which help the investor know where the company's stock will move. Many analysts prefer to opt for fundamental, technical, bottom-up, or top-down approaches. Such tools evaluate business cycles, market sectors, management competence, industry trends, etc.

Types

While different asset classes demand a different criterion for analysis, there are different types of research an investor has to conduct to ensure their investment is in the asset class or a particular security is going to generate returns. Let us understand a few types of analysis conducted by investors through the explanation below.

- Fundamental Analysis: As the name suggests it is the research of the basics of the company. The two branches of fundamental analysis are quantitative and qualitative analysis. While the former looks at the financial data and ratios of the company, the latter looks at non-financial factors such as management, brand recognition, and corporate governance.

- Technical Analysis: It is the method of analyzing a company’s financial data based on its historical price and volume. The analysis is carried out with the help of charts, statistical tools, and indicators.

- Sentiment Analysis: Despite the fact that a particular company’s fundamentals and technical indicators are great, investors might choose not to invest in them due to the sentimental value of the company or its products in the market. It is fascinating how sentiments drive the markets as much if not more than numbers. Therefore, to cover all bases, investors or their analysts conduct global investment research regarding the sentiments of the market.

- Macro-Economic Analysis: The analysis of factors on a large scale such as nation-level or international-level data such as the GDP growth, interest rates, inflation, and unemployment rates can play a role in the movements of the market.

Process

It is important to note that there is no prescribed process or a particular one for guaranteed success. Each investor has their own style of investing based on the capital at their disposal, risk appetite, and time frame.

Now that we understand the basics of the concept, let us understand the process of carrying out research before investment through the points below.

- Investment Objective: Before even looking into the fundamentals and technical of security, it is important for the investor to recognize their objective from the investment. They should be clear about the investment being made either for income generation, diversification, or risk management.

- Asset Allocation: In this step of the process, the investor has to decide the mix of asset classes such as stocks, bonds, cryptocurrency, etc in their portfolio. This helps them diversify their portfolio and curate their portfolio according to their own risk tolerance.

- Selection of Security: Once the asset allocation plan is in place, the particular stock or bond must be selected in accordance with the objectives and allocation plan. At this step, investors conduct fundamental, technical, and sentimental analysis. Often, they hire investment research analysts to do this for them to ensure thorough research has been conducted.

- Performance Evaluation: Once the investments have been made and a set time frame has passed, the investor sits with their advisor or auditor to analyze the performance. They check if the performance of their portfolio has met the pre-determined benchmark and if it aligns with their objectives.

- Portfolio Rebalancing: Based on the analysis, the investor sells the securities that no longer serve a purpose in the portfolio or the ones that are underperforming and replaces them with securities that align with their investment objectives.

Examples

Let us now understand the practical implications of the theoretical knowledge we have gained about investment research companies and the research conducted by investors with the help of the examples below.

Example #1

Mr. Jack, an investor, wanted to invest in ABC Corporation, whose share is being traded at $150 per share in the market. After spending time on the company's background and valuation reports, by doing technical and fundamental analysis, Mr. Jack believes that the company share's worth is only $100 because it's about to report earning 60% lower than expectations. Now, being a prudent investor and observing the market sentiments, Mr. Jack will short the stock and buy a call option at an exercise price of $ 175 to restrict his losses if the stock moves in the opposite direction. Such decisions can only be taken when an investor has a bird's eye view of the company's performance. Investment Research helps an investor select the type of investment instrument that best suits his needs, taking into consideration his risk appetite.

Example #2

Mr. Jacob wants to invest $1 00,000 in shares. However, he is confused about whether to go for share A, trading at $70, and share B, trading at $200. In layman's terms, Mr. Jacob should go for $ 70 because it could fetch him more shares.

However, understanding the company's history and expansion plans of company B makes it wise to invest in share B because there is a potential for a company's growth. Investment Research helps an investor to choose wisely in such situations.

