Table Of Contents

What Is A Merger And Acquisition Strategy?

Merger and Acquisition Strategy is a process in which one corporate buys, sells, or combines with the other corporate to achieve certain goals and attain rapid growth in the competitive market. The process takes into consideration different factors like market value of corporate’s stock, the financial health of both the companies, threats of both the companies, new opportunities arising along with market conditions.

It gives the parties involved in the mergers and acquisition deals to achieve one or the other thing in return. Some of them include diversified product lines, business expansion, increased competency, acquiring experts and new technologies, enhanced market share, etc.

Key Takeaways

- Merger and acquisition strategy refers to an approach adopted by an organization to merge with or take over another organization.

- There are different types of mergers and acquisition strategies, for example, horizontal, conglomerate, and vertical. Companies should select a strategy based on the analysis of some key factors, which include industry, company size, and geography.

- There are various advantages of correctly implementing an M&A strategy. For example, both companies can enjoy financial benefits, like improved profits.

- Moreover, it allows the resulting company to gain a competitive edge in the market and explore new markets and opportunities.

Merger and Acquisition Strategy Explained

Merger and Acquisition is a strategy that is applied by businesses when they see the benefits of merging or acquiring firms. In the process, the bigger companies in the market hunt for smaller companies for the acquisition process. Companies have different policies for mergers & acquisitions like expanding an existing business, research, development, etc. All these policies should be kept in mind while entering the M&A Strategy by both companies. Failure to implement proper planning, study, and lack of strategies, also fails the merger & acquisition strategy. The resulting company cannot survive in the long run. Hence, proper planning, understanding of the market and the business of both companies, and proper strategies should be done well in advance before implementing merger & acquisition strategies.

Many small and big companies prefer merger and acquisition strategies to fight or survive in the competitive environment in the market. Loss-making companies or small companies always prefer to merge with big companies to save themselves and stand in the market. However, if there is a lack of proper planning and strategies, the mergers and acquisition strategies also fail. Hence, both companies should undertake a thorough study and the proper analysis to make the strategies successful without any failure.

