Synergy in M&A | Types of Synergies in Mergers and Acquisitions

Table Of Contents

Synergy in Mergers and Acquisitions

Synergy is the concept that allows two or more companies to combine and either generate more profits or reduce costs together. These companies believe that combining gives them more benefits than being single and doing the same.

In this article, first, we will understand synergy, and then we will talk about the main emphasis of the article, i.e., types of synergies.

Let's get started.

What is Synergy in Mergers and Acquisitions?

Let’s talk about synergy in mergers and acquisitions in a different manner. First, we will directly illustrate how synergy in M&A works.

Let’s say that Company A and Company B decide to go for synergy. Since when we talk about synergy, we talk about mergers and acquisitions; let’s say that Company A and Company B merge because they believe that the decision to combine will enable them to reduce cost and increase profits.

They decided to merge because Company B produces the raw materials Company A uses to prepare the finished products Company A sells.

If they merge, Company A doesn’t need to look for a vendor, and sourcing raw materials would be seamless.

On the other hand, as a result of the merger, Company B doesn’t need to worry about sales and marketing. All they need to do is improve their processes to produce better raw materials for Company A.

In this case, the sum of Company A and Company B is better than individual Company A and Company B., And that’s why we can call this a synergy in mergers and acquisitions.

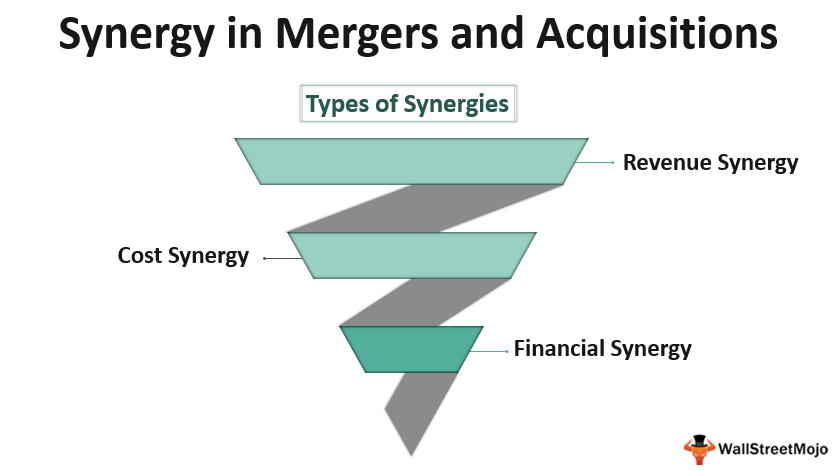

Types of Synergies

There are usually three types of synergies in mergers and acquisitions among companies. Let’s look at these different types of synergies so that we can understand how synergy works in different situations –

#1 - Revenue Synergy

This is the first of the three types of synergy in mergers and acquisitions. If two companies go through revenue synergy, they sell more products.

For example, let’s say that G Inc. has acquired P Inc. G Inc. has been selling old laptops. P Inc. is not a direct competitor of G Inc., But P Inc. sells new laptops cheaply. P Inc. is still very small in profit and size, but they have been giving great competition to G Inc. since it sells new laptops at a much lesser price.

As G Inc. has acquired P Inc., G Inc. has increased its territory from selling only used laptops to selling new laptops in a new market. By going through this acquisition, the revenue of both of these companies will increase, and they would be able to generate more revenue together compared to what they could have done individually.

And here lies the significance of revenue synergy.

Revenue Synergy Example

source: financhill.com

We note from the above example that Alaska Air acquired its smaller rival Virgin America for $2.6 billion. Alaska's Air management estimates the revenue synergies at $240 million.

#2 - Cost Synergy

The second type of synergy in Mergers is the cost synergies. Cost synergy allows two companies to reduce costs due to the merger or acquisition. If we take the same example we took above; we would see that due to the acquisition of P Inc., G Inc. can reduce the costs of going to a new territory. Plus, G Inc. can access a new segment of customers without incurring any additional cost.

Cost reduction is one of the most important benefits of cost synergy. In the case of cost synergy, the rate of revenue may not increase; but the costs would get reduced. In this example, when the cost synergy happens between G Inc. and P Inc., the combined company can save a lot of costs on logistics, storage, marketing expenses, training expenses (since the employees of P Inc. can train the employees of G Inc. and vice-versa), and also in market research.

That’s why cost synergy is quite effective when the right companies merge or one company acquires another.

Cost Synergy Example

source: gulfnews.com

We note that the merger between the National Bank of Abu Dhabi and First Gulf Bank will result in cost synergies of around Dh 1 billion. The cost synergies are expected to be realized over the next three years, driven by network and staff reductions, system integration, consolidation of common business functions, etc.

#3 - Financial Synergy

The third type of synergy in mergers and acquisitions is Financial Synergy. If a mid-level company borrows a loan from a bank, the bank may charge more interest. But what if two mid-level companies merge, and as a result, a large company goes to borrow the loan from the bank? They will get benefits since they would have a better capital structure and cash flow to support their borrowings.

Financial synergy is when two mid-sized companies merge together to create financial advantages.

For example, we can say that Company L and Company M have merged to create a financial synergy. Since they are mid-level companies, and if they operate individually, they need to pay a premium for taking loans from the banks or would never reduce the cost of capital. So that’s why the merger has turned out to be quite beneficial for both of these companies, and we can call it financial synergy in Mergers and Acquisitions.

Can these three types of synergies in M&A be achieved at the same time?

Now, this is the burning question. In an ideal world, these three can be achieved simultaneously.

But usually, the parties who decide to go for merger or acquisition aim for one or a maximum of two types of synergies.

No matter what they choose to achieve, the most important thing is whether the merger or the acquisition would turn out to be beneficial or not.

Aiming for synergy and achieving synergy in Mergers and Acquisitions are completely different things.

If both the companies decide to act together and their employees don’t resist the change, it is possible to benefit from the mergers or acquisitions. But in a few cases, employees of either of the companies cannot accept the sudden change in working structures, styles, environment, the center of control, etc.

As a result, not all the mergers or acquisitions turn out to create greater benefits.

Conclusion

Another important aspect in this regard is how one would understand whether to buy a company, sell one, or merge with another. To understand the opportunity, both the buyers and the sellers need to have a comprehensive understanding of the businesses they are in (or they want to be in shortly).

Understanding an opportunity to synergy in M&A isn’t easy to locate. It needs years of experience and a sense of market knowledge that only experienced business owners can have. Since the failure can be brutal, it’s always prudent to look at every possible factor before going for any merger or acquisition.

Recommended Articles

This article was the guide to synergies in mergers and acquisitions. Here we discuss the top three types of synergies in M&A along with practical examples. Here are the other articles that you may like –