Table Of Contents

What Is An Investment Banking Analyst?

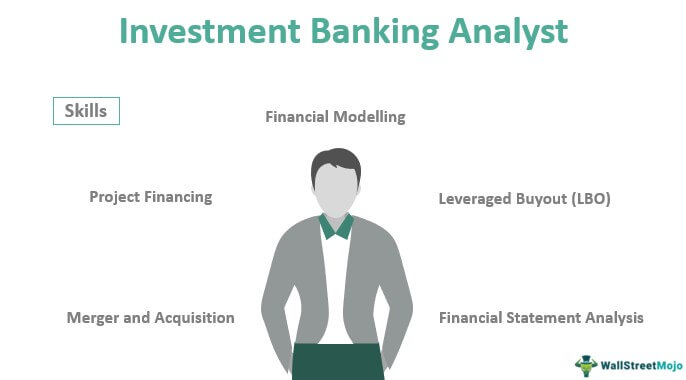

An investment banking analyst works with an investment banking team and has skills in accounting, financial modeling, project financing, project valuation, and financial statement analysis. In addition, this analyst has deep knowledge of Excel, and they are good at VBA to analyze market data and financial modeling. The analytical work consists of building an economic model for different projects like infrastructure projects.

Investment banking analyst jobs also require them to stay up to date with current affairs in the financial world and regulations relating to them. An analyst must have a bachelor’s degree, work experience, and a keen learning urge for domains such as closing protocols, deal structuring, principles, and regulations.

Key Takeaways

- An investment banking analyst is a person who works with an investment banking team. They possess accounting, financial modeling, project financing, project valuation, and financial statement analysis skills.

- The analyst possesses in-depth Excel knowledge and is skillful at analyzing market data and financial modeling at VBA.

- The analytical work comprises making a financial model for infrastructure projects like power projects, real estate, etc.

- Financial modeling, project financing, merger and acquisition, leveraged buyout, and financial statement analysis are required to become an investment banking analyst.

Requirements

The qualifications of an investment banking analyst are rigorous. It would help if one had most of the skills listed below: -

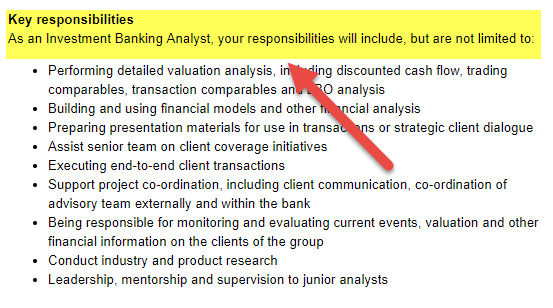

source: indeed.co.uk

- Strong analytical skills

- Excellent in verbal and written communication

- Proficiency in PowerPoint

- Excel, Advanced Excel & VBA skills

- Bachelor's degree in finance or accounting is preferable

- Ability to work under extreme pressure and tight deadlines.

- Passed CFA Exams (or at least cleared CFA Level 1).

Video Explanation of Careers in Investment Banking

Job Description

The responsibilities related to investment banking analyst jobs include the following: -

source: indeed.co.uk

- Provide valuation analysis, including discounted cash flows, relative valuations, asset valuations, comparable comps, and transaction multiple.

- Prepare pitchbook for client meetings, including M&A and LBO pitchbook.

- Prepare financial models and perform financial analysis of companies relatively quickly.

- Assist the investment banking associate with the coverage initiatives.

- Monitoring the industry for current events, valuations, and important financial information.

- It is also in their job description too mentor and supervise junior analysts.

- Coordinate with clients for financial data and analysis.

- Travel for client meetings and industry research.

Working Hours

Typically, analysts in investment banks work long hours that can range from 70-80 hours per week. It can be even more; the deal pipeline is a major factor that influences the work hours of an analyst. Note that analysts may have to be available the whole day, as there could be chances of a last-minute change related to any deliverable or project. Usually, they have to attend calls most of the time. Also, they have to keep responding to emails and urgent requests all the time.

Generally, work begins at 9 am or 10 am, but there is no specific time at which the shift ends. Also, analysts often have to work during weekends. Some investment banks are taking measures, like mandatory vacations and protected weekends, to provide a better work-life balance, but the work hours are usually still quite overwhelming.

Why Become An Investment Banking Analyst?

Individuals may consider becoming an analyst in an investment bank for the following reasons:

- Growth Opportunity: After joining as an analyst, one can get promoted to senior roles quickly.

- Significant Compensation: The salary and bonus structure for analysts is quite appealing. Hence, individuals looking for a high compensation package can consider working as an analyst in a reputable investment bank.

- Exit Opportunities: One can even switch to a private equity firm or hedge fund after working as an analyst if they find the job descriptions interesting.

