The investment banking vs wealth management salary is one of many criteria that has differences. Let us understand the other differences as well through the comparative tables below.

Investment Banking vs Wealth Management – An Analysis

Table Of Contents

What Is Investment Banking?

Investment banking is a section of the world of finance that places its primary focus on facilitating the flow of capital between investors and businesses. It includes a wide array of financial services. These services include underwriting securities offerings, providing financial advisory services, facilitating mergers and acquisitions, and trading financial instruments.

One of the fundamental functions of investment banks is to underwrite securities offerings, such as initial public offerings (IPOs) and bond issuances. They help companies in structuring and pricing their offerings, market them to potential investors, and facilitate the sale of securities to raise capital.

Investment banks also offer their advice to clients on different strategic intricacies, including mergers and acquisitions (M&A), corporate restructuring, and divestitures. They provide their insights and guidance throughout the transaction process. Thus helping clients evaluate potential targets or buyers, negotiate terms of deals, and help with structuring transactions to maximize value.

Additionally, investment banks engage in proprietary trading activities, which are basically trading stocks, bonds, currencies, and derivatives on behalf of the bank's account. Furthermore, investment banks operate in the capital markets, enabling the purchase and sale of securities on behalf of institutional investors and providing liquidity to the market.

They also offer research services, producing reports and analyses on companies, industries, and market trends to help investors make take calls regarding their investments.

What is Investment Banking?

Key Takeaways

- Investment banking is a particular segment within the financial industry. It focuses on corporate finance, capital markets, and advisory services.

- Required skills for investment banking professionals include financial analysis, deal execution, and resilience. They usually get substantial bonuses apart from salaries.

- Wealth management involves managing the financial assets and investments of individual clients. Investment management, financial planning, and estate planning are significant services.

- Wealth management requires solid financial knowledge, communication, and interpersonal skills. Career progression usually involves advancement from junior advisor to partner roles within the firm.

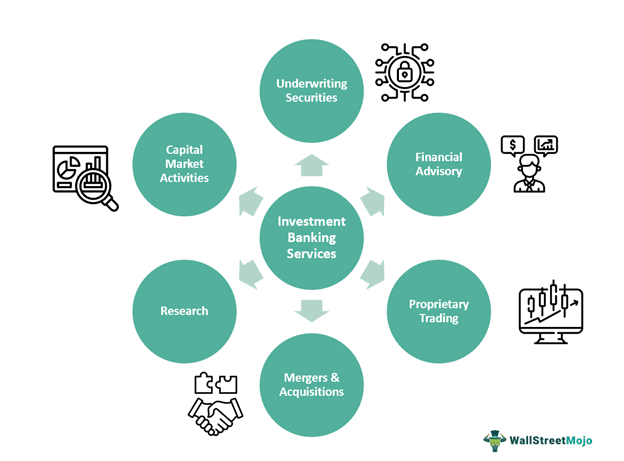

Investment Banking Services

Investment banks provide services that are of utmost importance in the world of finance. Some of the most common and vital services are:

- Underwriting Securities Offerings: Investment banks assist companies in issuing securities such as stocks and bonds. They do it by underwriting the offerings, pricing them, and facilitating their sale to investors to raise capital.

- Financial Advisory Services: Investment banks provide strategic advice to clients on various matters such as mergers and acquisitions (M&A), divestitures, corporate restructuring, and capital raising strategies.

- Mergers and Acquisitions (M&A): Investment banks advise clients on M&A transactions, helping them identify potential targets or buyers, negotiate deal terms, and structure transactions to maximize value.

- Proprietary Trading: Investment banks engage in proprietary trading activities, where they trade financial instruments such as stocks, bonds, currencies, and derivatives on their behalf to generate profits.

- Capital Markets Activities: Investment banks operate in the capital markets, facilitating the buying and selling of securities on behalf of institutional investors and providing liquidity to the market.

- Research Services: Investment banks produce research reports and analyses on companies, industries, and market trends to help investors make decisions regarding their investments.

Example

Henrich is into recycling plastic waste into raw material for reuse. He has been in the industry for over 25 years and wants to expand his company's operations. Therefore, he asked for advice from Travis, an investment banker who had advised him on several other matters in the past.

