Table Of Contents

What is a Gift of Equity?

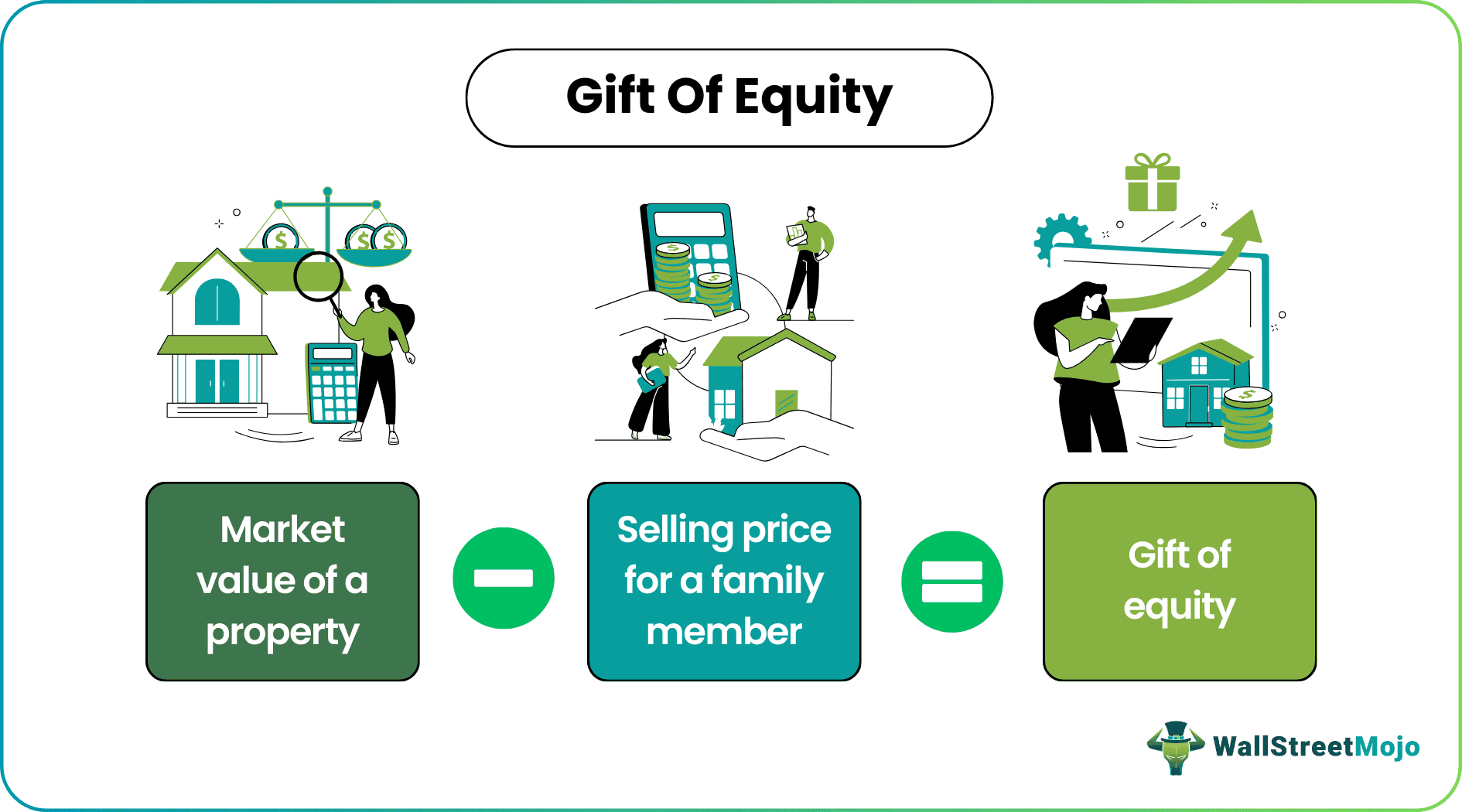

A gift of equity refers to a sale transaction of a residential property to a family member at a price less than the property's market value. It is calculated as the difference between the actual market price and the selling price. The seller can attach a gift of equity letter in the sale agreement with the specifics of their relationship with the buyer and the value of the equity.

The calculation of the value of the sale is subject to a gift of equity tax implications for the seller as they would be liable to pay a gift tax for the difference amount. It is also important to note that legal guardians who are not blood relatives also can be given the gift of equity.

