Table Of Contents

Long-Term Financing Definition

Long-term financing means financing by loan or borrowing for more than one year by issuing equity shares, a form of debt financing, long-term loans, leases, or bonds. It is usually done for big projects, financing, and company expansion. Such long-term financing is generally of high amount.

- The fundamental principle of long-term finances is to finance the strategic capital projects of the company or to expand the company's business operations.

- These funds are normally used for investing in projects that will generate synergies for the company in the future years.

- E.g.: – A 10-year mortgage or a 20-year lease.

Key Takeaways

- Long-term financing refers to borrowing or issuing equity shares for more than one year. It is typically used for large projects, financing, and company expansion. Long-term financing usually involves a high amount of capital.

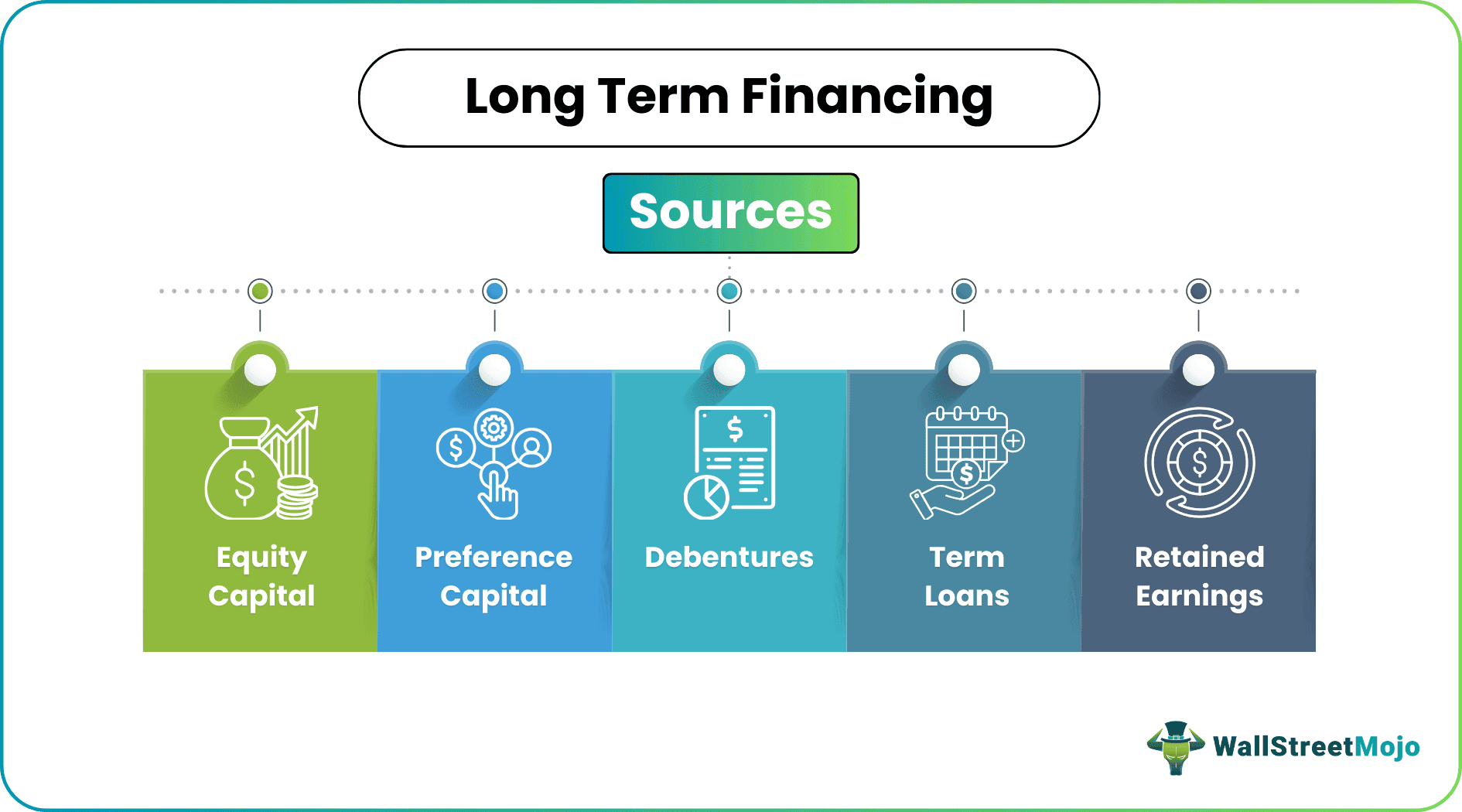

- The sources of long-term financing include equity capital, preference capital, debentures, term loans, and retained earnings.

