Table Of Contents

Divesting Meaning

Divesting refers to the act of partially or entirely selling organizational assets to generate funds urgently. The urgency could be caused by a legal or regulatory compliance issue. It is also referred to as divestiture.

Companies adopt divestiture as a part of an exit strategy and retain only the profitable divisions. It is also a common practice in government restructuring. This is seen when a government sells off a segment to meet significant capital investment or to mitigate losses.

Table of contents

- Divesting Meaning

- Divesting is a strategic move in corporate restructuring. This is achieved by partially liquidating assets or by selling poorly performing organizational divisions.

- Business entities resort to divestiture when a specific unit is causing losses. Other reasons involve legal, political, social, and environmental causes potentially forcing a restructuring of a company.

- There are three ways a company can plan divesting: demerger, sell-offs, and equity carve-out.

- Divestiture backfires at times resulting in the decline of business sales, market value, and acceptability.

How does Divesting Work?

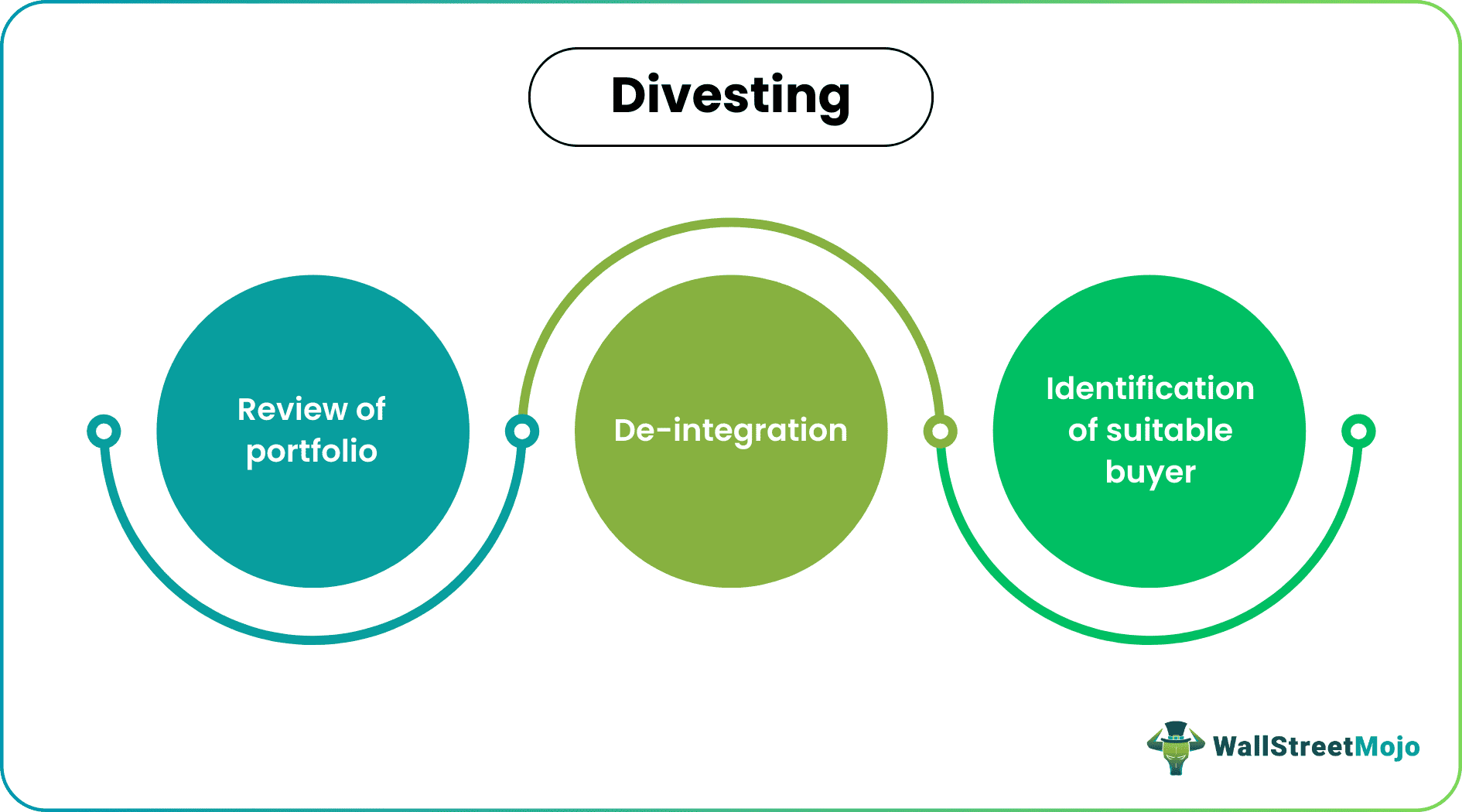

Divesting is simply a purposeful action that lets a company free up capital invested in certain poorly performing assets or business divisions. Sometimes segments of a firm come under legal pressure or regulation, initiating a divestiture. Subsequently, companies can pour the acquired funds into focused business lines to succeed. Owners often continue to keep such incompetent business units active. Some expect these divisions to perform well in the future; others are unaware of the divestiture process and its advantages. The basic steps involved in divesting are as follows:

- Review of Portfolio: Usually, it involves an assessment of the entire business portfolio. Each business unit's performance is analyzed. Additionally, a unit’s relevance to the company's long-term objective is ascertained.

- Identification of Suitable Buyer: Once a specific business unit is identified as part of the divestiture exercise, a suitable buyer is determined by availing an investment banking firm. Outsourcing helps in identifying a buyer.

- De-integration: Consequently, organizations then prepare a de-integration plan and convey the merits of such a divestiture. The purpose and benefits of the divestiture are highlighted. There is an attempt to send a positive message to both internal and external stakeholders.

