Table Of Contents

What is Financial Forecasting?

Financial Forecasting is the process of predicting or estimating future stats of an organization i.e. how the business will perform in the future based on historical data by analyzing the income statement, position statement, current conditions, past trends of the financial, future internal and external environment which is usually undertaken with the objective of preparing and developing a budget and allocating available resources to ensure best possible utilization.

The use of financial forecasting techniques helps businesses find direction and clearly lays out their goals based on their stage of growth. It also helps them find problem areas where optimization could result in more business and profits. At a macro level, it also makes it more attractive for investors to invest in a company with a high level of clarity.

Key Takeaways

- Financial forecasting is a process that one performs to estimate a business’s future performance by considering information related to historical performance, for example, sales and cash flow.

- A noteworthy benefit of this process is that it can help assess whether a new business venture is viable.

- There are two main forecasting methods from a financial standpoint, and they are qualitative and quantitative. A popular qualitative technique is the Delphi method.

- A key limitation of this process is that the data accumulation, data organization, and coordination procedures can be time-consuming.

Financial Forecasting Explained

Financial forecasting refers to the process of drafting projections relating to the future performance of the business. It helps with direction and finding problem areas of the business. It includes analyzing the business’s past performance and thoroughly studying current trends.

It is however important to acknowledge the fact that the components of the financial forecasting models might differ based on the nature of the business and the purpose of conducting these projections. More about the components of this concept in the next section.

For any organization, irrespective of its size, nature of business, and stage of growth, their goals are aligned with higher revenue, sales, and ultimately profits. Forecasting performances and scrutinizing the same from the recent past to make the upcoming quarter or year better gives everyone within the organization a high degree of clarity.

Moreover, investors find the business more attractive to park their investments when the company and its management have clarity of not just their strong points but also their flaws that are being actively and consciously worked upon.

Financial Forecasting Components

Let us understand the components and financial forecasting tools through the discussion below. This will give us a detailed understanding of the concept and its related factors.

Projected Income Statement - This is an anticipated income statement that depicts the expected expenses and revenues for the future financial period, i.e., usually one year.

Cash Budget - This depicts total cash inflow and outflow expected in the future. Sources of cash inflow include cash sales, collection from accounts receivable, short-term borrowing, long term debt, cash sales, and equity capital. Sources of cash outflow include payments of accounts payable, salaries, wages, capital expenditure, repayment of loans, and debts. The cash budget does not include expenses like depreciation. The reflected surplus or deficit in the cash budget forms the base for investment and financing.

Projected Balance Sheet - This sheet reflects the expected assets, liabilities, and owner’s equity at a particular date. To prepare this, inputs like initial balance sheet, capital expenditure budget, profit plan, investment, and financial plan are required.

Projected Sources and Uses of Fund - Sources of funds and its uses in the planning period are shown in this statement. The projected income statement, balance sheet, initial balance sheet are the inputs required for its preparation. Projected sources of funds are cash flow from operations, a decrease in fixed assets, an increase in long-term liabilities, and the issuance of share capital.

Individuals can better understand the components by taking a look at any financial forecasting Excel template available online.

Examples

Let us understand the concept of using financial forecasting techniques with the help of a couple of examples. These examples will give us a practical understanding of the concept and its intricacies.

Example #1

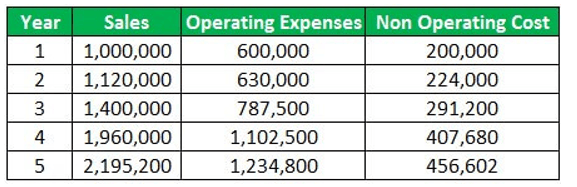

Orange Inc. has collected the following data for the future 5 years. You are requested to draw a comparative financial statement for the next 5 years and determine the company’s growth potential.

Out of the above figures, cash sales are 80%, and cash expenses are 75% of the total figure. Assume opening cash as 50,000 and comment on the cash position of the company.

Solution

Comparative Financial Statement

Comment - Company has good growth potential as profits are increasing at a good rate.

Cash Position

Comment - Since the company has a higher percentage of cash sales than cash expenses, the cash position is becoming stronger with the increasing sales year by year. Therefore it can be said that the overall company has good growth potentials.

Example #2

Novaturas, a market leader in the Baltic tourism sector, has recorded its best-ever quarter in the history of the company. After conducting a financial forecasting process, they adjusted their EBITDA from EUR 3-5 million to EUR 4-6 million.

In the first quarter of 2023, the company recorded EUR 39.6 million in revenue, which is 35% greater than the same period, in the previous financial year.

After thoroughly going through their previous year’s financials and analyzing market trends at the time, they decided to improve the numbers of their yearly performance forecast. The performance according to the experts who conducted the analysis adjusted the numbers up by EUR 1-2 million for the financial year 2023-24.

Financial Forecasting Process

The process of using financial forecasting techniques involves various steps. These steps can vary from company to company and can be different in different stages of the same company’s timeline. Let us understand the critical points of the process through the explanation below.

- Purpose: It is vital to understand the purpose for which the elaborate process of analyzing, processing, making changes, and constant monitoring is being implemented.

