Table Of Contents

What Is Product Cost?

Product cost refers to all those costs which the company incurs to create the product of the company or deliver the services to the customers, and the same is shown in the financial statement of the company for the period in which they become the part of the cost of the goods that the company sells. Direct material, direct labor, and factory overheads are its major types.

Product cost differs from period cost, which includes all indirect costs associated with production. They are called so as they are recorded for the period they are incurred. Some of the examples of period costs are marketing expenses related to production, legal costs, etc. Businesses use this calculated product cost to determine the prices of the products to make sure they do not undergo losses when they sell those items.

Product Cost Explained

Product cost is any cost that is directly linked with the production of goods. Such costs include expenses, like compensation, employee benefits, and payroll taxes. The wages on which the labors are hired for production also fall under the product expenses.

The cost of material and labor are the direct costs while the factory overheads are the indirect costs, all of which are required to create a finished good (or service) ready to sell from raw material.

As per GAAP and IFRS, the product costs are required to get capitalized as inventory in the balance sheet and should not be expensed in the profit and loss statements because the expenditures to such costs generate benefits and value for future periods.

Product costs are those that a business cannot do without as the expenses included are necessary ones. Calculating these costs helps businesses know the total costs they have to bear while producing a particular quantity of products. As a result, they plan their budget and try to adjust accordingly.

Moreover, when the costs related to production are clearly known, it helps businesses to price their products properly, ensuring the businesses do not incur losses.

Types

The product cost elements play a significant role in identifying what category the expenses belong to. The three types/elements associated with these costs are as follows:

#1 - Direct Material

The raw materials that get transformed into a finished good by applying direct labor and factory overheads are direct in cost accounting. Direct materials are those raw materials that can be easily identified and measured.

For example, an automobile manufacturing company typically requires plastic and metal to create a car. The amount of these resources can be easily counted or kept as a record. However, manufacturing a car also requires lubricants like oils and grease. Still, it is very difficult or insignificant to trace the low value of grease used in a particular vehicle hence referred to as indirect costs.

#2 - Direct Labor

Direct laborers are the employees or the labor force that gets directly involved in producing or manufacturing finished goods from raw materials. The direct labor costs are the salaries, wages, and benefits (like insurance) paid to these labor forces against their services.

For example, the workers in an assembly line of an automobile factory that weld the metal, fix the screw, apply oil and grease, and assemble pieces of metals and plastic into a car are direct laborers. However, for a particular employee to be classified as direct labor, it must be directly associated with a specific job. E.g., a secretary at a large automobile manufacturing company has to perform a variety of roles as and when required. Thus it gets difficult to quantify the number of benefits created by assembling a car. Hence it is not direct labor.

#3 - Factory Overheads

The indirect expense related to manufacturing a finished product that cannot be directly traced is the factory or manufacturing overheads. In other words, overheads are that cost that is neither direct material nor direct labor. That is why overheads are indirect costs that include indirect labor and material costs.

- Indirect Material - The materials used in the manufacturing process cannot be traced directly as raw materials are indirect materials. E.g., grease, oil, welding rods, glue, tape, cleaning supplies, etc., are all indirect materials. It is difficult and not cost-effective to determine the exact expense of indirect materials applied to a single unit of a product.

- Indirect Labor - The workers or employees required for the smooth functioning of the production process but do not get directly involved in creating a finished product are indirect materials. E.g., quality assurance teams, security guards, supervisors, etc., in the manufacturing premise are classified as the indirect labor force. The associated costs in their salaries, wages and other benefits are considered indirect labor costs.

- Other Overheads - The factory overheads that fall under the above two categories of factory overheads can be classified as other factory overheads. E.g., electricity expenses cannot be classified as material or labor. Similarly, costs like factory and equipment depreciation, insurance costs, property taxes on factory premises, factory rent or lease, the cost to utilities, etc.;

Note: The expenses that are not related to manufacturing a finished product or are incurred outside of the production facility should not be considered as product costs, for example, selling, general and administrative (SG&A) expenses. These costs generally get expensed to the income statement when they are incurred and do not get capitalized into the inventory value.

Formula

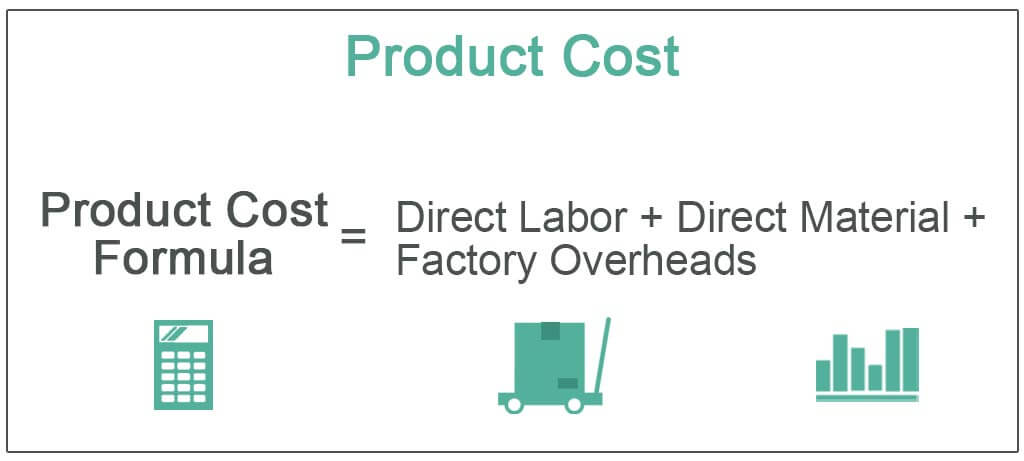

The product cost equation used to calculate these expenses has been mentioned below:

