Table Of Contents

What Is Business Risk?

Business risk is the risk associated with running a business. The risk can be higher or lower from time to time. But it will be there as long as you run a business or want to operate and expand.

Multi-faceted factors can influence business risk. For example, if a firm isn’t able to produce the units to make profits, there is a considerable business risk. Even if the fixed expenses are usually given before, there are costs that a business can’t avoid – e.g., electricity charges, rent, overhead costs, labor charges, etc.

Key Takeaways

- Business risk pertains to the inherent uncertainties and potential hazards that a business may encounter. The degree of risk associated with operating a business or undertaking expansion efforts can vary, but it is a constant factor.

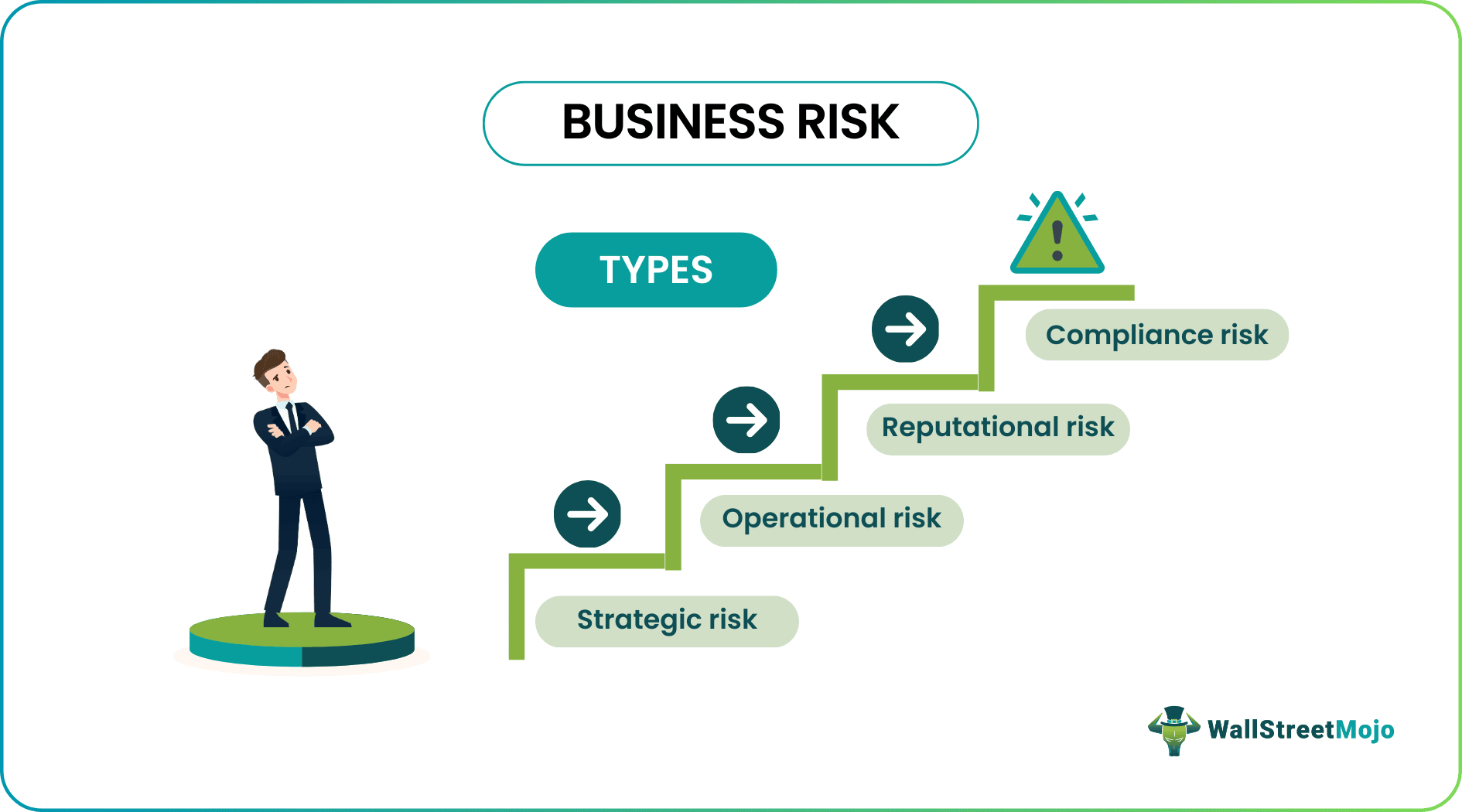

- Strategic, operational, reputational, and compliance risks constitute various types of business risks.

- Enhancing business profitability necessitates prudent cost reduction, focusing on non-essential expenses.

- Companies are advised to establish a balanced capital structure that mitigates the burden of substantial monthly debt payments.

Business Risk Explained

Business risk refers to the possibility of the organization facing adverse situations and any uncertainties in their daily operations which might affect the overall health and soundness of the business. It helps in measuring the probability of disruption that destroys the competitive position and their ability to grow and expand.

This kind of risk is a natural part of any business and cannot be avoided at any cost. However, there are ways and means to do business risk management, that is to identify and control they to a great extent.

They may arise due to both external and internal reasons, which may include operational inefficiency, system error, human error, weak management, economic and political problems, natural disasters or change in market conditions.