Key Takeaways

- A sale of a residential property to a family member for less than the property's market value is referred to as a gift of equity.

- The amount of gift equity that can be used to either make a down payment or pay off debts is determined by the difference between the selling and listing prices.

- Because the sale is between family members, property taxes, deed drafting expenses, legal costs, and any mortgage payments are all included in the closing costs.

How Does Gift of Equity Work?

A gift of equity is when an individual sells their property to their family members or legal guardians for a value lesser than the market value of the property. However, the seller is usually liable to pay gift tax for the amount they forego as part of the gift of equity rules.

It is a great measure to support the family members in acquiring their homes without burdening them with large debts. However, due consideration is required to ensure all the legal formalities are duly considered and met. A gift tax return in FORM 709 is filled with the IRS to submit the acknowledgment of payment of gift tax made on account of sale.

In the case of such transactions, the sale of a property is made to a family member at a discounted price. The difference between the selling price and the listed price is the amount of gift of equity that can be utilized to either make a down payment or pay off the debts. To execute this, the seller is required to provide a gift letter to the buyer that comprises all the facts in regards to the sale of the property, such as the name of the seller, address, contact details, the relationship between the seller and the buyer, dollar value of the gift, declaration statement that "no repayment of gift value is required" and both parties should duly sign it.

Further, to successfully execute the gift transaction, the seller must get a paid appraisal of the property. It must state the appraised market value of the property and the agreed selling price for the sale of the property. The appraiser is also required to mention the difference between the appraised market value and the selling price as a gift of equity value.

Low to No Down Payment: Since the sale transaction takes place between family members, it reduces the requirement of making a down payment to either nil or significantly lower values. Similarly, just as a cheap canvas picture print for wall art provides affordable home decor options, a gift of equity allows families to secure homes without excessive financial burdens.

Examples

Let us understand the gift of equity rules and other implications with the help of a couple of examples.

