Table Of Contents

What Is Cross-Collateralization?

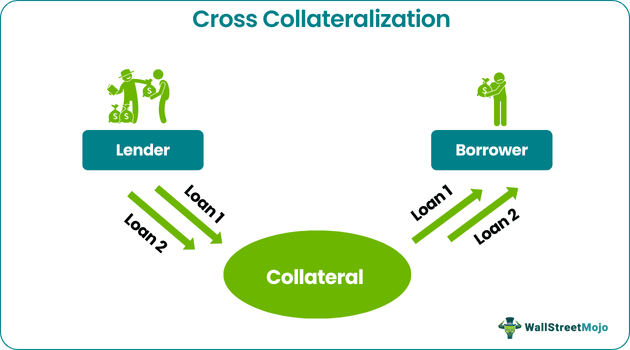

Cross collateralization is a phrase used when collateral from one loan is reused further as collateral for another loan, thereby increasing the leverage for the borrower and increasing the lending capacity of the bank or the lender. It is specifically implemented when an asset or multiple assets collateralize one or more loans.

In this process, if the borrower cannot repay the loan on time, the lender can extract the money by liquidating the borrower’s assets. While borrowing money, it is necessary to ensure that the sanctioned loan is not cross-collateralized unless expressly agreed upon. It increases the borrower’s risk, even though it benefits the lender.

Key Takeaways

- Cross-collateralization allows a borrower to use the collateral from one loan to secure another loan, increasing leverage for the borrower and potentially increasing the capacity of the lending bank or lender.

- Cross-collateralization can involve using one or more assets to secure one or more loans.

- Types of cross-collateralization include multiple assets securing one or more loans and a single asset securing two or more loans.

- Cross-collateralization can benefit firms, such as multiple tax deductions, reducing the effective tax rate and increasing profitability.

How Does Cross Collateralization Work?

A cross-collateralization loan is the one in which the lenders use the collateratized assets of one loan to secure another loan which the same borrower has taken. Sometimes borrower fail to take note of this fact and end up managing a higher risk against their loans.

The cross-collateralization clause, in simple terms, converts multiple single loans into a single loan wherein a single asset or group of assets are bundled together to act as collateral for the loan. However, it is much more than just an implementation mechanism in practice. It helps a borrower, whether a retail borrower or a corporate firm, unlock the value of fixed assets, increase the leverage, get a lower interest rate, and better tax benefits.

With so many advantages, there is also a catch. Over-collateralization can lead to stressed assets and investors losing ownership of the collateral if the loan payments are delayed. Hence, one should understand the pros and cons of such a sophisticated mechanism before opting for it. In fact, because of such dependence on assets and how they have been valued in the loan documents, cross-collateralization clause attracts the scrutiny of the regulators.

Features

- A cross-collateralization mortgage helps borrowers qualify for a larger loan than they usually are entitled to. Many people have never taken a loan and hence have no credit history. Banks in such scenarios find it challenging to provide approvals for sanctioning the loan for these first-time users. This issue can be avoided using cross-collateralization.

- Specifically, cross-collateralization offers a mechanism to finance multiple assets into a single unit for real estate investors and consumers.

- The assets are often under stress when collateralized because of cyclic economic downturns. However, the same investment can be valued better when the cycles turn. Using cross collateralization mortgage, assets devalued due to cyclic economic downturns can be collateralized to raise more money.

- Cross-collateralization helps firms claim better tax benefits as they are entitled to multiple tax deductions, lowering the effective tax applied and increasing profitability.

Types

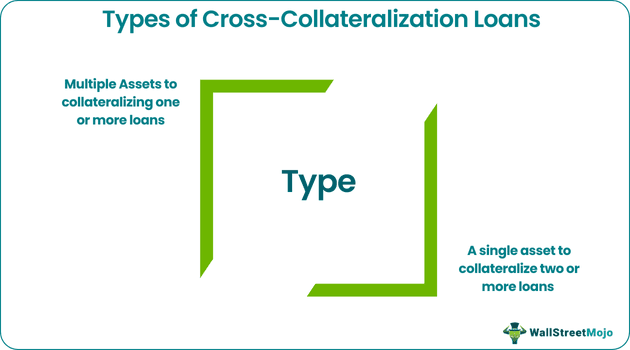

Let us look at the various types of cross-collateralized loans.

