Table Of Contents

What Is Manufacturing Overhead?

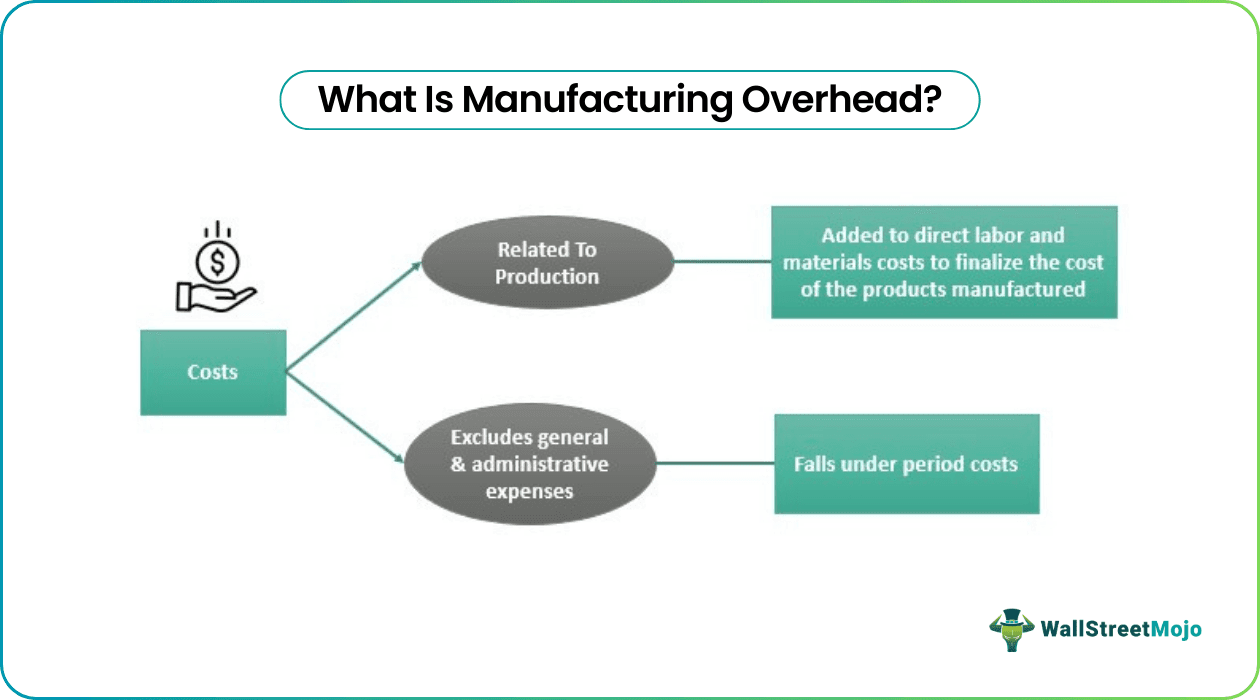

Manufacturing overhead refers to the indirect costs incurred in the manufacturing of products. It is assigned to every unit produced so that the price of each product can be derived. Such costs include rent of the manufacturing building or premises, depreciation, utilities cost in manufacturing, like electricity, water, gas, oil repairs, maintenance costs incurred in production, insurance, etc.

Businesses add the manufacturing overhead costs to the direct materials and direct labor costs incurred in the process of production to obtain an appropriate Cost of Goods Sale (COGS). These costs do not include general and administrative expenses. These general expenses become a part of period costs.

Key Takeaways

- Manufacturing overhead refers to the unintended costs incurred during the production of products. For the price of each product to be determined, it is assigned to every unit produced.

- There are two types of these overheads, fixed and variable. Variable overheads depend on the number of units produced, such as electricity bills.

- However, fixed costs do not depend on the number of units produced; they remain the same. Examples include rent and depreciation.

- They are tax-deductible, and it helps to concise costs during inflation.

- However, it also has a few disadvantages, such as it requires a strong workforce that needs to be assigned to various manufacturing units, and this means that even when production isn't happening, the costs remain the same.

Manufacturing Overhead Explained

Manufacturing overheads are those costs that are not directly traceable. This includes all indirect costs related to manufacturing activity. It does not indicate period expenses. Instead, it adds to the direct costs incurred in labor and equipment to determine the price of the produced items.

Types

The types of such overheads are - fixed and variable.

- Variable – It depends on the number of units produced. The cost changes if the number of units changes. Such expenses include sales commission, electricity, water, etc.

- Fixed – These costs do not change even when the number of units produced changes. For example, rent, depreciation, insurance, property taxes, and other costs involved with the production units and tools used.