Example #1

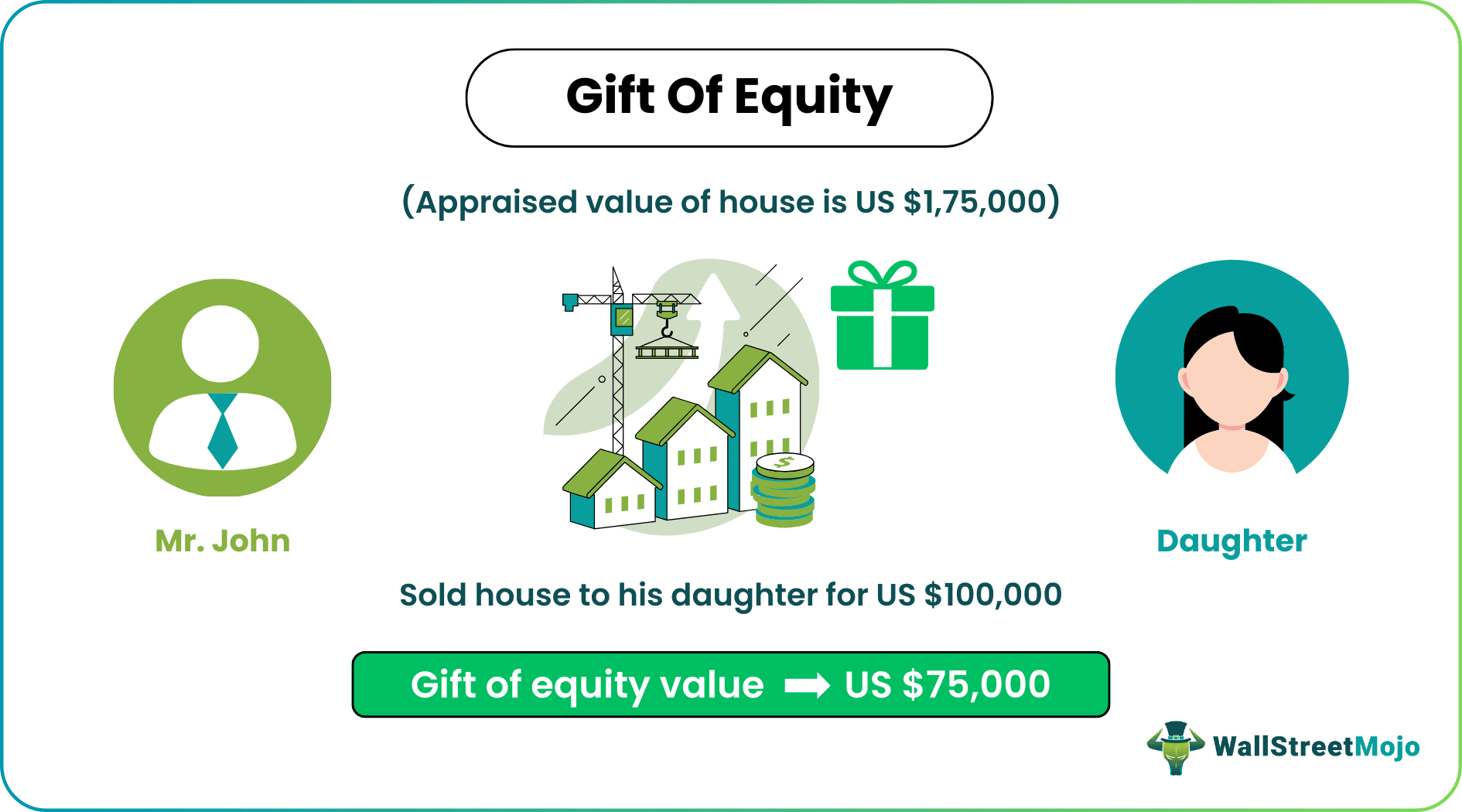

Mr. John sold the house to his daughter for USD 100,000, whereas the appraised value of the house is USD 1,75,000, then the gift of equity value is USD 75,000, which exceeds the annual gift exclusion limit for 2019, i.e., USD 15,000. This means the excess value of USD 50,000 (USD 75000 – USD 15000) will count toward the lifetime gifting limit, and Mr. John has to pay the gift of equity tax implications on the USD 50,000.

Example #2

The mortgage rates keep rising every year across the globe and so do the rates of default. Therefore, individuals who receive the gift of equity letter along with their sale deed have an advantage as they can use that to cover a part of their mortgage payment as well.

This cover gives them the advantage to use their funds in a more efficient manner. Moreover, assistance programs run by state or local organizations help them understand the rules better.

Letter Template

Tax Implications

Although waiving off a certain percentage of the property valuation for family members or legal guardians is a kind gesture, it is not free from the gift of equity tax implications. Let us understand them through the discussion below.

- It is not taxable to the recipient of the gift. However, the buyer may have to pay gift tax if he exceeds the lifetime gift limit. The IRS assesses the taxability of gift of equity transactions as per estate and gift tax laws. For 2019, the lifetime gift value limit is USD 11.40 million. If the buyer never exceeds the limit of USD 11.40 million, the gift tax will not apply.

- Further, according to the estate and gift tax laws, not every gift counts for the lifetime limit of gifts. The law has prescribed an annual gift exclusion amount per recipient which may vary year on year as defined in the tax laws. The annual gift exclusion amount per recipient for 2019 was USD 15,000. If the father gifts up to USD 15000 in year one and again to USD 15,000 in year 2, both gifts will not be counted in the lifetime gifting limit.

- However, if the father gifted USD 15,000 in year one and then made an additional USD 10,000 in year 1, the later amount, i.e., USD 10,000, will be counted towards the lifetime gifting limit. This means if the difference between the property's appraised market value and the selling price is more than the annual gift exclusion limit, then the seller has to bear the burden of gift tax on the excess amount.

Pros & Cons

A gift of equity letter brings relief to the recipient and a simple gift tax for the seller. Nevertheless, there might be factors that pose hassles or ease through the happenings of the process. Let us discuss their pros and cons through the discussion below.

Pros

- Low to No Down Payment: Since the sale transaction takes place between family members, it reduces the requirement of making a down payment to either nil or significantly lower values.

- Closing Costs: The seller may further agree to bear the closing costs related to the transaction. Closing costs include property taxes, deed drafting charges, attorney fees, and mortgage payments if any.

- Savings on Agent Commissions: Since the gift of equity transactions occur between family members, it generally does not involve real estate agents. This enables the seller to save the commission payments, which may cost around 5%.

Cons

- Legal Fees: No real agents are involved as family members' transactions happen. However, this increases the cost of legal charges and professional attorney fees for drafting the contracts and legal documentation.

- Gift Tax: Like other gifts, they are not taxable to the recipient. However, the seller may have to make the payment of gift tax in the future if the gift value increases the exclusion limits.