Table Of Contents

What Is Supply Chain Finance?

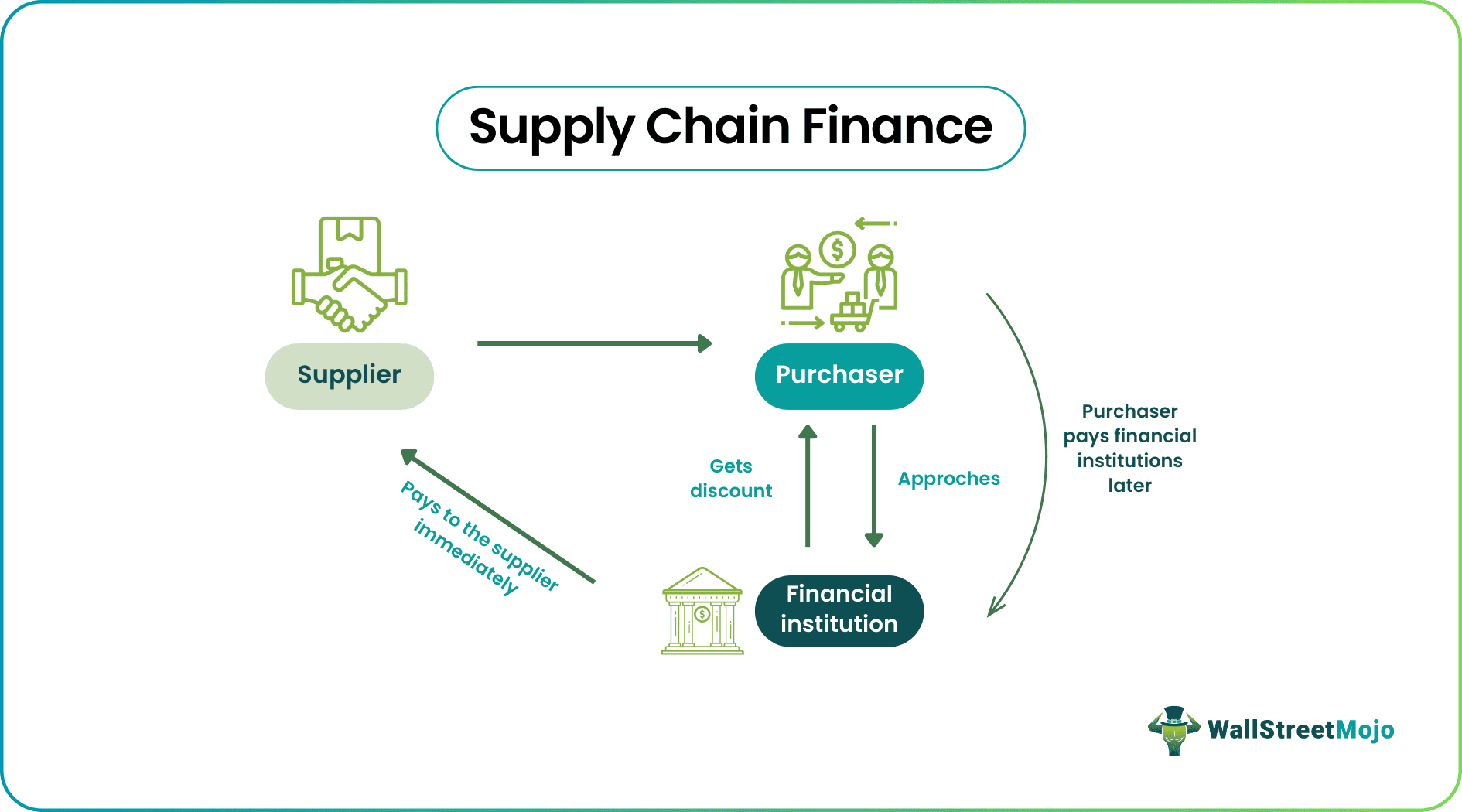

Supply chain finance (SCF) or reverse factoring is an arrangement between the buyer, the supplier, and a financier or factor by which the payment for the receivables by the supplier is received in advance, thereby benefiting both the buyer and the supplier.

In the process, the buyer approaches the financial institution to pay the supplier immediately, which is very useful for the supplier. The buyer pays the financial institution later, thereby keeping a control on their own cash outflow. The supplier’s receivable time is reduced.

Key Takeaways

- Supply chain finance involves an arrangement between a buyer, a supplier, and a third-party financier that benefits both parties.

- It is not a loan but rather an extension of credit that helps both parties achieve their objectives.

