Table of Contents

What Do Investment Banks Do?

Investment banks are the binding agents of the global financial system. They provide an extensive range of services to corporations, governments, institutional investors, and high-net-worth individuals. At their core, investment banks facilitate the movement of funds between investors and businesses, helping to raise funds for corporate clients and providing investment opportunities for investors.

One of the fundamental functions of these professionals is to underwrite securities offerings, such as initial public offerings (IPOs) and bond issuances. In this capacity, investment banks assist companies in structuring and pricing their offerings, marketing them to potential investors, and ultimately facilitating the sale of securities to raise capital. This process involves extensive due diligence, financial analysis, and regulatory compliance to ensure the success of the offering.

Additionally, investment banks offer advisory services to clients on various strategic fronts, like mergers and acquisitions (M&A), corporate restructuring, and divestitures. They impart valuable expertise and advise all through the transaction process, helping clients figure out the best actions for complex negotiations, evaluate potential targets or buyers, and structure deals to maximize value.

Investment banks also engage in proprietary trading activities. Here, they trade financial instruments such as stocks, bonds, currencies, and derivatives on behalf of the bank's account. These trading activities can generate significant profits for the bank but also involve risks, including market volatility and regulatory scrutiny.

Furthermore, investment banks operate in the capital markets, coordinating the purchase and selling of securities for institutional investors and providing liquidity to the market. They also offer research services, producing reports and analyses on various companies, industries, and market trends.

Overall, investment banks have a multi-dimensional role in the global economy. They are intermediaries between capital seekers and investors, providing financial advisory and trading services and contributing to the efficient functioning of financial markets.

Key Takeaways

- An MBA in investment banking offers specialized education in finance, including financial analysis, valuation techniques, and capital markets expertise.

- It enhances career prospects and opportunities for advancement in investment banking, serving as a credential highly valued by employers.

- MBA programs provide extensive networking opportunities with industry professionals and recruiters, facilitating valuable connections and access to job opportunities.

- Many MBA programs incorporate hands-on learning experiences, such as internships and real-world projects, allowing students to gain practical experience and exposure to the complexities of investment banking.

Role Of An Investment Banker

We just understood that investment banking is a multifaceted role. Naturally, an investment banker also would don multiple hats in their careers. Let us understand their core roles through the discussion below.

- Capital Raising: Investment bankers assist companies in raising capital through various means, including initial public offerings (IPOs), secondary offerings, and debt issuances. They help structure the offering, determine pricing, and market the securities to investors.

- Mergers and Acquisitions (M&A): Investment bankers provide advisory services to clients involved in mergers, acquisitions, and divestitures. They help evaluate potential targets or buyers, negotiate deal terms, and structure transactions to maximize value for their clients.

- Corporate Restructuring: Investment bankers advise companies on strategic initiatives such as corporate restructuring, spin-offs, and reorganizations. They help optimize the company's capital structure, streamline operations, and enhance shareholder value.

- Financial Advisory: Investment bankers offer financial advisory services to their clients for a variety of matters, including capital allocation, risk management, and corporate finance strategy. They provide valuable insights and guidance to help clients with complicated financial calls and with achieving their business objectives.

- Trading and market-making: Some investment banks engage in proprietary trading activities, where they trade financial instruments on behalf of the bank's account. They also perform as market makers, providing liquidity to the players in the market by facilitating the buying and selling of securities.

- Research: Investment banks produce research reports and analyses on various companies, industries, and market trends. These research reports help investors make investment-related decisions and provide valuable insights into market dynamics.

Skills Required For An Investment Banker

For a high-intensity job profile, the one of an investment banker, a particular set of skill sets are non-negotiables, while others are skills that are better to have. Let us understand a few of the most sought-after skills in the industry through the explanation below.

- Investment bankers must possess strong financial analysis skills, including proficiency in financial modeling, valuation techniques, and accounting principles. They analyze financial statements, assess company performance, and evaluate investment opportunities.

- Practical communication skills are essential for investment bankers to convey complex financial concepts to clients, colleagues, and stakeholders. They must be able to articulate their ideas clearly and persuasively in presentations, reports, and client meetings.

- Investment bankers negotiate deal terms, pricing, and agreements on behalf of their clients. They must be skilled negotiators who are able to figure out complex transactions and advocate for their client's interests while maintaining positive relationships with counterparties.