If you want to break into investment banking, it is vital to have some key skills and knowledge that recruiters look for in candidates. In that regard, this Investment Banking Mastery Program (IBMP) can be helpful as it has been designed to ensure you gain the necessary expertise easily.

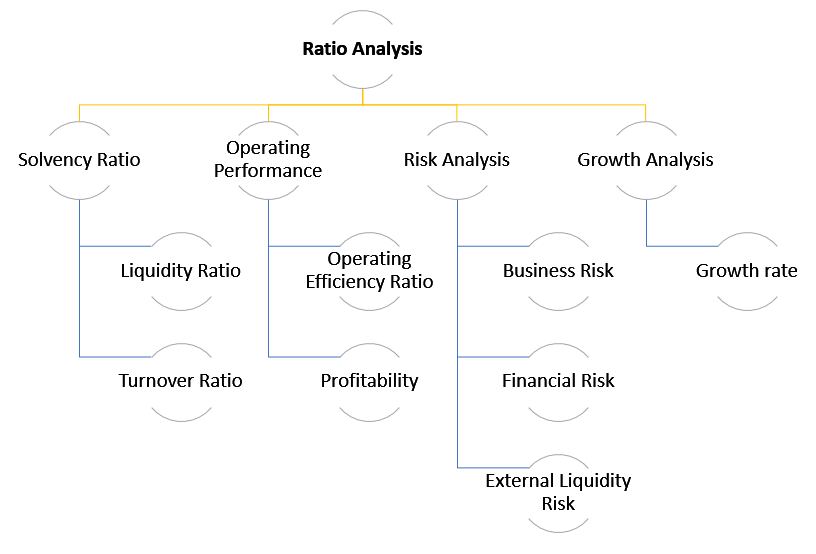

The program will help you understand key topics like financial modeling, accounting, ratio analysis, and more in detail via a step-by-step approach. The instructor uses examples and case studies to ensure you develop a practical understanding of the key concepts and techniques so that you can use them in real-world scenarios. Apart from gaining these skills, you will get certificates representing your proficiency in such skills so that you can stand out from other candidates.

