Table Of Contents

What Is Gray List?

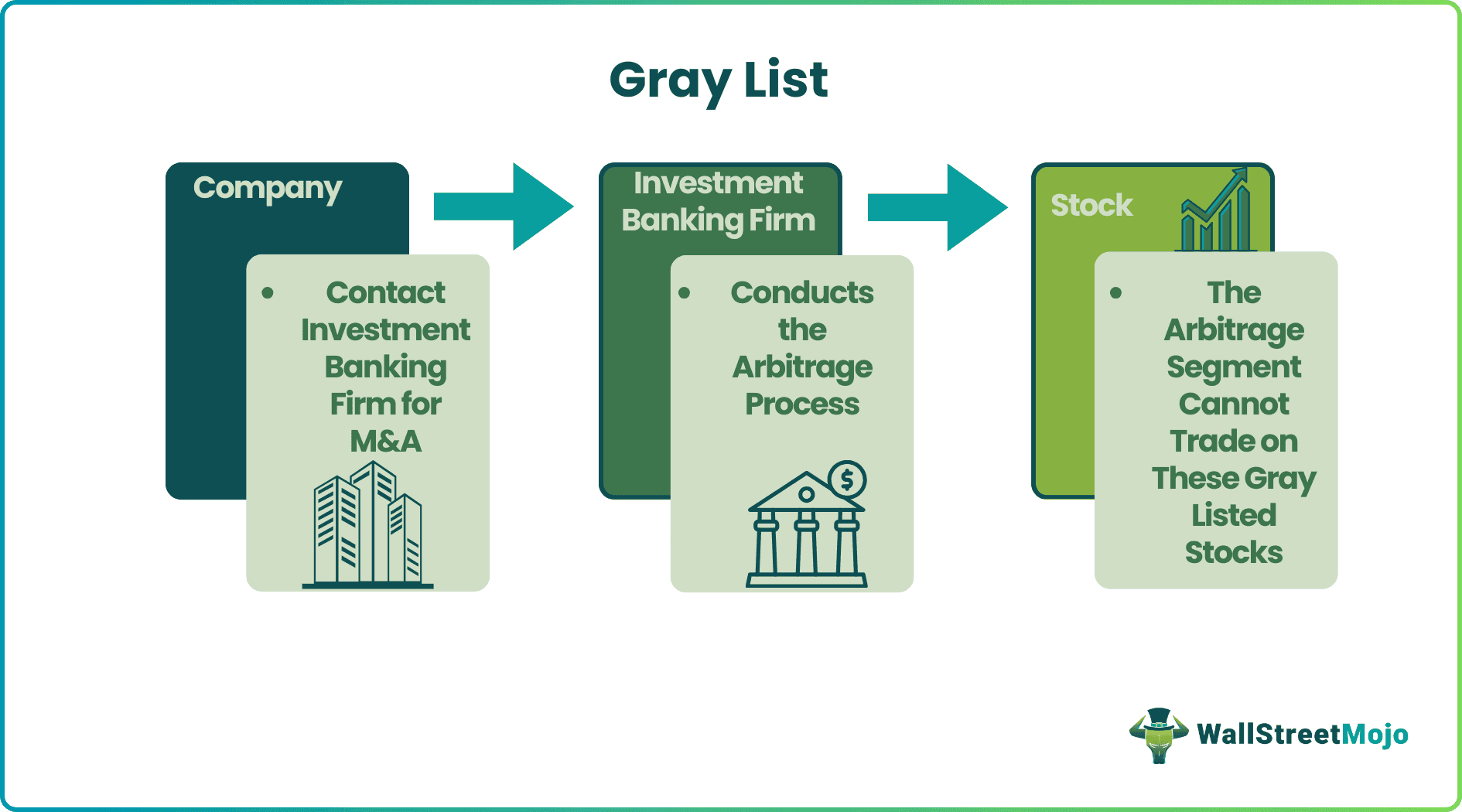

The gray list lists the stocks restricted for trading by the investment bank's risk arbitrage division. This list includes companies in contact with investment banks for matters relating to mergers and acquisitions. These stocks can be traded again once they have completed business with these banks.

To regulate any means of unethical practices, the regulatory bodies have barred the 'Arbitrager' segment from manipulating or taking any advantage of the 'investment banking' department in advance. These malpractices can be restricted through proper security and checklists like introducing the 'Chinese wall.' Proper maintenance of secrecy should be maintained between the two departments of the bank.

Gray List Explained

The Gray list is the list of stocks wherein an arbitrage investment bank division is restricted to take a position. This is primarily due to banking activities like M&A being carried out on such stocks by their Investment Banking M&A division.

