Table Of Contents

Factory Cost Definition

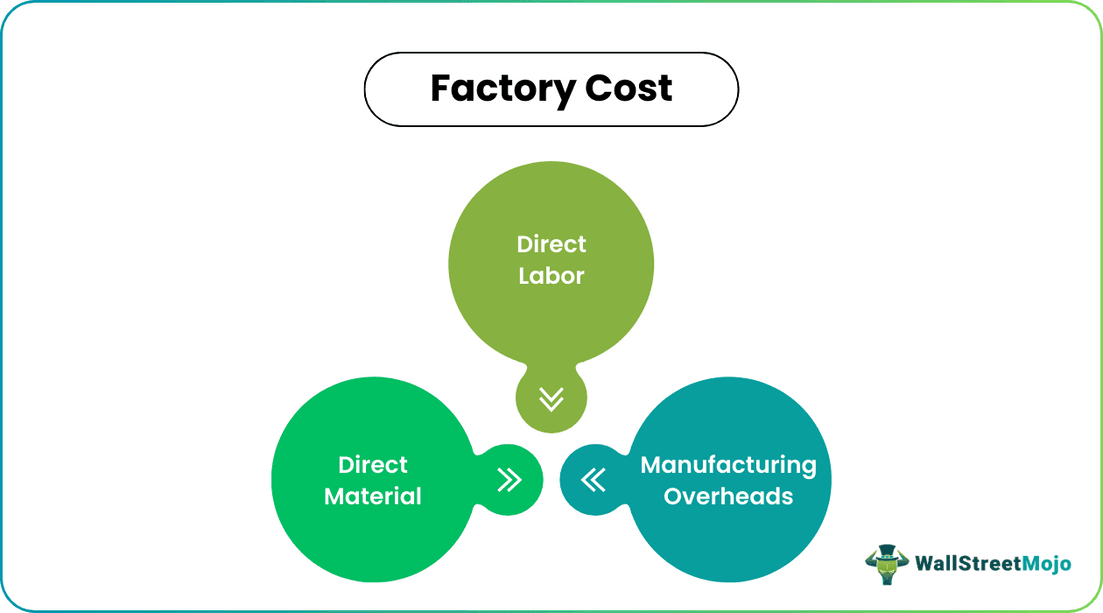

Factory Costs are the expenses incurred by the business to manufacture goods intended to be sold to the customers in the normal course of business and include all costs linked to production like direct material, direct labor, and other manufacturing overheads.

Factory Cost Categories

These costs are categorized into three different costs: they are:

#1 - Direct Material

These costs are associated with the procurement of materials required to produce goods. For example, suppose a company is in the business of car manufacturing. In that case, the direct material cost is the purchase of plastic, iron, etc. Still, if the plastic is purchased for any other purpose and not for use in manufacturing, then the same will not be considered a direct material cost.

#2 - Direct Labour

These costs include the wages and other benefits paid to the factory staff or the employees involved in manufacturing goods. For example, the worker's salary who works in the factory to manufacture goods is the direct labor cost, but the office staff salary is the administrative cost.

#3 - Manufacturing Overheads

These costs include all the directly linked to the production of goods except direct material and direct labor costs. An example of the same is the materials not directly allocated to the product but are used in products such as oil, glue, tape, power & fuel, etc. The wages are paid to the overhead manufacturing employee who is not working directly to manufacturing overhead. Still, they are also present in the factory for supervision and other things like a security guard, supervision employee, etc.

How to Calculate Factory Cost?

Traditionally, these costs are divided into three categories: direct material costs, direct labor costs, and manufacturing overheads. Now, to calculate this cost, the following steps can be used:

Step 1: Firstly, determine the total value of the direct material costs required to manufacture the goods. These are the costs of the material that are associated directly with the manufacturing of the company's goods. The formula for calculating the direct material cost is:

Direct Material Costs = Beginning Direct Materials + Direct Materials Purchases - Ending Direct Materials.

Step 2: Then, determine the total value of the direct labor costs required to manufacture the goods. These are the labor costs associated directly with the manufacturing of the company's goods. The formula for calculating the direct labor cost is:

Direct Labor Costs = Number of Direct Labor Hours * Hourly Rate of Direct Labor

Step 3: After that, determine the total value of the manufacturing overhead required to manufacture the goods. These are the costs incurred to run the factory but are not associated with a specific inventory unit. The manufacturing costs generally include Factory rent expenses, factory utility bills, Production supplies, Supervisor salaries, etc. So, to determine manufacturing overhead, all these costs are added together.

Step 4: Finally, the factory cost will be determined by adding the total value of the direct material costs, the total value of the direct labor costs, and the total value of the manufacturing overhead. So, the formula would be:

Factory Cost = Total Value of Direct Material Costs + Total Value of Direct Labor Costs + Total Value of Manufacturing Overhead

Example

Let's take the example of a company named Cloud incorporation, which deals with clothes manufacturing. The following are the details of the transactions by the company during the financial year 2019-20:

Solution:

Calculation of Direct Material Cost will be –

- Direct Material Cost = $550000 + $1000000 - $450000 = $1100000

Calculation of Direct Labor Cost will be –

- Direct Labor Cost = $20 * $100000 = $2000000

Calculation of Manufacturing Cost will be –

- Manufacturing Cost = $100000 + $50000 + $240000 = $390000

Calculation of Factory Cost will be –

The Factory utility bills, Production supplies, and Factory Rent paid are the expenses that are directly linked to the production, so it is included in factory cost. Moreover, the sales & marketing costs are part of selling & distribution overhead, and research & development expenses are part of research & development costs, so they are also not included in this cost.

Advantages

- These costs are the highest cost for producing goods that are to be sold in the market to generate revenue. Without incurring these costs, the business of any person cannot survive.

- These costs provide benefits of taxation as all the factory costs are deductible from the revenues to get the income on which the tax is to be paid.

- The manufacturing overheads included in these costs are generally fixed in nature. If the production is on a large scale, the manufacturing overheads remain the same. Therefore, it results in cost-cutting because by incurring the same manufacturing cost, more production of goods can be done.