Table Of Contents

What Is Manufacturing Overhead?

Manufacturing Overhead is a kind of cost incurred in manufacturing the product, but those costs shall be indirectly associated with the process of manufacturing the product. The costs could be fixed, variable, or semi-variable. It includes the depreciation on equipment and machinery, indirect overheads such as indirect labor, indirect material, electricity, insurance, and repairs.

A fixed manufacturing overhead formula helps a manufacturing unit maximize efficiency in its production process as this process is its primary revenue source. It also allows them to use and reuse materials at their fullest potential and routine maintenance checks are encouraged to ensure machines are in pristine condition to keep the production plan on track.

Manufacturing Overhead Formula Explained

Manufacturing Overhead are the costs incurred, irrespective of the goods manufactured or not. These are mostly fixed in nature and occur along with the start of the production unit.

For any business, efficiently managing the inflow and outflow of funds in the core revenue-generating activity is a priority. Therefore, for production units, this function acts as the top priority to ensure their process is at its efficient best.

It generally includes rent of the production unit, wages, and salaries paid to factory employees and managers, quality department employee’s expenses, people who inspect the products, electricity, sewer, etc., for operating manufacturers' equipment, property taxes, and insurance for the production unit. Simply taking a sum of that indirect cost will result in manufacturing overhead.

Against the contrary perception that the allocated manufacturing overhead formula is only related to cutting costs and promoting frugal spending. However, it also promotes regular maintenance checks, reviewing processes for constant development, and optimal usage of resources as well.

These additional checks and processes help the company better its resources to a point where their pristine conditions not only give them enough production but also save costs relating to repair and replacements as well.

Formula

Let us understand the fixed manufacturing overhead formula that shall act as a basis for all calculations relating to this factor.

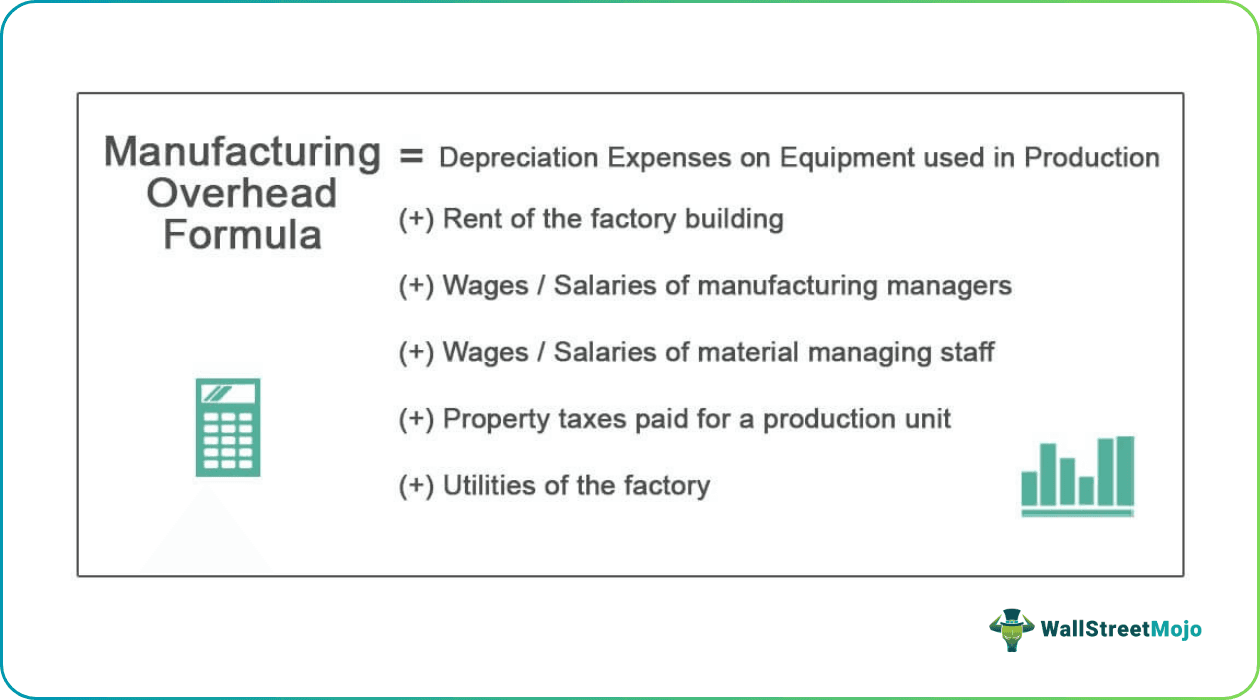

Manufacturing Overhead Formula = Depreciation Expenses on Equipment used in Production

