Table Of Contents

Subsidiary Company Meaning

A subsidiary company is controlled by another company, a parent or holding company. The control is exerted through ownership of more than 50% of the subsidiary's voting stock. Subsidiaries are either set up or acquired by the controlling company. In cases where the parent company holds 100% of the voting stock, the subsidiary company structure is referred to as a wholly owned subsidiary.

Subsidiaries have a separate legal entity from that of their parent company. They are independent in terms of their liabilities, taxation, and governance. Thus, a subsidiary company structure can sue and be sued separately from its parent. Nevertheless, due to the majority ownership, the parent has a major say in the election of the subsidiary's board of directors and its functioning.

Key Takeaways

- A subsidiary company is owned and controlled by another company, the parent or holding company. The control is exercised by owning over 50% of the subsidiary's voting stock.

- The controlling business either creates or acquires subsidiaries. The subsidiary firm structure is an owned subsidiary when the parent company owns 100% of the voting shares.

- Legally speaking, subsidiaries are distinct from their parent corporation. Therefore, they are independent regarding their obligations, taxes, and governance.

- A subsidiary company structure can bring a claim and be sued independently of its parent.

- Notwithstanding this, the parent significantly influences the election and operation of the subsidiary's board of directors because of its majority ownership.

Subsidiary Company Explained

A subsidiary company is when an existing company purchase controlling stakes in existing companies since these benefits help them in expanding their business at minimal risk. In addition, the parent-subsidiary relationship helps in locking the liabilities and credit claims of the subsidiary company structure, keeping the parent's assets safe. There could also be other specific synergies benefitting parents, for example, increased tax benefits, diversified risk, or assets like earnings, equipment, or property. The wholly owned subsidiary company, in turn, benefits from the brand reputation of the parent company and valuable resources.

Although the two companies are considered separate legal entities for liability purposes, they are considered single entities for reporting financials. Therefore, if the holding is >80%, the parent can gain valuable tax benefits and offset profits in one business with losses in another.

The legal costs involved in acquiring subsidiaries are usually less than mergers Further, the acquisition subsidiaries in foreign land results in tax benefits apart from easing business conditions with otherwise less cooperative countries. This helps increase market share and gain competitive advantage through economies of scale.

The separate legal entity of the subsidiary may help the parent company to gain tax benefits, track the results of a unit separately, segregate subsidiary risk from the parent company, prepare assets for sale, etc.

Features

Let us understand the features that facilitate the subsidiary company benefits and helps the parent company in more than one ways. This discussion would help us understand the concept in depth.

Larger parent-subsidiary structures may involve several subsidiaries, termed as a first-tier subsidiary, second-tier subsidiary, third-tier subsidiary, and so on.

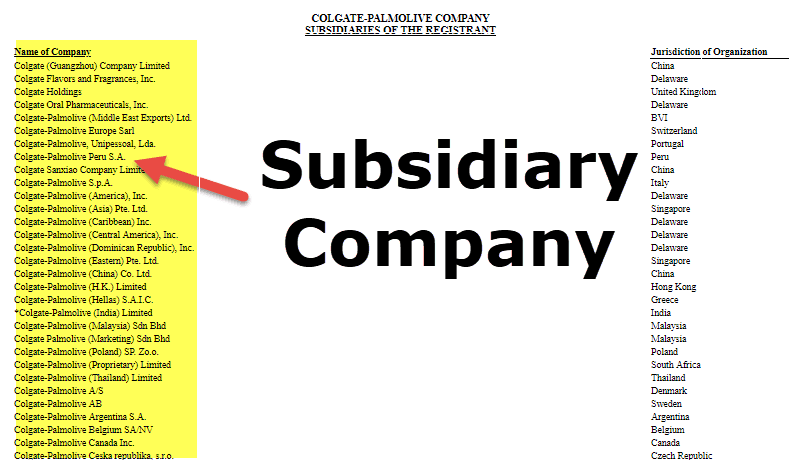

As shown in the subsidiary company example Figure 1, where any other company does not own the uppermost company in the tiered structure, the subsidiaries controlled by this company are first-tier subsidiaries. Where a first-tier subsidiary owns more than 50% of shares in another entity, this entity is referred to as a second-tier subsidiary and so on.

