Table Of Contents

What Are The Investment Banking Jobs For Graduates?

Investment Banking Jobs For Graduates refers to all the jobs that career seekers get exposed to once they complete their graduation in the field of finance or related fields. There are myriads of career options that individuals get as soon as they are a graduate. Some of them include starting roles in accounting or auditing field that builds the foundation for a core investment banking or IB job.

Though it is good to have finance as the academic background for individuals who aspire to have a career in investment banking, it is not mandatory. Individuals graduating in a discipline other than finance can also opt for investment banking career options if they have an aptitude in the discipline and the field.

Table of contents

- Numerous opportunities are available for graduates to start their careers in an investment bank and related industries and fields.

- Graduates of quantitative disciplines can start their careers in investment banking through internships readily available for graduates. These internships can be in numerous fields and industries.

- Certain traits can help graduates secure a job in investment banks. These include self-confidence, time management, expansion of education scope, strategies, in-depth preparation, and practical application of knowledge and experience.

- Other related fields can offer internships and employment opportunities, if not in investment banking. These include corporate finance, hedge funds, commercial banking, private equity, venture capital, insurance, etc.

Investment Banking Jobs For Graduates Explained

Investment banking jobs for graduates are available in numbers. The only thing that restricts the entry of individuals in the investment banking industry is their skills and aptitude. To get an entry level job in the investment banking sector, one may or may not have an academic background in finance. However, if there is quantitative, statistical, and analytical skills in individuals, they qualify to start a career in IB.

Investment banking jobs for graduates are available in numbers. The only thing that restricts the entry of individuals in the investment banking industry is their skills and aptitude. To get an entry level job in the investment banking sector, one may or may not have an academic background in finance. However, if there is quantitative, statistical, and analytical skills in individuals, they qualify to start a career in IB.

The basic qualification or graduation can be in any discipline, including finance, mathematics, economics, etc. Irrespective of their graduation subject, the individuals can pursue an MBA or obtain master’s degree in any finance discipline to acquire finance-related skills that would increase their chances of getting an easy entry into the investment banking field. In addition, there are certificate courses, like Chartered Financial Analyst (CFA) that helps them grab a good break in the investment industry.

If one is an engineering graduation, it may seem tough to enter the investment banking sector. However, it is not difficult if they are determined and have interest in the field, They can appear for CFA or take a short-term course in Investment Banking to ensure acquiring the required skills.

How To Start?

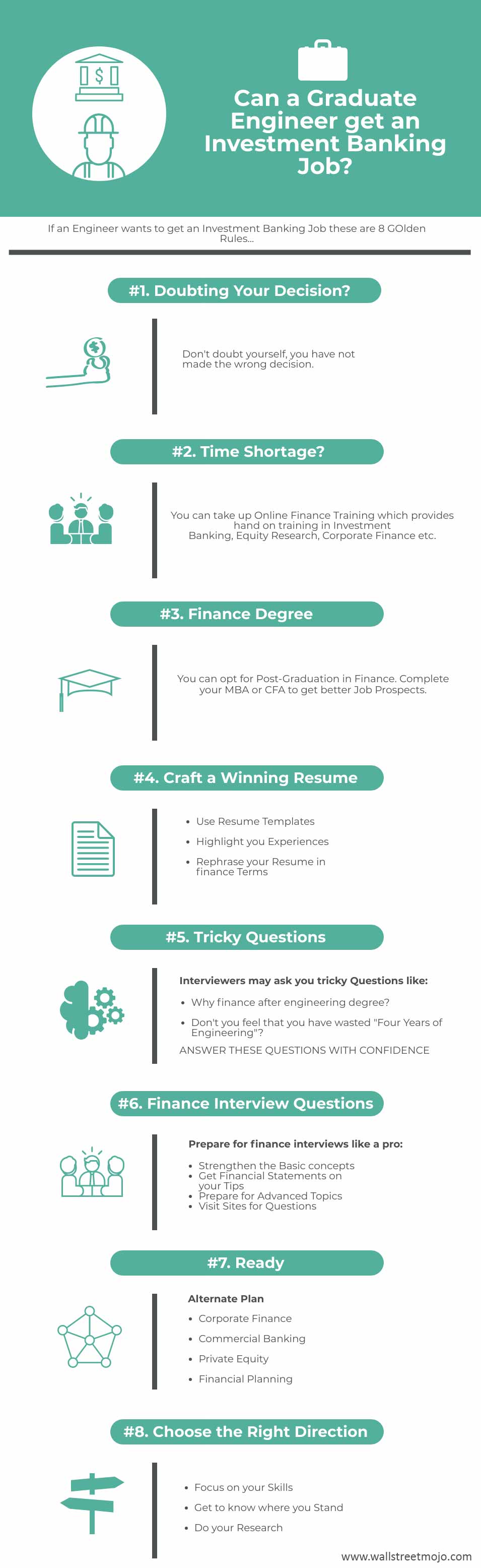

Here are quick infographics on the steps you can take to move into Investment Banking.