(+) Rent of the factory building

(+) Wages / Salaries of manufacturing managers

(+) Wages / Salaries of material managing staff

(+) Property taxes paid for a production unit

(+) Utilities of the factory

NOTE: The above list is not exhaustive, it shall depend on case to case, and there could be another indirect cost which is incurred solely for the production unit, and those have to be considered while calculating the manufacturing overhead.

Examples

Let us understand the concept of a fixed and allocated manufacturing overhead formula with the help of a few examples. These examples shall give us a practical overview of the concept and its related factors.

Example #1

Product JM is prepared, and it incurs a lot of overhead costs. The production head gives the details as below:

- Rent of Production Property: 100000.00

- Depreciation on Plant & Machinery: 50000.00

- Depreciation on Office Building: 30000.00

- Property Taxes on Production Unit: 5000.00

- Salaries of Production Staff: 75000.00

You are required to calculate manufacturing overhead based on the above information.

Solution

Use the above-given data for the calculation of manufacturing overhead.

Therefore, the calculation of manufacturing overhead is as follows,

Manufacturing Overhead will be -

NOTE: We shall ignore the depreciation on office building as it is not incurred indirectly for the production unit.

Example #2

Samsung Inc. is planning to launch a new product called A35 and is deciding upon the product's pricing as the competition is fierce. The production department has provided the finance head with the details of the existing model A30, which is equivalent to A35.

- Direct Labor: 176225

- Direct Material: 310023

- Rent of Production Property: 142830.00

- Depreciation on Plant & Machinery: 71415.00

- Property Taxes on Production Unit: 7141.50

- Sales and Administrative Cost: 78599.00

- Salaries of Production Staff: 107122.50

- Utilities for Manufacturing Unit: 332131.00

- Total Cost for A30: 1225487.00

The finance head has asked the cost accountant to calculate the overhead cost, which shall be incurred for A35 and costing purposes even if one unit is still not manufactured.

Based on available information, you are required to estimate the cost the finance head expects.

Solution

The finance head refers to indirect overhead cost, which shall be incurred irrespective of whether the product is manufactured.

Therefore, the calculation of manufacturing overhead is as follows,

= 71,415.00 + 1,42,830.00 + 1,07,122.50 + 7,141.50 + 3,32,131.00

Manufacturing Overhead will be -

NOTE: Direct costs are associated with units produced, and sales and administrative are office expenses and hence have to be ignored during computation of factory overhead.

Example #3

You are required to compute the Manufacturing Overhead. A common size production sheet is available from the ABC motors inc annual report. The analyst is trying to compute the total factory overhead cost.

- Rent of Production Property: 10.00%

- Depreciation on Plant & Machinery: 25.00%

- Property Taxes on Production Staff: 4.00%

- Salaries of Production Staff: 13.00%

- Production Sunk Cost: 7.00%

Solution

The below percentage was based on gross revenue and gross revenue for that period was 45,67,893.00

Therefore, the calculation of manufacturing overhead is as follows,

=456789.30+1141973.25+182715.72+593826.09+319752.51

Manufacturing Overhead will be -

Relevance And Uses

Many startup or single-owned businesses, while pricing the products, fail to make a profit as most of them, while pricing the product, consider the competition level and only try to recover the variable cost, which is a direct cost.

Hence, the manufacturing overhead or factory overheads must be considered and taken into account while pricing the product and should be recovered to make the firm profitable. These are the costs incurred to make the manufacturing process keep going. Further, office expenses should not be included in the factory overheads.