Travis introduced Henrich to Aiden, who owns a company that turns recycled plastic into everyday household items. Coincidentally, he was also looking for a partner to source raw materials for better pricing and expand his business beyond the current geographic boundaries.

Travis, therefore, advised both Henrich and Aiden to merge their companies. They negotiated the terms and conditions that worked best for both of them and were overseen by Travis.

Required Skills To Become An Investment Banker

To become an investment banker, a professional must develop a particular set of skills that not only help them lead a successful career in investment banking but also help their client make wiser decisions. Let us understand the skills most sought-after in the market.

- Financial Analysis: Proficiency in financial analysis is crucial for investment bankers to evaluate company financial statements, assess investment opportunities, and perform valuation analysis.

- Valuation Techniques: Being a pro at valuation methodologies like discounted cash flow, comparable company analysis, and precedent transactions analysis is essential for determining the fair value of companies and assets.

- Communication Skills: Excellent communication skills are non-negotiable for investment bankers to convey complex financial concepts to clients, colleagues, and stakeholders clearly and concisely.

- Negotiation Skills: Investment bankers play a significant role in negotiations with clients, counterparties, and other stakeholders. They negotiate to structure deals, negotiate terms, and resolve conflicts effectively.

- Attention to Detail: Precision is critical for investment bankers, who must meticulously analyze data, do their due diligence, and make sure compliance with regulatory requirements is in place.

- Time Management: Efficient time management is necessary for investment bankers to prioritize tasks, meet deadlines, and manage workloads effectively amidst tight schedules and demanding work environments.

How Much Does An Investment Banker Earn?

Investment bankers' salaries vary based on factors like experience, location, and employer. Below is an overview of ballpark figures at different levels:

- Analyst: Entry-level investment banking analysts can earn base salaries ranging from $85,000 to $120,000, with bonuses potentially doubling or tripling their total compensation.

- Associate: Associates, typically with a few years of experience, earn base salaries ranging from $150,000 to $250,000, with bonuses significantly increasing their total compensation, often doubling or more.

- Vice President (VP): VPs in investment banking earn base salaries between $250,000 and $400,000. Additionally, bonuses comprise a substantial portion of their total compensation.

- Director or Managing Director: Directors and managing directors, senior leaders within investment banking firms, can earn base salaries ranging from $350,000 to over $1 million. Just like others in a firm, their bonuses also substantially augment their total compensation. In fact, bonuses sometimes exceed their base salary.

It's vital to note that these figures are approximate and may differ due to factors such as the firm's size, location, and performance. Additionally, bonuses can fluctuate significantly based on individual and firm performance

Career Prospects In Investment Banking

The career prospects in investment banking are pretty straightforward. They go through different levels in the hierarchy and naturally perform different tasks.

Advancement is typically based on performance, deal experience, client relationships, and leadership capabilities. Some may transition to roles in private equity, hedge funds, corporate finance, or other areas of finance as they progress in their careers.

Let us understand the career prospects within investment banking through the brief discussion below.

- Analyst: Entry-level position for recent graduates, responsible for financial analysis, building financial models, and supporting deal teams in various transactions.

- Associate: Typically promoted after 2-3 years as an analyst, associates take on more responsibility in deal execution, client management, and business development.

- Vice President (VP): VPs oversee deal teams, lead client relationships, and perform significant roles in business development and firm-wide leadership.

- Director or Managing Director: Senior leaders within investment banking firms, responsible for driving business strategy, managing key client relationships, and overseeing deal execution.

What Is Wealth Management?

Wealth management is the professional oversight or management of an individual's financial assets and investments with the goal of achieving their financial objectives. This extensive approach includes a range of services, including investment advisory, financial planning, retirement planning, estate planning, tax planning, and risk management.

Wealth managers work with clients closely to grasp their financial goals, risk appetites, time horizons, and unique circumstances to develop personalized strategies to help them grow and preserve their wealth over the long term.

Critical components of wealth management are asset allocation, diversification, portfolio construction, and ongoing monitoring and rebalancing to optimize investment performance and manage risk. Wealth managers put their expertise to use in investment analysis, financial markets, and tax laws to give clients personalized advice and solutions that are in line with their objectives and preferences.

Additionally, wealth managers often collaborate with other professionals, such as tax advisors, estate planners, and attorneys, to provide holistic financial planning and wealth preservation strategies for their clients.