- Investment bankers encounter a wide range of challenges and obstacles in their work, requiring strong problem-solving skills to analyze issues, develop creative solutions, and overcome obstacles to achieve their clients' objectives.

- Precision and accuracy are critical for investment bankers, who must meticulously analyze data, perform due diligence, and ensure compliance with regulatory requirements. They must pay close attention to detail to avoid errors and mitigate risks in their work.

- Investment bankers often juggle working on many projects simultaneously, requiring substantial time management skills to prioritize tasks, meet deadlines, and efficiently allocate resources to maximize productivity and effectiveness.

How To Become An Investment Banker?

Investment banking is one of the most respected and high-paying jobs in the world of finance. The question of how to become an investment banker can have multiple answers. The most common route is:

- Educational Background: Obtain a bachelor's degree in finance, economics, accounting, or a related field. Consider pursuing advanced degrees like a Master of Business Administration or a Master of Finance (MFin) for additional specialization and career advancement opportunities.

- Gain Relevant Experience: Seek internships or entry-level positions in roles related to finance, like financial analysis, investment banking, or corporate finance. These experiences provide valuable exposure to the industry and help develop essential skills and knowledge.

- Develop Technical Skills: Hone your financial modeling, valuation, and analytical skills through self-study, practical experience, or by enrolling yourself in one of the best investment banking courses on the internet. Familiarize yourself with financial software and tools commonly used in investment banking, such as Excel, Bloomberg, and financial modeling software.

- Networking: Build professional relationships with individuals in the finance industry, including current investment bankers, alums, and industry professionals. Attend networking events, join professional associations, and utilize online platforms such as LinkedIn to access career opportunities.

- Prepare for Interviews: Be prepared to undergo a rigorous interview process, including technical interviews, case studies, and behavioral interviews. Practice answering common interview questions, demonstrate your knowledge of finance and investment banking concepts, and highlight relevant experiences and achievements.

Is An MBA In Investment Banking Necessary?

While an MBA in investment banking and equity research can certainly enhance one's qualifications and opportunities, it is optional for a career in the field. The world of investment banking is highly competitive, and candidates with advanced degrees like an MBA may have a competitive edge, particularly for prestigious positions at top-tier firms or for roles that require advanced financial analysis and strategic decision-making skills.

However, many successful investment bankers have backgrounds in finance, economics, or related fields without holding an MBA. What matters most is a strong foundation in financial analysis, valuation techniques, and industry knowledge, along with relevant work experience and a demonstrated ability to become adept in the fast-paced and demanding environment of investment banking.

Ultimately, whether or not to pursue an MBA in investment banking depends on individual career goals, current qualifications, and personal circumstances. While an MBA can offer valuable opportunities for networking, skill development, and career advancement, it is not a prerequisite for a successful career in investment banking.

What Type of MBA Degree Helps People Become Investment Bankers?

For individuals aspiring to become investment bankers, pursuing an MBA with a concentration or specialization in finance is highly beneficial. This specialized MBA program equips students with in-depth knowledge and skills relevant to the field of investment banking, including financial analysis, valuation techniques, corporate finance, and capital markets.

Some MBA programs offer specific tracks or elective courses focused on investment banking, providing students with practical insights and hands-on experience through case studies, internships, and networking opportunities. Additionally, participating in student-led investment clubs, attending industry conferences, and securing internships at investment banks during the MBA program can further enhance students' prospects in the field.

While an MBA with a finance specialization can undoubtedly boost your credentials for a career in investment banking, it's essential to supplement academic coursework with practical experience, networking, and professional development to maximize career opportunities in this competitive field. Ultimately, the combination of a specialized MBA degree and relevant experience positions individuals for success in the fast and dynamic world of investment banking.