- Gathering Data: Gathering historical sales and marketing data along with financial statements could allow the management to make more informed decisions based on past performance. Adjustments to strategies become easier with past performances in order.

- Time Frame: Creating clarity in terms of the length of this process can give the management and the other employees in the company a clear idea of what they are working towards in terms of daily actions supporting the plans.

- Method: Choosing a forecasting method that fits the best to the structure of the business and the purpose of the forecast and maintaining all documentation in the same format need to be clearly established to make analyzing more efficient.

- Results: Regular documentation of happening can help managers assess the results in real-time or at least in regular intervals, which makes the process less time-bound. Therefore, resources also could be mindfully spent.

- Analysis: The final data can be analyzed and it can be clarified if the strategies worked well for the company. Based on the results they can choose an interval after which these checks coulf be conducted again.

Financial Forecasting Methods

Let us look at some popular financial forecasting techniques.

Broadly speaking, the methods related to this concept fall into two categories — qualitative and quantitative. First, let us dive into the qualitative techniques.

Experts’ experience and knowledge form the basis of qualitative forecasting instead of historical financial data. These methods are subjective, but can provide key insights into forecasts and can take into account factors that are unpredictable when utilizing historical data.

A popular qualitative financial forecasting method is the Delphi method. It involves consulting different experts who carry out the analysis of market conditions to estimate an organization’s performance. Precisely, a facilitator contacts specific experts with questionnaires; the former requests projections concerning the business performance on the basis of the latter’s knowledge and experience. After that, the facilitator compiles all the analyses and asks other experts to comment on them. The circulation of the analyses continues until they reach a consensus.

Another popular method is market research, which involves getting a holistic market view on the basis of fluctuating consumer patterns and competition. This method is vital for startups when they do not have adequate historical financial data for projections.

Now, let us look at some quantitative methods:

- Percent of Sales: This technique involves the computation of financial line items’ future metrics as a percentage of the company’s sales.

- Straight Line: In this case, individuals assume that the growth rate of the organization will stay constant. Thus, projecting future sales involves multiplying the sales recorded in the previous year by the growth rate. Note that this method does not factor in supply chain problems or market fluctuations.

- Moving Average: This quantitative method involves considering the weighted average or average of the preceding periods to project future values.

Financial Forecasting Importance

Let us understand the importance of using financial forecasting tools through the points below.

- New Business Promotion – Financial forecasting helps businesses utilize their funds to promote new business ventures and initiatives. It also helps in determining the success rate of the business they are promoting.

- Seamless Functioning– Accurate and effective forecasting of the finances like current revenue, revenue potential, and other expenses helps in the organization’s smooth running. The forecast also helps in anticipating future roadblocks.

- Estimating Financial Requirements – It helps determine sales and cost of customer acquisition, capital for a specific project, and other expenses required for further management of the business. This preemptive forecast helps in making sound business decisions.

- Control Cash Flow – It helps in controlling the cash flows of a business. Organizations with a good amount of cash/bank balance are more financially organized and better control their business operations.

- Archive Overall Success – Financial forecast is important in achieving overall success for the business as it forms a strong foundation for the complete budgeting of departments across the organization.

Financial Forecasting Advantages

Let us understand the advantages of financial forecasting models through the explanation below.

- The financial forecast allows businesses to predict future financial performance against set standards. It provides a benchmark against which performance, loopholes, and corrective actions of an organization are monitored.

- It helps in identifying the processes that are most capital consuming. Financial risk can be lowered by pumping out money from such processes and channelizing them towards the profitable ones.

- It helps in predicting the financial viability of new business ventures. It helps prepare the best model for figuring out how a business will perform when specific plans and strategies are worked out.

Financial Forecasting Disadvantages

Despite the various advantages mentioned above and throughout the article, there are a few factors from the other end of the spectrum that prove to be a hassle for the management and employees. Let us understand the disadvantages of using financial forecasting techniques through the points below.

- Even if we have forecasting experts and a great process in place, predicting the future accurately is impossible. Markets have a high volatility level, and the number of factors influencing demand keeps changing with time.

- Data gathering, data organizing, and coordination are required for this process, which is very time-consuming. Also, substantial input from the marketing and sales team is required, making it a resource-intensive process.

- Hiring a team of advanced planners is a significant investment. Adding good-quality tools, high-quality talent, and software might prove a costly affair for the forecasting process.

Difference Between Financial Forecasting and Financial Modeling

Both financial forecasting and modeling have been widely discussed and are considered synonymous. However, there are a few differences in their very fundamentals and implications. Let us understand the differences through the comparison below.

Financial forecasting is a method of prediction that a company makes and prepares for the future. It involves a possible outcome of the future by determining its current financial statements and performance, whereas financial modeling is the action taken on financial forecasting.

Once the forecast assumptions are developed, and numbers are calculated using a financial statement, financial modeling comes into the picture. Financial modeling builds a predictive operating model to help a company in making sound business decisions. These financial models are mathematical models where different variables are linked together. The process involves preparing the company’s future balance sheet.

If individuals wish to enhance their understanding of financial modeling, they can opt for the Financial Modeling 2-Day Bootcamp. The course aims to help learners worldwide develop a practical understanding of how financial modeling works via real-world examples.