- It is initiated by the buyer, making it different from factoring initiated by the supplier. It also differs from trade finance, which involves banks financing trade between importers and exporters.

- It works by the supplier raising invoices, which the third-party financier then funds.

How Does Supply Chain Finance Work?

The supply chain finance platform is a financial arrangement between the buyer and the seller, in which the buyer makes an arrangement with a financer to pay the seller immediately and buyer pays the financer later.

The buyer and the seller enter into an agreement with each other and the supply chain financier. The buyer and the seller’s transactions occur, and the seller raises invoices on the buyer. The buyer then has to upload the invoices into a cloud facility of the supply chain financier. The seller approves the invoices and gets said invoices from the financier. The payment received is less invoice value than the financing charges for the early settlement.

The financier then approaches the buyer and gets back the payment for the invoices on the actual due date of the invoices. Depending on the nature of the supply chain finance program the financing charges might be borne by one of the parties or by both.

The buyer and the seller is always in a contradictory situation where the buyer wants to hold back the payment longer to delay cash outflow, which can be used in the business. But the seller always wants to receive the payment on time so that they can plan out their business process without any cash crunch and unnecessary waste of time in following up for payment with the buyer.

Thus, when conducting a transaction, it becomes vital for the buyer to extend the working capital line by paying the supplier as late as possible. That would mean fewer funds getting blocked and more available for the business. However, the supplier wouldn’t consider this condition ideal, and the terms of trade with the buyer might be affected if the delay is too large.

To help with this issue, the buyer and supplier get into a mutual agreement with an external financier who uses the invoices raised and grants the supplier credit on that basis. When the invoice payments become due, it gets the payment from the buyer. Through this, the supplier got early access to his receivables, and the buyer also did not have to compromise his payment window. This way, supply chain finance enables both parties to fulfill their objectives without proving disadvantageous to the other.

Features

Let us look at some features of the supply chain finance platform.

- Supply chain finance involves the participation of a third party or supply chain financier who assists in completing the model. The financer makes the payment to the seller on time and extends the payable time for the buyer.

- It is not a loan. It is just the extension of credit for mutual assistance of both the buyer and the supplier. The buyer has control over their cash outflow and the sellers receivable time is reduced.

- Unlike factoring, which the supplier initiates, this is initiated by the buyer. Hence, sometimes it is also referred to as reverse factoring. So, unlike factoring, which is directed just towards the seller's objectives, the SCF fulfills the objectives of both the buyer and the seller.

- Since the SCF works based on the invoices raised by the seller on the buyer, it comes into consideration after due diligence of the buyer's creditworthiness. If the buyer does not have good credibility, the financier may refuse to fund the supplier in advance.