However, it is always better to calculate this cost per unit as it can help decide the appropriate sales price of the finished product. To determine this cost on a per-unit basis, divide this cost as calculated above by the number of units produced.

To avoid losses, the sales price must be equal to or greater than the product cost per unit. If the sale price is equal, it is a break-even situation, i.e., no profit or loss, and the sales price covers the cost per unit. On the other hand, a sales price higher than the cost per unit results in gains.

Examples

Let us consider the following examples to understand the concept and also understand how to calculate the product cost:

Example #1 - Direct Material Purchase Budget

A direct Material Purchase Budget is required to create a product. This purchases budget is required to calculate the amount of raw material that needs to be purchased for the production process and estimate the related costs.

Let's say Raymond's Pvt. Ltd, a small shirt manufacturing company, requires fabric, thread, and buttons. Consider the direct raw material to be just fabric, while the requirements of the other two materials cannot be directly tracked and are hence considered indirect.

The company targets to produce the following number of shirts in each quarter of the year. Data collected from the production budget:-

Raymond management collects the following details to create its direct raw material budget:

- The cost of fabric is $80 per kilo. The production department requires 500 grams (or 0.5 kg) of fabric to manufacture a single shirt.

- Management decides to store at least 10% of fabric for the following-quarter production requirements.

- At the beginning of the year (January-1), the opening value of the stock of fabric was 210 kilos.

- Assume the desired value of ending inventory is 250 kilos at the end of the year (quarter 4)

Use the following two accounting equations will help to create the budget:-

Total Raw Material = Raw Material Required for Production + Ending Raw Material Inventory.

Raw material to be Purchased = Total Raw Material Required – Beginning Raw Material Inventory.

Ending Note: The product cost related to direct materials can be determined through a budget that estimates the desired quantity of direct material required for a period and its related costs.

Example #2 - Direct Labor Budget

A direct Labor Budget is required to estimate the labor force requirements to produce the required units of goods per the production budget. Therefore, it calculates the cost based on labor hours and units produced per labor.

Assume that in Raymond's Pvt. Ltd:

- The time required by a sewing machine operator to stitch a single piece of shirt is 0.5 hours—also, other laborers need 0.2 hrs per shirt for buttoning and finishing work.

- The company costs $50 per hour for a machine operator and $15 per hour for other laborers.

Ending Note: The Direct labor budget calculates the cost related to the labor force engaged in the production process and estimates the required labor force in numbers. Thus management can anticipate hiring needs and budget its costs.

Example #3 - Factory Overhead Budget

The budget includes every cost related to the production process other than costs related to direct material and direct labor. The final costs determined as per the overhead budget are not capitalized under the balance sheet but expensed in the income statement as cost of goods sold.

Also, the overall cost determined under the overhead budget is converted into per unit terms to determine the cost of ending inventory. The ending inventory becomes a part of the balance sheet.

The budget for factory overhead costs of "Raymond's Pvt Ltd" is presented in the following table:-

Ending Note: The factory overhead budget helped the company's management estimate the variable and fixed factory overheads separately and helped determine the required amount of cash to be disbursed to meet overhead expenses.

Example #4 - Budget

The management of Raymond's has estimated its costs to direct material, direct labor, and factory overhead costs.

The most crucial step of the whole budgeting process is determining the overall and expected product cost per unit (shirt).

The management of the company adds all the components of cost together to reach the total product cost as presented below:-

Ending Note: The Product cost budget determines the overall expenses incurred by an entity to create a product on a periodical basis. The management can further calculate the cost per unit by dividing the estimated units produced as per the production budget.

By estimating the per-unit cost, the entity can set an appropriate sales price and avoid under-pricing or over-pricing its products. Both product under-pricing and overpricing bring losses to the entity.

- Under-pricing means the entity is charging less than the product cost -> Losses.

- Overpricing leads customers to look for substitutes ->, less demand, -> Losses.

In our example, quarterly, Raymond's management determines all product cost components, including direct material, direct labor, and factory overhead costs. With the help of this data, an overall cost is determined on both a quarterly and annual basis.

An average product cost per shirt of $103 is then determined by dividing the total annual product cost of $2.23 million by the annual production of 21720 shirts. The company should charge an amount higher than $103 per piece of its shirts.

Recommended Articles

This article has been a guide to what is Product Cost. Here, we explain the concept with the formula, its examples, and various types of it. You can learn more about accounting from the following articles –