Table Of Contents

Acquiree Meaning

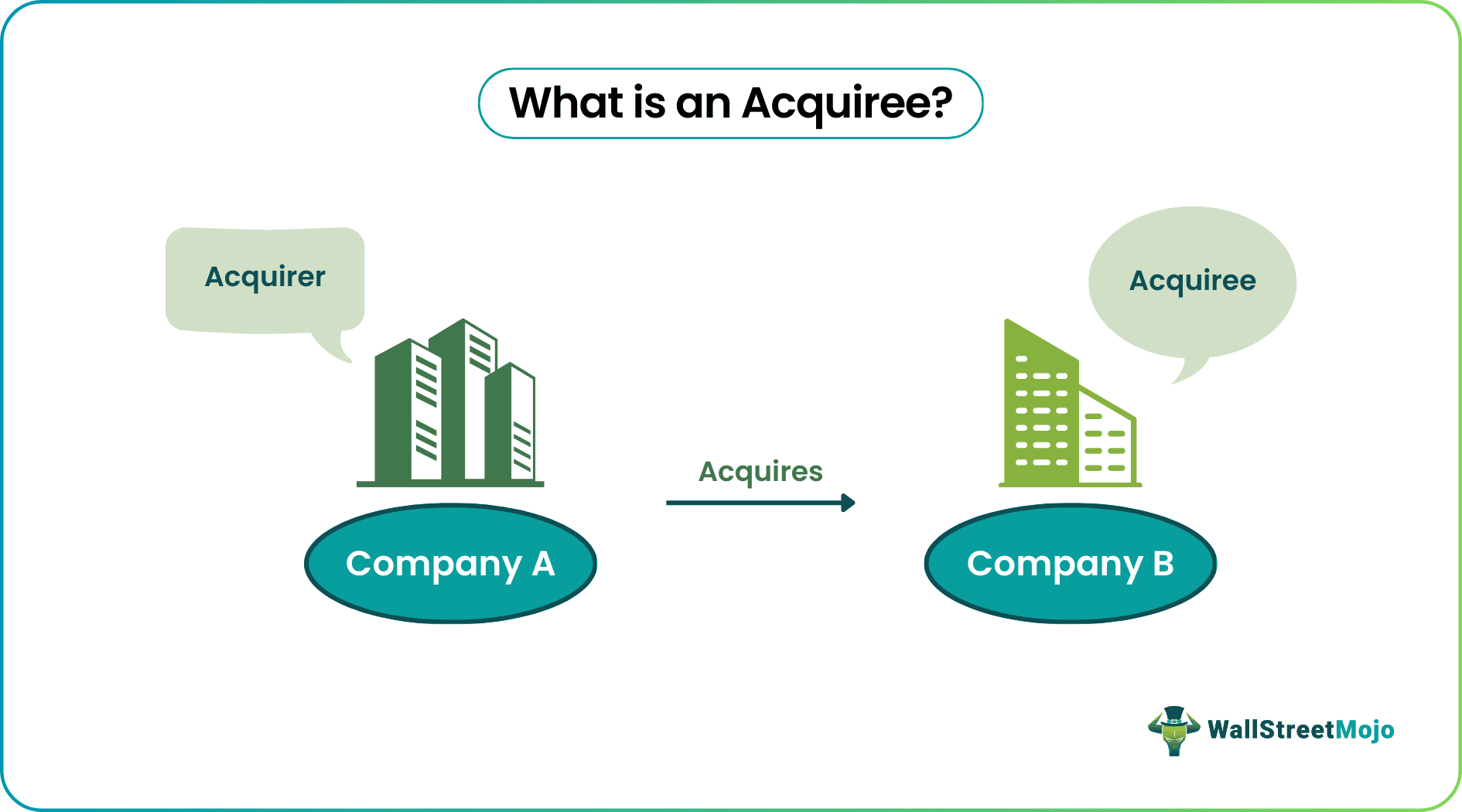

The acquiree, also known as the target company, is the one taken over by the acquirer company in a merger and acquisition transaction. It is usually the smaller two companies unless it is a merger of two companies of equal stature.

The company that is ready to acquire is an acquirer, while the one that is to be acquired in the process is an acquiree. When the acquirer acquires an acquiree company, acquisition occurs. Though the acquirer and acquiree are participants in the process, the former becomes supreme after acquisition.