Example

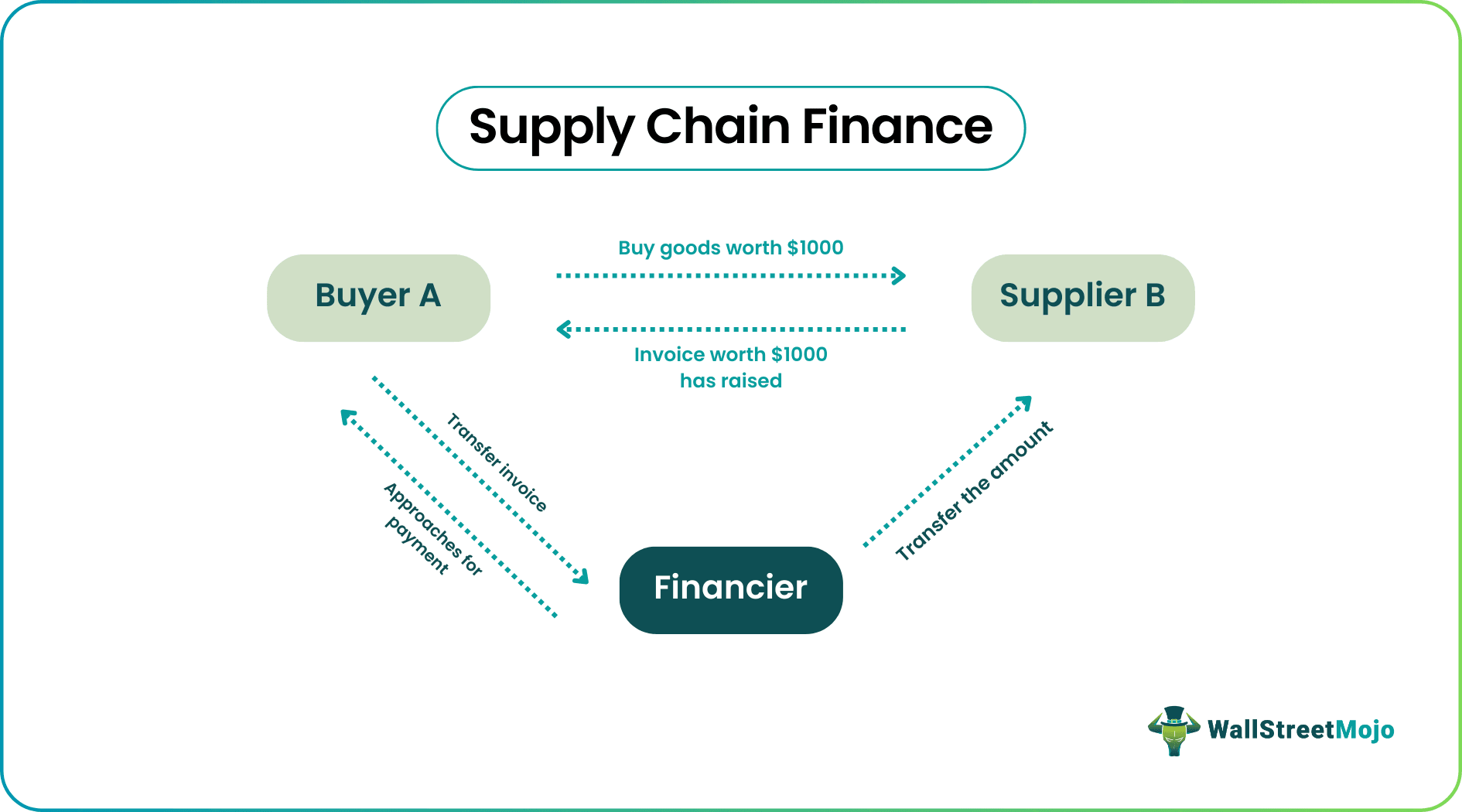

The above example will explain the supply chain finance program in detail.

Let's say customer A buys goods worth $1000 from B on 31st August, which is due in 2 months. Now, A wants to make the payment as soon as possible to utilize the funds in his business, whereas B wants to get the payment immediately. They then approach financier F and get into a mutual agreement.

Now, after the invoices worth $1000 have been raised by B on A, it transfers them to F. After due diligence and vetting, F transfers the whole amount less the financing charges to B, let's say $990. B can now utilize the payment that it received in advance. Also, after two months, when the invoices get due on 31st October, F approaches A to get the payment for the invoices. In this scenario, it will get a total payment of $1000. The financier earns the charges of $10 plus any other interest that it might levy on the basis of the agreement. B gets the advance payment even though it might have to forgo a small amount, and A still pays on the actual due date of the invoices.

Benefits

Some benefits of the supply chain finance process flow is explained below.

- It works to the mutual advantage of both the supplier and the buyer, extending the credit line and getting the funds available to the supplier.

- It improves the relationship between the buyers and sellers and paves the way for future trades.

- Improves the creditworthiness of the buyer and gives the liquidity advantage to the seller.

- Unlike the involvement of the banks who charge a higher rate, the financing cost in the case of supply chain finance is relatively small.

Limitations

The supply chain finance process flow has some limitations too.

- Since a financier is not a bank, there is a risk in dealing with a third party. The may not pay the seller on time or may not honour the contract as per the terms.

- It is used as a tool to cover payments for dubious goods. There are great supply chain finance risks where the seller or the buyer takes advantage of the time gap in payment to transact goods which are illegal.

- It can only be used to finance finished goods which has a readily available market value. If the goods are not ready for sale it is not possible to get a financer to make payment. The financer will not enter into contract for payment of goods that is not ready to be sold.

Supply Chain Finance Vs Trade Finance

- Unlike a supply chain finance that takes the help of an external financier which is a supply chain finance risks and the invoices raised to get funds flowing between the concerned parties, generally in trade finance, a bank is involved, which helps finance the trade between an importer and an exporter. Also, trade finance might involve a bank guaranteeing the payment from the buyer in case there is a default from the buyer's side or whenever the supplier demands the payment, as the case may be.

- Trade finance is not based on invoices. Rather, it utilizes other payment terms like the letter of credit (for import-export transactions) or bank guarantees (for domestic payments).

- Trade finance generally is an agreement between the buyer and the bank. However, the supply chain is an agreement between the buyer, supplier, and financier.

- Whereas trade finance is a form of loan or credit that the bank extends, supply chain finance is merely funding the receivables based on the invoices and the buyer's creditworthiness.