Examples

Let us understand the intricate details of a wholly owned subsidiary company with the help of a couple of examples.

Example #1 - Walt Disney

The Walt Disney Company has more than 50 subsidiaries. A partial list of subsidiary companies is provided below

You may check out the full list here

Example #2 - Nike Inc

Nike Inc has more than 100 subsidiary companies. The partial list of the subsidiaries is provided below.

You may have a look at the full list of the subsidiaries here

Difference Between Minority Passive Holding and Associate Company

These two types vary based on the percentage of ownership of the parent company and thereby the authority over the subsidiary company benefits. Let us understand other details through the explanation below.

- Subsidiaries are entities where the parent or holding company owns more than 50% of its voting stock.

- In contrast, if the parent holds 20%-50% of the voting stock of another company, that company is referred to as an associate company.

- Further, where the parent holds less than 20% of another company's stock, that investment is a minority passive investment.

In the case of a subsidiary company structure, financial statements of the subsidiary are merged with the parent's statements, and the consolidated financial statements are furnished along with standalone results in the audited financials of the parent.

For minority investments, the investment is categorized as a financial investment in the asset side of the parent's balance sheet. At the same time, dividends received are shown in the income statement under financial income.

Accounting Treatment

The consolidated financial statements need to incorporate all subsidiaries of the parent. During consolidation, all intra group balances, transactions, income, and expenses are eliminated. In addition, there must be uniformity in accounting policies for like transactions while combining the accounts.

- 100% of the wholly owned subsidiary company's income and expenses are included in the consolidated income statement. Any net income attributable to non-controlling interest of the subsidiary company structure is subtracted from the consolidated net income to get the net income attributable to the parent.

- On the same lines, 100% of the subsidiary's assets and liabilities are included in the consolidated balance sheet, and the non-controlling interest of the subsidiary is recorded as a separate line item under the equity section, labeling it as non-controlling in subsidiaries or minority interest.

- The purchase price of an acquired subsidiary above its fair value is reported as Goodwill in the Parent’s balance sheet and classified as an unidentifiable asset.

- For greater than 80% ownership, the parent must submit consolidated tax returns.

Consolidated and Unconsolidated Subsidiary Companies

Regulators require all parent companies to compile a list of wholly owned subsidiary companies. However, in some cases there might be exceptions. Let us discuss them through the discussion below.

- As per regulations, parent companies are required to consolidate all subsidiary financials. However, subsidiaries may remain unconsolidated in rare cases, like when a subsidiary company structure is undergoing bankruptcy wherein the parent cannot control the subsidiary's operations.

- Such firms are treated as equity investments and recorded in the same way as an associate investment is recorded in the parent company's balance sheet.

Subsidiary Company Structure and Other Business Combinations

The control, authority, and subsidiary company benefits are limited to the percentage of ownership of the parent company. Let us understand this aspect of the concept by understand this in combination with other business combinations.

Business combinations can be categorized as mergers or acquisitions, consolidations and special purpose entities.

While a subsidiary company structure has its own true identity and the existing organizational structure even after the acquisition by a parent or holding company, mergers result in absorption of the smaller company into the larger company which purchases it, resulting in the merging company ceasing to exist. Consolidation is the formation of a completely new company by combining two firms. At the same time, special purpose entities are created by sponsoring a firm for a special purpose or a project.

Valuation Issues in Cross Holdings- EV/EBITDA

Earnings before interest, tax, depreciation, and amortization (EBITDA) plays an important role in any company’s valuation. While considering subsidiary company benefits these numbers are closely looked at. Let us understand their importance through the explanation below.

Firms with cross holdings are faced with valuation issues like in the case of EV/EBITDA estimation. For example, when a holding is categorized as a minority holding, operating income of the holding company does not reflect the income of the minority holding. However, the numerator of the multiple includes the market value of equity which includes the value of minority holding, thus leading to an overvaluation of the parent's stock. Hence, the value of minority holding has to be subtracted to arrive at the correct EV.

In case of majority holding like for subsidiaries, the EBITDA includes 100% of subsidiary operating income, while the EV reflects only the portion of the holding belonging to the firm. This could give a misleading interpretation of low multiple, categorizing the holding company stock as undervalued. For consolidated holdings, adjustments would thus be required to exclude the value and operating income of the holding from the numerator and denominator, respectively.