Table of contents

- Acquiree Meaning

- The acquiree, also known as the target company, is the entity being acquired in a merger and acquisition transaction.

- Typically, the acquirer company is larger than the acquiree unless it is a merger between companies of equal size.

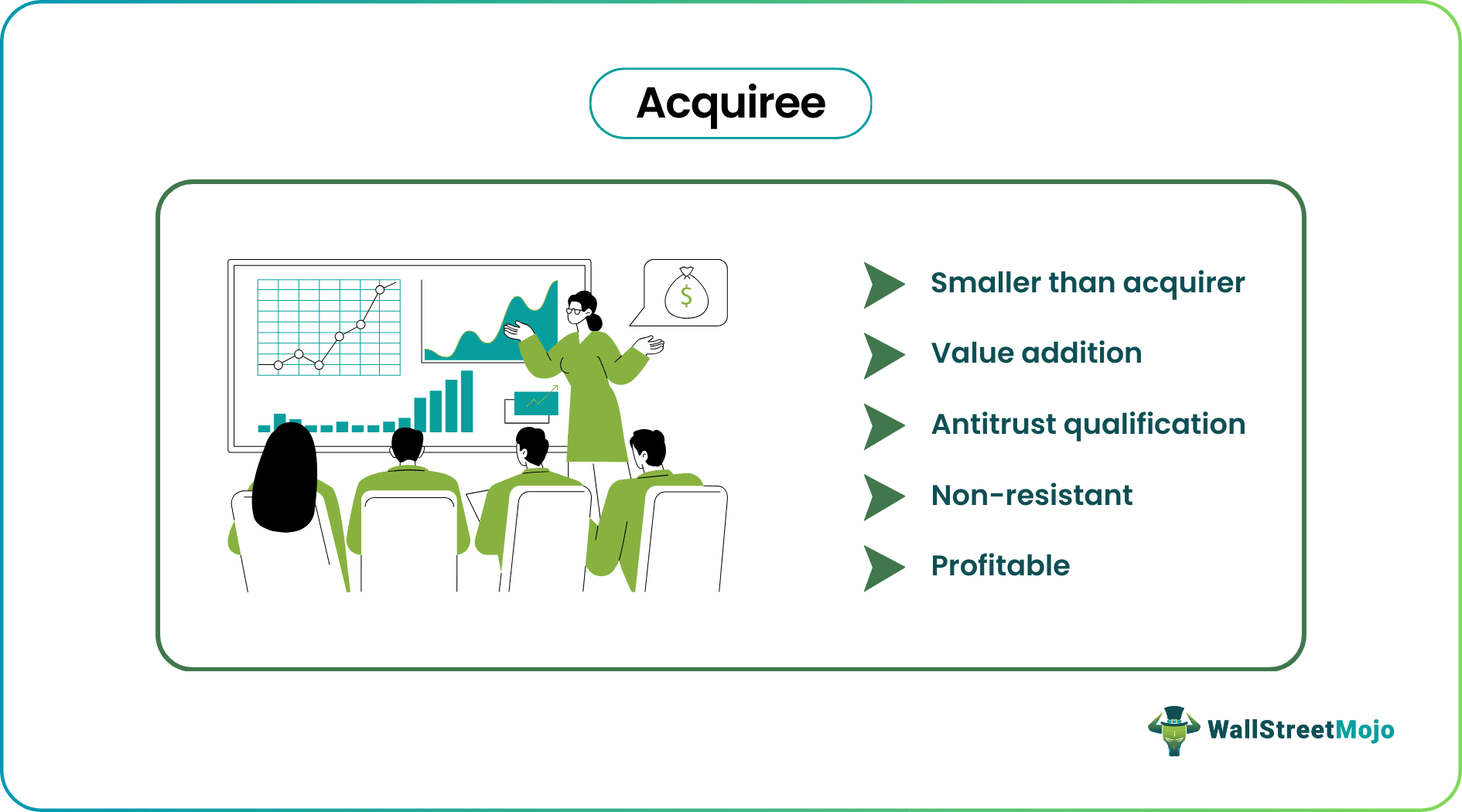

- Ideal acquiree characteristics include being smaller in size, providing value addition to the acquirer, and having no resistance from antitrust qualifications while being profitable. As a result of the transaction, the majority shareholding of the acquiree is transferred to the acquirer, leading to a change in control.