Formula

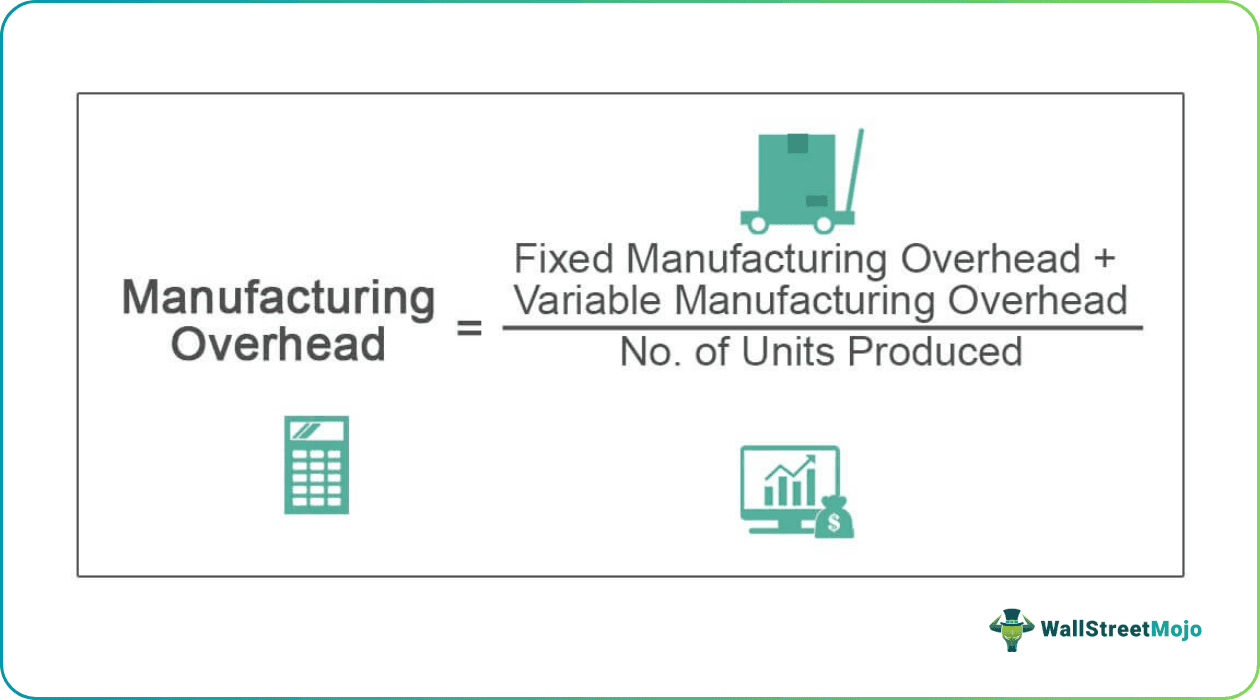

The manufacturing overhead formula is as follows:

Manufacturing Overhead = Fixed Overhead + Variable Overhead / No. of Units Produced

Calculation Examples

Let us consider the following manufacturing overhead examples to understand how to calculate it:

Example #1

Below is the manufacturing overhead statement of Alfa Inc. for 2018, where the company has an estimated overhead of 9000, 10000, and 11000 units. The company has some variables and some fixed overhead in the information below. The variable overhead depends on the number of units, whereas fixed overhead remains fixed irrespective of the number of units manufactured.

Below are the variable overhead expenses of the company

- Indirect Material cost = $1 per unit.

- Electricity Expenses = $0.50 per unit.

- Royalty Expenses = $0.25 per unit.

- Other Indirect Material Cost = $2 per unit.

Below are the fixed overhead expenses of the company

- Factory Rent = $10,000.

- Depreciation on Plant, Machinery, and Equipment = $5,000.

- Insurance for Manufacturing Activity = $1,500.

- Property Tax = $1,800.

- Other Fixed Overhead Expenses = $500.

Let us see how to calculate manufacturing overhead for 9000 units of production:

Similarly, let's calculate for 10000 and 11000 units of production.

In the above statement, the total variable cost of the company is $33,750 for 9000 units, $37,500 for 10000 units, and $41,250 for 11000 units, but the total fixed cost is $18,800 for any number of units that it produces.

Example #2

Below is an example of manufacturing overhead for Mercedes-Benz Cars. In 2018, the company manufactured 1000 units of Cars.

Below are the expenses of the company.

- The company has purchased $500 million of material, of which $100 million is for indirect material.

- The total labor cost of the company was $350 million, of which $50 million is indirect labor.

- Power, fuel, and electricity expenses incurred by the company were $80 million.

- The company's comprehensive insurance was $20 million, of which $5 million was for other than manufacturing activity.

- Depreciation of plant, machinery, and equipment was $5 million.

- Research & development expenses incurred $5 million.

- Selling & distribution expenses incurred $10 million.

- Repair & maintenance expenses of $15 million.

In the above examples, research and development of $5 million and sales & distribution expenses of $10 million are unrelated to manufacturing activity. Therefore, these expenses are not considered in the manufacturing overhead of Mercedes-Benz.

Advantages

- Considering overhead as a part of the cost of each product helps price the product effectively.

- It is tax-deductible. A company should identify all these costs as part of its manufacturing expenses as it reduces the taxable income and lower the tax burden.

- It helps to control the cost in the inflationary market by controlling the manufacturing cost. Failure to control overhead costs could increase the product cost.

- Assigning the overhead with products allows management to better plan, budget, and price products.