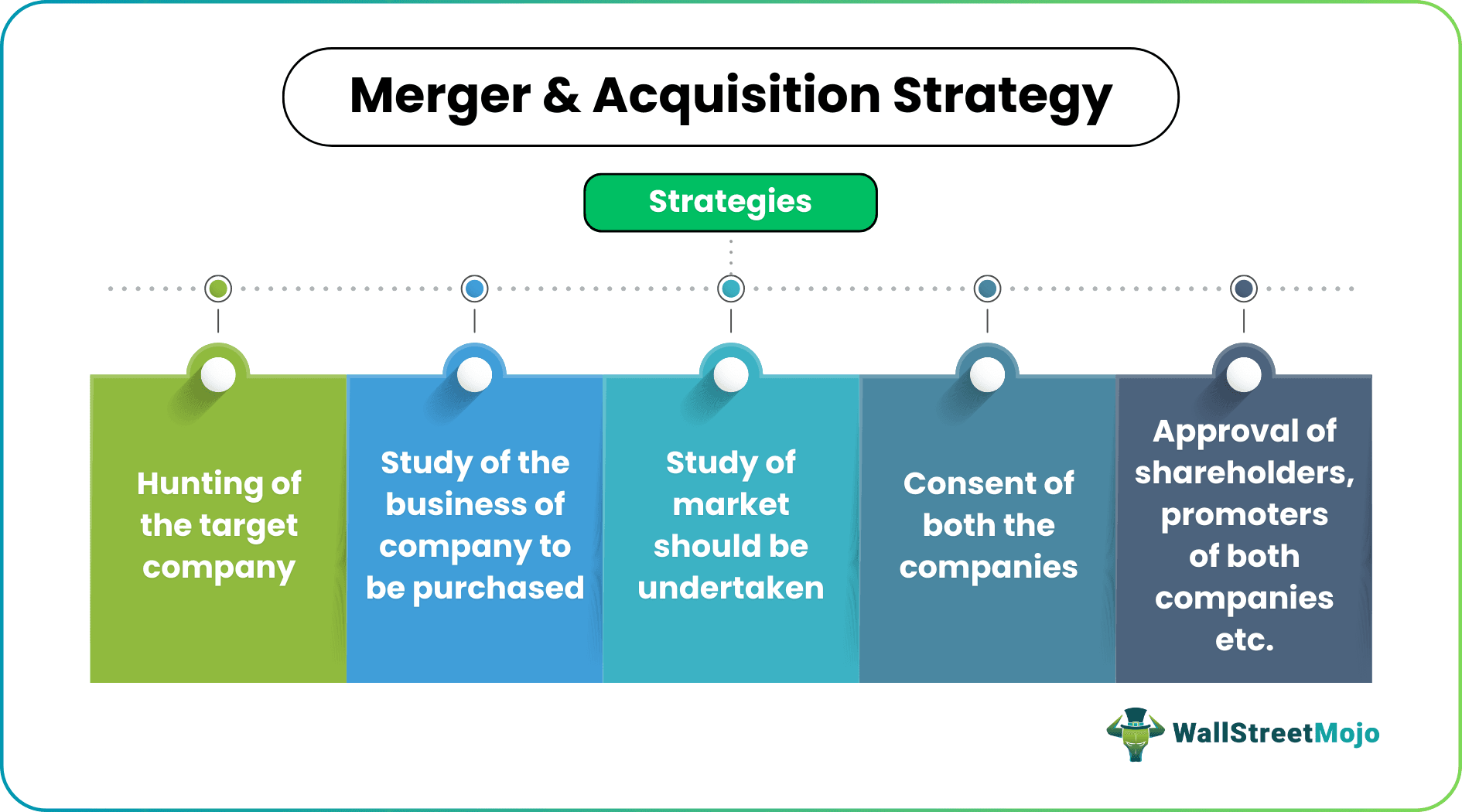

As soon as the mergers and acquisition is adopted, the process gets divided into several steps, which include the following:

- The most crucial strategy of M&A is the hunting of the target company. Once the company has decided on its target company for acquisition, it can plan further acquisition steps.

- The next step is a thorough study of the business of the company to be purchased. The study of the expected business, demand, and future growth is also to be undertaken. It will also give an idea of the risks involved in the acquisition or future business.

- Next, the study of the market should be undertaken. It will give the idea of growth factors in the market. The company can also get an idea of future opportunities, trends in the market, and customers' demands.

- There should be the consent of both the companies, i.e., the acquiring company and the target company, to take part in the merger and acquisition before implementing the strategy.

- Plans and strategies should also be studied, including staff involving process, work environment, and work to be done by the staff by gathering knowledge and information.

- Finally, there should be shareholders, promoters of both companies, management, and other key persons of both companies. Then, the merger & acquisition deal should be finalized.

Types

Mergers and acquisitions strategy is of multiple types. Depending on the requirements, purpose, and benefits of the mergers or acquisitions, the companies decide whether to go for M&A and if yes, which type of it should it be.

Listed below are the types of M&A strategies:

#1 - Vertical Strategy

This is the strategy where one company chooses to merge with or acquire another firm that is part of the same supply chain but operates at a different stage. These two entities merge and integrate the items they offer to consumers. For example, a car manufacturing company A merges with the same car distributor company B, which becomes operational at a later stage.

#2 - Horizontal Strategy

This M&A strategy is evident when one company merges with or acquires another firm that operates in the same domain. It is normally a measure adopted to reduce competition in the market.

#3 - Conglomerate Strategy

This strategy is observed to be adopted when two companies operating in two completely different niches collaborate. In this strategy, the companies either continue operating in their own markets or adopt a mixed approach whereby they opt for market extensions. Diversified business and a larger market share lead to enhanced revenue generation.

#4 - Market Extension Strategy

As the name implies, this strategy gives entities dealing in similar products but different markets to collaborate and have an extended market to reach more customers.

