Table Of Contents

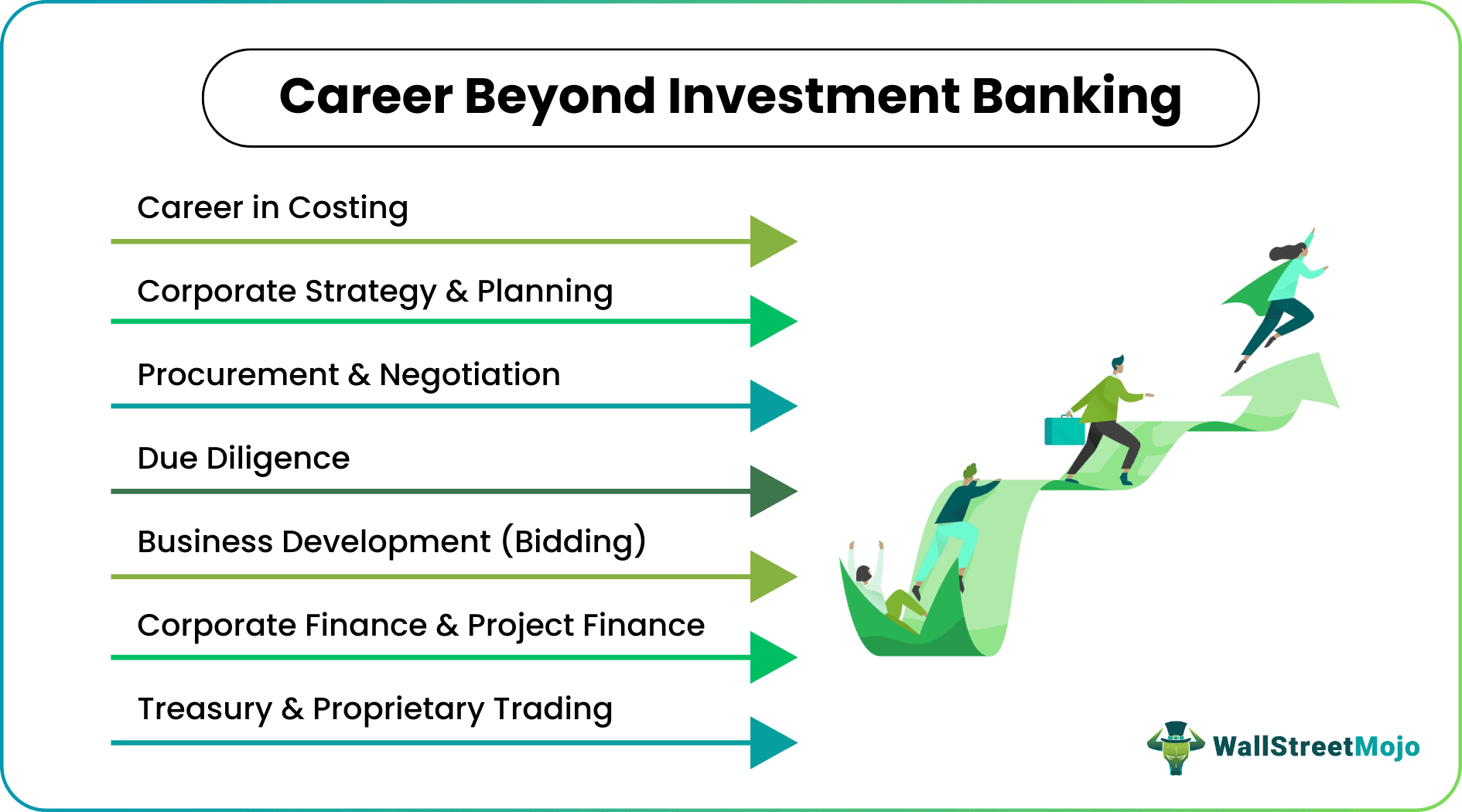

Career Beyond Investment Banking & Equity Research

To make a career beyond the equity research career, one can go for a career in due diligence, a career in procurement and negotiation, a career in the field of cost, a career in the business development, a career in the Project financing, a career in the field of corporate planning, etc.

You may have often thought that “what if I could use my ability and skills to do something else other than getting trapped in the two most popularized and hyped career choices!”

Writing this article is to answer this unfailing question!

Many people don’t want to go beyond their comfort zone. But the few who are equipped with so many technical skills (financial modeling, financial analysis, valuing companies, etc.), needn’t go for the same old-fashioned “investment banking” and “equity research.”Why not something else?

Let’s break down some impactful career paths outside of Investment Banking and Equity Research.. Read on, and discover something you may have never considered before.