- In significant cases, the acquirer must prepare consolidated financial statements, while the acquiree generally prepares stand-alone financial reports.

Acquiree Explained

Acquiree is the company that is taken over as part of the merger and acquisition transaction by the acquirer. It might continue or cease to exist after the transaction culminates, depending upon the nature of the transaction. In most cases, this brings synergies for the acquirer but is the smaller of the two companies forming part of the transaction in terms of its financial position.

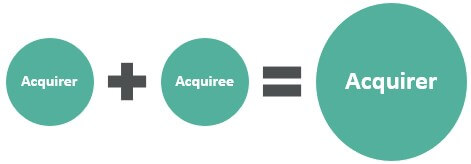

Below is the diagram for a merger, wherein the acquirer takes over the acquiree and posts the transaction. The only acquirer remains.

While the below diagram shows how post-acquisition, both the acquirer and the acquiree continue to exist independently, but the acquirer has greater control.

Features

Some of the traits exhibited by an acquiree company:

- Smaller than Acquirer: Most of the time, the acquiree is smaller than the acquirer company because, in most of the merger and acquisition transactions, it is the bigger company taking over the smaller company. The smaller company does not have enough financial resources to take over the bigger company. But this is not always the case, and there are exceptions everywhere.

- Value Addition: The purpose of any merger and acquisition transaction is to create some value for the entity created once the transaction completes. This value addition is the ‘synergies’ of the transaction. If there are no synergies, the transaction must at least break even; otherwise, it may lead to a winner’s curse where the acquirer may end up paying more than it is worth.

- Antitrust Qualification: Most of the time, the acquiree might not be so large that the antitrust action is taken for the M&A transaction. It would be one where such measures are not there, and if they are there, their impact is negligible. However, when the companies need to give up their assets to merge and stay within the antitrust guidelines, the transaction may or may not be worth it, and the analysis can become highly complicated.

- Non-Resistant: Both companies must reach a consensus for a successful merger or acquisition. When the takeover attempt is hostile, the acquiree might put up resistance in the form of one or many pre-and post-takeover defenses. So, it is ideal that the offer is non-resistant because resistance affects the success rate of the transaction.

- Profitable: The acquirer conducts a cost-benefit analysis when coming up with an offer price. The price offered should be profitable to the acquirer over a reasonable investment horizon, so that the transaction is worth entering into.

Examples

Let us consider the following examples to understand how an acquiree company works:

Example 1

One of Facebook's most talked-about mergers and acquisition transactions is acquiring WhatsApp and Instagram. Both companies exist in their name after the acquisition, but now Facebook owns most of these. These transactions depict that Facebook is the acquirer, and WhatsApp and Instagram are acquirees in their respective trades.

Example 2

In 2009, Disney took over Marvel Entertainment for $4 billion. So, Disney was the acquirer, and Marvel was the acquiree. Marvel movies were released, and Marvel has retained its name, but now it is owned by Disney.

Acquiree Vs Acquirer

The difference between acquiree and acquirer are as follows:

- In the mergers and acquisition (M&A) process, the acquirer is the company that wishes to acquire a company. On the other hand, the company to be acquired is an acquiree.

- Once the acquisition occurs, the acquiree loses its identity completely, while the acquirer remains.

Frequently Asked Questions (FAQs)

Acquirees face various risks when undergoing an acquisition, including potential disruption to business operations, integration challenges with the acquiring company, cultural clashes, loss of key talent, changes in management, financial risks, and the need to align with new strategic objectives and organizational structures.

Acquisitions can have both advantages and disadvantages for acquirers. While acquisitions can offer opportunities for growth, access to new markets, synergies, and enhanced resources, they can also bring risks, such as integration challenges, cultural differences, loss of autonomy, and potential dilution of shareholder value. As a result, the success of an acquisition largely depends on factors like strategic fit, proper due diligence, effective integration planning, and execution.

Accounting standards for acquirees refer to the specific guidelines and regulations that govern the accounting treatment and financial reporting requirements for entities that have been acquired. These standards ensure consistency and transparency in reporting the financial impact of acquisitions, including the recognition of assets, liabilities, goodwill, and related expenses.

Recommended Articles

This article is a guide to Acquiree and its meaning. Here, we explain the concept with examples, differences with the acquirer, and features. You can learn more about it from the following articles: -