- To maintain a healthy asset-liability management (ALM) position, a company's management should ensure a mix of short-term and long-term financing sources. Depending too heavily on long-term funding may not always benefit the company.

Video Explanations of Long-Term Financing

Sources of Long-Term Financing

#1 - Equity Capital

It represents the interest-free perpetual capital of the company raised by public or private routes. The company may either raise funds from the market via IPO or opt for a private investor to take a substantial stake in the company.

- There is a dilution in the ownership and the controlling stake with the largest equity holder in equity financing.

- The equity holders have no preferential right in the company's dividend and carry a higher risk across all the buckets.

- The rate of return expected by the equity shareholders is higher than the debt holders due to the excessive risk they bear in repayment of their invested capital.

#2 - Preference Capital

- Preference shareholders carry preferential rights over equity shareholders in terms of receiving dividends at a fixed rate and getting back invested capital in the company if the same is wound up.

- It is a part of the company’s net worth, thus increasing its creditworthiness and improving its leverage compared to its peers.

#3 - Debentures

Is a loan taken from the public by issuing debenture certificates under the company's common seal? Debentures can be placed via public or private placement. Suppose a company wants to raise money via NCD from the general public. In that case, it takes the debt IPO route where all the public subscribing to it gets allotted certificates and are the company's creditors. If a company wants to raise money privately, it may approach the major debt investors in the market and borrow from them at higher interest rates.

- They are entitled to a fixed interest payment per the agreed-upon terms mentioned in the term sheet.

- They do not carry voting rights and are secured against the company's assets.

- In case of any default in debenture interest payment, the debenture holders can sell the company's assets and recover their dues.

- They can be redeemable, irredeemable, convertible, and non-convertible.

#4 - Term Loans

Banks or financial institutions generally give them for more than one year. They have mostly secured loans offered by banks against strong collaterals provided by the company in the form of land and building, machinery, and other fixed assets.

- They are a flexible source of finance provided by the banks to meet the long-term capital needs of the organization.

- They carry a fixed interest rate and give the borrower the flexibility to structure the repayment schedule over the tenure of the loan based on the company's cash flows.

- It is faster than the company's equity or preference shares issue as there are fewer regulations to abide by and less complexity.

#5 - Retained Earnings

These are the profits the company has kept aside over time to meet the company's future capital needs.

- These are the company's free reserves, which carry nil cost and are available free of charge without any interest repayment burden.

- One can safely use it for business expansion and growth without taking additional debt burden and diluting further equity in the business to an outside investor.

- They form part of the net worth and directly impact the equity share valuation.

Examples of Long-Term Financing Sources

1) Funds raised by an NBFC named NeoGrowth Credit Pvt. Ltd. via private equity routes from LeapFrog Investments amounting to ₹300 crores ($43 million).

source: economictimes.com

2) Amazon raised $54 million via the IPO route to meet the long-term funding needs of the company in 1997.

Source:- inshorts.com

3) Apple raises $6.5 billion in debt via bonds.

Source:- livemint.com

4) Paytm to raise funds via selling a significant controlling stake in the company to Warren Buffet for $10-$12 billion.

Source:- livemint.com

Advantages of Long-Term Financing

- Align specifically to the long-term capital objectives of the company

- Effectively manages the asset-liability position of the organization

- Provides long-term support to the investor and the company for building synergies

- Opportunity for equity investors to take controlling ownership in the company

- Flexible repayment mechanism

- Debt diversification

- Growth and expansion

Limitations of Long-Term Financing

- The regulators lay down strict regulations for the repayment of interest and principal amounts.

- High gearing on the company may affect the valuations and future fundraising.

- High gearing on the company may affect the valuations and future fundraising.

- Stringent provisions under the IBC Code for non-repayment of the debt obligations may lead to bankruptcy.

- Monitoring the financial covenants in the term sheet is very difficult.

Important Points to Note

- The company's management needs to be assured about creating a mix of short-term and long-term financing sources. More long-term funds may not benefit the company as it affects the ALM position significantly.

- The company's credit rating also plays a major role in raising funds via long-term or short-term means. Hence, improving the company's credit rating might help the organizations raise long-term funds at a much cheaper rate.