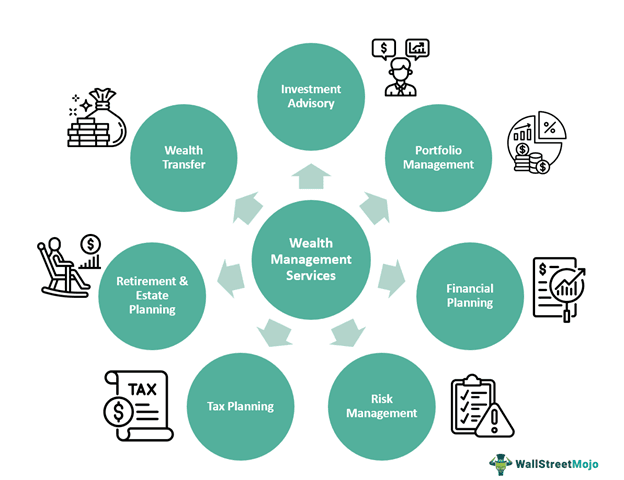

Wealth Management Services

Wealth management services can vary starkly based on the client's requirements and financial situation. However, it is better to understand the most common services. They are as listed below:

- Investment Advisory: Providing personalized investment advice and recommendations based on the client's financial goals, risk tolerance, and time horizon.

- Financial Planning: Developing comprehensive financial plans that include different aspects of clients' financial lives, including retirement planning, education funding, tax planning, and estate planning.

- Portfolio Management: Constructing and managing investment portfolios tailored to clients' objectives, employing strategies such as asset allocation, diversification, and risk management.

- Retirement Planning: Helping clients plan for a financially secure retirement by estimating retirement expenses, determining retirement income needs, and developing strategies to achieve retirement goals.

- Estate Planning: Assisting clients in creating estate plans to manage and transfer their wealth effectively, including wills, trusts, and powers of attorney, to minimize estate taxes and ensure their wishes are carried out.

- Tax Planning: Optimizing clients' tax liabilities through strategies such as tax-efficient investment placement, tax-loss harvesting, and charitable giving.

- Risk Management: Identifying and negating risks to clients' financial security, including market risk, inflation risk, longevity risk, and unforeseen events such as disability or death.

- Wealth Transfer: Helping clients transfer their wealth to future generations or charitable causes through gifting strategies, trust planning, and other wealth transfer techniques.

Example

Elyse is a professional sportsperson. Her packed schedule of matches only allows her to pay attention to her investments and overall wealth management. Therefore, she hires Pattrick to manage her portfolio.

In her initial meeting, she made it clear to Pattrick that she wanted to take only a slight risk with her portfolio. As a result, Pattrick suggests diversification across asset classes with minimal exposure to cryptocurrency and mid and small-cap stocks.

They meet every quarter to understand the status of her portfolio and also make changes if they mutually feel it might add to the portfolio's strength and Elyse's investment principles

Required Skills To Become A Wealth Manager

Being a wealth manager is a multi-disciplinary role. It requires an extensive knowledge of the financial markets, risk management, and a great set of communication skills to communicate with clients and clarify their intricate doubts.

Let us understand the top-rated skills of a wealth manager through the discussion below.

- Financial Knowledge: A deep understanding of financial products, investment strategies, and market trends is essential for providing practical wealth management advice.

- Communication Skills: Effective communication is required to adequately put across complex financial concepts to clients and build trusted relationships.

- Analytical Skills: Analytical abilities are crucial for evaluating clients' financial situations, assessing investment opportunities, and developing tailored wealth management strategies.

- Customer Service: Providing exemplary customer service and addressing clients' needs promptly and professionally is critical to retaining and growing a client base.

- Relationship Building: The capability to build and sustain strong relationships with clients, colleagues, and other professionals such as tax advisors and estate planners is essential for success in wealth management.

- Ethical Standards: Adhering to high ethical standards and acting in clients' best interests is an absolute non-negotiable in the wealth management profession.

- Problem-Solving Skills: Being able to identify challenges, develop solutions, and figure out a way out of complicated financial situations is critical for effective wealth management.

How Much Does A Wealth Manager Earn?