Top 8 Tips To Get An Entry Level IB Job

Apart from the qualification, skills, and interests that individuals require to join the investment banking, they must also have known some tips that would help them enter and grow in the fields they join. Starting from account development executive to portfolio administrator, analyst, business valuation manager, and investment associate, the following tips can help individuals achieve their career goals in the IB field. Let us have a look at what are these tips:

#1 Don’t doubt yourself, you have not made the wrong decision.

When you are entering into the world of Investment Banking as a graduate, it is ok to feel lost at first. But it is not ok to feel sorry for yourself. Do not think that you have made the stupidest decision. Remember that you will not learn all the Finance Jargons in one go and become a PRO. Hard work is the key that will bring you in focus.

When you feel a little low at the initial stage, I recommend you think about the Three People listed below and get motivated.

- K Rowling - Twelve publishers rejected her Harry Potter manuscript. Imagine if she stopped at the first rejection? The fifth? Or the tenth?

- Steve Jobs - Even though his company became successful at a young age, he was kicked out of it and had to start over. He managed to become successful once again in his mid-thirties.

- Frederick Henry Royce - Multimillionaire co-founder of Rolls-Royce. Dropped out of elementary school.

These examples are just to let you know that anything and everything is possible. There are CEOs of Finance companies who are from an engineering background. So getting an Investment Banking job for an Engineering graduate is not a hard nut to crack.

#2 If you are short of time, you can take up some Online Finance Training.

Is getting a Master’s degree in Finance the only way? Yes, I agree that you can get into the field of finance by either completing your MBA or CFA. These are some well-known and traditional ways of getting into the finance field, but not the only ones. Other options could be –

- Skilled Based Organizations- Various training organizations are all equipped to provide some excellent finance training.

- Practical Applications- The training provided by these organizations is not just theoretical; it comes with all the practical finance applications.

- Industry-Based Training- Here, you ought to get some value-added industry-based training through various courses in Investment banking, Equity Research, Financial modeling and many more. You definitely can get into one of such courses to sharpen your financial skills.

#3 You can complete your Post-Graduation in Finance

- Giving Competitive Exams- If you are opting for an MBA, you need to have a graduation degree for entering into MBA finance. You will have to give competitive exams to make yourself eligible for entering a good MBA college. Candidates can begin preparation during the third year by enrolling in training institutions and gaining knowledge. Also, have a look at CFA or MBA.

- Academic Performance Helps- One needs to complete engineering with at least 50% marks. The candidate’s performance in their engineering academics will help in the later stages of the selection process. Hence, a candidate needs to focus on performing well in both engineering semesters and entrance exams.

- Figure out what you want- Before considering finance after engineering, one needs to figure out why they want to do an MBA or get into finance. Hence, one should not get into finance merely to become a manager in a reputed organization.

- Career Prospects- Getting a finance job after engineering improves career prospects. However, before becoming a manager, you can gain some work experience and understand the way businesses function.

- Understand the Difference- If you want to shift from engineering towards finance, you need to understand the difference between the two fields and have a passion for Investment Banking. Some self-examination combined with some amount of research on finance will help determine the goal.

- Experience helps ?- If you pursue MBA or any other degree in finance after gaining some work experience, you will be in a better position to grasp the course contents and apply them appropriately to your work.

#4 Craft a Winning resume for your interview!

Prepare to keep in mind that the interviewer will have good fun while interviewing you. I kept this in mind during my interview, and it helped me prepare for the stressful interview. So to prepare yourself, you can start first by having a Winning Resume. Here's how you can do that:

- Step 1 - Use Resume Templates- Use some investment banking resume templates if you are unsure how to structure the perfect resume. All the templates are available online; you can select the one which best suits you and get it to download.

- Step 2 - Highlight your Experiences- Pick some experiences you would like to highlight the most. These may include what you've done during the entire finance course,, summer internship projects, Business competitions or any other major activities where you have displayed your leadership quality.

- Step 3 - Rephrase your Resume in finance Terms- It is best that you rephrase your resume in business and finance terms rather than using big jargon or some engineering lingo.

#5 Be confident while answering Tricky Questions

I mean by Tricky questions: Your mischievous neighbor pouring cold icy water on you on a 5-degree night.

Interviewers can shoot some similar questions like:

- Are you genuinely interested in Investment Banking?

- Why Investment Banking after graduate degree?

- Don’t you feel that you have wasted “Four Years of Engineering graduation”?

- Have you learned enough about accounting and finance to compete with commerce students?