Advantages

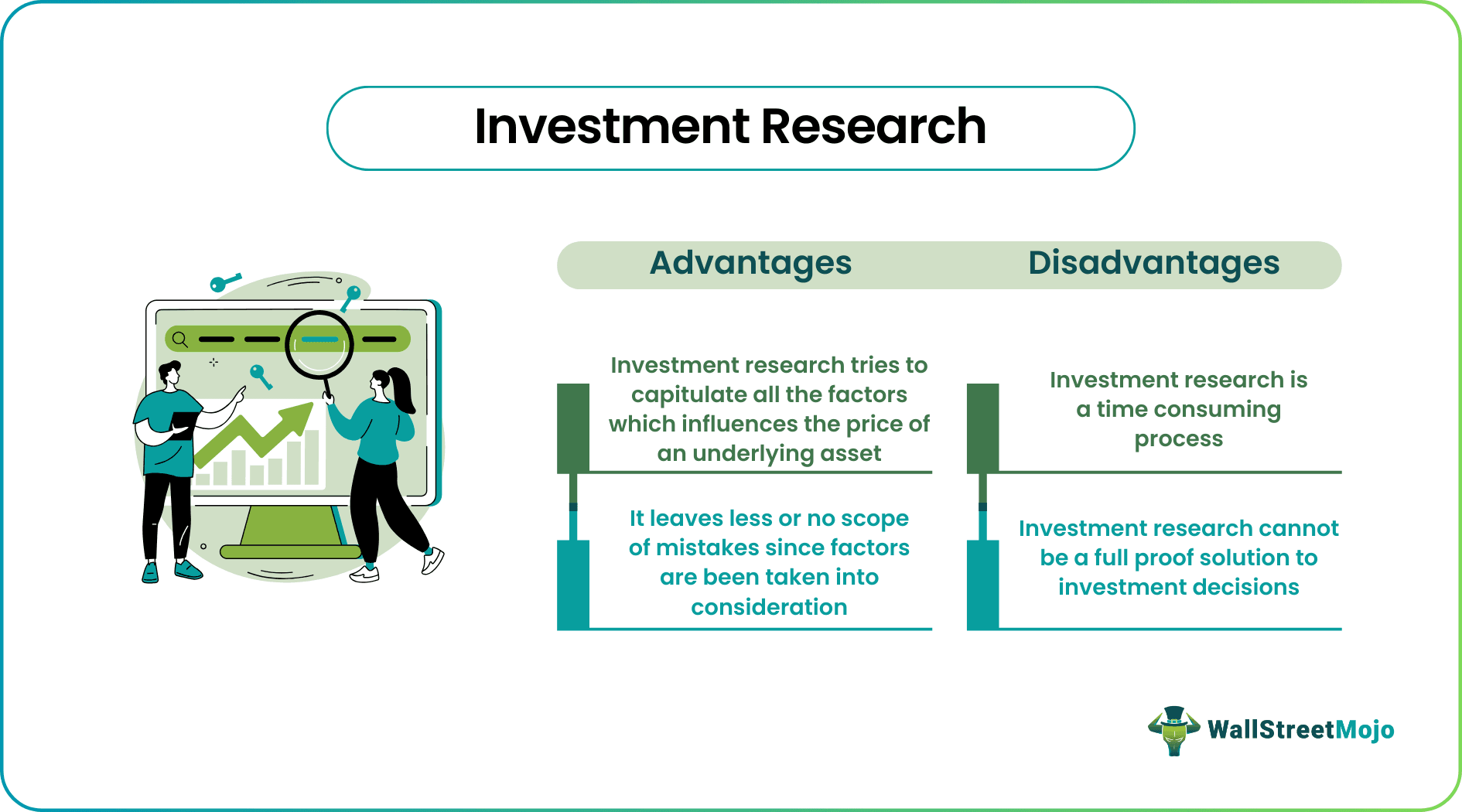

Let us understand the advantages of hiring an investment research company to conduct the analysis before an investment is made through the discussion below.

- Investment Research tries to capitulate all the factors that influence an underlying asset's price. For example, while analyzing the performance of a mutual fund, an investor opts for a peer comparison of other mutual funds, their expense ratio, management stability, and other relevant factors.

- It leaves less or no scope for mistakes since many factors are being considered. Investors can protect themselves from the risk of fraud, inaccuracy of information, etc.

- It is cost-effective because investors can fetch quality information at an affordable price. Moreover, the benefits accrued from the information outweighs its costs.

- Whenever an investor can gauge the overall performance of a company, it gives him an advantage in making more efficient decisions. It gives him the option to choose from the number of securities available that best suit his risk profile.

Disadvantages

Despite the various advantages mentioned above, there are a few disadvantages of this aspect of investing. Let us understand them through the points below.

- Investment research is a time-consuming process. One has to consider all the factors before concluding. Everything has to be studied in depth before taking the final call, from checking the technical levels to knowing the company’s reputation in the market and knowing its competitors' moves.

- Any research done tries to capture the recent results and announcements. It ignores other factors that might play a vital role in deciding for an investor. As already said, Timing plays a crucial role while going for Investment research; this leaves less opportunity for the events which were not afresh and essential to have capitulated.

- One size does not always fit all. Every investor has different goals, time horizons, and incomes. One research cannot fit everyone’s needs. For example, an older investor is more risk-averse than a young investor.

- Every company has different standards for research. For example, while evaluating the performance of a pharmaceutical company, Revenue from Patients and Medicines is taken into account. While going for a bank's performance, its loan growth, interest rates, interest income are considered.

Recommended Articles

This article has been a guide to What is Investment Research. Here we explain its examples, process, types, advantages, and disadvantages. You can learn more about it from the following articles –