It is essential to understand that wealth managers' salaries and remunerations differ based on factors like experience, location, and employer. However, here is the average salary of professionals in the wealth management sector based on their positions within a firm:

- Entry-Level Wealth Manager: Entry-level wealth managers can earn base salaries ranging from $60,000 to $100,000 annually. They are also awarded with bonuses that increase total compensation by 10% to 20%.

- Mid-Level Wealth Manager: Mid-level wealth managers with several years of experience typically earn base salaries between $100,000 and $200,000. Here, bonuses comprise a significant portion of their total compensation. It can, in fact, often be double or more.

- Senior Wealth Manager: Senior wealth managers with extensive experience and a sizable client base can earn base salaries ranging from $200,000 to $500,000 or more annually, with bonuses substantially augmenting their total compensation.

- Wealth Management Director or Partner: Directors or partners in wealth management firms who oversee teams or have equity stakes in the firm can earn base salaries exceeding $500,000. These directors or partners also earn additional bonuses and profit-sharing options that significantly increase their total compensation.

Career Prospects In Wealth Management

A career in wealth management is based on a significant amount of updation in knowledge and maintaining relationships with clients and associate professionals. However, here is what a typical career progression in wealth management would look like:

- Financial Advisor/Associate: Entry-level position for recent graduates, responsible for helping clients with financial planning, investment management, and client service.

- Wealth Manager/Senior Financial Advisor: With experience, individuals can advance to wealth manager roles, taking on more responsibility in client management, portfolio construction, and financial planning.

- Senior Wealth Manager/Vice President: Senior wealth managers, often with extensive experience and a sizable client base, may be promoted to vice president roles. Professionals in these roles are responsible for overseeing teams, developing business strategies, and managing key client relationships.

- Director or Partner: Directors or partners in wealth management firms have significant leadership responsibilities, including setting strategic direction, managing operations, and driving business growth. They may also have equity stakes in the firm and participate in profit sharing.

Comparative Table

| Basis | Investment Banking | Wealth Management |

|---|---|---|

| 1. Primary Focus | Focuses primarily on corporate finance, capital markets, mergers and acquisitions, and advisory services for corporations and institutions. | Primarily focuses on individual clients and their financial goals, including investment management, financial planning, and wealth preservation. |

| 2. Services | Services include underwriting securities offerings, mergers and acquisitions advisory, restructuring, and trading. | Services include investment management, financial planning, retirement planning, estate planning, tax planning, and risk management. |

| 3. Clients | The client base consists of corporations, financial institutions, and government entities. | The client base consists of high-net-worth individuals, families, and sometimes institutional clients. |

| 4. Skills | Requires strong financial analysis, valuation, and deal execution skills, along with resilience and the ability to work under pressure. | Requires strong financial knowledge, communication, interpersonal, and client relationship skills, as well as ethical standards and trustworthiness. |

| 5. Compensation | The compensation structure is heavily weighted towards bonuses, especially for senior positions. | Compensation typically includes a base salary supplemented by bonuses, commissions, and fees based on assets under management or performance. |

| 6. Career Progression | Career progression typically follows a structured hierarchy from analyst to managing director, with opportunities for lateral moves. | Career progression may involve moving from junior advisor to partner or principal roles, with opportunities for advancement within the firm. |

Highlights Of The Top 5 Investment Banking Courses Offered

The best investment banking courses not just educate but also boos one's interest in the profession and finance as a whole. The top 5 such courses online are:

| Top 5 Courses | Highlights |

|---|---|

| Wallstreetmojo | Detailed chapters on equity research, raising capital, underwriting, market making, and career opportunities |

| Wharton | Hedge Fund and buy-side investing |

| Imarticus Learning | Trade life cycle and risk management |

| Financial Edge | Financial statement analysis and interview tips |

| New York Institue of Finance | Mergers and Acquisitions |

Highlights Of The Top 5 Wealth Management Courses Offered

Among the plethora of courses online, there are only a handful of reliable courses on wealth management that cover the intricate details that set the best apart from the rest. The top 5 courses, in our learned opinion, are:

| Top 5 Courses | Highlights |

|---|---|

| Wallstreetmojo | History, types, tax planning, and red flags |

| New York Institute of Finance | Commodities and hedge funds |

| CFI | High-yield bonds, subordinated debts |

| BSE Institute | Retirement and estate planning |

| Financial Edge | Security analysis and equity trading |