Thus, the arbitrage division of that bank or any other financial institution will be prohibited from trading in that particular stock as the outcome is not certain. While the arbitrage segment cannot trade in 'Gray Stocks', the other departments can trade on these 'Gray Stocks' and are not barred from trading. The regulatory body keeps its eye on the different departments of the banks to stop any malpractices, which would eventually lead to unethical consequences. In addition, the arbitrageurs would likely be making handsome profits from the information leakage from the 'Investment banking' team.

Data has become the 'new oil' for the modern business world, and the same is applicable for the modern-day trader and the Arbitrager. They used to take advantage of short-term volatility to make handsome profits. But if the fundamental reason for a particular stock is known before the announcement made by the management itself, it can be termed as 'unethical' for traders.

It is important to understand the following point to understand the concept of the gray list in better detail:

- Change in gray lists depends on the investment bankers conducting the 'Mergers & Acquisitions.'

- Till the news of mergers and acquisitions arrives, the 'Arbitrage' section of the same investment banker’s division should be barred from taking a position on the derivative segment of that particular stock.

- After the news has arrived, the volatility of the stock will reduce. Then the gray list can be changed, and the particular arbitrage segment of that Investment Banking group can be allowed for making arbitrage positions on that particular script.

- However, there is no such change for that particular group's 'trading department.'

Examples

Let us understand the concept in greater detail through the examples below.

Example #1

Stock X (Market capitalization of $100 million) is going to merge with Stock A (Market capitalization of $300 million) and the Investors of Stock X are suspected of getting one share of Stock A against every two shares held. This is very lucrative for Stock X. As the market capitalization of Stock A is three times of Stock X, and that's why the ratio should be one share of Stock X against every share of stock X. Thus before the decision comes out, Stock A will fall, and Stock X will rise.

Again, if the Investment Banking division of ABC Bank is doing the merger and acquisition between Company A and X, they would be the first to get informed about the upcoming mergers. So the 'Arbitrage' Department would be barred from taking a position in Stock A and Stock X. As the regulatory body is aware, there might be a chance of information leakage before the actual decision has been made.

Example #2

The Financial Action Task Force (FATF) regulates and keeps companies and countries under surveillance. They also ensure there is no money laundering or terror financing with these companies or countries they keep under surveillance.

In February 2023, South Africa’s government-owned organizations and businesses might find it difficult to borrow money as FATF would likely list them under ‘Gray Listed’ companies as these companies have already been misappropriated and the public funds have been mismanaged to great detail.

Advantages & Disadvantages

Let us understand the concept of gray-listed stocks or companies and discuss their advantages and disadvantages in detail.

Advantages

- It omits the risk of making a trade on particular derivatives of a stock going through merger and acquisition. The primary reason is to hold investors' NAV and restrict abnormal losses.

- The stock market reacts negatively when there is ambiguity. In case of any mergers and acquisitions, the volatility of the stock increases and can trade upward or downward depending on the Fundamental news. In case of positive news, the traders who have shorted the stocks in their respective derivative market would tend to lose as there is an amount of positivity for the company, which would be reflected in the stock price and its derivatives. The opposite situation is also possible.

- Protecting the investor's wealth is the prime purpose of the regulatory body. So, these stocks with a larger risk would be barred from trading by the particular banks' trading and arbitrage division.

Disadvantages

- Despite having the 'Chinese Wall,' there might be information leakage from the 'investment banking division to the 'arbitrage' segment. The leakage of information might lead to 'unethical' practice. So, an Internal Audit is required to avoid these practices.

- High confidentiality and high security need to be maintained when these separate operations are considered.

- Mergers and acquisitions happen in most of the corporate world, and a certain amount of uncertainty prevails along with it. So, it is not a good option to trade for the 'traders' and 'arbitrageurs.' In most cases, the regulatory body should bar the script for a while until the actual fundamental news comes in.

Limitations

- A lot has to depend on the secrecy maintained by two separate banking or Financial institution departments.

- In case of any positive outcome from 'mergers & acquisition,' investors won't be able to participate in the Stock movement, as the 'arbitrage' desk will not allow participating in the stock's movement.

- The traders and the 'Arbitrageurs 'of other institutions can continue trading most of the time.

- Sometimes, the 'investment bankers' team members might transfer the information to other organizations or institutions with an arbitrager department. These things are very hard to find out, as a sense of personal contact is involved in each case. Thus, on the other hand, if the regulatory body finds out any relation between the members of the other two institutions, the regulatory body might question both parties.