In order to manage high business risk, the company should implement strategies and techniques to minimise its impact and effectively navigate its negative effect and continue to attain its objectives.

Types

Since business risk can happen in multi-faceted ways, there are many business risks. Let’s have a look at them one by one –

#1 - Strategic risk

It is the first type of business risk. Strategy is a significant part of every business. And if the top management isn't able to decide the right strategy, there's always a chance to fall back. For example, when a company introduces a new product to the market, the existing customers of the previous product may not accept it. The top management needs to understand that this is an issue of wrong targeting. The business needs to know which customer segment to aim at before introducing new products. If a new product doesn’t sell well, there’s always a more significant business risk of running out of business.

#2 - Operational risk

Operational risk is the second necessary type of business risk. But it has nothing to do with external circumstances; instead, it’s all about internal failures. For example, if a business process fails or machinery stops working, the business won’t be able to produce any goods/products. As a result, the business won’t be able to sell the products and make money. While strategic risk is pretty challenging to solve, operational risk can be solved by replacing the machinery or providing the right resources to start the business process.

#3 - Reputational risk

It is also a critical type of business risk analysis. If a company loses its goodwill in the market, it is a big chance to lose its customer base. For example, if a car company is blamed for launching cars without proper safety features, it would be a reputational risk for the company. The best option, in that case, is to take back all the cars and return each one after installing the safety features. The more accepting the company would be, in this case, the more it would be able to save its reputation.

#4 - Compliance risk

It is another type of business risk. To run a business, a business needs to follow certain guidelines or legislation. If a business cannot follow such norms or regulations, it is difficult for a business to exist for long. First, it's best to check the legal and environmental practices before forming a business entity. Otherwise, the business will face unprecedented challenges and unnecessary lawsuits later on.

Causes

Some factors that may result in a business risk are as follows:

- Intense market competition within the sector can lead to risk. Competitors offer same types of products leading to price war and lower profitability.

- Rapid technological changes can disrupt the business and the existing method of operation mey become obsolete. If companies fail to adopt the innovative strategies, they lose the market share and business fails.

- Rules and regulations, legal requirements, penalties, damage to reputation can disrupt the business.

- Any problems arising out of operations issues like supply chain disruption, human errors, system security breaches, equipment failure, natural disasters, etc affect the working of the business.

- If the financial management process is not steady and strong, due to high debt and collection of receivables are pending, the business may not be able to meet the day-to-day expenses. The credit period given to customers and method of collection plays a role in managing the cash flows. There are also interest rate and currency fluctuations, which impact financial stability.

- Political and economic instability, changes in government and its policies, global policy changes and disturbances can create business risk in the domestic market.

Thus it is extremely crucial b for businesses to be able to understand what are the causes of risk and try to identify them at early stages for better business risk management.

Example

Let us take the example of ABC Ltd, which is a cosmetics manufacturing company operating in the market for almost a decade. It has made quite a mark in the domestic market with its wide range of fashionable products for all age groups.

However, some research suddenly revealed that a chemical that is very commonly used in one of its high value products contains properties which are very harmful for health. This news spread very fast in the industry resulting in a drastic downfall of the entire cosmetics segment and people started switching to natural and chemical free products, which are very less in number in ABC Ltd’s product range.

Thus, the company started losing its customers rapidly and ended in losses. This example shows an external risk that lead to the downfall of the business, which could be avoided had the company properly researched its raw materials before starting to use them.

How To Measure?

Business risk can be measured by using ratios that fit a business's situation. For example, we can see the contribution margin to find out how much sales we need to increase to increase the profit.

One can also do business risk assessment by using operating leverage ratio and degree of operating leverage to help find out the company's business risk.

But it differs as per the situation, and not all situations will suit similar ratios. For example, if we want to know the strategic risk, we need to look at a new product's demand vs. supply ratio. If the demand is much lesser than the supply, there’s something wrong with the strategy and vice versa.

How To Reduce?

- First, the business should reduce costs as much as possible. Some costs are unnecessary for businesses. For example, instead of hiring full-time employees, a considerable cost would be reduced if they hire employees on a contract. Another example of cost reduction might be using the shift formula. If the business works 24*7, and the employees work on shifts, the production every month would be huge, but the cost of rent would be similar.

- Second, the business should construct its capital structure so that it doesn’t need to pay a hefty sum of money every month to pay off the debt. If a business assumes that its business risk analysis is going through the roof, it should be trying to create a capital structure through equity financing only.

Business Risk Vs Financial Risk

The above two types of risk are very different from each other but are interconnected. Let us try to identify the differences.

- The business risk assessment relates to risk connected with the entire company operations as a whole where the latter is only related to financial problems.

- The former affects the profitability, market share, competitiveness, etc but the latter affects only the capital structure, cash flow and financial strength.

- The former results due to factors like competition, technological change, economic problems or legal issues, etc but the latter is due to debt level, interest and currency fluctuation, credit risk, liquidity problem, etc.

- The business risk assessment helps in identifying the factors that affect the overall health of the company whereas the latter affects only the financial health of the company.

However, it should be noted that the financial risk is a part of the business risk and thus both of them are strongly connected to each other. In order to handle the former, it is necessary that the company is financially sound and strong.