- Do you have the stamina and passion to work 100-hour weeks?

- Do you like to communicate with people?

Here’s how you can answer these questions with Confidence-

- Talk about Projects & lab Work- The 100-hour work question can be answered easily. You may talk about all the lab work you had to do during your engineering degree. , focus on all the last-minute projects you have worked on or the experience you gained during your summer internship or full-time job if you have previous work experience.

- Talk about Interesting Firms- You may talk about some interesting companies or IPOs or stocks to prove your interest in finance. You may stick to some unusual companies or success stories rather than opting to talk about common companies, as everyone is bound to do the same. Talk about any investment you've done or any recent market news which displays your market awareness.

- Interview guides & Programs- To answer technical questions, you can get access to some interview guides or join financial modeling programs that will teach you everything you need to know.

- Mock Interviews Helps- To answer the questions related to your interpersonal skills, you must be absolutely polished and well prepared. Do not hesitate or get confused while answering such questions. The best way to get good at this is to practice with any smooth talkers' friends.

- Be Crisp & Clear- Make sure that all your answers are crisp and to the point. Do not run around the same bush again and again.

“In Your Favor points” for engineering students during the Investment Banking Questions!

- Employers won't doubt your quantitative skills or your attention to detail.

- Depending on your experience, you can convince the employer that you can work long hours relatively easily.

- Also, you have options outside of investment banking that lawyers and accountants don't have access to.

#6 Prepare for the Finance Technical Round like a Pro

- Don’t Ignore- Employers may have lower expectations regarding technical questions since you do not have a finance background. But this does not mean that you ignore them.

- Strengthen the Basic concepts- You must know all the basic concepts, for example, fundamental accounting and valuation questions.

- Get Financial Statements on your Tips- Be thorough with all the three financial statements, financial statement analysis, how they are linked together, how to walk through changes to the financial statements, and how to value a company.

- Prepare for Advanced Topics- You can also prepare questions on advanced topics like merger and Acquisitions, Credit rating and Leveraged Buyouts. At the same time stick to the basics of these topics, you do not have to know all the absolute and intricate details of the topics at the initial steps.

#7 Smart people always have an alternate plan and remember you are Smart ;)

You prepared your story, crafted an excellent resume, and have gone through all the technicalities of finance, but what if you do not get a job in the desired investment bank? You came out of the interview room with no offers. Are you already thinking that Getting a finance job in engineering is indeed difficult? Do not panic, and don't get depressed. It's not the end of the world for you. Keep other options open as well. Also, consider Finance Roles Outside of Investment Banking.

Some of the other options are as follows:

- Corporate Finance- Corporate finance jobs include working for a company and managing the capital necessary to run the enterprise.

- Commercial Banking- A career option available in commercial banking includes bank tellers, loan officers, operations, marketing, and branch managers. (also look at Investment Banking vs Commercial Banking)

- Hedge Funds- Hedge funds are private investment funds whose managers can buy or sell an array of assets and financial products. Because of the mystery that surrounds them, jobs of Hedge-fund are considered by many to be glamorous. (also look at Investment Banking vs Hedge Fund)

- Private Equity- Private equity job includes helping businesses find capital for expansion and current operations. It also includes providing financing for corporate business transactions like buyouts and restructurings. (also look at Investment Banking vs Private Equity)

- Venture Capital- Venture-capital job includes evaluating pitches by founders and small-company leaders to determine if the venture capital firm will make an investment in such businesses.

- Financial Planning- Financial planning job includes helping individuals develop plans to ensure their present and future financial stability.

- Insurance- Finance jobs in insurance involve aiding businesses and individuals to anticipate their potential risks and protect themselves from losses.

#8 Choosing the Right Direction is the Key to a Happy Carrier Life!

- Focus on your Skills- Different finance jobs require different skills and portray different work environments. And this is why it is wise to select a job that aligns with your long-term interests and abilities.

- Get to know where you Stand- For example, someone with good interpersonal skills can do well as a financial advisor, while on the other hand, someone who enjoys working with numbers might do better in accounting.

- Do your Research- It is wise to do the research first to discover your options.

Frequently Asked Questions (FAQs)

Tremendous prospects for graduates in the field of investment banking are present. Graduates can commence their careers with internships in investment banks and financial institutions. These internships can facilitate the graduates to get versed in the field of investment banking and the major corporations that are playing in the industry.

A graduate can adopt and incorporate certain traits to secure a job in an investment bank. These include accounting, corporate financial skills, MS Excel, Tableau, time management, educational prowess, certification courses, etc.

Graduates can enter into certain industries and specializations to start their careers and move toward the field of investment banking. These include corporate finance, hedge funds, commercial banking, private equity, venture capital, insurance, etc.