- Executing the Divestiture: Finally, the business unit being sold undergoes valuation. Again, the selected investment banking firm executes this. (It is important to note that the valuation exercise is undertaken to determine if the price derived is at least equal to the opportunity cost of not selling the business unit). Consequently, the assets are sold off.

Divesting Explained in Video

Purpose of Divesting Assets

The primary purpose of divesting is to restructure the business investment and finance. The underlying need for restructuring is discussed below:

- Divesting enables businesses to focus on their core operations. The firm once again focuses on the niche where it holds expertise.

- It is a tool for monetizing assets. Divestiture usually results in a cash inflow.

- Companies evaluate the performance of all the divisions and divest those divisions whose internal rate of return is below the average or required rate of return.

- It is often done to improve shareholders’ value. Alternatively, firms are forced into a divestiture by regulatory authorities.

- Non-alignment with the primary niche also requires divesting of an asset.

- It keeps a check over the sustained underperformance of business units, denting the organization's overall profitability.

- The availability of better opportunities compared with the existing business lines also motivates management to divest current business endeavors and set up a new one.

Divesting Strategy

Before divesting, the management should be sure. Before taking such a huge step, other possible alternatives should be reviewed first. Another crucial part is selecting the path, i.e., the type of divesting to go for. It is essential to follow a systematic and structured process. A fair valuation must be executed, ascertaining the assets' acceptability among buyers. Divestiture is practically a slow process. Patience is another crucial requirement for divestiture; it may take a year or more to crack the deal.

Firms must ensure that divestiture is carried out by a team of skilled executives headed by a professional. Lastly, the customers cannot be overlooked; the management must successfully convey that this strategic decision is for the betterment of the organization and the clients.

Types of Divestitures

Depending on its need and purpose, the three most prominent forms of divesting are given below.

#1 - Equity Carve-Out

In this kind of divestiture, the company releases initial public offerings (IPOs) to initiate the partial sale of its business sectors, subsidiaries, or divisions. However, the parent organization is the major shareholder and holds complete control over the divested business unit.

#2 - Sell-Offs

The organization can sell out one or more business divisions, subsidiaries, or units. The reason behind such a decision can be a failure of a particular segment, the underperformance of a subsidiary, non-alignment with core functions, or excessive capital requirement.

#3 - Demerger

Splitting up a business unit is another method. When splitting up, the organization parts into two or more new independent corporations and the parent company's identity dissolves. Alternatively, a spin-off method can be followed. In a spin-off, the business entity subdivides into multiple subsidiaries, but the parent company persists in its operations.

Examples of Divestiture

Let us understand divestiture through an example. Assume that a Swiss Corporation operates in three business divisions,' namely clothing, automobile, and real estate. The company has an internal rate of return of 13%, 8%, and 15%, respectively, from its three divisions. Swiss Corporation has a required rate of return of 12%. In such a case, by divesting its automobile division, an 8% internal rate will be generated, and the company will be able to utilize the proceeds towards more profitable divisions. Ultimately this will result in a higher rate of return for the business as a whole.

Further, consider this real-world example reported by the Guardian. In 2017, Harvard University decided to divest its direct capital investment worth $42 billion in fossil fuels.

Harvard management took this massive step under the sustained pressure of alumni, students, and faculty. Ultimately it was a move towards an investment portfolio comprising green economy products.

Advantages and Disadvantages

Divesting can be a turning point for companies. It is a source of funds from non-business operations. But this, in turn, facilitates corporate expansion, focusing on core niches. Additionally, it is an opportunity to unload debts. Moreover, restructuring helps a company eliminate failing divisions. The freed-up funds are invested into profitable ventures. Ultimately, divestiture results in a higher return for the shareholders.

Despite various benefits, divestiture has certain limitations. In the absence of proper disclosure of such a strategy, the investors can presume it to be an adverse sign of poor corporate health and withdraw their funds from the company. Even clients and vendors can lose trust over a disinvesting organization and could shift to a competitor. Further, divestiture is a cost-intensive process where the company has to pay for various transition and transaction costs, including the fees for professional experts, employee severance pays, and asset transfer charges.

Divestment vs. Disinvestment

Divestment is nothing but the strategy of selling off some of the business divisions, assets, and investments to acquire funds. In this case, restructuring of the business entity takes place while its functioning is not affected.

With disinvestment, the company faces a reduction in its capital assets due to a loss. Alternatively, a company deliberately sells assets like buildings and equipment to pay off its lenders and shareholders caused by business failure or shutdown. Here, the organization is not in a state to reinvest the funds.

Frequently Asked Questions (FAQs)

Divestiture is the process of selling or transferring a significant chunk of business assets, division, investment, or subsidiary due to financial, political, or social reasons. Divesting can be done in various ways; its three crucial strategies are as follows:

1. Sell-offs

2. Equity Carve-out

3. The demerger, i.e., split-up and spin-off

A business entity usually divests its assets due to debts, bankruptcy, corporate restructuring, or niche streamlining. Sometimes it is done to reduce operational expenditure or to raise finance. In extreme scenarios, companies divest without wanting to, due to the pressure from regulatory authorities. Under duress, companies give up a division.

Liquidation refers to a business shutdown whereby the organization gives away all the assets to the lenders, debenture holders, shareholders, creditors, and other claimants. However, divestitures do not dissolve the organization. They only restructure companies by selling a part of the assets, investment, subsidiary, or division. This is followed by asset allocation and reinvesting.

Recommended Articles

This article has been a guide to what Divesting is and its meaning. Here we discuss divestitures types, purpose examples, advantages, disadvantages, and how it works. You may learn more about M&A from the following articles -