Key Takeaways

- A career beyond investment banking offers diverse opportunities in various finance-related fields, including due diligence, procurement and negotiation, cost analysis, company development, project finance, corporate planning, and more.

- Professionals evaluate cost drivers and management processes for each cost head in a costing profile career.

- By contributing to effective cost reduction, they play a pivotal role in accomplishing organizational objectives, where cost reduction is a key focus.

- While corporate finance and project finance represent distinct career paths, both professions rely on financial modeling.

- This versatile skill is indispensable in making informed decisions and analyzing financial data across different finance roles.

Video Explanation of Careers in Investment Banking

#1 - Career in Costing

You have not thought about it yet. But have a look at the job profile and skills required. You would see you already have the skills to tap into it and make your mark.

- Job profile: Usually, there’s a separate costing department in organizations, but in some cases, the costing is part of the accounting or marketing department.

- In this job profile, you need to go through each cost head and do a thorough analysis; you need to determine the cost drivers and cost control measures.

- As cost reduction is one of the prime goals of an organization, you would be contributing directly to achieving organizational objectives.

- You also need to do ABC (Activity-Based Cost) Modeling by using interest rates, expected inflation, past trends, and other variables.

- It would help if you also monitored the actual cost through variance analysis and design control measures.

- Skills required: There are three basic skills you need to have to perform at your best in costing function.

- Firstly, you need to understand financial modeling and should be able to do it regularly.

- Secondly, you need to have a good idea about statistical models to use them to design various control measures.

- Lastly, you also require an analytical bent of mind to be aware of what’s going on, especially in the marketing, production, and accounting department.

- Compensation: As of Feb 2021, the median salary you would get to do cost analysis in an organization is the US $59,937 per annum.

Ideal Choice because costing professionals help companies remain lean and competitive and offer insights influencing pricing, production, and supply chain decisions.

Source: Salary.com

#2 - Procurement & Negotiation

Now not many of you may like negotiation. But many do. Most people think people who negotiate only act as debaters, but they're the world's most brilliant and strategic minds. Have a look at the profile and skills required.

- Job profile: As mentioned above, negotiation is not a cup of tea for everyone. In professional life, we all need to negotiate sometimes.

- This sort of negotiation is completely different because a small decrease in the number of raw materials can create havoc in competing with other competitors.

- So only the best and brightest sit for negotiation.

- But if you're interested in negotiation, the maximum opportunity is in procurement/sourcing.

- Skills required: You need to be very thorough in analyzing the situation quickly. Two things are required for success in this field.

- Firstly, you need to have an amazing presence of mind to point out any loopholes in your /buyers’ proposal.

- Secondly, you need to be very thorough (organized) with the cost computations, pricing quotes, financial modeling (not required always), etc.

- Compensation: Depending on the position you have, the compensation varies. If your position is the procurement manager, the median salary is US $82,001 per annum. In procurement, negotiation is the major part.

It is an ideal choice because procurement roles provide exposure to finance as well as operations and are critical in retail, pharma and manufacturing sectors.

source: payscale.com

#3 - Corporate Strategy & Planning

There are people in business who need to plan for the growth of the business. They sit, think, strategize, analyze, and find ways to implement their plans. If you’re interested in doing the same, read on.

- Job profile: It may seem easy as people sit, think, and strategize, but to get the board's approval for the new growth strategy, you need to present a lot of evidence as support for whatever you’re prescribing. Let’s look at the main functions of this job profile.

- First, you need to do SWOT, competitor analysis, PESTEL analysis, the cost of going into a new market or creating a new product, etc.

- Then once you’re done with the analyses, you will be able to design a strategy via which the organization can leap into new territory.

- After designing the strategy, you need to present the strategy in front of the board of directors. After approval,, you shouldchunk the whole strategy into do-able parts so that the execution becomes easier.

- Once chunking down is done, the responsibility of achieving these objectives is properly allocated to the departments (marketing, finance, human resource).

- The final step is constant monitoring or creating a feedback loop so that the implementation doesn’t get halted in between.

- Skills Required:

- Here are the skills you need to have to design and implement corporate strategy – financial skills (without which you can’t do any analyses on your own, and you need to depend on others’ inputs)

- Ability to understand human resources (you need to have an understanding about human capital so that the right work gets attributed to the right person while implementing the strategy)

- Marketing and business development (business doesn’t grow in a vacuum, you need to know how to understand the preferences of customers and fulfilling them) and overall business knowledge. The good news is that financial modeling will help you compute the return on investment, IRR, and NPV of projects, make strategic investments, do a market analysis, and how to lend, borrow, and think about mergers and acquisitions.