#5 - Product Extension Strategy

Unlike market expansion, this strategy allows entities dealing in different products but same market to merge together. This way, they have diverse products and services to offer to customers in that market.

If you wish to enhance your understanding of mergers and acquisitions and other key financial concepts, you can take this Financial Planning & Analysis Course. The program covers an extensive range of topics to help you gain the skills and expertise required to build a successful career as a finance professional

Examples

Let us consider the following examples to understand the definition of merger and acquisition strategy and how it works:

Example #1

The most common and famous example of merger & acquisition is Google and Android. Google is the master company in the IT industry and search engine, whereas Android was a start-up company struggling to exist in the mobile phone market. Android was also not much known in the telecom or IT industry. Hence, Android was taken over by Google for $50 million. At that time, Microsoft led the market due to its Apple iPhone and Windows mobile products. After the acquisition of Android by Google, 54.5 Percent of U.S. smartphone Subscribers became users of Google Android devices. The report was based on the May 2018 data.

In this example, the small company Android was taken over by large company Google to meet the competitive edge, which Windows created from its products like iPhone and Windows Mobile.

Example #2

In May 2023, CVS Health, one of the major healthcare service providers, announced that it would no longer focus on mergers and acquisitions, but rather emphasize integrating required products and services of other players in the industry. The two mentions that the ace made were of Signify Health and Oak Street Health.

CEO Karen Lynch said that the company may think of integrating the above-mentioned firms with other businesses it owns in the near term. Meanwhile, it would be purchasing the required items from the other players in the healthcare sector.

This shows mergers and acquisition strategy is applicable only when it is more fruitful than other options available to the corporate players.

Benefits

Companies undergo mergers and acquisitions as there are many benefits to doing so. Let us have a look at the reasons below to understand why companies opt for M&A options:

- They are popular due to their advantages, including the business efficiencies and performances of both companies. As two companies get combined and carry on the single business, the ideas from the businesses of both companies emerge, and the resulting company formed as the result of merger and acquisition attains many financial benefits in terms of profits.

- As both companies carry on a single business, the staff and other costs relating to both companies get reduced, and these costs apply to only one resulting company. Also, the company's purchasing power improves due to improvement in negotiation power. As there is a combined business, the production volume increases, resulting in a reduction of production per unit cost.

- The resulting company formed due to merger and acquisition gains a much competitive edge from its peers because it is well equipped with better technology, better workforce talent, and better resources.

- The network of the resulting company formed as a result of merger and acquisition gets improved, and hence market reach also gets easy for the resulting company. Because of this, the company gets new shareholders, new sales opportunities, and new areas to explore.

- Hence, considering the above benefits of mergers and acquisitions, these strategies are very popular. The market value of the resulting company formed as a result of merger and acquisition gains a much better market share making it eligible to survive in case of challenging situations in the market. The resulting company also enjoys new technological benefits and updates.

How To Choose A Merger And Acquisition Strategy?

Choosing the right M&A strategy requires companies to consider some key factors, which are as follows:

- Company Size: If an organization is large in size, it can consider pursuing multiple M&A opportunities simultaneously and opt for complex strategies. That said, for small companies, experts usually recommend choosing a straightforward strategy.

- Geography: When planning to enter new markets through an M&A deal, companies must evaluate the conditions associated with the markets. This means organizations must factor in the consumer behavior, regulations, besides other elements. Only then can an organization ensure that it chooses an M&A strategy that is in line with its growth goals.

- Cultural Fit: When picking an M&A strategy, factoring in the culture of the other organization is vital. This is especially important when considering the selection of horizontal transactions for merging with or acquiring direct competitors. When there is a cultural fit, carrying out operations once the deal is complete becomes easier.

- Industry: The industry in which a company operates has a significant influence on the choice of M&A strategy. For example, for a company in an industry that is highly competitive, opting for a horizontal strategy can help in eliminating rival companies. This, in turn, can improve market share. That said, in an industry that involves a complicated supply chain, a company may consider choosing a vertical strategy for cost-saving efficiencies.