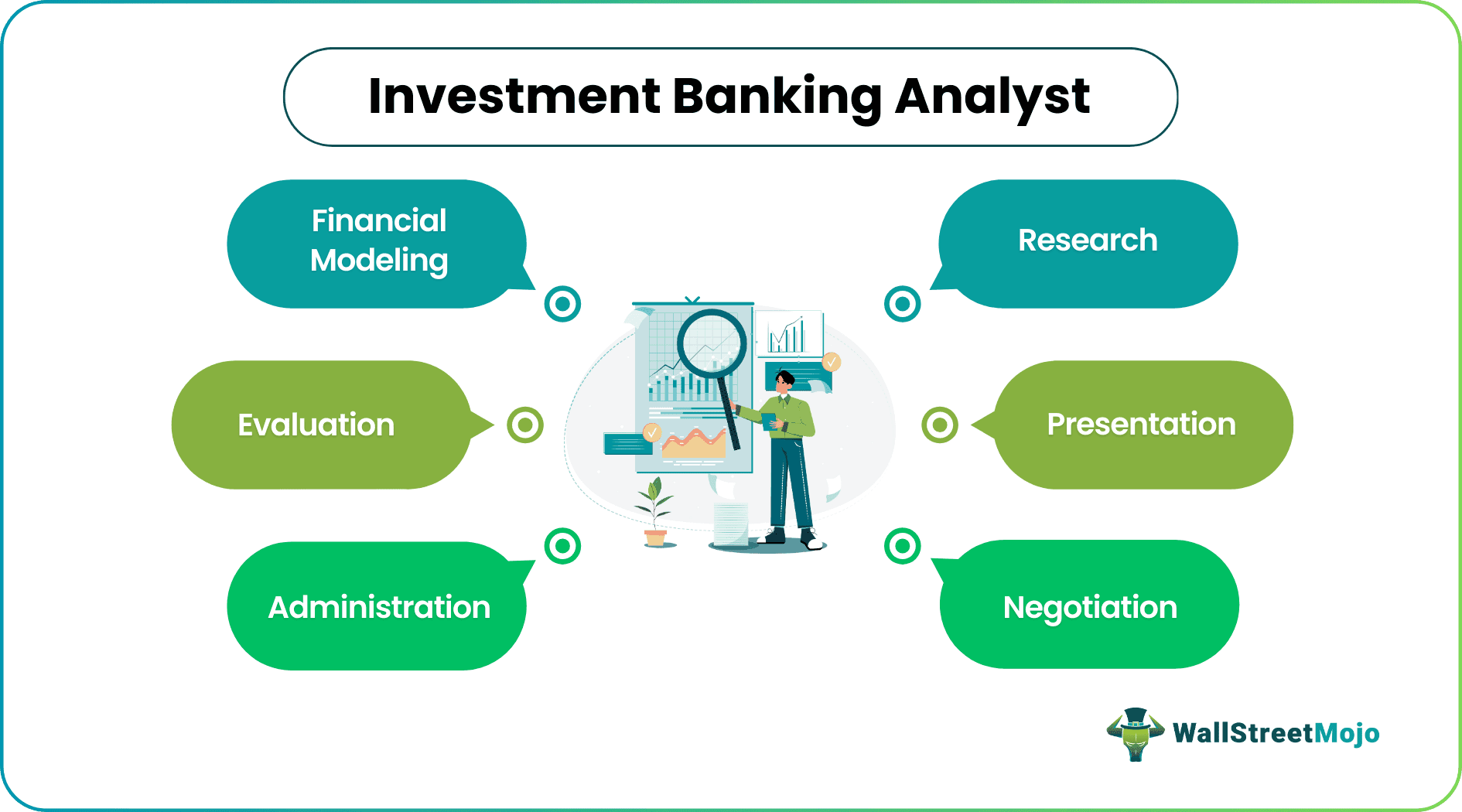

Roles

An analyst at an investment banking firm takes care of multiple things at the same time. It is a high-risk-high-reward job which is why the investment banking analyst salary is usually hefty. Let us understand the skills that would help an individual become a successful analyst.

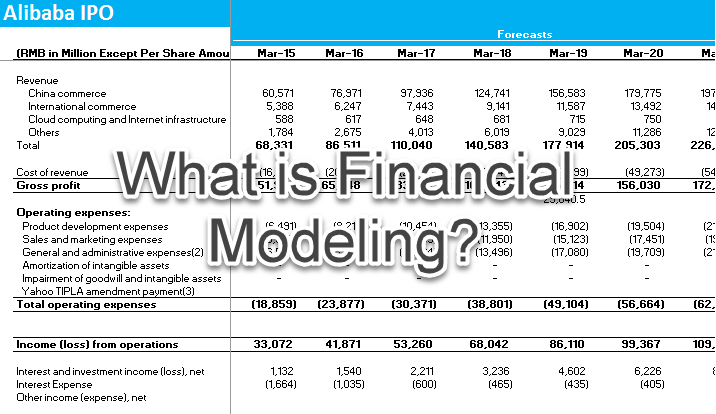

#1 - Financial Modeling

An investment banking analyst job description requires them to help in developing a financial model from scratch.

The economic model has three general objectives that should be in someone’s back of mind before starting to write any Excel formulas or developing any assumptions. These are: –

- Coming up with an expected value.

- Assessing the risk of the investment.

- Developing financial structure.

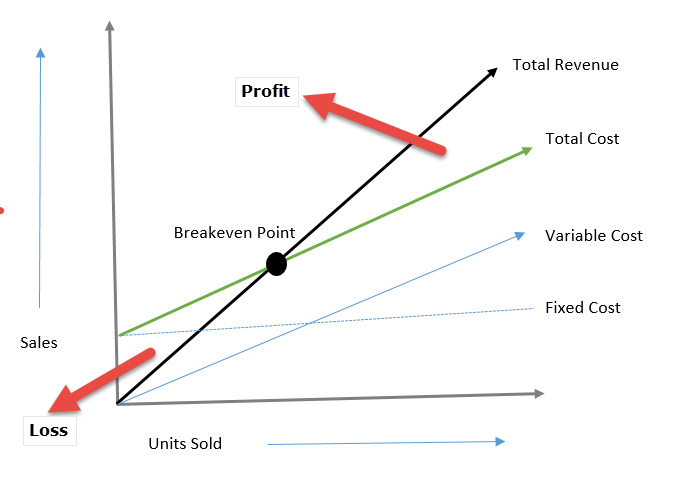

Effective risk assessment is the centerpiece of valuation and the fundamental reason for creating any financial model.

#2 - Project Financing

Project financing is to finance a project. The lenders provide money to the developers to develop a project by looking into the specific project's risks and future cash flows.

The raising of on a limited-recourse or non-recourse basis to finance economically separable capital investment projects in which the fund providers look primarily to the cash flow from the project as the source of funds to service their loans. In addition, provide the return of and a return on their equity investment in the project.