- Compensation: It’s assumed that the compensation of a corporate strategy manager would be more than six figures. The average salary of a corporate strategy manager is US $108,199 per annum.

This role is ideal for those who wish to operate at the intersection of finance, marketing, and operations.

source: payscale.com

#4 - Due Diligence

If you are one of those who like to investigate more about the pragmatism of anything, you’re the perfect fit for this sort of profile. Read on to know more about it.

- Job profile: If we need to explain this profile in two words, it would be – feasibility analysis. The job profile of due diligence is primarily attached to the following functions-

- You need to go through the business plans and find out portions that seem unrealistic.

- It would be best if you questioned the assumptions and expectations of the business so that the organization can stand on a solid base.

- Lastly, the most important is the feasibility analyses of commercial plans, strategic moves, business expansion, and business intelligence.

- Skills required: You may ask if this profile needs any requirement of financial modeling! The straight answer is not directly.

- Financial modeling as it helps diagnose whether the business plan, strategic moves, and business expansion are feasible.

- Compensation: If you want to pursue a career in due diligence, you would be getting around US $66,000 per annum on average. But you need to have thorough knowledge in due diligence to receive that salary range.

It is ideal for those professionals who enjoy project-based roles, investigative work, and want to work on live transactions without being in IB.

source: payscale.com

#5 - Business Development (Bidding)

Your job as a business developer (part of the bidding team) is to explore territories and venture into new geographies, products, tenders, etc. Read on to know how exciting this field is for professionals who know financial modeling.

- Job profile: The basic thing about this profile is you need to decide what yields more profit; to be specific, which project will generate more profits than another. You decide that b financial modeling. The top management won't give the nod unless there's enough proof that the yield from the new project, new business, and new expansion exceeds the specified benchmark returns. So you need to make sure that you have enough evidence and supportive analyses.

- Skills required: In this profile, the bid needs to be priced. Until and unless you have access to all the cost computation, interest rate, depreciation, rate of profit, safety margin, etc., at the same place, you won’t be able to price the bid well. There are two important skills required here.

- Firstly, you should have the ability to organize every detail in one place so that the execution becomes easy.

- Secondly, you should know about financial modeling.

- Compensation: The salary of a bid manager (in the different terms, they’re also called Request for Proposal manager) is around US $128,696 per annum on an average.

Best suited for those who enjoy dealing with deal structuring, presentations, and playing a role in revenue generation.

source: salary.com

#6 - Corporate Finance & Project Finance

It is the traditional corporate finance and project finance field. But these career options have a lot to do with financial modeling. Let’s have a look at the job profile.

- Job profile: Corporate finance and project finance are completely different career options, but if we consider the role of financial modeling, in both these career options, financial modeling should be used actively.

- As far as the main functions are concerned, you need to perform a few key areas – making financial strategies, fundraising via equity or debt.

- Besides, you need to know financial planning, hedging, treasury management, and risk management.

- Skills required: As both of these (corporate finance and project finance) are different fields, the parties involved, documents required, and the process of raising funds are different. You need to have specifically three skill sets that are applicable for both of these –

- You need to have in-depth knowledge and practical experience in ratio analysis and financial modeling. Because you would be required to calculate working capital, do cash flow analysis of PE investments, price the proper hedging instrument, compute the projections of future cash flow, etc.

- You should have detailed knowledge of how the process works – how you should do the financial planning for the organization, from where you would raise funds, what you will do with the profit that needs to be reinvested, etc.

- Effective communication and interpersonal skills also go a long way. It would be best if you were thorough with the organizational strategy, how the marketing team is thinking of expanding to a new market, how human resources are planning to hire, and many more things that will need finance.

- Compensation: No matter which area you choose to work in, we would like to give you a range of compensation to understand how much you can expect from the corporate finance and project finance domain. The average compensation is around US $74,162 per annum.

Ideal for those that can mix analytical depth and strategic input, especially in sectors with complex financial structures.

source: payscale.com

#7 - Treasury & Proprietary Trading

This field needs active financial modeling. Let’s find out.

- Job profile: Both of these profiles are different. But the basic function of these profiles is to create short models.

- You need to take care of risk management, working capital management, hedging, and pricing. All of these need financial modeling. However, the merit of these models may vary from simple to complex.

- Skills required: These are the skills you need to have –

- You should know how to do technical analysis.

- You should have a fundamental knowledge of equity, debt, swap, commodities, options, etc.

- You should know how to do both simple and complex financial modeling and how to create shorter models.

- Compensation: The compensation of a proprietary trader is around the US $79,980

Suitable for those who like fast-paced financial markets, attention to detail, and decision-making under pressure.

source: Payscale.com