Based on the mechanism in which it has been implemented, cross-collateralization loan can be further classified into two major categories: -

- Multiple assets collateralizing one or more loans: In this scenario, one or more assets are pooled together for one or more loans. The simplest example would be the securitization of loans in real estate.

- A single asset to collateralize two or more loans: Unlike the above case, in this scenario, a single asset's value is unlocked to collateralize multiple loans. The simplest example would be a retail user who can collateralize multiple loans like a credit card, auto loan, or any personal loan using a piece of land he owns.

Example

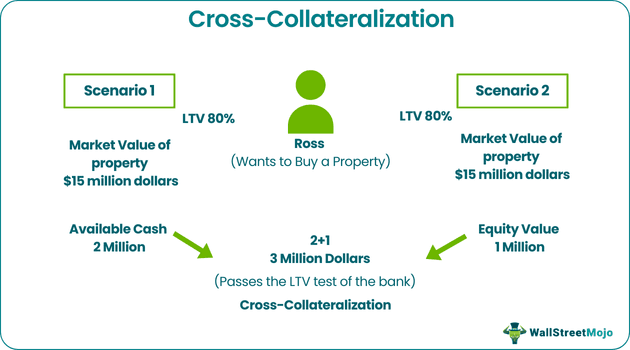

Let us consider the scenario of a gentleman named Ross who wants to buy a property whose current value is $15 million. Consider the case when Ross has only $2 million as available cash. He wants to take the loan for the remaining amount. However, per the bank’s policy, a minimum LTV (loan to value) ratio of 80% is required to sanction any loan. Hence, Ross cannot qualify for the loan in such a scenario. (This is summarized as scenario 1 in the following table.)

| Scenario 1 | (in Millions) |

|---|---|

| Market Value of Property | 15 |

| Available Cash | 2 |

| Loan to Value Requirement | 80% |

| Required Cash for Loan Eligibility | 3 |

| Differences | 1 |

| Car Loan be Granted | No |

Consider the scenario when Ross has another property whose equity value is $1 million. Using this information, the bank can unlock the potential value of this asset as the total ($2 million + $1 million) now passes the LTV test of the bank. Hence, Ross can be granted the loan. (This is summarized in scenario two below)

| Scenario 2 | (in Millions) |

|---|---|

| Market Value of Property | 15 |

| Available Cash | 2 |

| Loan to Value Requirement | 80% |

| Required Cash for Loan Eligibility | 3 |

| Equity Value of Another Property | 1 |

| Differences | 0 |

| Car Loan be Granted | Yes |

Effectively cross-collateralization helped increase the leverage and removed any liquidity crunch for Ross.

Advantages

Given below are a few benefits of cross-collateralization.

- In simple terms, cross-collateralization's biggest and foremost advantage is its leverage. It helps firms raise capital on behalf of the assets sitting on their balance sheets and getting depreciated daily. Simply put, it helps unlock the value of the assets and, in turn, creates more cash-generating opportunities for the firm.

- Cross-collateralization is a boon for borrowers with a bad credit history who do not qualify for loan approvals. These borrowers can be entitled to loans if one can use the existing collateral to get an additional loan, thereby helping reduce the liquidity crunch. If not solved at the right time can lead to a credit crunch crisis.

- The borrower has other benefits of cross-collateralization, such as ease of transaction and low establishment fees. In addition, there can be a single cross-collateralized loan instead of multiple single loans.

Disadvantages

The following are some disadvantages of cross-collateralization: -

- Though cross-collateralization helps get the loan on the same asset, it can be equally disastrous in bad times. The borrowers may lose the investment if there is a default or delay in payments, even on anyone’s loan payment schedule. Not to forget, the correlation between the assets increases in times of distress.

- When two assets are combined to secure a single loan, investors can lose ownership of both assets if there is a delay or default in scheduled payments, similar to the above scenario.

- It becomes difficult to sell assets individually when pooled as part of cross-collateralization for a secured loan.

Cross Collateralization Vs Cross Default

Cross Collateralization is the process of taking two loans secured by one asset whereas in cross default the default provision is applicable on one loan if the borrower defaulted on the other. However, let us look at the differences.

| Cross Collateralization | Cross Default |

|---|---|

| It is related to loan collateralization. | It is related to loan default. |

| Two loans are secured by one collateral. | Default of one loan automatically lead to default of the all other loans. |

| It analysis the mortgage and indebtedness of borrower. | It analyses the credit worthiness of the borrower. |