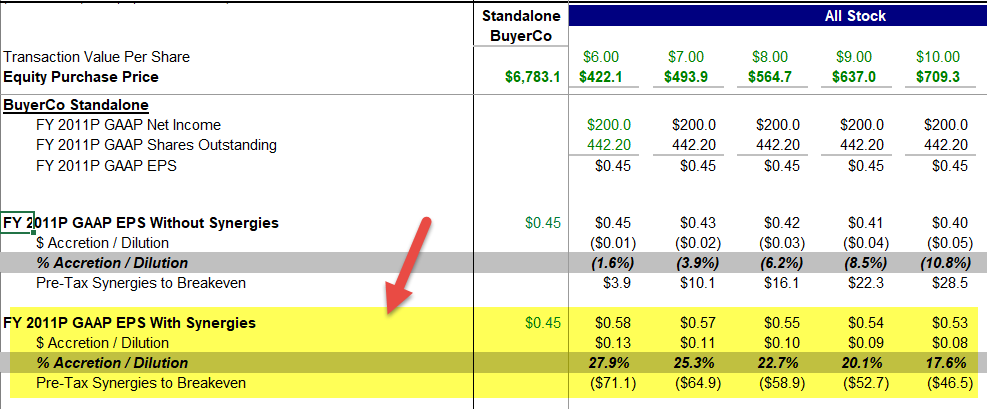

#3 - Merger and Acquisition

An investment banking analyst would help the company in the process of decision-making during the process of merger and acquisition by analyzing the facts: -

- Know what they are buying – this often occurs within industries or with a target that can leverage an existing business.

- The buyer is acquiring from a position of strength, not weakness. Strength can be defined as performance, management expertise, systems, culture, market leadership, etc.

- The worst deals occur in "hot" M&A markets or competitive bid situations (overpayment.

- A discipline of cash vs. stock.

#4 - Leveraged Buyout (LBO)

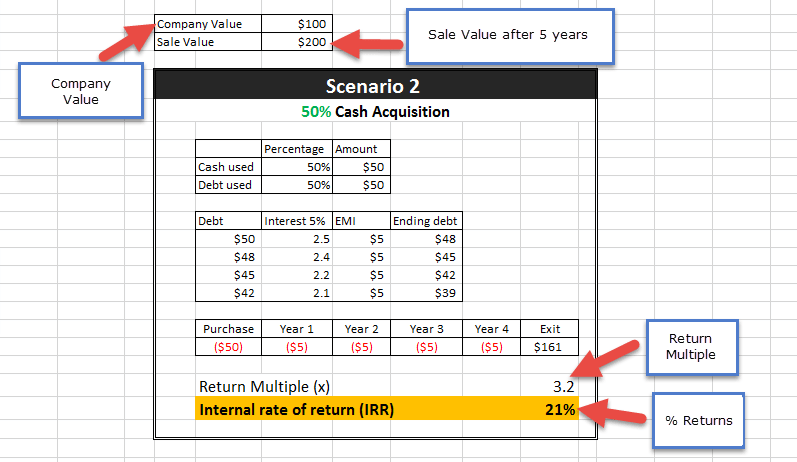

Investment bankers are expected to be great at LBO modeling.

Steps to create an LBO model: -

- Analyze the market value of a company.

- Deter the equity return through IRR calculation.

- Determine the cash flow of the company.

- Determine the debt service limitation of a company.

- Analyze the risk for the financial buyer.

#5 - Financial Statement Analysis

As an investment banking analyst, one should have the technical skills to analyze the financial statement. The financial statement analysis includes: -

- Net operating cash flow

- Financing expenditure

- Discretionary expenditure

- External financing

- Net movements in cash

- Short-term debt

- Dividend payable

- Tax paid

- Bank debt

- Equity structure

- Depreciation

- Interest rate

Compensation

In exchange for the long hours put in by analysts, they receive significant compensation. In fact, it is one of the best job roles for any new graduate, particularly in terms of salary.

According to salary.com, in the United States, the average investment banking analyst salary per year is $119,975 per year as of July 01, 2025. Besides the salary, what makes the overall compensation package quite attractive is the bonus structure.

Investment Banking Analyst vs. Private Equity Associate vs. Private Equity Analyst

In this section, let us look at the difference between three of the popular roles in finance, which are private equity analyst, investment banking analyst, and private equity analyst. After going through the distinct features, individuals can determine which role is more suitable for them.

| Basis Of Comparison | Investment Banking Analyst | Private Equity Associate | Private Equity Analyst |

|---|---|---|---|

| Responsibilities | Building financial models, preparing pitch books, carrying out research, etc. | Team management, transaction negotiations, deal execution, etc. | Carrying out market research, financial modeling, due diligence, etc. |

| Entry Requirements | A bachelor’s degree, a finance background (preferred) | Prior experience in financial analysis and a bachelor’s degree | Experience in investment banking, an MBA or a master’s degree in finance |

| Average Base Salary in the US | $128.039 as of July 14, 2025 (Source: Indeed) | $164,683 as of July 14, 2025 (Source: Indeed) | $109.906 as of July 14, 2025 (Source: Indeed) |

Note that the entry criteria vary across investment banks and private equity firms, depending on the requirements of recruiters.