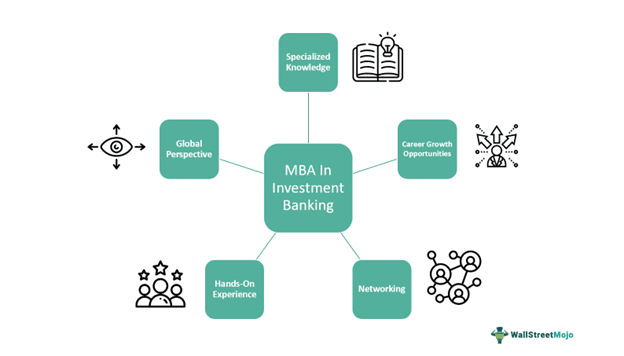

MBA in Investment Banking: Scope

While an MBA in investment banking salary is obviously higher in most cases, other factors are beneficial. It is essential to acknowledge them as well because, after a certain point in a person's career, the impact they make in an organization or for their client satisfies them way more than money ever could. Let us understand these factors through the points below.

- Specialized Knowledge: An MBA in Investment Banking provides candidates with unique knowledge and skills curated to meet the demands of the investment banking industry, including financial analysis, valuation techniques, and capital markets.

- Career Opportunities: Graduates of MBA programs in investment banking are well-positioned for a wide range of career opportunities in investment banking firms, financial institutions, corporate finance departments, and related fields.

- Networking: MBA programs offer extensive networking opportunities with industry professionals, alums, and recruiters, facilitating connections and access to job opportunities in the investment banking space.

- Practical Experience: Many MBA programs incorporate hands-on learning experiences such as internships, case competitions, and real-world cases, allowing students to gain hands-on experience and exposure to the challenges and dynamics of investment banking.

- Global Perspective: MBA programs often offer opportunities for international study and exposure to global markets, preparing students to solve the complexities of international financial organizations in their careers in investment banking.

Why Get An MBA For Investment Banking?

An MBA in investment banking & equity research can be beneficial on multiple fronts. Let us understand the most crucial ones through the points below.

- An MBA offers specialized education in finance, equipping students with the information and skillsets necessary for success in investment banking. It includes financial analysis, valuation techniques, and capital markets.

- Many MBA programs incorporate hands-on learning experiences such as internships, case studies, and real-world projects, allowing students to gain practical experience and exposure to the complexities of investment banking.

- An MBA enhances career prospects and opportunities for advancement in the highly competitive field of investment banking. It provides a credential that is highly valued by employers and can open doors to prestigious positions and higher salaries.

- MBA programs often offer opportunities for international study and exposure to global markets, preparing individuals to establish a career in international finance through their careers in investment banking.

- Good MBA programs provide significant networking chances with industry professionals, alums, and recruiters, providing valuable connections and access to job opportunities in investment banking.

Pros Of Getting An MBA for Investment Banking

An MBA for an investment banker could help them fast-track their career and secure more critical positions. The discussion below helps us understand how that could be possible.

- An MBA provides specialized education in finance, equipping individuals with the knowledge and skills required for investment banking, including financial analysis, valuation techniques, and capital markets expertise.

- While technical proficiency is taught through the most reputed courses on investment banking, an MBA could help with leadership training and the skill of managing a team or, even better- an organization.

- An MBA, along with the experience of being an investment banker, could give me valuable exposure to real-world cases of different categories. This shall help with having the practical knowledge along with the technical prowess.

- An MBA brings more brand value and credibility to a candidate's CV. This gives recruiters more confidence that the candidate can manage the significant things within the organization and for their clients as well.

- MBA programs give students opportunities to network and connect with industry professionals and recruiters, facilitating valuable connections and access to job opportunities in investment banking.

Cons of Getting an MBA for Investment Banking

While the advantages of an MBA in investment banking salary and other such perks are apparent, they come at a cost. Let us understand the other end of the spectrum through the discussion below.

- Pursuing an MBA can be expensive, with tuition fees, living expenses, and potential lost income during the program. This financial investment may only sometimes result in immediate returns, mainly if job prospects in investment banking are uncertain.

- MBA programs usually demand a significant time commitment, ranging from one to two years of full-time study. This time away from the workforce can delay career progression and income growth for individuals already established in their careers.

- Some MBA programs may not offer a specialized focus on investment banking, resulting in a broader curriculum that may not fully meet the specific needs of aspiring investment bankers.

- The investment banking world is highly competitive, and an MBA alone may not guarantee success. Individuals may still need to compete with counterparts who have enough relevant work experience or specialized certifications in the field.

- Pursuing an MBA for investment banking may involve letting go of other opportunities, such as gaining practical experience through entry-level roles or pursuing certifications like the Chartered Financial Analyst (CFA) designation, which may offer more direct pathways to a career in investment banking.